Assessing whether Bitcoin can rise above $27k once again

- BTC was down by greater than 3% final week and was buying and selling at $26,887.08.

- Although the value motion was bearish, on-chain metrics turned bullish.

Bitcoin [BTC] managed to carry its value above $27,000, however final week, issues once more turned in bears’ favor. This occurred as a result of BTC witnessed a serious value correction, pushing its value down.

Learn Bitcoin’s [BTC] Value Prediction 2023-24

Due to this fact, let’s check out BTC’s efficiency on a number of fronts final week to see what’s really cooking.

Bitcoin falls under $27,000

After reaching almost $28,000 on 9 October, the king of crypto’s value witnessed a value correction. Over the past seven days, BTC’s value has remained beneath $27,000. At press time, it was buying and selling at $26,887.08 with a market capitalization of over $524 billion.

Notably, James V. Straten, a well-liked crypto analyst, just lately identified how Bitcoin carried out over the past week on a number of fronts.

To sum up this week for #Bitcoin

Almost definitely spot ETF approval (subsequent 6 months. #GBTC closed greater.

Max worry: STHs offered the second most quantity of #Bitcoin at a loss this yr with report divergence with LTHs (Wednesday).

Hypothesis is close to all time lows, STH provide in any respect…

— James V. Straten (@jimmyvs24) October 14, 2023

For example, short-term holders offered the second-largest quantity of Bitcoin at a loss this yr, with report divergence from long-term holders. This considerably additionally mirrored on the coin’s provide.

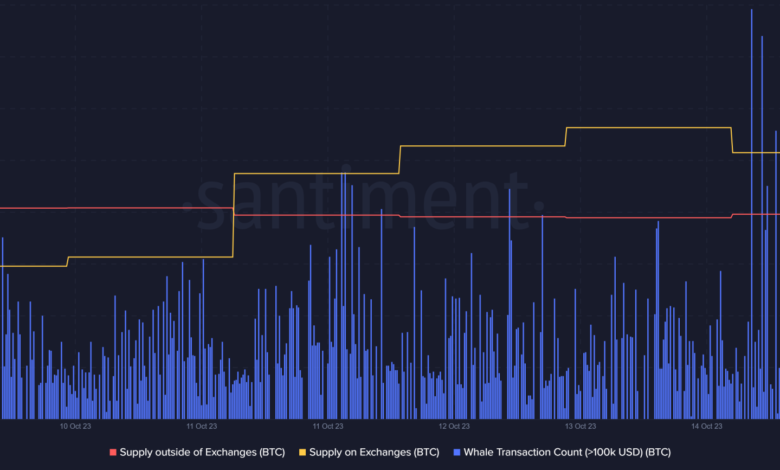

BTC’s Provide outdoors of Exchanges remained flat whereas its Provide on Exchanges elevated final week, which mirrored traders’ worry of an additional value plummet. Nonetheless, whale exercise round BTC remained excessive, as evident from its Whale Transaction Depend.

Supply: Santiment

A have a look at Bitcoin’s mining sector

Bitcoin’s upcoming main occasion can also be drawing in, because the blockchain is anticipating its halving in 2024. The truth is, BTC is lower than 28,000 blocks away from halving. BTC’s hash price reached an all-time excessive, with issue adjusting 6% greater this weekend.

Whereas the occasion attracts nearer, miners have began to promote their holdings. Glassnode’s knowledge identified that miners’ stability registered a pointy decline over the past month.

Supply: Glassnode

Not solely that, however as per CryptoQuant, miners have been really promoting their belongings at a loss in comparison with their one-year common. Although this mirrored the truth that miners weren’t assured in BTC, it might additionally point out a doable market backside.

What to anticipate from BTC

Although the final week didn’t go in traders’ favor, the upcoming days would possibly look completely different, as few of the metrics seemed bullish on BTC. For instance, Bitcoin’s Binary CDD was inexperienced, that means that long-term holders’ motion within the final seven days was decrease than common.

Is your portfolio inexperienced? Try the BTC Revenue Calculator

Its NULP revealed that the market was in a “worry” stage, which is usually a optimistic signal. On prime of that, BTC’s derivatives market indicators additionally seemed optimistic.

Notably, its Taker Purchase Promote Ratio and Funding Price have been inexperienced, which meant that purchasing sentiment was dominant within the derivatives market.

Supply: CryptoQuant