Assessing Ethereum’s weekend slip and what’s next for the market

- ETH’s promoting strain was stronger than shopping for strain.

- The market’s sentiment shifted from impartial to greed, indicating a possible rise in shopping for within the days forward.

Ethereum [ETH] continued to retreat in the course of the weekend, falling as little as $2,407 as of this writing, in keeping with CoinMarketCap.

The most important altcoin fell 2.64% over the past 24 hours, with weekly losses of greater than 4%.

Assessing ETH’s subsequent strikes

Taking inventory of the developments, common technical analyst Ali Martinez famous that ETH was in an important zone. The bounce from the assist at $2,388 might doubtlessly drive ETH greater.

Having mentioned that, he additionally had a phrase of warning for market merchants, remarking,

“If ETH fails to take care of this stage, we’d see a pullback to the following vital assist space round $2,000.”

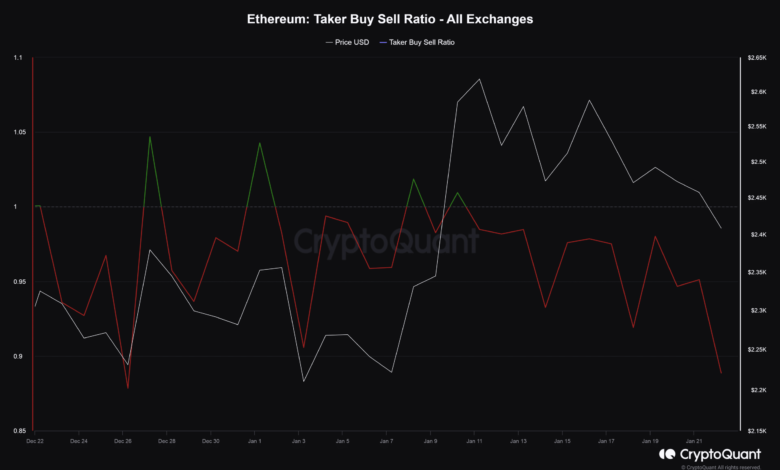

Effectively, the temper out there wasn’t precisely bullish. In accordance with AMBCrypto’s evaluation of CryptoQuant knowledge, the ratio of ETH’s purchase quantity to promote quantity of takers has been beneath 1 for the final 1o days.

This meant that extra sellers have been keen to promote at a lower cost, in flip, signaling that promoting strain was stronger than shopping for strain on the time of writing.

Supply: CryptoQuant

Whales go quiet

One other notable facet that grabbed consideration was the exercise of whale buyers. Utilizing Santiment’s knowledge, AMBCrypto noticed a dramatic fall in massive ETH transactions over the previous 10 days.

Be aware how the surge in transactions from the interval between the seventh to the tenth of January precipitated a spike in ETH’s value, indicating that whales have been accumulating.

Nevertheless, the ascent was halted because the whales withdrew. Since then, ETH has been range-bound.

Supply: Santiment

ETH’s reserves on exchanges dropped over the previous week as properly. This was an indication that whales have been in a HODLing temper.

Derivatives merchants are bearish on ETH, however…

A take a look at ETH’s derivatives market highlighted that bearish leveraged merchants have been dominant at press time.

In accordance with Coinglass, ETH’s Longs/Shorts Ratio has been beneath 1 for the reason that twelfth of January, implying that positions betting on value declines have been greater than these gunning for value will increase.

Supply: Coinglass

Learn Ethereum’s [ETH] Value Prediction 2023-24

Curiously, the market’s sentiment shifted from impartial to greed, as per AMBCrypto’s examination of Hyblock knowledge.

This might make method for a rise in ETH shopping for within the days forward, thus resurrecting its value.

Supply: Hyblock Capital