AVAX’s price – Up to hit $37 or down to $32?

- Lengthy positions focusing on $37 may expertise large-scale liquidations.

- If the cash movement stalls, AVAX may drop to $32.

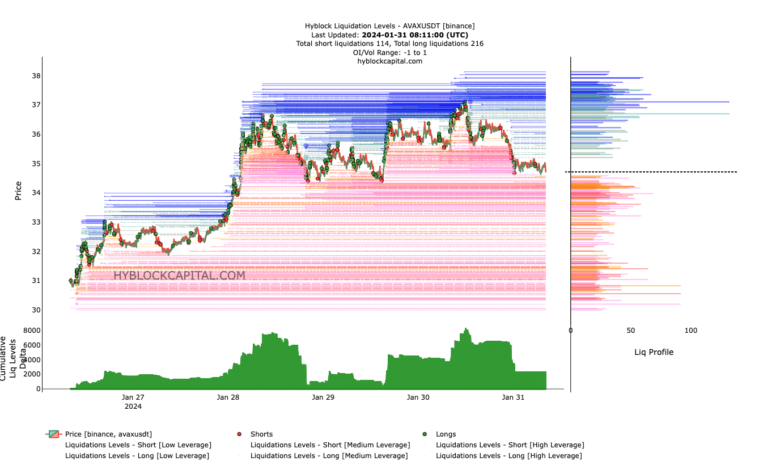

AMBCrypto’s evaluation of the Liquidation Ranges has flashed a warning sign for Avalanche [AVAX] merchants. In line with the information evaluated utilizing Hyblock Capital, there was a cluster of liquidity across the $37 area.

For context, Liquidation Ranges present the estimated costs the place a liquidation occasion may happen. From the chart beneath, AVAX may proceed towards $37.

Is south the following route?

However as soon as it hits the zone, it may set off the cease lack of lengthy positions with excessive leverage. Upon hitting this stage, little or no liquidity is perhaps left, forcing the worth to reverse southward.

Supply: HyblockCapital

AMBCrypto additionally noticed the Cumulative Liquidation Degree Delta (CLLD), which appeared to indicate an analogous sign. The CLLD can be utilized to ascertain a directional bias for a cryptocurrency.

At press time, the CLLD was optimistic. However this place means that AVAX may endure a full retracement, which may plunge the worth.

AVAX’s value at press time was $34.54, indicating a 5.62% 24-hour lower. Additionally, the buying and selling quantity of the ninth most useful cryptocurrency decreased.

A scenario like which means that the worth motion has turn out to be weak. Ought to the quantity enhance whereas the worth decreases, AVAX may drop as little as $32.

However it is very important assess the likelihood from a technical perspective, which we did.

AVAX eyes $32

In line with the every day chart, the AVAX was on the verge of dropping beneath the brief and mid-term EMAs. EMA is a brief for Exponential Transferring Common. At press time, the 20 EMA (blue) and 20 EMA (yellow) had been virtually on the similar spot.

This implies that AVAX doesn’t have a transparent route but. Ought to the worth break beneath the EMAs, then AVAX’s subsequent transfer may both be a decline to $33.10 or $32.06.

Both approach, a value lower seems to be extra doubtless for the token.

But when the 20 EMA rises previous the 50 EMA, the bearish thesis could possibly be invalidated. Concerning the Cash Stream Index (MFI), the chart confirmed that the studying had elevated.

This enhance means that bulls had been attempting to impact a optimistic capital movement to influence an uptrend for AVAX. If this continues, AVAX may goal $37.

Nevertheless, it may face rejection on the stage, contemplating the liquidity cluster at that time.

Supply: TradingView

The Relative Energy Index (RSI) additionally rose to 49.87, indicating a slight enhance in shopping for momentum. If the RSI flips 50.00, AVAX may get well to $35. If not, the token may proceed buying and selling between $32 and $35.

Learn Avalanche’s [AVAX] Worth Prediction 2024-2025

When it comes to the Funding Price, on-chain knowledge showed that the metric was optimistic. If the Funding Price, it implies that the perp value is buying and selling at a reduction in comparison with the index worth.

Supply: Santiment

Nevertheless, the optimistic Funding Price prompt that the perp value was at a premium in comparison with the spot. As well as, the optimistic Funding Price whereas AVAX’s value drop infers a bearish sign.