Azuki Elementals’ Floor Price Collapses To 1.65 ETH!

Your entire Azuki model NFT sequence witnessed a pointy decline, with the ground worth dropping to 10 ETH, marking a staggering 24-hour lower of 31%. This disappointing flip of occasions has raised considerations throughout the digital collectibles neighborhood.

Considered one of Azuki’s co-founders acknowledged the failure of the minting expertise, stating that it didn’t meet the anticipated commonplace. This admission highlights the challenges confronted by the workforce in delivering a passable person expertise and assembly the excessive expectations of collectors and traders.

We hear your suggestions loud and clear. The mint expertise was lower than the Azuki commonplace. Need to give some readability on what occurred throughout the presale and a few normal ideas

1/8

— location tba (@locationtba) June 27, 2023

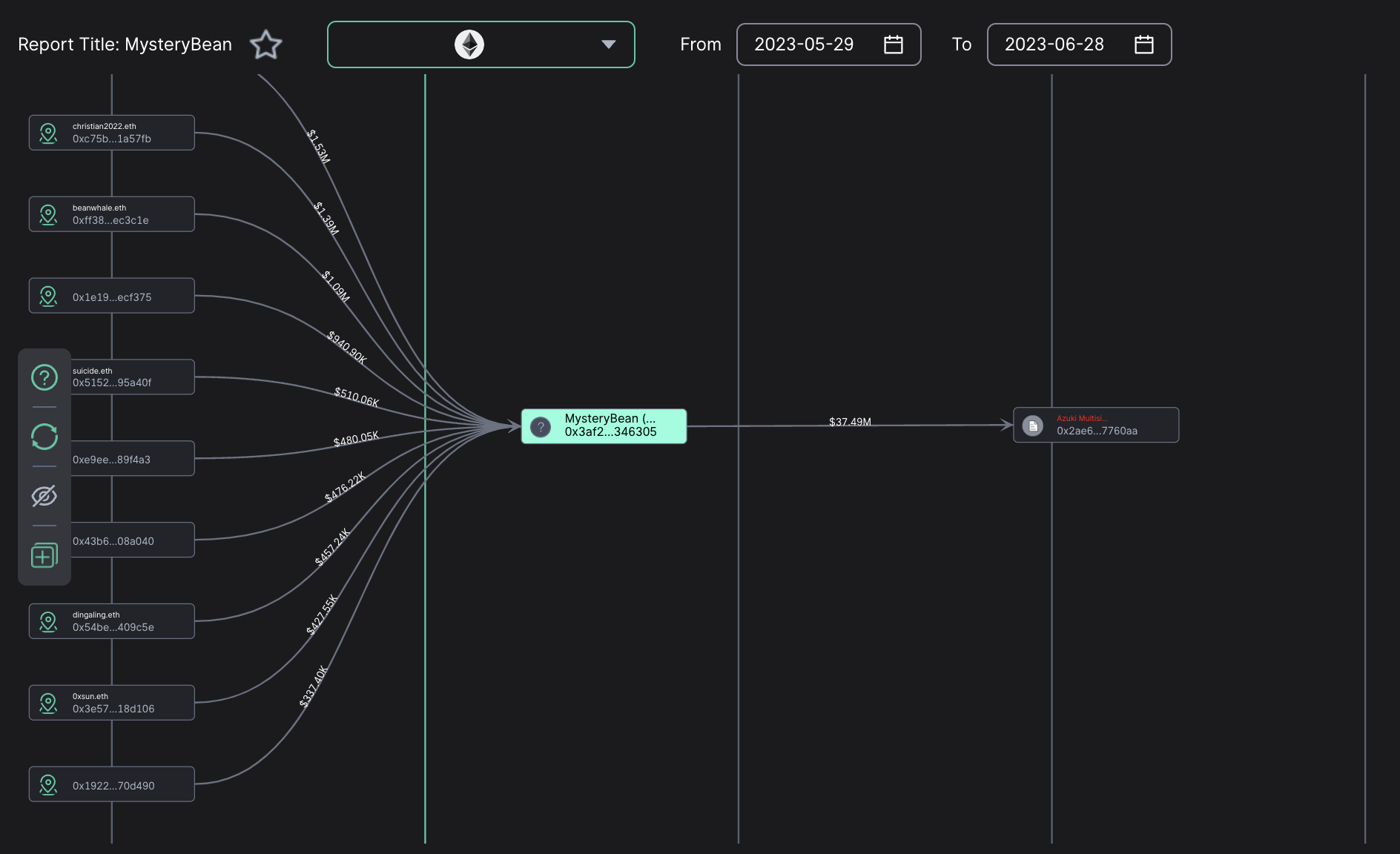

Regardless of the decline in costs and the admission of failure, the Azuki official workforce (0x3A…6305) managed to generate substantial income by means of the sale of Azuki Elementals. They acquired 20,000 ETH, which quantities to roughly $37 million. Shortly after, the funds have been transferred to the Azuki workforce’s multi-signature tackle (0x2a…60AA). This switch of funds alerts the workforce’s continued dedication to navigating the challenges and striving for future success.

Notable particular person consumers emerged throughout the sale of Azuki Elementals, reflecting the continued curiosity within the NFT market. Amongst them, luggis.eth stands out as the most important purchaser, investing a considerable $1.53 million in Azuki Elementals.

.#AzukiElements offered out inside quarter-hour

Throughout the sale, the @Azuki workforce acquired 20000 $ETH ($37.49M), which has been transferred to the multisig tackle 0x2ae6.

High spenders on the left:

luggis.eth: $1.53M

christian2022.eth: $1.39M

beanwhale.eth: $1.09M pic.twitter.com/PNdrLsgnSn— 0xScope (🪬 . 🪬) (@ScopeProtocol) June 27, 2023

Different important consumers embrace christian2022.eth, who bought Azuki Elementals for $1.39 million, beanwhale.eth, who acquired them for $1.09 million, and suicide.eth, who invested $0.51 million. These sizable transactions show the continued attraction of NFTs as a type of digital asset funding.

The decline in Azuki Elementals’ ground worth and the admission of minting failure have sparked discussions throughout the NFT neighborhood concerning the challenges confronted by initiatives aiming to ship distinctive and compelling digital collectibles. Collectors and traders are eagerly observing how the Azuki workforce will tackle the considerations and enhance their choices shifting ahead.

DISCLAIMER: The Info on this web site is supplied as normal market commentary and doesn’t represent funding recommendation. We encourage you to do your personal analysis earlier than investing.