‘As exciting as Bitcoin, Ethereum are,’ ETFs take the stage – Why?

- Bitcoin’s dominance persists amidst rising pleasure for altcoins.

- Retail curiosity continues to stay important and shouldn’t be missed.

2024 has been stuffed with surprising twists and turns within the cryptocurrency realm. From the extremely anticipated Bitcoin [BTC] halving to the relentless fluctuations in worth, traders have skilled important adjustments.

Regulatory scrutiny from our bodies just like the Securities and Trade Fee (SEC) and now the Federal Bureau of Investigation (FBI) has added one other layer of complexity to the panorama.

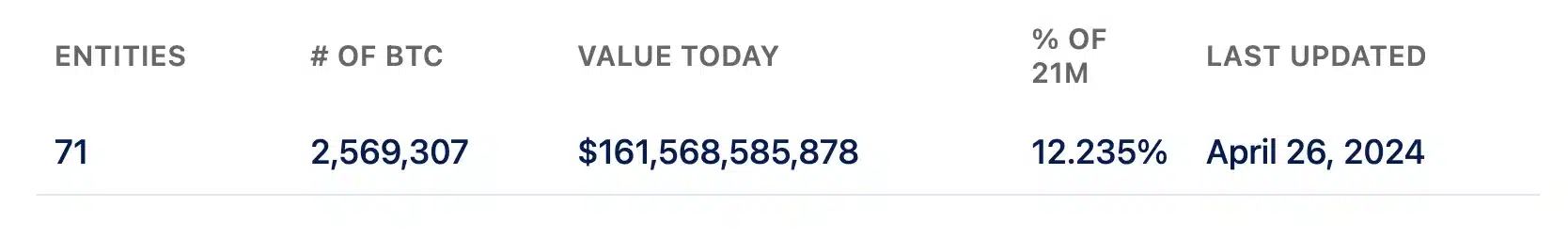

Regardless of these crucial points, traders have remained captivated by main cryptocurrency Bitcoin, per AMBCrypto’s evaluation of Bitbo information.

Supply: Bitbo

Remarking on the identical, Zach Pandl, Managing Director of Analysis at Grayscale Investments, in a latest dialog with Anthony Pompliano, stated,

“I’m extremely bullish on this asset class.”

Bitcoin or altcoins?

Nonetheless, opposite to the above sentiment, Brett Tejpaul, Head of Coinbase Institutional, claimed,

“As thrilling as Bitcoin and Ethereum are, the altcoin merchandise to me are much more thrilling.”

He added,

“I believe that speaks to the resiliency of who is definitely shopping for these merchandise and the thought course of that they’ve.”

This highlighted the growing pleasure and a spotlight surrounding altcoin merchandise within the cryptocurrency market.

Regardless of the ups and downs of the market, there was constant curiosity and funding in altcoins akin to Uniswap [UNI], Cardano [ADA], Polkadot [DOT], and Solana [SOL].

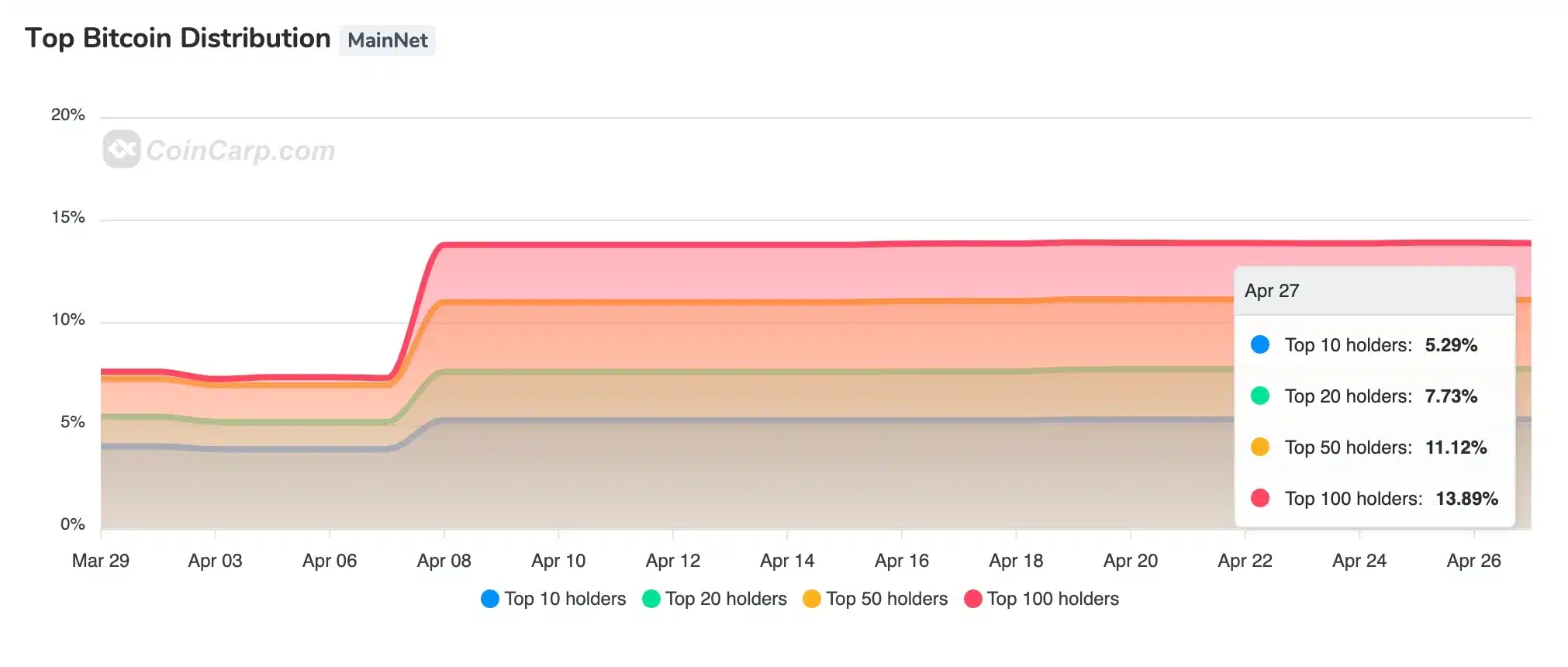

This was additional confirmed by information from CoinCarp, indicating that the highest 10 holders collectively possess solely 5.29% of the entire BTC provide.

Supply: CoinCarp

Bitcoin leads the market

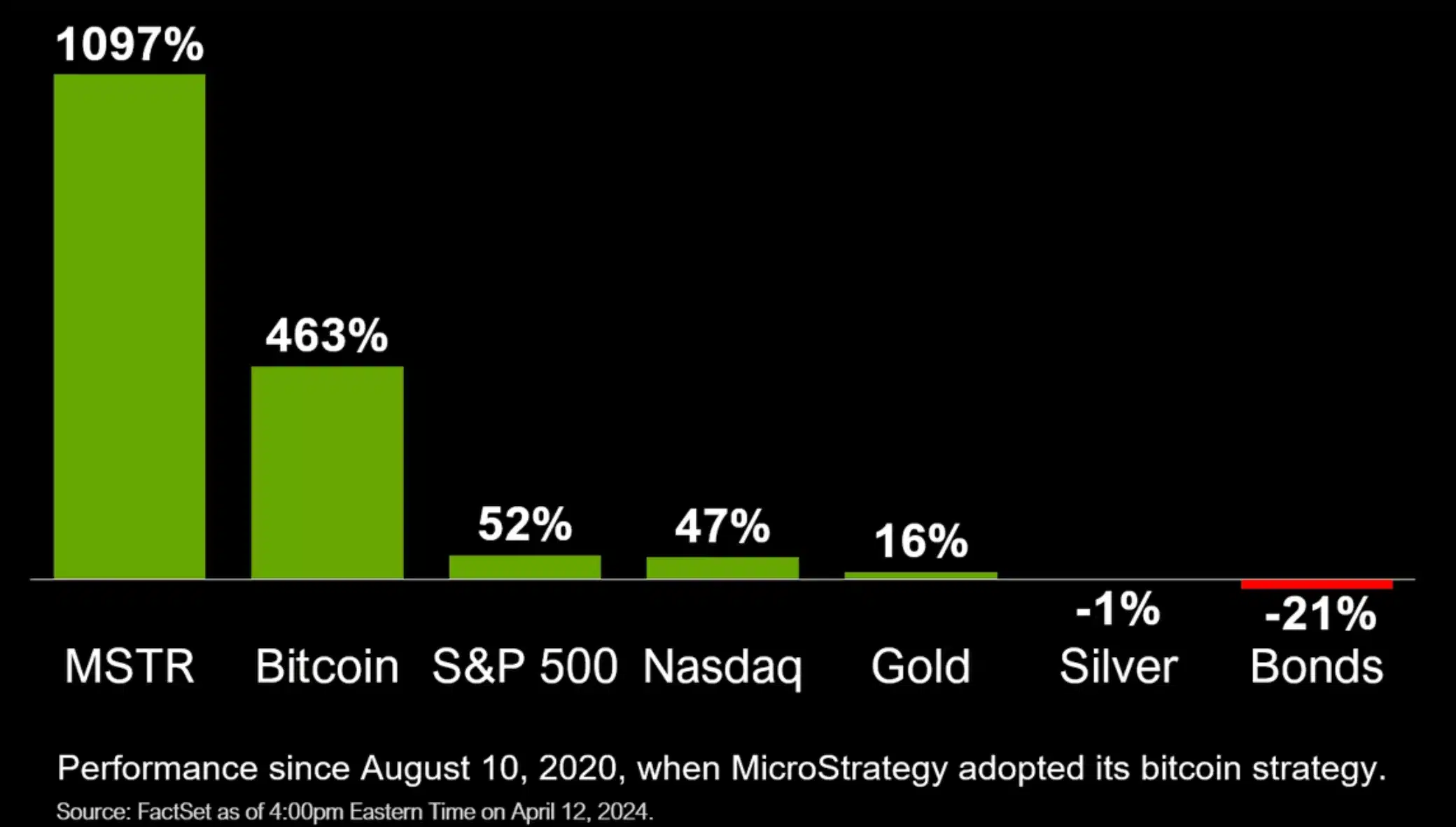

Opposite to Tejpaul’s perspective, Michael Saylor remained optimistic on the king coin. Via a chart shared on X (previously Twitter) publish, he illustrated how BTC has been worthwhile for his firm.

Supply: Michael Saylor/Twitter

As of the nineteenth of March, MicroStrategy owned 214,246 BTC.

Supply: Bitbo

In 2021, institutional demand boosted Bitcoin’s rise, setting a brand new precedent.

Now, with BTC Trade Traded Funds (ETFs) in 2024, institutional curiosity surged once more, highlighting their essential function in driving demand and worth.

Function of retail traders

Amidst the thrill surrounding institutional entry into crypto by way of ETFs, it’s essential to acknowledge the numerous function performed by retail traders.

Reiterating the identical, Russell Star, Head of Capital Markets at Defi & Valour added,

“Nicely the ETF welcomes a mix of institutional and retail as a starter.”

In conclusion, whereas ETFs present extra liquidity for establishments, it’s important to acknowledge that early adopters already possess direct cryptocurrency investments.

Due to this fact, whereas ETF approval marks an important milestone, it could take time for institutional inflows to completely materialize.