Bernstein: Why Ethereum ETF staking approval could boost ETH

- Bernstein has gone lengthy on ETH, citing probably ETF staking yield approval.

- Different catalysts embrace constructive ETH ETF flows and institutional curiosity.

Bernstein analysts are bullish on Ethereum [ETH], citing a possible US ETH ETF staking approval below the Trump administration as a significant catalyst.

The analysis and brokerage agency additionally cited three different catalysts for the altcoin, terming its current relative underperformance as an excellent reward setup.

A part of the analysts’ report, led by Gautam Chhugani, learn,

“We consider, given the ETH’s underperformance, the risk-reward right here seems to be enticing’

Ethereum ETF staking approval

In contrast to Hong Kong’s ETH ETF, which has staking, the US didn’t greenlight staking yield for the merchandise in July.

In response to the analysts, this might change below the Trump administration and supply a horny yield amid Fed fee curiosity cuts.

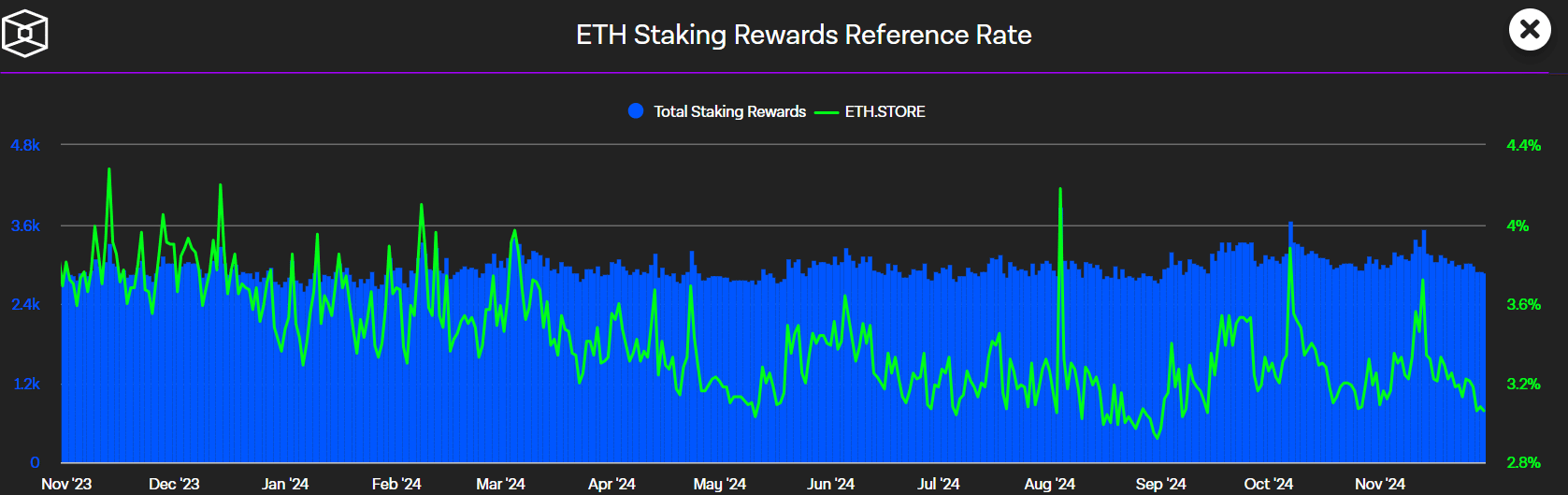

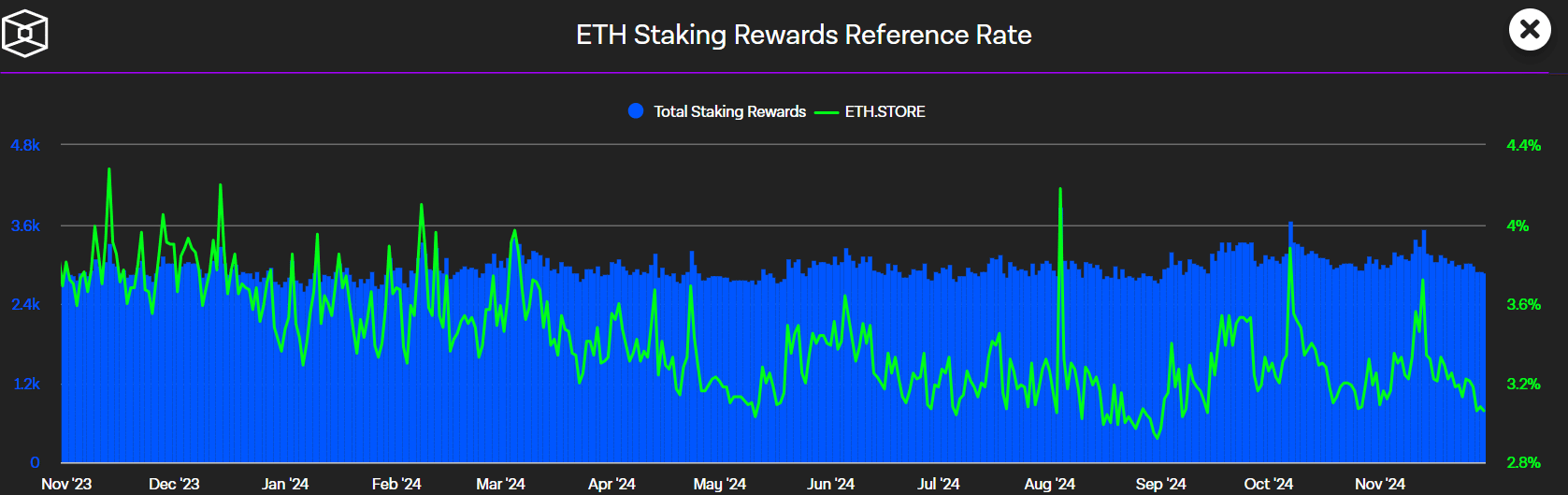

“ETH staking yield could also be coming quickly… We consider, below a brand new Trump 2.0 crypto-friendly SEC, ETH staking yield will probably be authorised. In a declining fee surroundings, ETH yield (3% in ETH right this moment) might be fairly enticing.”

Supply: The Block

In Might, Galaxy Digital’s Mike Novogratz predicted the identical, with a possible timeline of mid-2025 or 2026.

The analysts added that the ETH staking yield, which was 3% at press time, may surge to 4-5% upon ETF staking approval. This might entice extra institutional curiosity within the altcoin.

“The ETH yield characteristic in ETFs would additionally depart some unfold for asset managers, bettering ETF economics, bringing additional incentive to push ETH ETF as institutional asset allocators improve digital asset publicity.”

Constructive ETH ETF flows

ETH’s robust demand and provide dynamics alongside constructive ETH ETF flows have been different catalysts highlighted by Bernstein.

Out of 120M ETH in provide, the analysts said that 28% was staked (about 34.6M ETH), whereas 10% (12M ETH) was locked in deposit/lending platforms.

This left 60% of ETH in provide untouched previously 12 months, on what the analysts termed a ‘resilient investor base’ and favorable demand/provide dynamics.

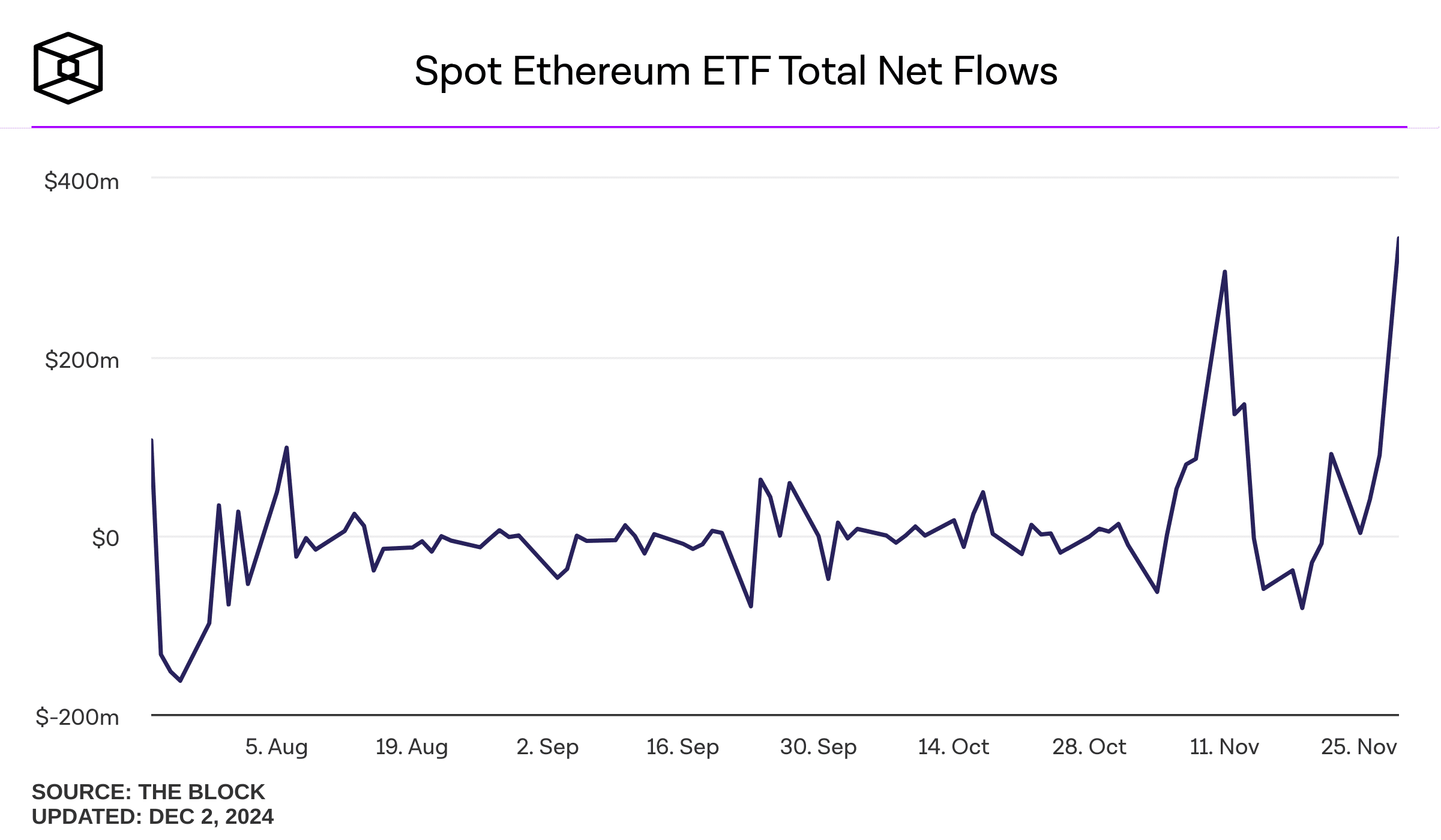

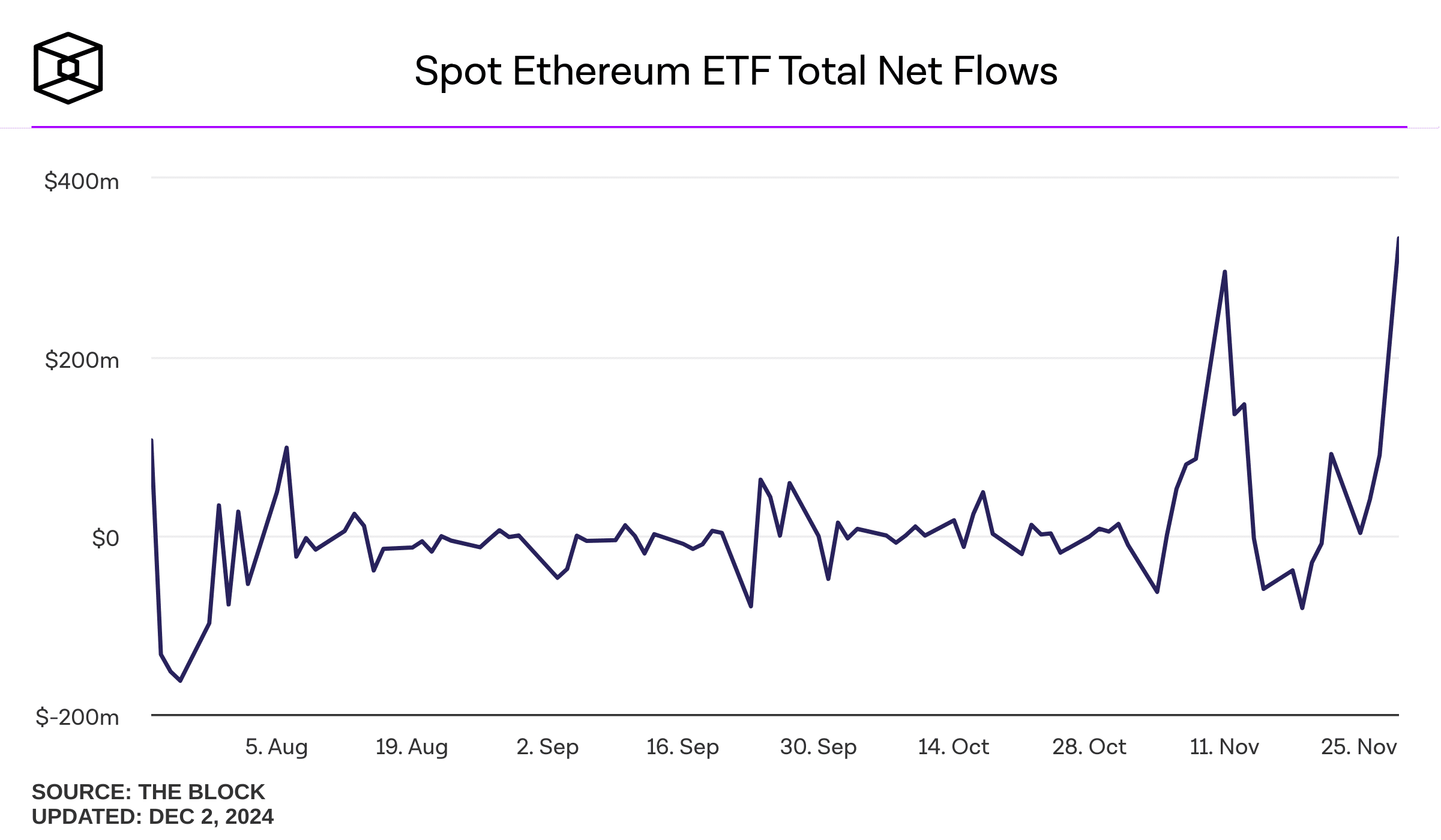

In addition to, ETH ETF flows turned constructive and even flipped BTC ETFs for the primary time.

The ETF’s complete web flows have been unfavorable since launch, however that modified in November. Per Bernstein, this might strengthen the altcoin’s robust demand/provide dynamics.

Supply: The Block

Lastly, the excessive stage of belief from giant retail and institutional traders within the Ethereum community may enhance ETH.

Bernstein cited ETH’s TVL, which stood at about 60% ($89B), as a vote of confidence amongst institutional gamers. At press time, ETH was valued at $3.6K, up 47% previously month.