Avalanche’s path to $150: Why analysts are bullish on AVAX’s next move

- Analyst predicts AVAX may rally to $150 if bullish breakout patterns maintain sturdy.

- Key resistance close to $44 should be cleared for AVAX to succeed in the brief time period $50 goal.

Avalanche [AVAX] is capturing market consideration, with its worth climbing 1.82% to $43.30 previously 24 hours. The token traded between $41.29 and $43.91, exhibiting sturdy worth resilience throughout this era.

With a market cap of $17.76 billion and a 24-hour buying and selling quantity of $486.1 million, AVAX stays a key focus for buyers.

Institutional curiosity is fueling bullish momentum for AVAX, making it a standout performer available in the market. BlackRock’s BUIDL fund has contributed considerably to the optimistic sentiment across the token.

This rising consideration exhibits a stable basis for upward motion within the close to time period.

AVAX getting ready to a large breakout

Avalanche is gearing up for a big breakout, with technical indicators pointing towards a possible rally to $150.

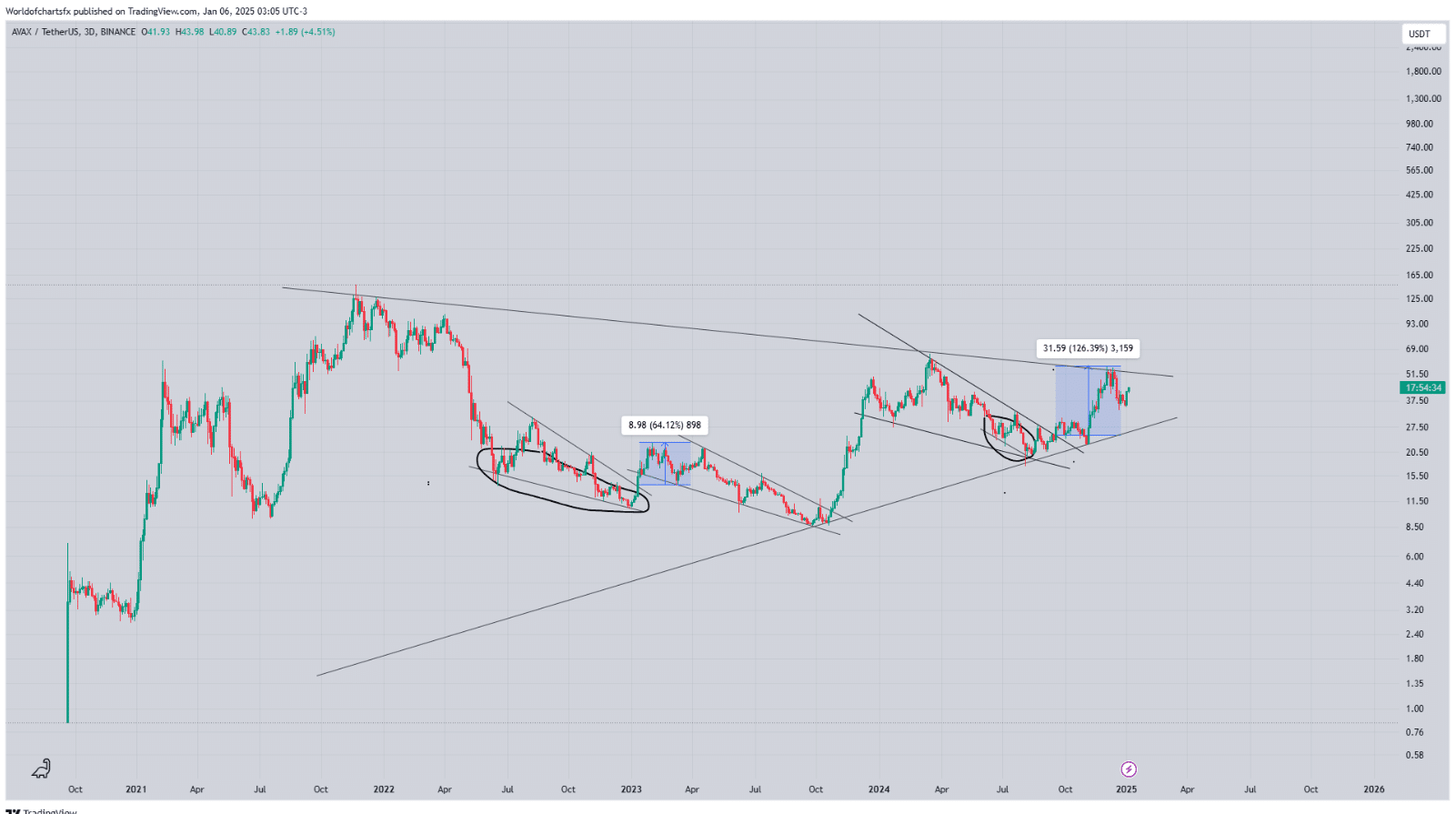

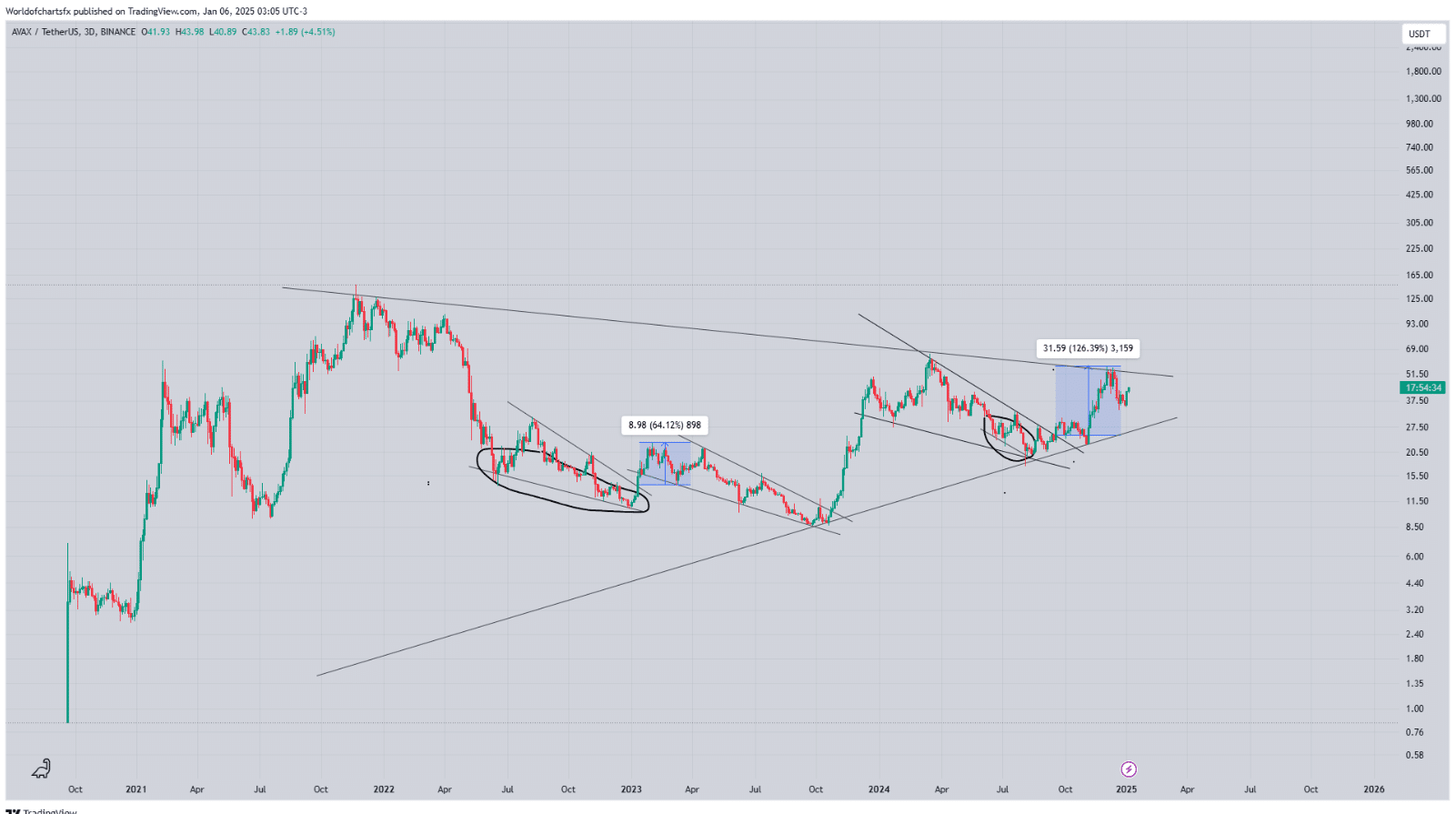

Latest information from World of Charts revealed ascending consolidations since 2021, reflecting the token’s skill to maintain larger lows.

These setups align with the present worth development, the place AVAX is testing resistance inside a narrowing vary.

Supply: World Of Charts

The Avax worth highlighted sturdy bullish sentiment, indicating {that a} breakout above this resistance may set off important worth motion.

Including to this bullish outlook, AVAX recorded a buying and selling quantity of $196.81 million within the final 24 hours, demonstrating strong liquidity and lively dealer participation.

$44 resistance important for subsequent transfer

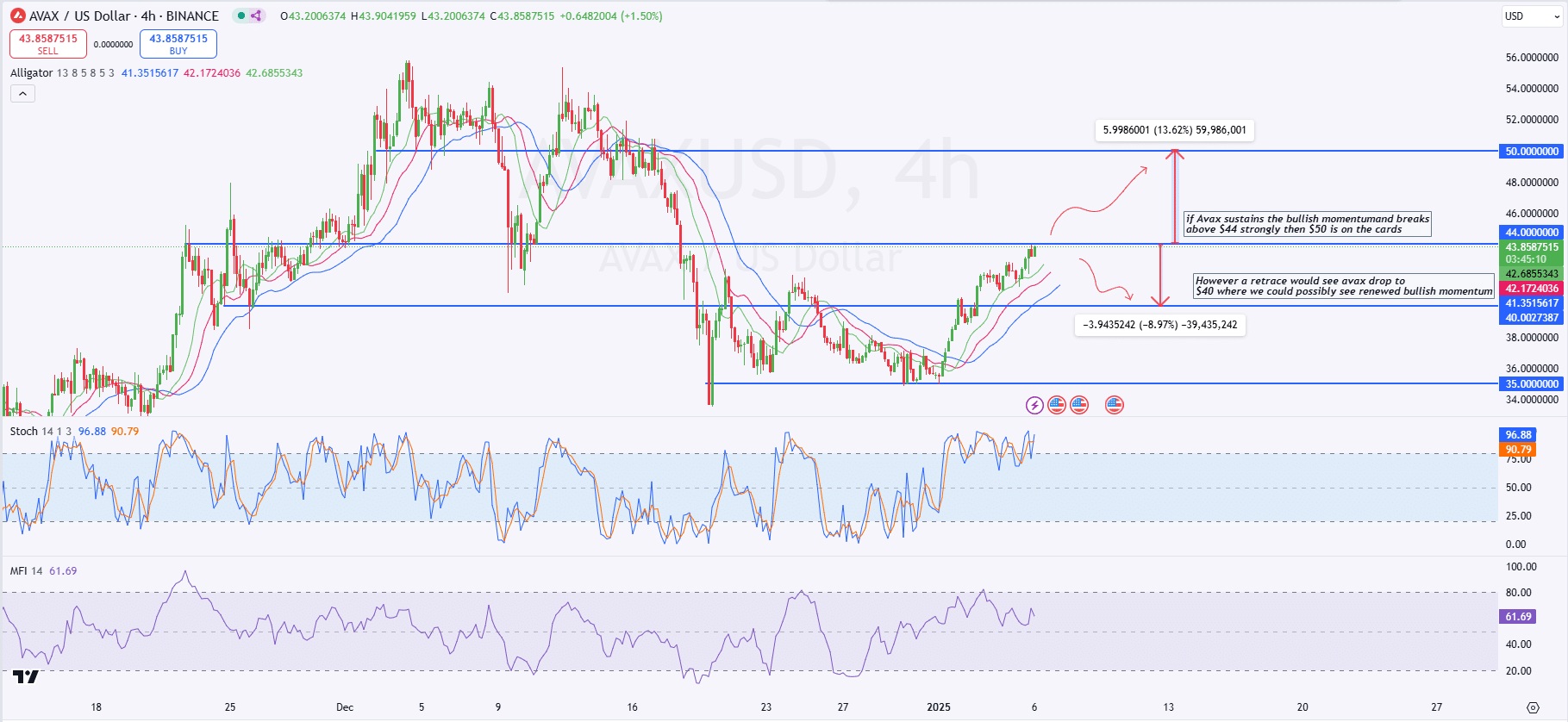

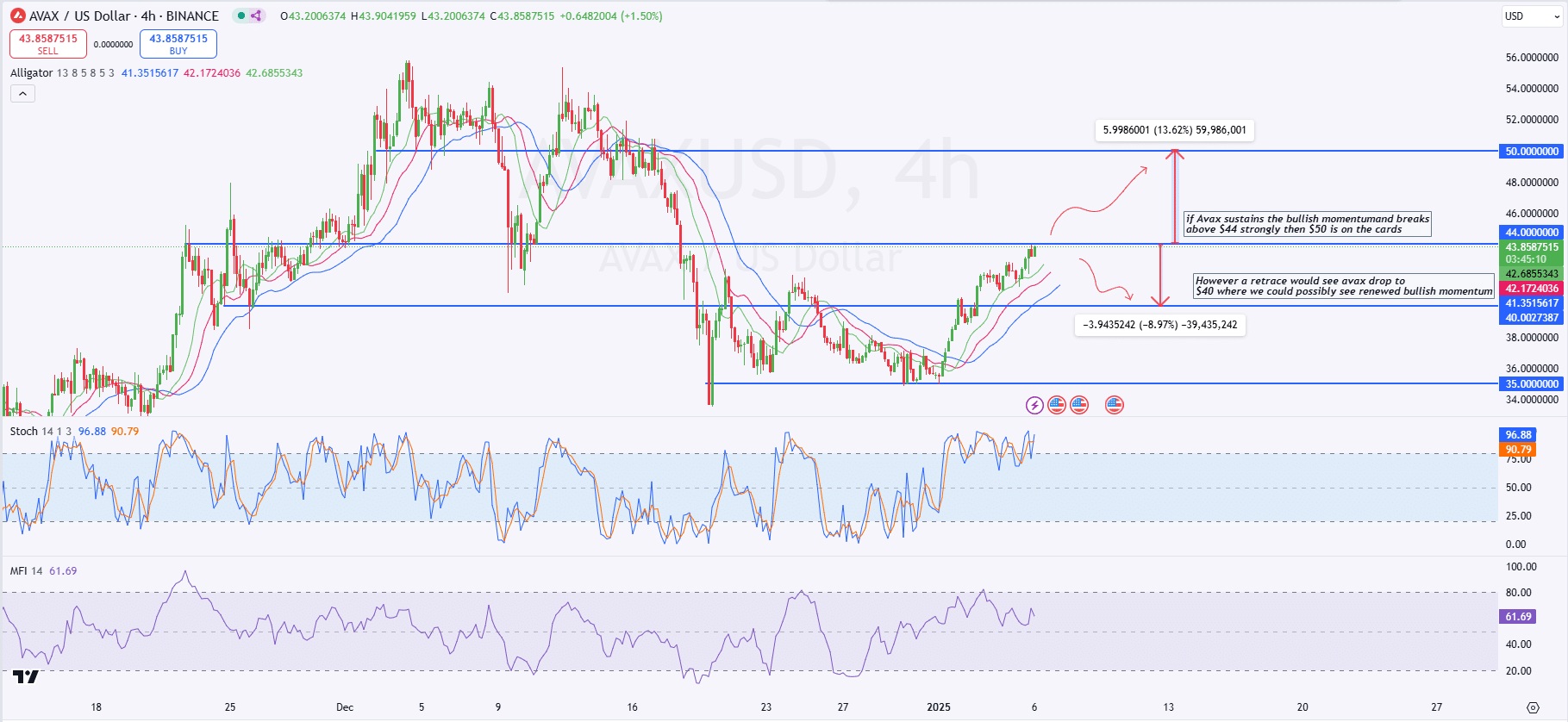

Avalanche was buying and selling close to the $44 degree, a key resistance zone that might dictate its subsequent worth motion.

If the bullish momentum persists and AVAX breaks decisively above $44, the worth could goal the psychological resistance at $50, representing a possible 13.62% upside.

Supply: TradingView

Nevertheless, failure to take care of this degree may set off a retrace towards $40, a important assist degree the place bullish exercise could renew.

The Alligator indicator confirmed a large divergence among the many transferring averages, signaling sturdy upward momentum.

The Stochastic RSI is overbought at 96.88, suggesting {that a} short-term cooldown would possibly happen.

In the meantime, the Cash Stream Index (MFI) stood at 61.69, indicating reasonable shopping for strain however leaving room for additional accumulation if bullish sentiment strengthens.

AVAX holder sentiment

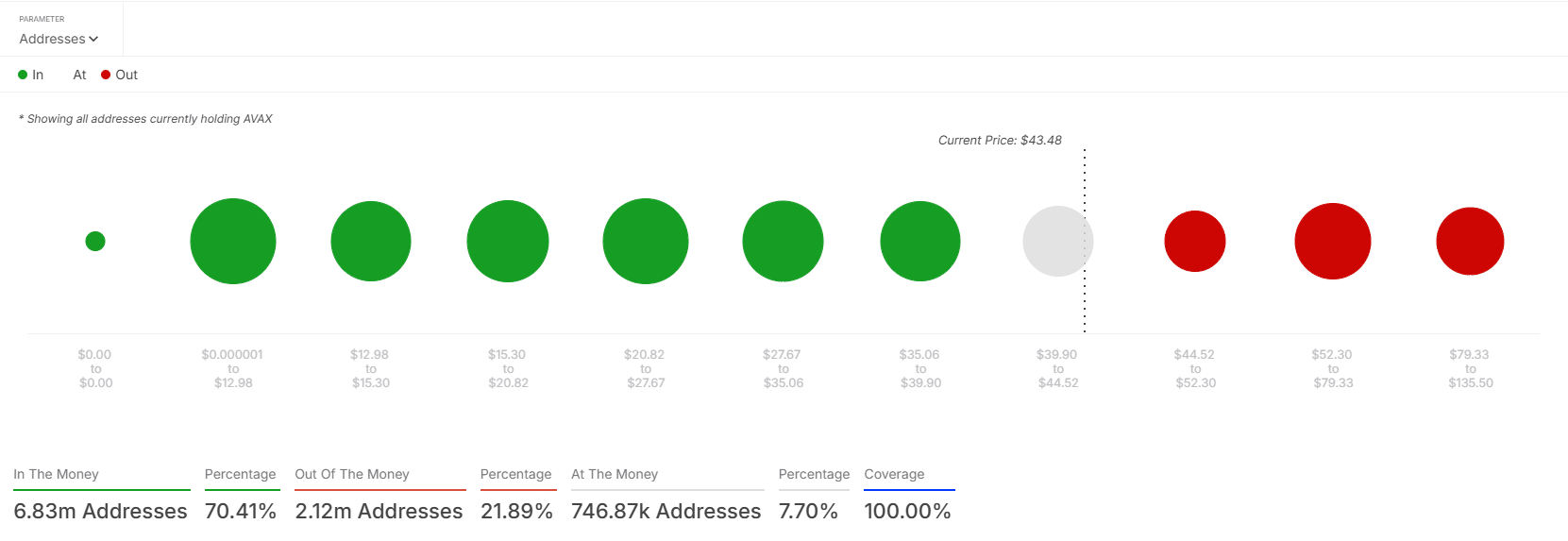

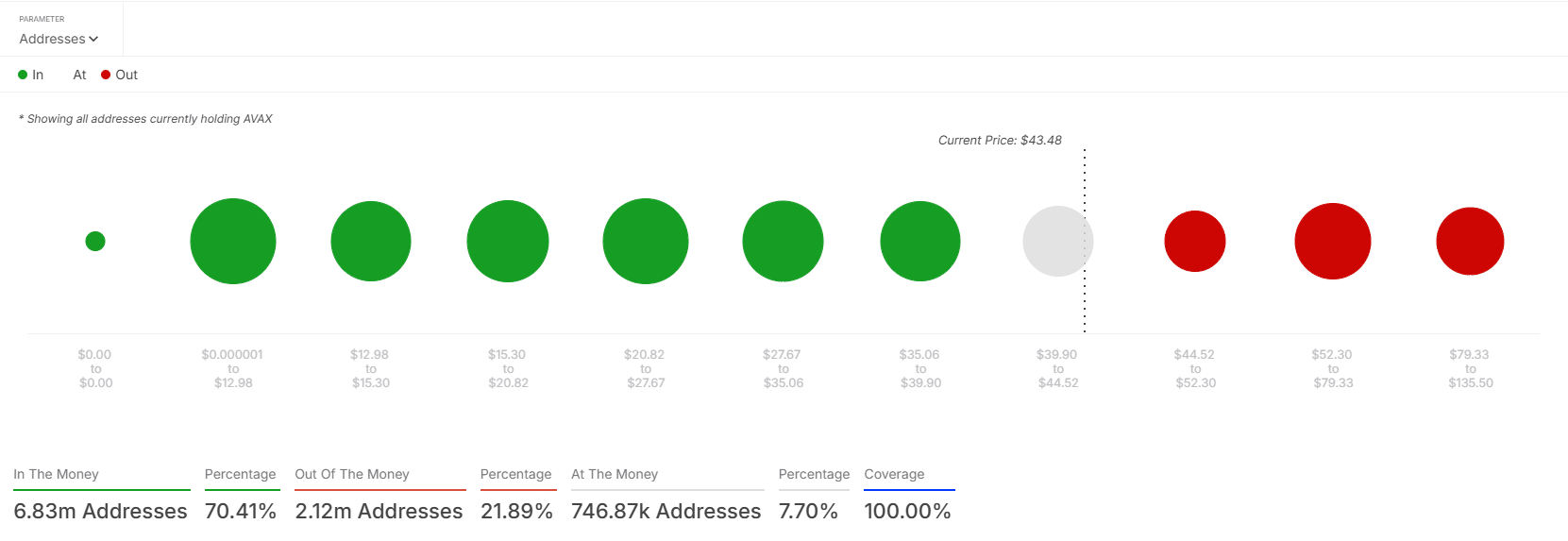

Avalanche’s holder information from IntotheBolck confirmed that 70.41% of addresses holding AVAX have been worthwhile at press time, with the acquisition value under $43.48.

Roughly 21.89% of addresses have been out of the cash, holding tokens at costs above the present degree. In the meantime, 7.70% of addresses have been on the cash, indicating a balanced place on the present worth.

Supply: IntotheBlock

Learn Avalanche’s [AVAX] Worth Prediction 2025–2026

Clusters of worthwhile holders accrued AVAX between $12.98 and $27.67, marking this as a big historic shopping for zone.

As AVAX closes in on $44 resistance, potential promoting strain could emerge from holders in search of to exit at break-even ranges.