Assessing Bitcoin’s [BTC] losses as it fails to recover from the fake news-induced FUD

- The divergence between day by day miner income and 365-day SMA has broadened because the begin of 2023.

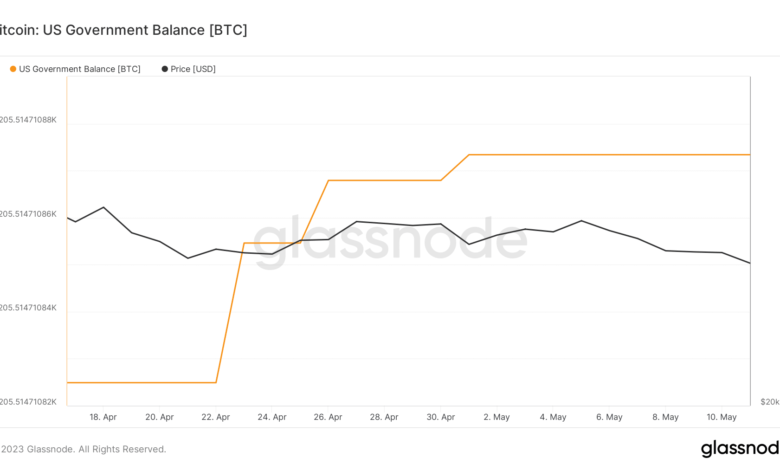

- The info on U.S. authorities’s BTC holdings didn’t present any decline because the starting of Might.

Bitcoin [BTC] recorded losses for the second day in a row, plunging to its lowest degree in practically two months. On the time of writing, the coin exchanged palms at $26,332.73, a pointy descent from the $28,000 degree attained barely two days in the past.

Learn Bitcoin’s [BTC] Worth Prediction 2023-24

As BTC sneezed, the broader crypto market caught chilly. Main property have been buying and selling in purple and the worldwide crypto market cap decreased by practically 3% from yesterday, knowledge from CoinMarketCap revealed.

A lot of the sell-off was pushed by FUD triggered because of the information of U.S. authorities divesting its BTC holdings. Nevertheless, because it seems, the rumors have been discovered to be false.

The age of misinformation

Blockchain analytics agency CryptoQuant described the try to propagate faux information of U.S. authorities promoting its Bitcoin as “coordinated”, with many widespread accounts retweeting the information with none fact-checking.

Because the rumor travelled far and large, it resulted within the second-largest lengthy liquidation for BTC in 2023, with positions price $36 million getting liquidated inside an hour on 10 Might.

Coordinated FAKE NEWS about US authorities promoting Bitcoins results in second-largest lengthy liquidations in 2023

“Many accounts retweeted this information with none fact-checking, and because of this, we noticed the second-largest lengthy liquidations in 2023, with over $36M being liquidated inside… pic.twitter.com/mfyglR8M8m

— CryptoQuant.com (@cryptoquant_com) May 11, 2023

Furthermore, the info on U.S. authorities’s BTC holdings didn’t present any decline because the starting of Might. This confirmed the falsity of the rumor.

The metric, developed by Glassnode, corresponds to the quantity of BTC held in addresses managed by authorities. The info was obtained from publicly accessible data.

Supply: Santiment

Extra bearishness for BTC?

BTC’s Open Curiosity (OI), or the greenback worth of lively buying and selling positions on the futures market, elevated by 1.36% within the final 24 hours, as per Coinglass knowledge.

This shaped a divergence with falling costs. It indicated that new brief positions have been being opened.

Supply: Coinglass

Is your portfolio inexperienced? Take a look at the Bitcoin Revenue Calculator

The Longs/Shorts Ratio for BTC additional validated the thought. Over the previous 24 hours, the ratio dipped sharply under 1. This implied that extra merchants have been gunning for worth losses as in comparison with these positioning for worth positive aspects.

Supply: Coinglass

Moreover, the newest occasion reignited the controversy round Bitcoin’s threat issue. The decoupling from fairness markets confirmed that the most important tradable digital asset strikes extra on hypothesis and rumour than on macroeconomic drivers.