Cardano: Is ADA setting up a bear trap before a 2021-style breakout?

- ADA’s historic worth motion and key technicals have been aligning with its 2021 cycle.

- If historical past rhymes, may one other main breakout be on the horizon?

Ten days after Cardano’s [ADA] historic single-day surge of 72% to $1.14, the worth has totally retraced, dropping again to the $0.70 vary.

This sharp pullback comes amid a broader risk-off sentiment. But, the ADA/BTC pair is flashing inexperienced, suggesting traders could also be shifting into high-cap property for stability.

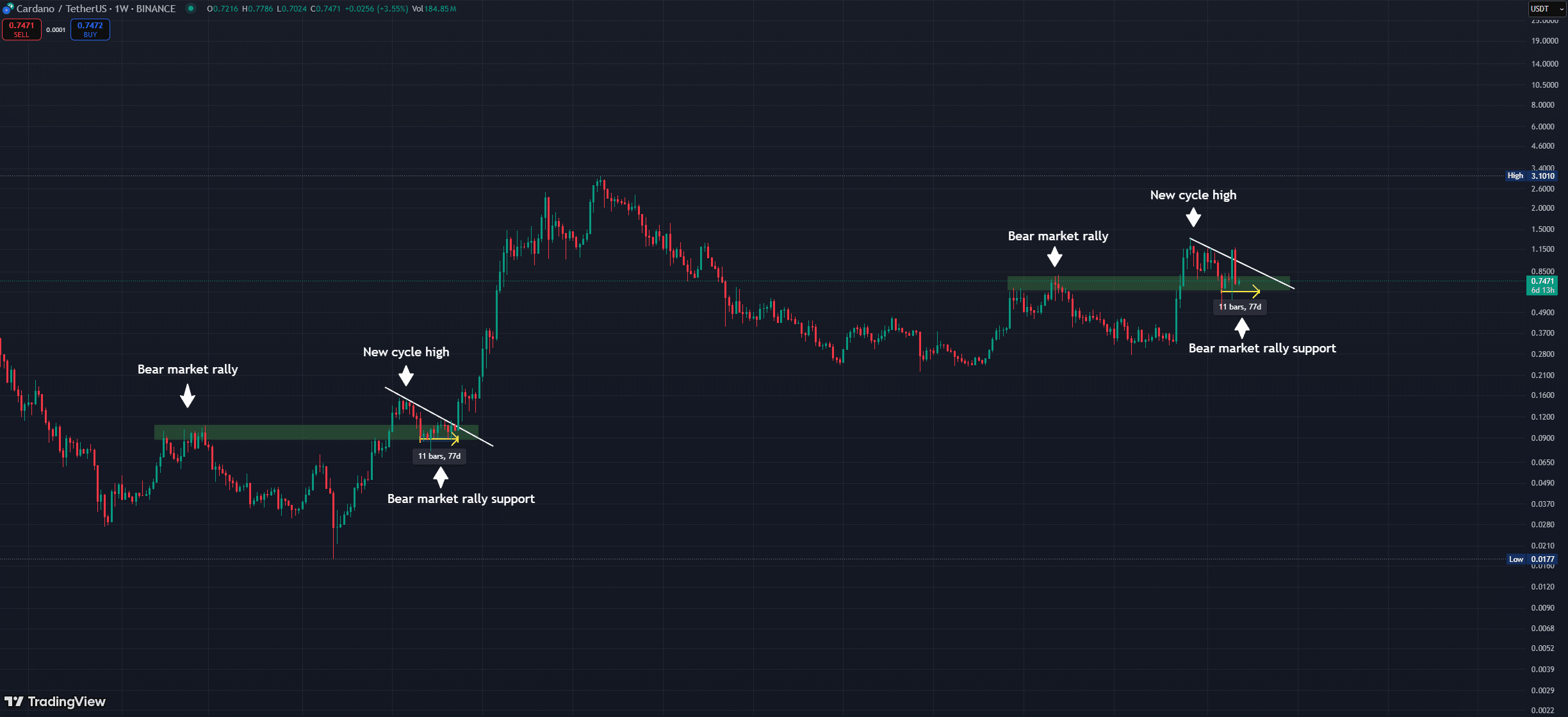

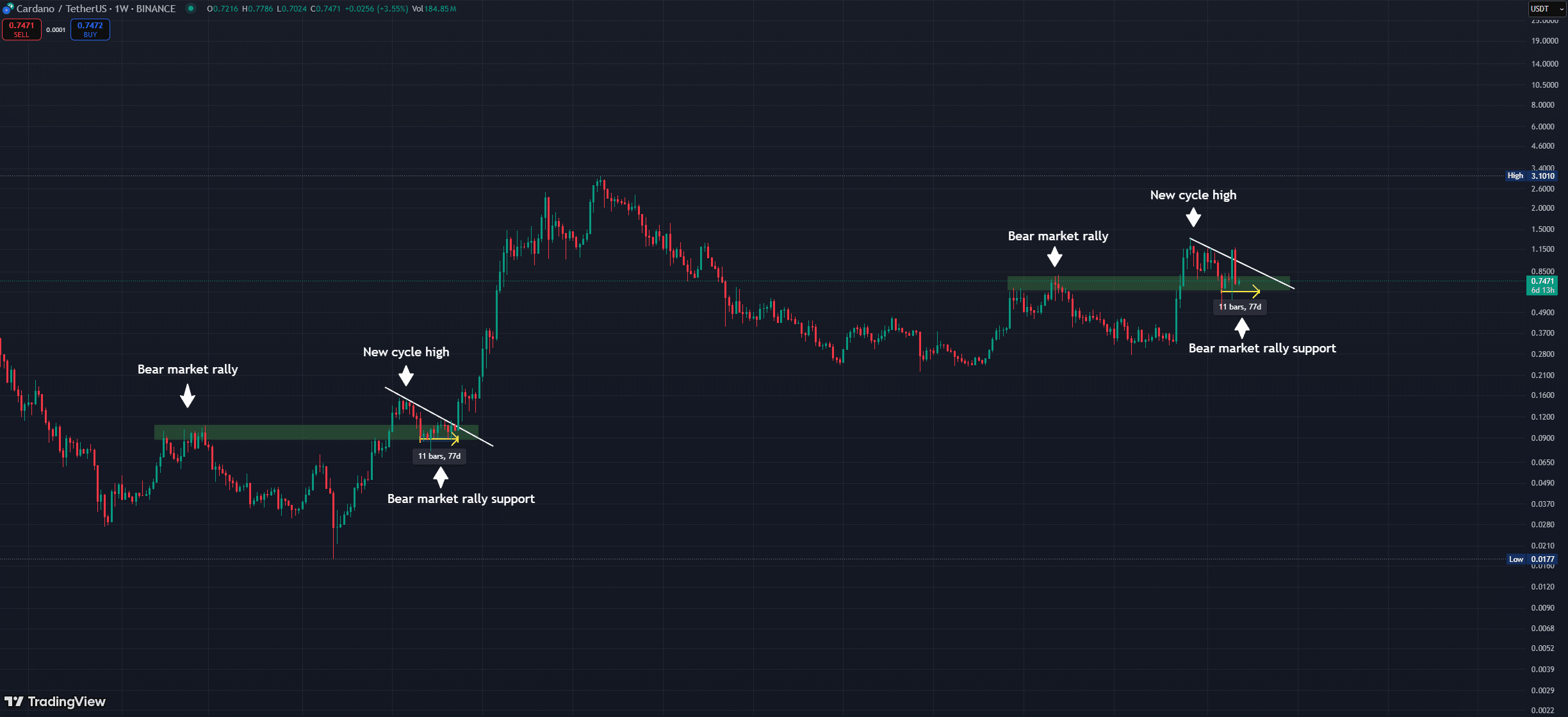

Notably, ADA’s weekly construction mirrors its 2021 cycle, when a 52% drop led to an 11-week consolidation earlier than a 4,000% breakout to $3.10.

At press time, ADA was down 47% and consolidating for 5 weeks from this cycle’s excessive.

Supply: TradingView (ADA/USDT)

Regardless of the general bearish market sentiment, ADA has proven relative energy, remaining 110% above its election day opening worth of $0.34.

On the 1D chart, the altcoin’s worth motion is inside a key assist zone, with the RSI nearing oversold circumstances. If on-chain metrics verify accumulation, this setup may point out a excessive likelihood reversal.

With historic worth developments and key technical indicators aligning, may ADA’s present place be a bear lure earlier than its subsequent explosive breakout?

Trying into ADA’s long-term outlook

Derivatives information highlights de-risking, with Open Curiosity (OI) dropping 11.79% to $734.16 million as $750 million was unwound inside two weeks.

In the meantime, spot market demand stays sturdy, with withdrawals outpacing inflows and buying and selling quantity growing 12% to $2.01 billion. This means sustained shopping for stress.

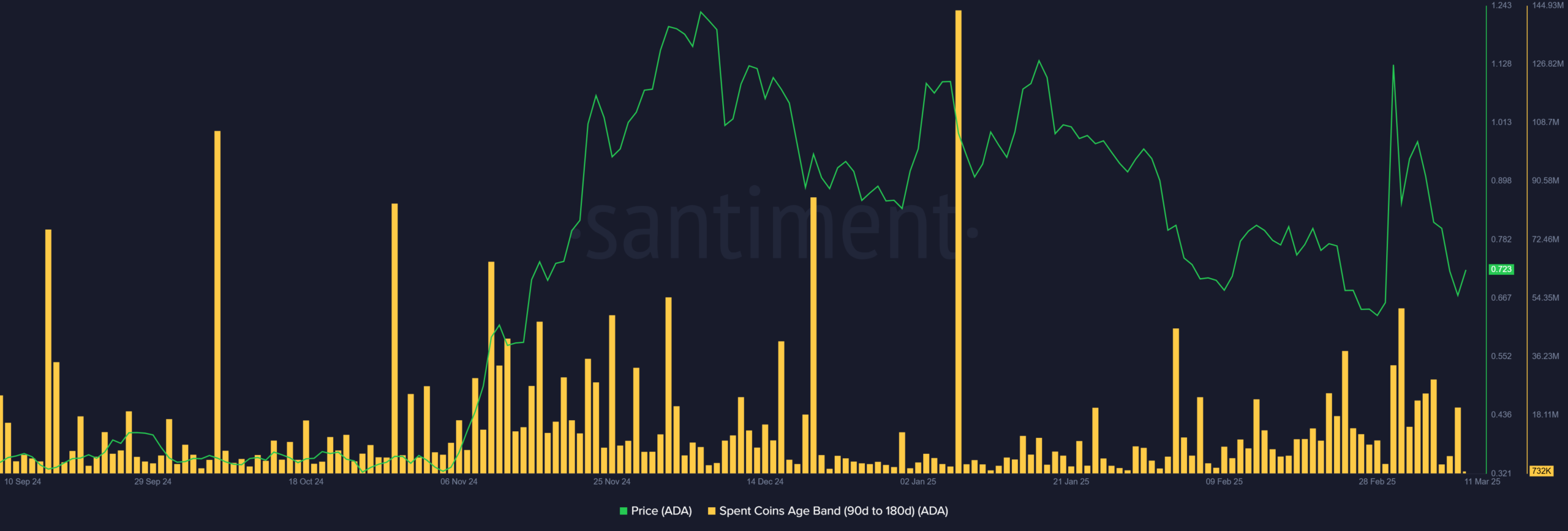

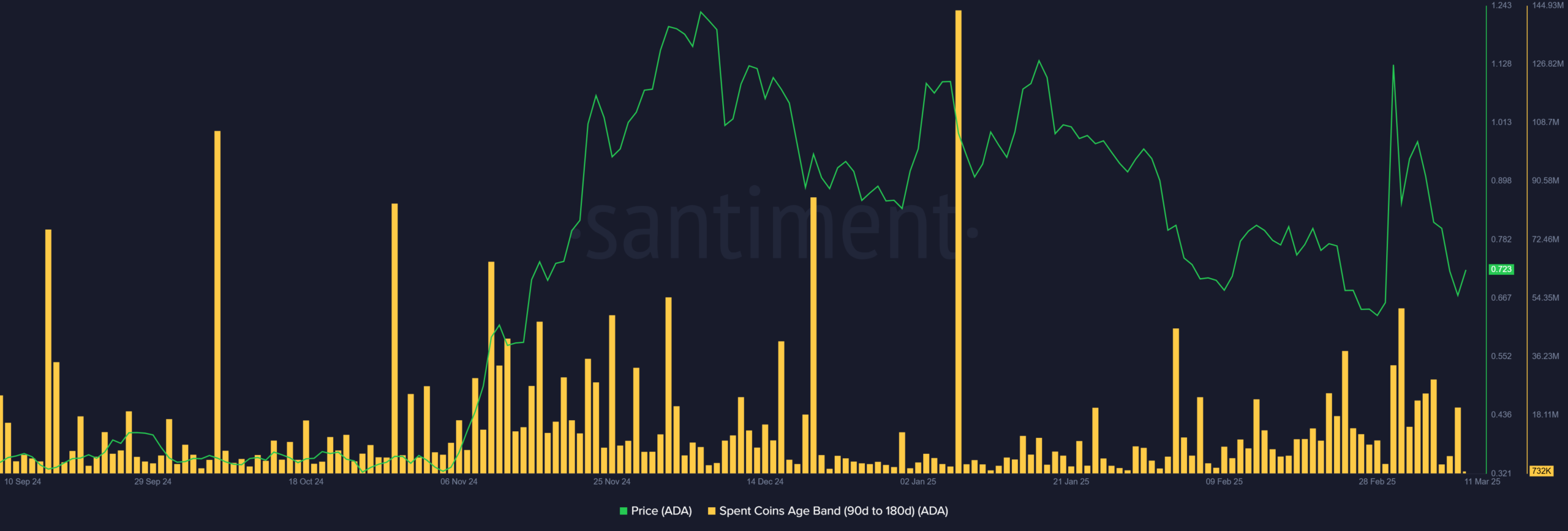

In the meantime, a 15 million ADA uptick within the Spent Coin Age Band (90-180 days) suggests mid-term holders are shifting funds. This might sign early-stage distribution.

Supply: Santiment

With sell-side liquidity being absorbed, ADA could also be organising for deeper consolidation beneath $1, as futures unwinding meets regular spot demand.

Within the coming days, the market will reveal whether or not this consolidation section persists. If it holds, a bear lure may emerge, probably triggering short-seller liquidations as market circumstances shift. This might pave the way in which for a rally harking back to 2021.