Assessing the odds of UNI’s price hiking by another 30% to hit…

- UNI my be breaking out of an Adam & Eve sample, signaling a possible 30% upswing

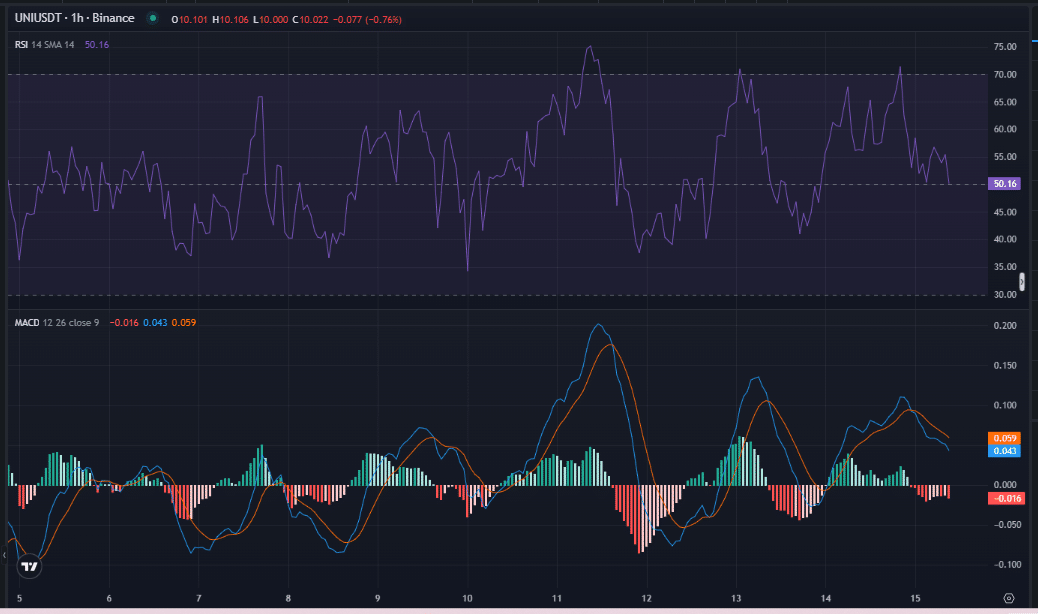

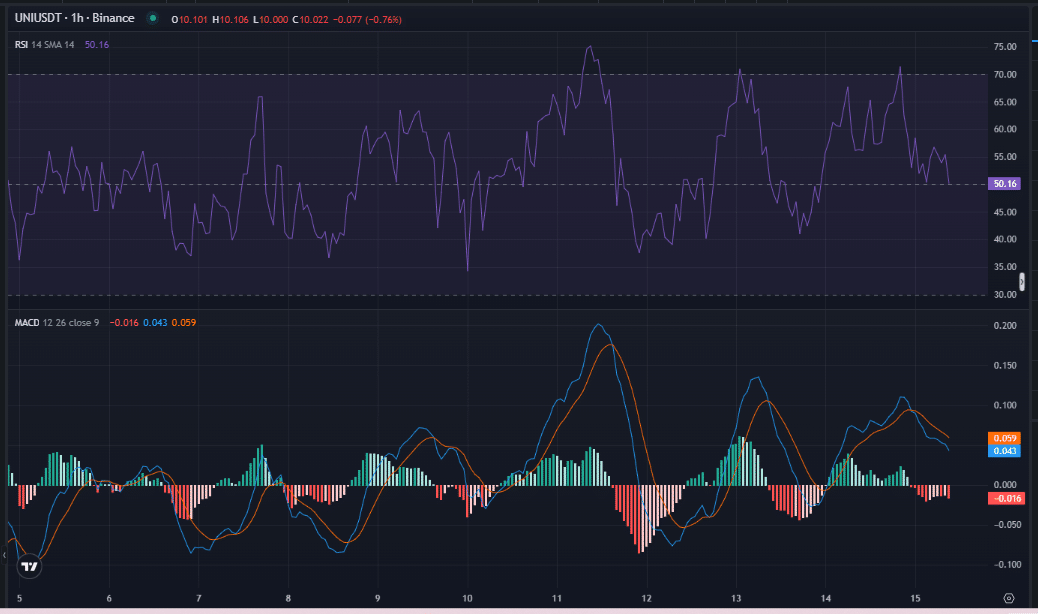

- Altcoin’s RSI had a studying of fifty.16 at press time, with out fairly leaning in the direction of overbought territory

Uniswap [UNI] made information and grabbed the eye of many throughout the crypto market after its breakout from an Adam & Eve sample. Actually, such was the size of the breakout that many now anticipate a possible 30% upswing in the direction of $13 on the charts.

A key sign for UNI’s upswing

The Adam & Eve sample signifies a transition from a downtrend to an uptrend. This sample is shaped by a pointy ‘Adam’ peak, adopted by a extra rounded ‘Eve’ trough, which usually represents consolidation earlier than a breakout.

A breakout from this sample may trace at a shift in market sentiment, with the identical adopted by vital worth motion.

Supply: X

The MACD’s bullish crossover highlighted the uptick in shopping for momentum throughout the market. Moreover, the histogram flashed optimistic values, reinforcing the shopping for power following the breakout.

Supply: Coinglass

On the time of writing, the RSI stood at 50.16, signaling a impartial market. Nonetheless, it gave the impression to be transferring in the direction of overbought territory – An indication that purchasing strain may proceed and make the $13 goal extra believable.

This mix of the Adam & Eve sample, bullish MACD crossover, and rising RSI steered that UNI would possibly see main progress quickly. This might be in step with the projected 30% worth hike.

Minimal promoting strain indicators alternative

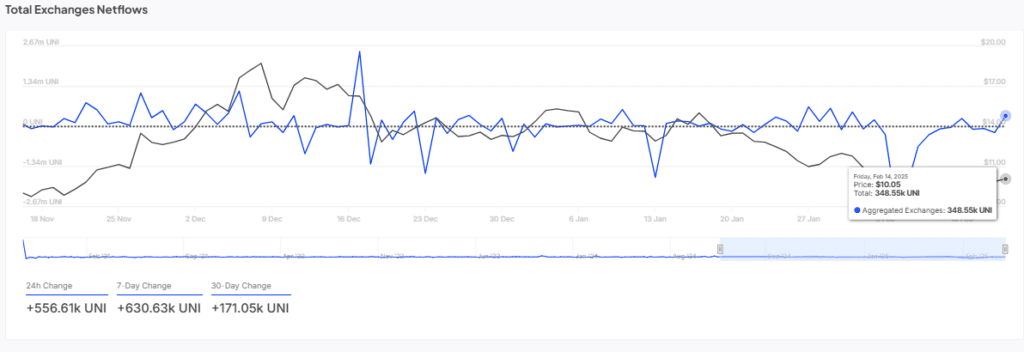

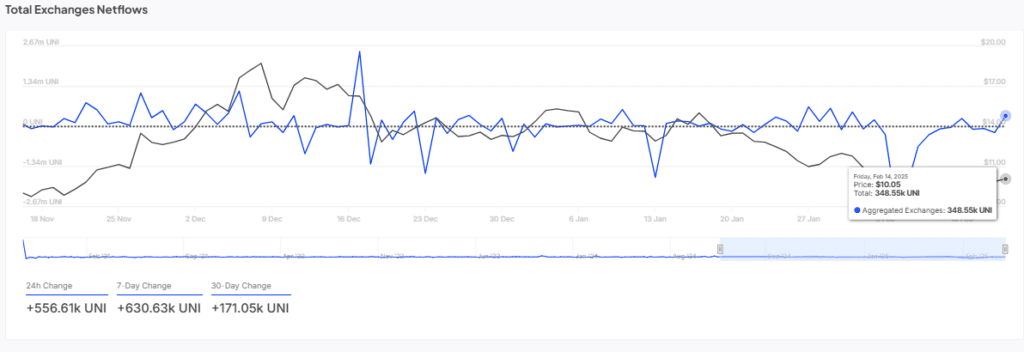

Complete Netflow evaluation shared some insights into how a lot UNI is flowing into or out of exchanges.

A big netflow into exchanges may imply excessive promoting strain, whereas a fall in netflow would trace at accumulation by buyers.

Supply: IntoTheBlock

As may be seen right here, UNI’s market noticed modest netflows of 348.55k UNI on 14 February 2025. This alluded to minimal promoting strain, which bodes effectively for the bullish case. When promoting strain is low, upward worth actions are inclined to face much less resistance, supporting the chance of a sustained rally in the direction of $13.

Key ranges for UNI’s worth motion

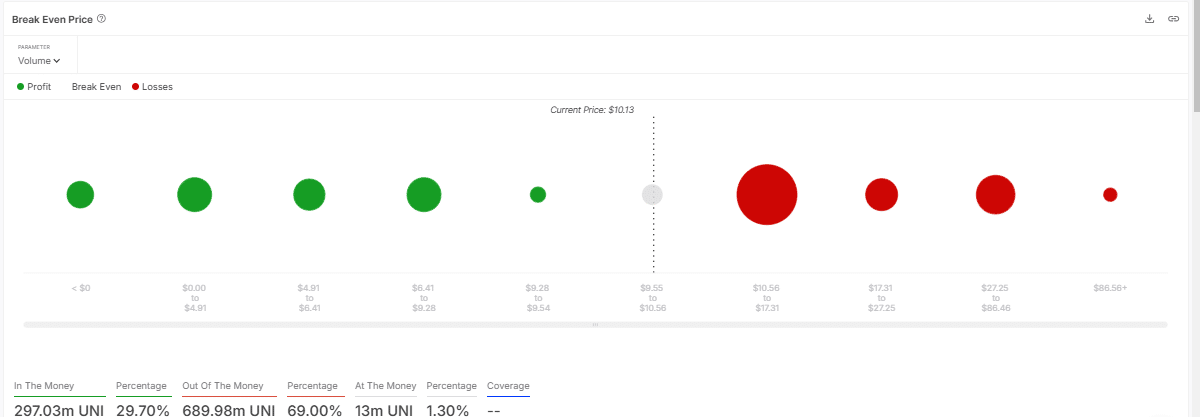

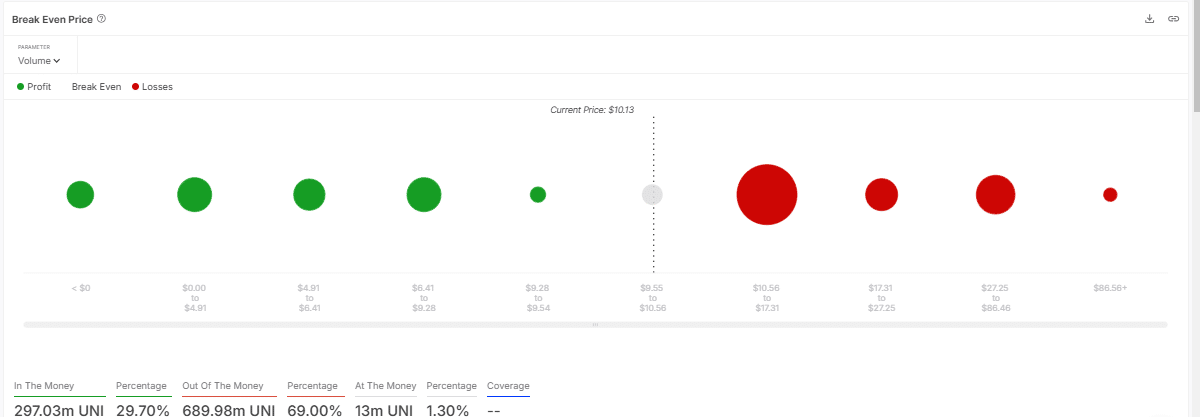

The Break-Even Worth chart revealed that a good portion of UNI holders are at the moment in revenue, with $297.03 million in UNI worthwhile. This positions many buyers to both maintain or purchase extra, probably pushing the value larger.

Supply: IntoTheBlock

Then again, $689.98 million value of UNI stays at a loss. If the value strikes in the direction of break-even ranges, these within the pink might begin shopping for, contributing to better upward strain.

This dynamic implied that as UNI strikes nearer to the $13-target, extra shopping for exercise may speed up the value surge.

How shopping for strain can gas UNI’s rise

Lastly, the Cumulative Quantity Delta (CVD) chart offered a deeper understanding of web shopping for and promoting strain.

A current pattern in the direction of damaging CVD hinted at a hike in promoting strain. Nonetheless, a reversal of this pattern may sign a shift in the direction of shopping for, reinforcing the bullish sentiment.

Supply: CoinGlass

The breakout from the Adam & Eve sample, coupled with a optimistic shift in CVD, may verify the continuing shopping for momentum. If promoting strain subsides and shopping for intensifies, UNI is more likely to transfer nearer to the $13 goal, signaling sturdy market absorption of promote orders.