Assessing the fall in Ethereum DEX volumes, active addresses as ETH cools down

- DEX buying and selling quantity’s drop signaled declining exercise, however rising distinctive addresses hinted at potential re-engagement

- On-chain indicators such because the MVRV ratio and SOPR prompt Ethereum could also be undervalued

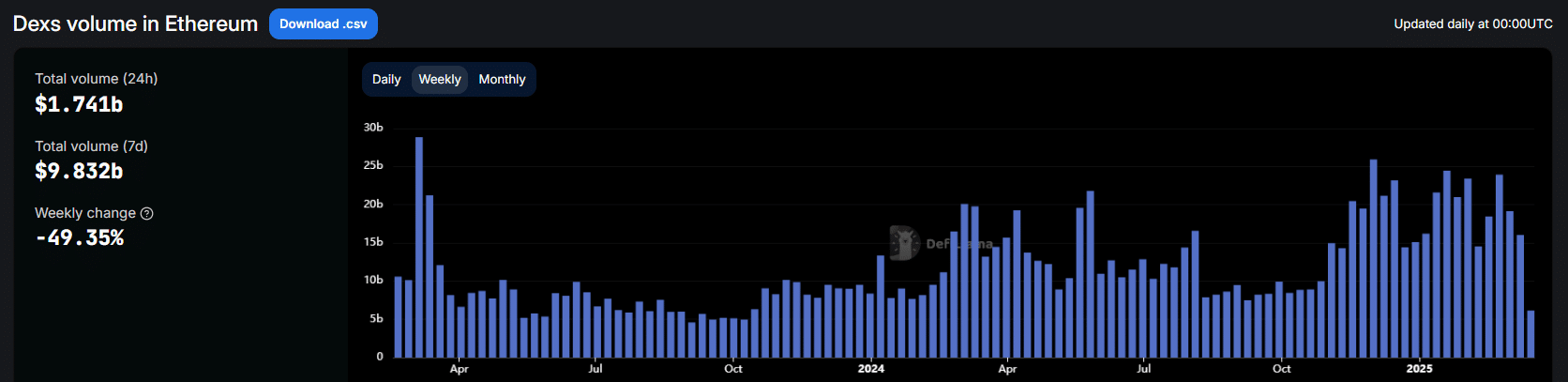

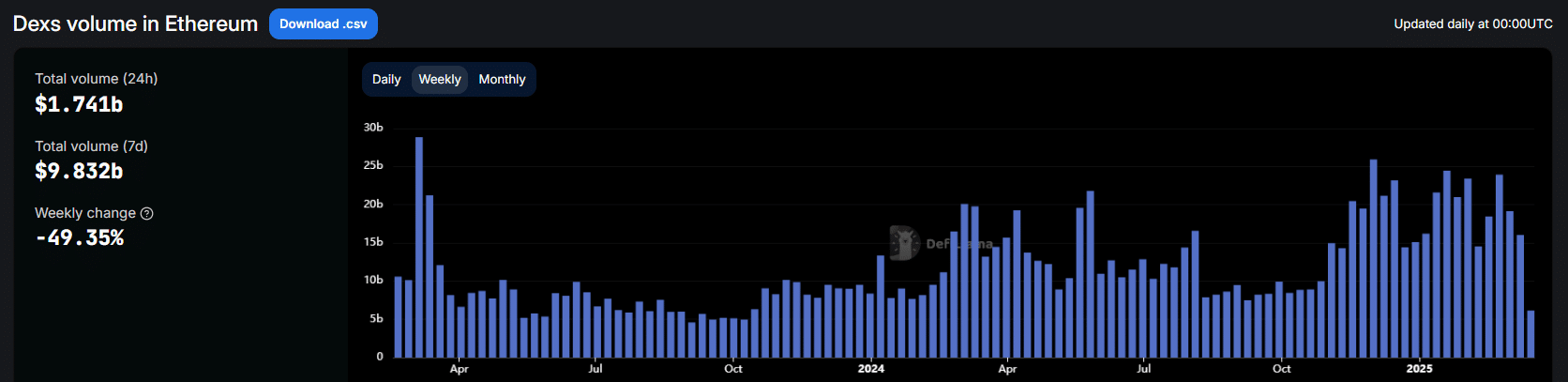

Ethereum DEX volumes drop 50% in every week

Ethereum’s [ETH] DEX market has seen a pointy downturn these days, with weekly buying and selling volumes dropping by almost 50%.

Over the previous month aline, the decline has been even steeper, with the whole quantity falling from $86.02 billion in January to $14.54 billion in February. It principally represented an 83% discount in exercise.

Supply: DefiLlama

The autumn in buying and selling curiosity is an indication of weakening engagement, one which naturally raises issues about Ethereum’s broader market participation.

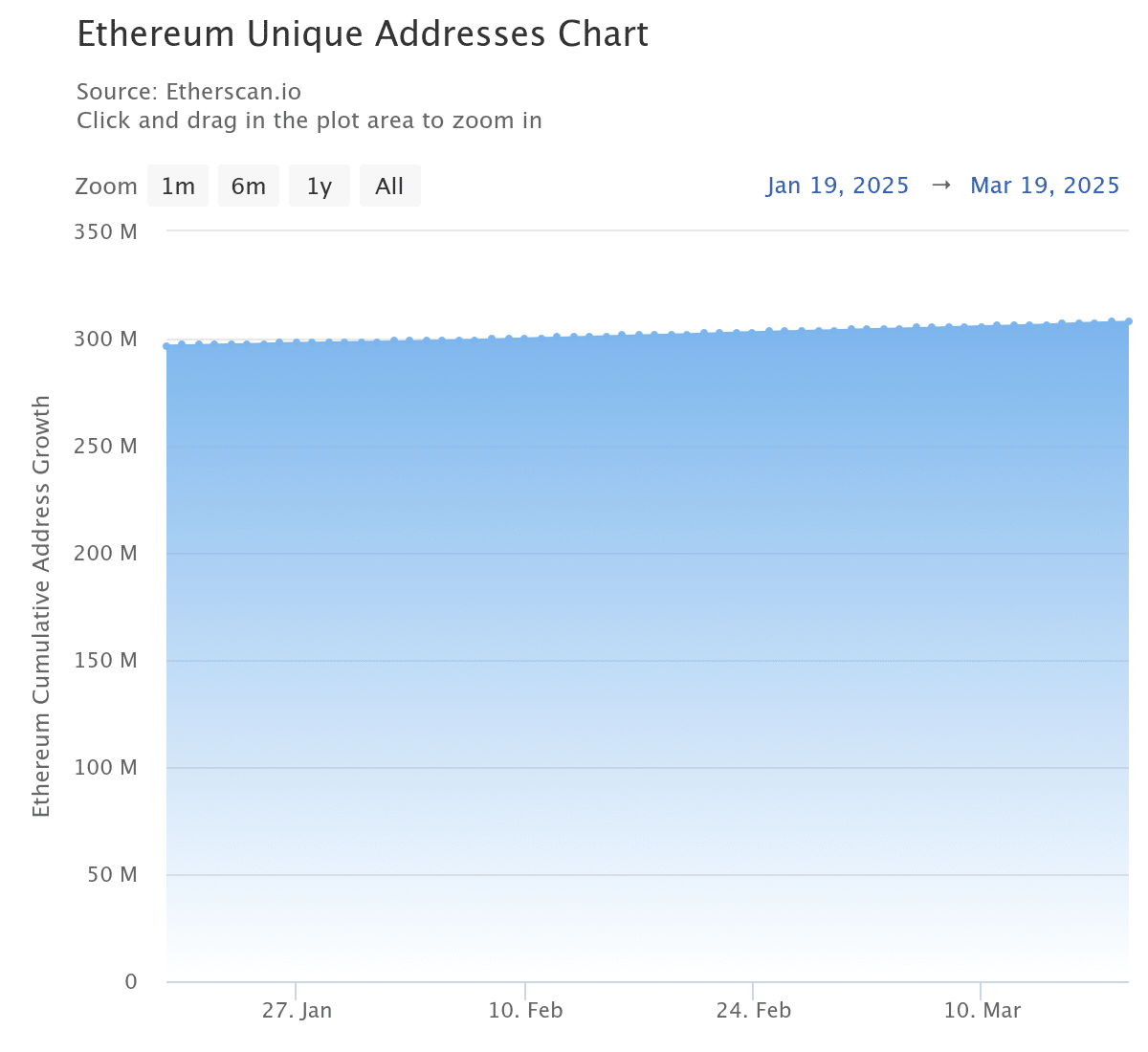

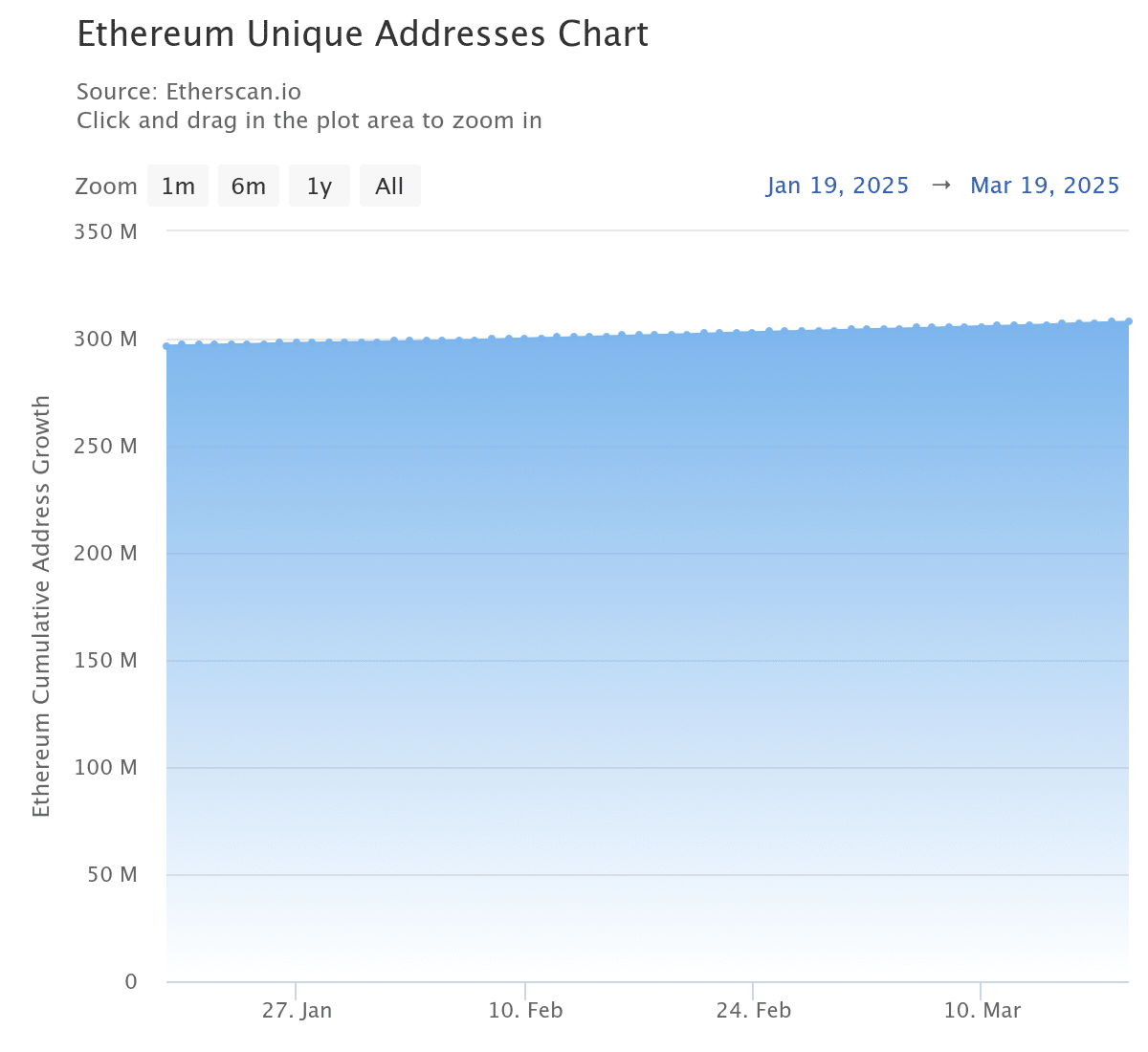

Regardless of this decline, nonetheless, Ethereum’s unique address rely has grown steadily, rising by 11.93% from January to March.

Supply: Etherscan

This pattern means that whereas new customers proceed to enter the community, present members could also be decreasing their exercise. The distinction between falling buying and selling volumes and rising distinctive addresses indicated that customers could also be shifting towards sholding or staking, fairly than energetic buying and selling.

To grasp this higher, we have to study the info additional.

Fewer palms on deck – On-chain information indicators a cooling market

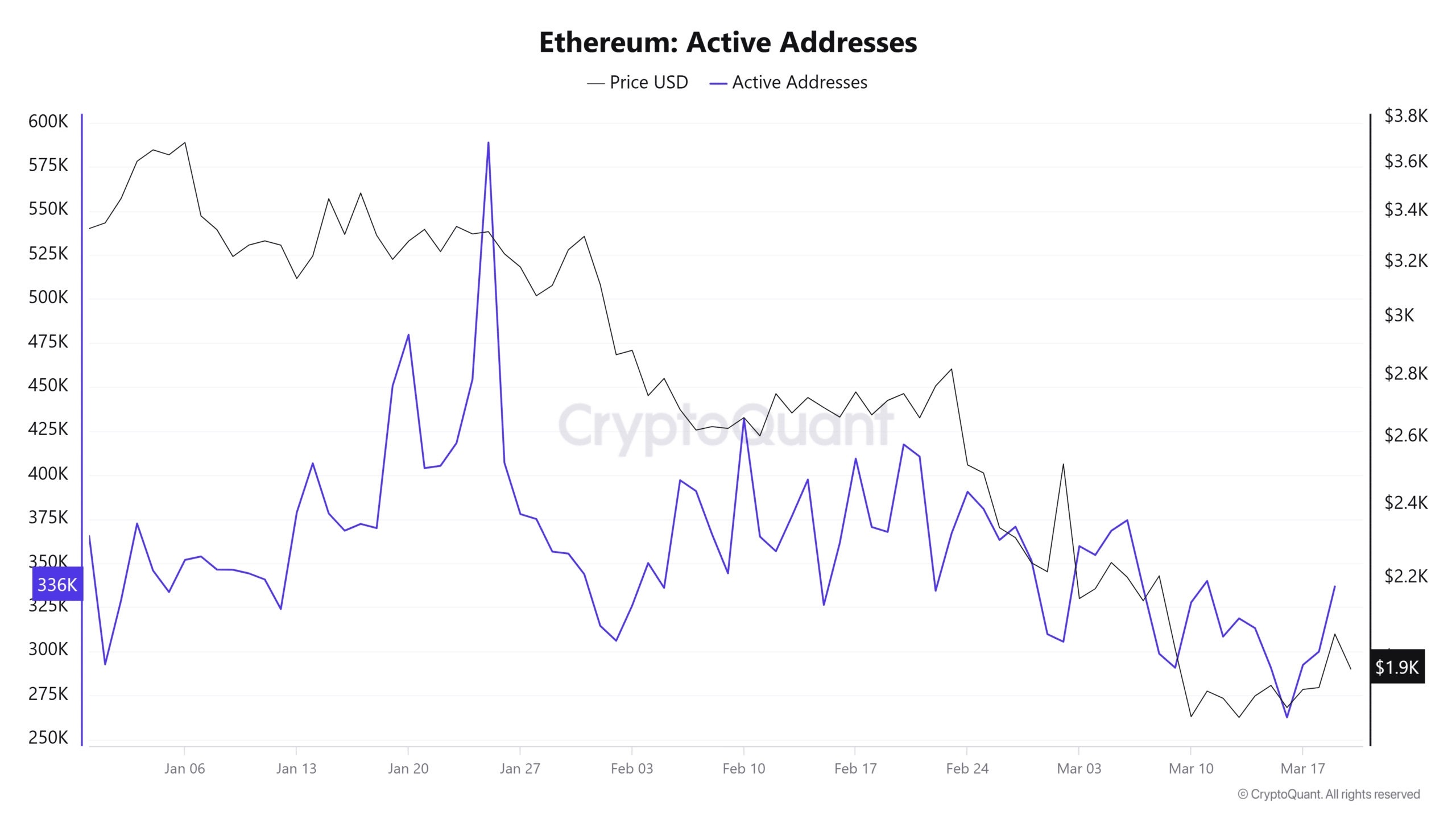

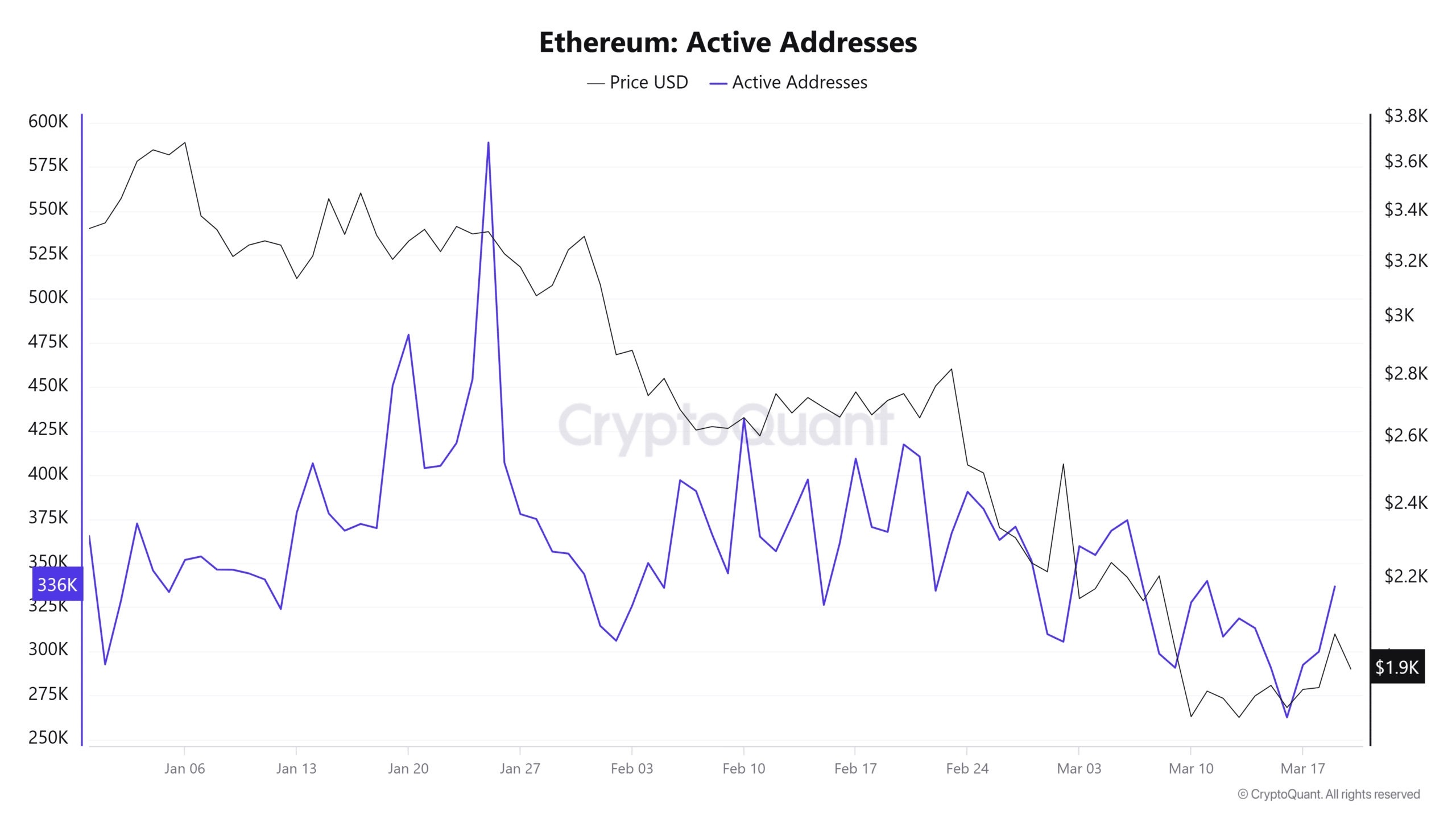

Ethereum’s community exercise has fallen these days, with energetic addresses dropping by 55.4% from 588,782 on 25 January to 262,466 by 16 March.

Supply: CryptoQuant

The worth mirrored this decline, falling by 43.7% from $3,353 to $1,887.

Traditionally, decrease tackle exercise may be interpreted to imply weaker demand, elevating issues over Ethereum’s ongoing downtrend.

MVRV sounds the alarm – Is Ethereum undervalued?

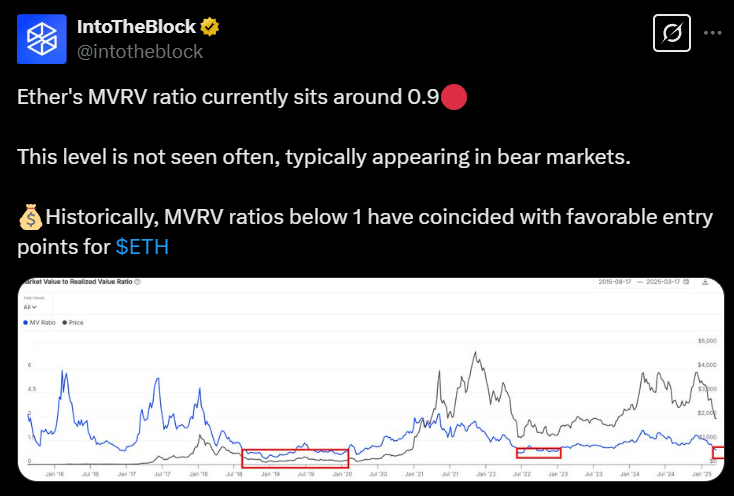

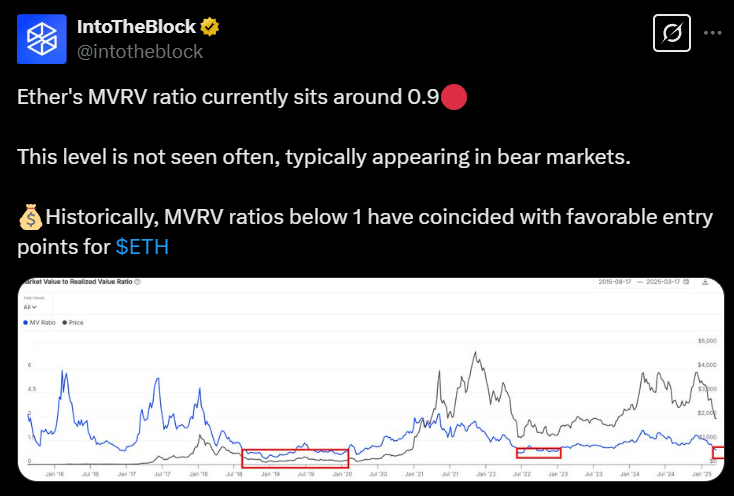

Amid the declining community exercise, Ethereum’s Market Worth to Realized Worth (MVRV) ratio fell to 0.9 on the charts.

Supply: IntoTheBlock’s X

A ratio under 1.0 has traditionally signaled that Ethereum is undervalued. Earlier occurrences of such ranges have coincided with bear market bottoms. What does this imply?

Ethereum’s MVRV ratio dropped 30% from 1.32 in February, mirroring previous market corrections in 2018, 2020, and 2022 – Durations which have preceded recoveries on the value charts.

Capitulation or a hidden accumulation play?

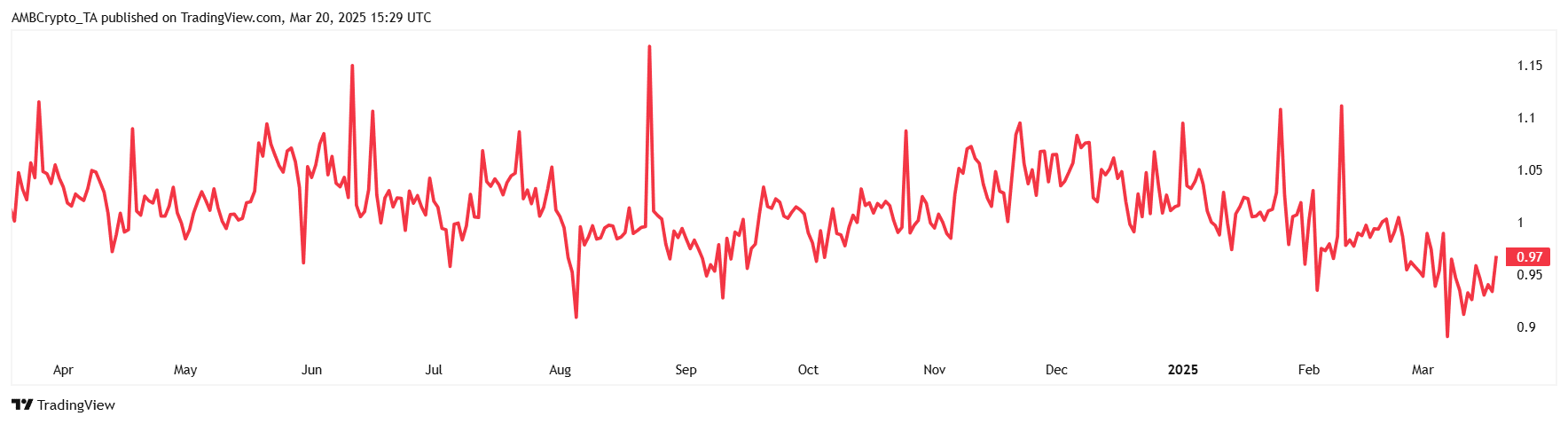

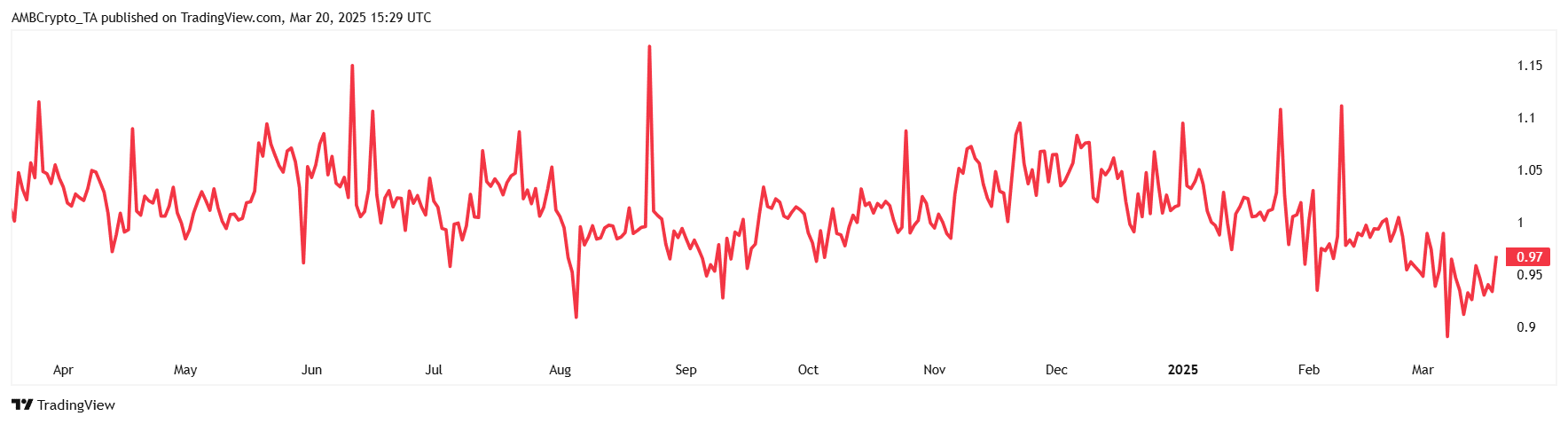

One other key metric, the Spent Output Revenue Ratio (SOPR), added additional insights into investor conduct.

Supply: TradingView

On the time of writing, the SOPR sat at 0.97, signaling that almost all ETH trades have been at a loss – A standard capitulation signal. When SOPR falls under 1.0, it has usually been marked by native market bottoms as promoting stress begins to subside.

The decline in each metrics is an indication that Ethereum could also be close to an area backside – Traditionally, an accumulation part earlier than restoration.

Ethereum at a crossroads

Ethereum’s market circumstances current two doable outcomes.

Falling buying and selling volumes and community exercise level to weak demand, probably dragging costs decrease. Nevertheless, with the MVRV and SOPR at traditionally low ranges—beforehand seen earlier than main rebounds—this may be an accumulation part.

Whether or not the market sees additional losses or a restoration will depend on how traders react to the info.