Ethereum’s price struggles – Will President Trump’s vote of confidence be key?

- Ethereum’s Q1 struggles have sparked a debate about its long-term worth

- Regardless of current losses, Trump’s backing might sign confidence in Ethereum’s potential for future restoration

As Ethereum [ETH] faces its most difficult quarter in years, with a delayed improve and a sluggish market efficiency, one element stands out – 91% of President Trump’s crypto holdings are anchored on the Ethereum blockchain.

Because the community grapples with its present hurdles, this important funding has ignited hypothesis about Ethereum’s long-term prospects. Might Trump’s backing be a sign of untapped potential, or is Ethereum’s wrestle just the start of a deeper downturn?

Ethereum – A rocky begin to 2025

Supply: X

ETH has been recording one among its worst Q1 performances lately. In reality, at press time, March’s returns stood at -10.95%, following a steeper decline of -31.95% in February – Considerably beneath the typical March returns of +19.48%.

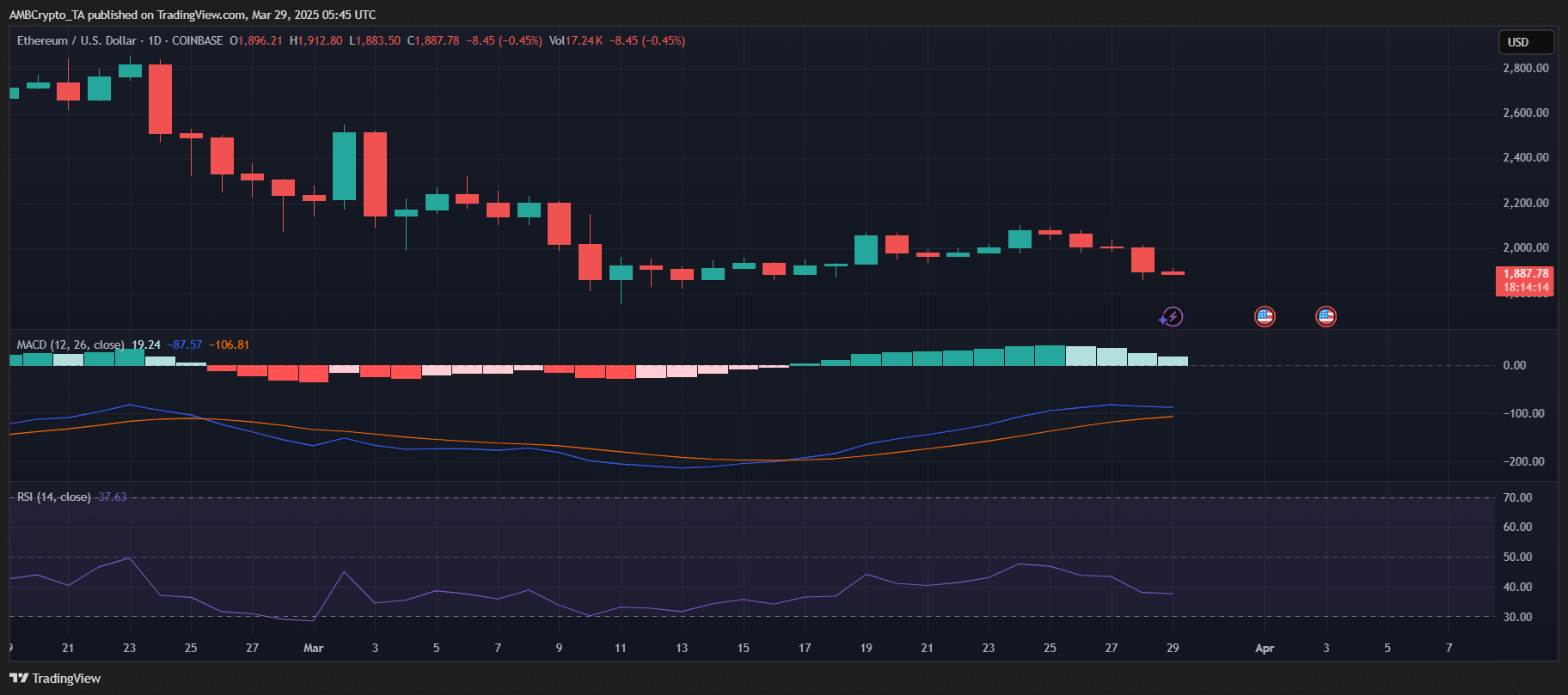

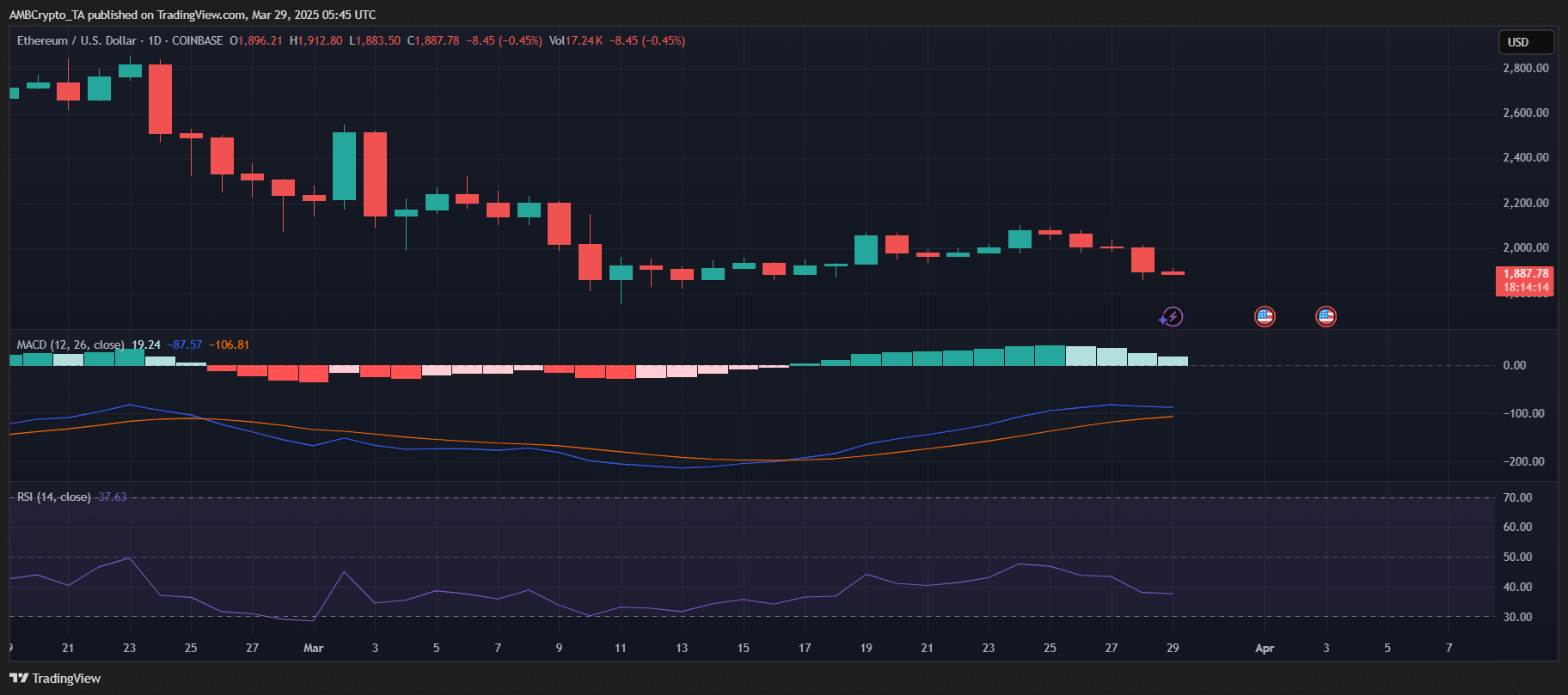

Supply: TradingView

Technical indicators highlighted this bearish pattern, with ETH buying and selling at round $1,887 at press time. The MACD revealed rising bearish momentum, whereas the RSI was close to 37 – Indicating oversold circumstances. A sequence of purple candles on the each day chart underlined sustained promoting strain all through March.

Including to the uncertainty, the ecosystem stays in limbo as merchants anticipate upcoming upgrades. Sentiment stays cautious, with ETH’s value motion persevering with to replicate the broader market’s skepticism too.

Trump’s crypto holdings – What we all know

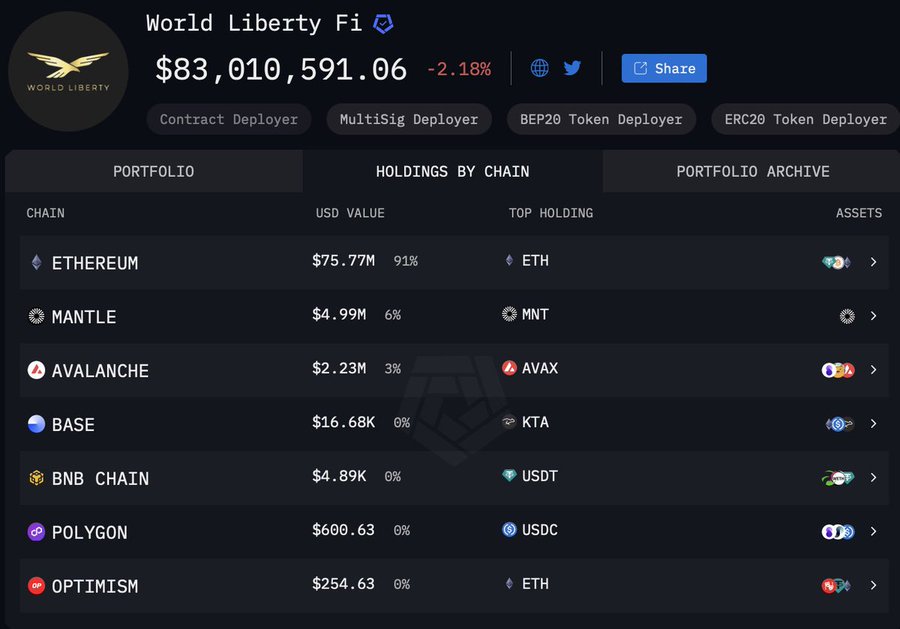

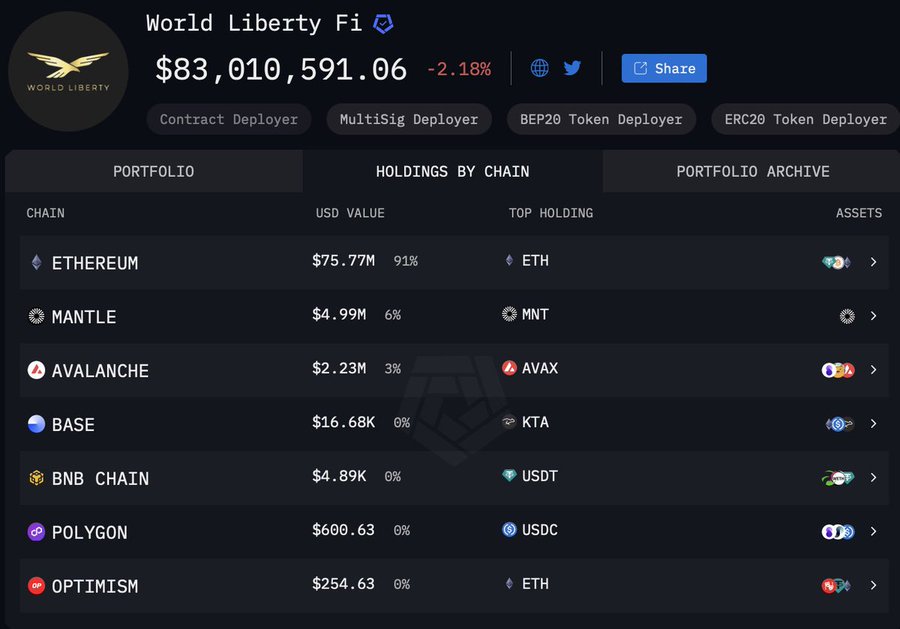

President Donald Trump’s monetary footprint within the crypto world is bigger than many may count on. By way of his household’s important management over World Liberty Monetary (WLFi), it’s clear that Ethereum performs a central position.

Current information revealed that 91% of WLFi’s crypto portfolio – price roughly $75.77 million – is anchored in Ethereum proper now.

Supply: X

This substantial dedication to ETH raises questions on Trump’s affect on the community’s future, particularly amid Ethereum’s ongoing struggles. Whereas market sentiment stays shaky, Trump’s oblique endorsement may replicate confidence in Ethereum’s long-term worth proposition.

Given the dimensions of his holdings, any shifts in Trump’s crypto place may ripple by means of the market, influencing each ETH’s valuation and broader public notion.

The case for undervaluation

Some market observers argue that ETH may at the moment be undervalued, seeing the Trump household’s important stake as a vote of confidence within the asset’s resilience. This angle pertains to historic information – Like Ethereum’s downturn in 2020 – the place bearish cycles ultimately gave technique to restoration. This might be an indication that present struggles might mirror previous patterns.

Nonetheless, not everyone seems to be satisfied.

Skeptics consider that ETH’s sustained decline may result in new lows, risking extended bearish momentum. Bitcoin’s persistently detrimental 1-year share change may also influence ETH, dragging it additional down. Moreover, considerations over diminished liquidity and waning investor confidence current potential dangers that might problem the asset’s stability.

Balancing these views, Ethereum’s trajectory might rely upon broader market dynamics and whether or not monetary endorsements like Trump’s actually sign power or a fleeting vote of confidence.

What’s subsequent for Ethereum?

ETH’s future restoration could also be pushed by a number of elements. One potential catalyst is the implementation of sharding, which goals to reinforce scalability and scale back charges. Institutional curiosity can also be rising, with Deutsche Boerse’s Clearstream planning to supply custody and settlement companies for ether, boosting participation.

Lastly, the potential approval of Ether-based ETFs may entice important capital inflows, particularly because the Trump administration maintains a pro-crypto place. Within the DeFi area, Ethereum stays foundational regardless of market challenges, with its position in decentralized functions intact.

Nonetheless, regulatory readability round staking and Ethereum-based tokens shall be very important, and the administration’s supportive strategy may strengthen investor confidence and foster additional adoption.