Best Crypto Debit Cards in 2024: An Overview of the Best Bitcoin Cards

In case you’ve lived a day within the fashionable world, there’s a extremely excessive likelihood that you simply’ve interacted with a credit score or debit card earlier than. However what about crypto playing cards? Identical to their conventional cousins, they can be utilized to make on-line and in-store purchases, earn rewards, and make transactions. In contrast to the playing cards issued by banks, nevertheless, they retailer crypto belongings. Right now, I’ll speak about a few of the greatest crypto debit playing cards accessible in the marketplace — and in addition take a look at whether or not these playing cards are price utilizing in any respect.

The 5 Finest Bitcoin Debit Playing cards in 2024

Whereas there should not as many crypto debit (or credit score) playing cards as conventional debit playing cards, there are nonetheless sufficient to select from. The Bitcoin debit playing cards beneath are a few of the greatest in the marketplace, and canopy a variety of preferences.

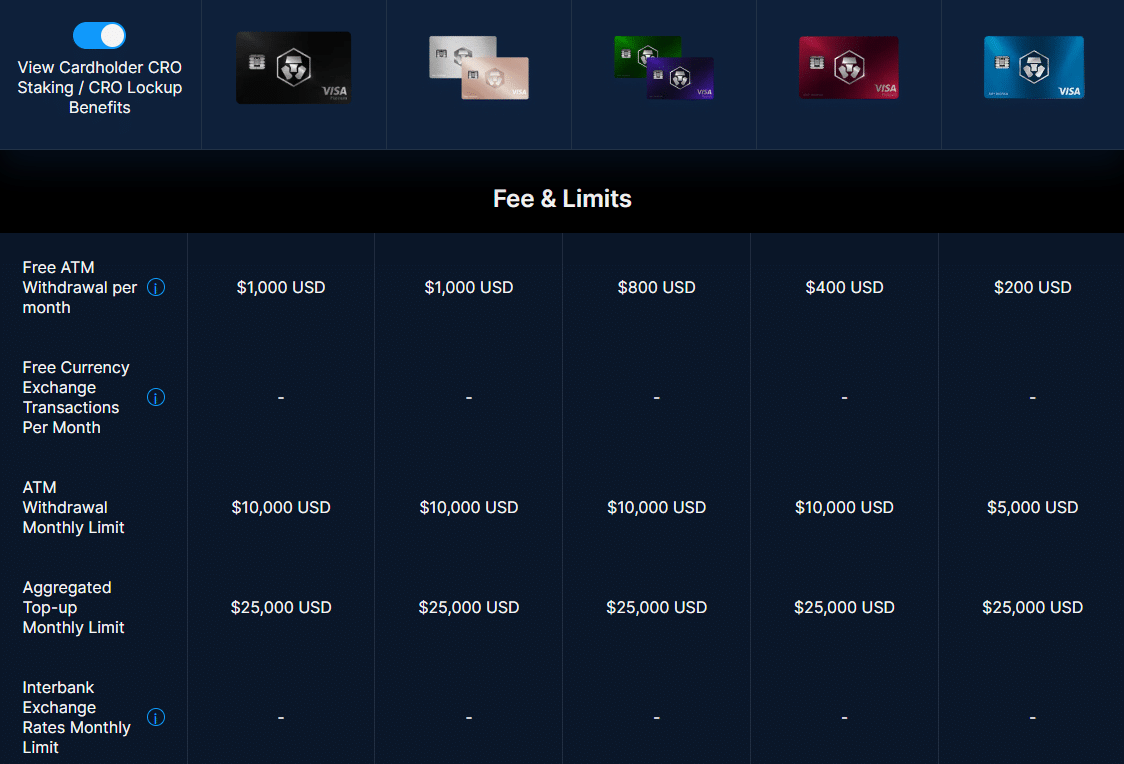

Crypto.com Visa Card

Probably the most common choices within the cryptocurrency card market, the Crypto.com Visa Card makes it potential for customers to transform and spend their crypto holdings on on a regular basis purchases whereas incomes beneficiant rewards. Linked on to Crypto.com’s platform, it permits seamless conversion of crypto belongings to fiat forex, which will be spent at any location that accepts Visa. The cardboard provides a tiered rewards system primarily based on the quantity of CRO tokens (Crypto.com’s native token) staked, with greater tiers providing extra advantages comparable to greater cashback percentages, complimentary airport lounge entry, and no international transaction charges.

- No. of Crypto Supported: Big selection of cryptocurrencies

- Charges: No annual price; particular charges depend upon card tier

- Rewards: As much as 5%, various by card tier

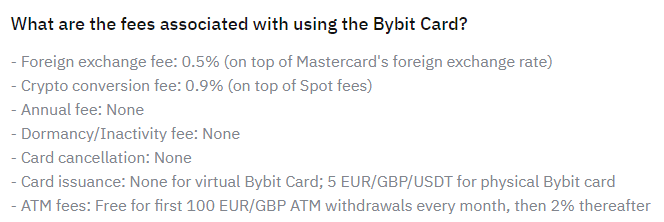

Bybit Crypto Card

The Bybit Crypto Card, powered by Mastercard Worldwide Included, is designed to permit Bybit change customers to spend their crypto holdings globally. This card converts digital forex into fiat forex robotically, enabling simple purchases and ATM withdrawals. It provides a digital card possibility, which can be utilized instantly upon approval, and a bodily card that arrives later. The Bybit card stands out for its integration with Bybit’s buying and selling platform, making it simple for customers to handle their digital and fiat currencies in a single place.

Please be aware that the Bybit card is at the moment solely accessible in AUS and EEA.

- No. of Crypto Supported: Numerous cryptocurrencies supported on Bybit

- Charges: No annual or hidden charges; aggressive ATM withdrawal charges

- Rewards: Rewards fluctuate, promotional cashback provides

Coinbase Crypto Card

Coinbase, one of many largest crypto exchanges globally, provides the Coinbase Crypto Card, a Visa debit card that converts cryptocurrency into fiat forex for purchases and ATM withdrawals. The cardboard integrates straight with Coinbase accounts, permitting customers to spend any of the cryptocurrencies they maintain. It provides safety features comparable to two-factor authentication and instantaneous card freeze via the cell app. The Coinbase card facilitates administration of crypto and fiat bills straight from the Coinbase app, offering detailed receipts and summaries after every transaction.

- No. of Crypto Supported: Helps all cryptocurrencies accessible on Coinbase

- Charges: No spending or annual charges; different charges might apply

- Rewards: As much as 4% again in crypto rewards

BitPay Crypto Debit Card

The BitPay Debit Card is a pay as you go card. With it, crypto holders can convert their digital belongings into US {dollars}: the latter will be spent anyplace Mastercard is accepted. This card is notable for its ease of use, permitting for quick conversion from crypto to fiat with out the necessity for a financial institution. It’s a wonderful selection for individuals who wish to use their cryptocurrency for each day bills with out the effort of a number of transfers or exchanges. BitPay’s card additionally helps withdrawals from ATMs, offering a liquidity possibility for customers.

- No. of Crypto Supported: Helps Bitcoin, Ethereum, and different main cryptocurrencies

- Charges: Has no issuance price and normal transaction charges

- Rewards: Cashback varies by provide

On the time of writing, BitPay has briefly paused the issuance of recent BitPay playing cards. U.S. residents can be part of the waitlist on their web site.

Wirex Visa Card

The Wirex Visa Card empowers customers to spend their cryptocurrency belongings by immediately changing them to fiat forex. This card is accessible in a number of areas, together with Europe and Asia, and provides important rewards via its Cryptoback™ program, the place customers earn again a share of their spending in cryptocurrency. Wirex card customers take pleasure in the good thing about free worldwide ATM withdrawals and 0 change charges as much as a selected restrict, making it a aggressive possibility for worldwide vacationers.

- No. of Crypto Supported: Helps a number of cryptocurrencies

- Charges: No issuance price; free worldwide ATM withdrawals as much as a sure restrict

- Rewards: As much as 8% again with Cryptoback™

Binance Visa Card – No Longer Accessible

The Binance Visa Card used to grant Binance customers the liberty to spend their cryptocurrency holdings at over 60 million retailers worldwide, straight changing their crypto belongings into fiat forex on the level of sale. This card built-in seamlessly with Binance’s crypto wallets, facilitating real-time conversion of digital belongings to fiat forex, guaranteeing customers can handle their funds effectively. The Binance Card additionally provided cashback in BNB on each buy, which elevated relying on the quantity of BNB the consumer holds.

Nonetheless, Binance card is now not accessible – it ceased operations in December 2023 as a consequence of regulatory points.

The right way to Select the Finest Crypto Debit Card

When selecting the perfect crypto debit card, a number of key elements must be thought of to make sure the cardboard meets your monetary habits and way of life wants. Right here’s a complete information, outfitted with important key phrases, that will help you navigate the choice course of:

Understanding the Fundamentals

Crypto debit playing cards operate equally to conventional debit playing cards; but, you spend your cryptocurrency holdings for on a regular basis transactions. In contrast to crypto bank cards, these don’t require credit score checks, thus simplifying the applying course of. It’s important to know that if you use a crypto card, the digital forex is often transformed into fiat forex, doubtlessly triggering a taxable occasion every time you transact.

Card Issuance and Supplier

Choosing a good card supplier is essential. The supplier ought to provide sturdy buyer help, simple card issuance processes, and have monitor report within the cryptocurrency market. Verify whether or not the cardboard is issued by a well known fee community like Visa or Mastercard, as this may have an effect on the place the cardboard will be accepted.

Supported Cryptocurrencies

Think about which cryptocurrencies you’ll be able to spend with the cardboard. Whereas some playing cards might solely help main cash like Bitcoin and Ethereum, others would possibly provide a wider vary of digital currencies. Guarantee your card is appropriate together with your cryptocurrency pockets and helps the particular crypto belongings you maintain.

Charges and Limits

Perceive all related prices, together with card issuance charges, month-to-month or annual charges, and transaction charges comparable to ATM withdrawals or international transaction prices. Additionally, take into account the ATM withdrawal limits, as these can fluctuate considerably between playing cards and would possibly impression your entry to money.

Cashback Rewards and Advantages

Many crypto debit playing cards provide cashback rewards on purchases in cryptocurrency. These rewards can fluctuate from 1% to as excessive as 8%, relying on the cardboard tier and the way a lot you spend or maintain in your related crypto pockets. Moreover, some playing cards provide perks comparable to airport lounge entry, greater withdrawal limits, and decrease international transaction charges, relying on the extent of crypto belongings you preserve with the issuer.

Safety Options

Go for playing cards that present superior safety measures. These can embody two-factor authentication, the power to freeze and unfreeze your card via a cell app, instantaneous transaction notifications, and safe chip expertise. Such options defend towards fraud and unauthorized entry to your funds.

Integration and Comfort

Assess how effectively the cardboard integrates with present monetary instruments and companies you employ. Some playing cards provide higher integration with particular cryptocurrency exchanges or wallets, permitting for real-time crypto stability updates and seamless conversion from crypto to fiat currencies.

Person Expertise

Learn consumer evaluations and verify the cardboard supplier’s app and on-line instruments. A very good consumer interface and consumer expertise in managing your card and crypto belongings can tremendously improve your total satisfaction.

Regulatory Standing

Lastly, make sure that the cardboard supplier complies with the regulatory necessities of your jurisdiction. This compliance not solely impacts the legality of utilizing the cardboard but additionally ensures that the supplier follows stringent knowledge safety and privateness legal guidelines.

Crypto Debit Playing cards: Are They Price Utilizing?

How do the perfect crypto debit playing cards match up towards an everyday debit card? Nicely, since there are basic variations between the playing cards issued by conventional monetary establishments and crypto initiatives, there are of course variations in what they’re good — and dangerous — at. Listed below are a few of the upsides and drawbacks of utilizing crypto debit playing cards that you need to take into account earlier than getting one your self.

Crypto Debit Card: Upsides

- Ease of Use: Very like an everyday debit or bank card, crypto debit playing cards can be utilized for on-line purchases, in-store transactions, and even to withdraw money from ATMs. They’re notably helpful for individuals who wish to spend their crypto holdings with out the necessity for a number of transactions to transform them into fiat forex first.

- Rewards and Incentives: Many crypto debit playing cards provide engaging rewards comparable to crypto cashback on purchases, which is usually a important incentive for customers to spend crypto moderately than conventional fiat by way of financial institution accounts. These rewards usually fluctuate by card tiers, doubtlessly rising with extra intensive utilization or greater balances maintained.

- Rapid Entry to Funds: Customers can spend their cryptocurrency holdings straight, with out the necessity to switch funds to a checking account. Some playing cards additionally help options like Google Pay, permitting customers to take a look at immediately with their smartphones.

- No Credit score Verify: Since crypto debit playing cards sometimes don’t lengthen a credit score line, they hardly ever require a credit score verify. This could make them extra accessible than conventional bank cards, particularly for customers with poor credit score historical past.

Crypto Debit Card: Downsides

- Volatility: Spending crypto will be difficult due to the value volatility related to cryptocurrencies. The worth of the crypto cashback earned might additionally considerably fluctuate, doubtlessly eroding the actual worth of the rewards.

- Charges: Crypto debit playing cards will be weighed down with numerous charges, together with month-to-month charges, transaction charges for international transactions, and ATM withdrawal charges. These can add up and would possibly negate a few of the advantages of utilizing the cardboard, particularly if the charges are greater in comparison with these related to common debit playing cards.

- Regulatory Considerations: Crypto debit playing cards function in a quickly altering regulatory setting. This could result in problems or discontinuation of sure card options with out a lot discover, impacting the way you monitor transactions or handle your account.

- Restricted Acceptance: Whereas many crypto playing cards are backed by main fee networks like Visa or Mastercard, the acceptance of crypto for on a regular basis transactions will not be common. This might restrict the place and the way you should utilize the cardboard, particularly in areas with much less developed digital fee infrastructures.

FAQ

Is there a crypto debit card with no KYC?

Most crypto debit playing cards require some stage of KYC (Know Your Buyer) verification to adjust to regulatory requirements and stop fraud. The KYC verification course of sometimes includes offering identification paperwork and, in some circumstances, proof of deal with. The requirement for KYC verification helps make sure that monetary establishments, together with crypto card issuers, adhere to anti-money laundering legal guidelines. It’s extremely unlikely to discover a respected crypto debit card that gives full performance with none KYC processes.

What’s the greatest nameless Bitcoin debit card?

True anonymity is uncommon with Bitcoin debit playing cards as a result of regulatory necessities for KYC verification talked about above. Whereas some playing cards might provide restricted performance with out full id verification, these usually include strict limits on transactions and ATM withdrawals. Customers in search of greater ranges of privateness ought to deal with playing cards that prioritize safe knowledge practices and minimal private knowledge retention moderately than full anonymity.

Is there a crypto card with free ATM withdrawals?

Some crypto debit playing cards provide free ATM withdrawals, however these are sometimes capped at a sure variety of withdrawals or a most month-to-month withdrawal quantity. Past these limits, charges are often utilized. Playing cards that provide free ATM withdrawals have a tendency to make use of this characteristic as a promoting level, so it’s highlighted of their advertising and marketing supplies. Nonetheless, customers ought to learn the superb print to know the situations beneath which free withdrawals are permitted.

What are the crypto debit card charges?

Charges related to crypto debit playing cards can fluctuate extensively relying on the cardboard issuer, the fee community, and the particular card tier. Widespread charges embody month-to-month upkeep charges, ATM withdrawal charges, international transaction charges, and crypto-to-fiat conversion charges. Some playing cards can also cost for issuance and alternative. Larger-tier playing cards, which regularly require holding or staking the issuer’s native digital asset, might provide decrease charges as a part of their advantages to encourage extra intensive utilization and loyalty.

How do I get a Bitcoin debit card?

Let’s use the Coinbase card for example. To acquire a Coinbase Bitcoin debit card, you’ll first must have a verified Coinbase account. In case you don’t have already got one, you’ll be able to enroll on the Coinbase web site or via their app and observe the on-screen directions to finish the KYC (Know Your Buyer) verification course of. As soon as your Coinbase account is about up and verified, you’ll be able to apply for the Coinbase Card via the identical platform. Hyperlink your Coinbase pockets to the cardboard to start out utilizing it for on a regular basis transactions like conventional debit playing cards, however be aware of the tax implications related to each single transaction.

Disclaimer: Please be aware that the contents of this text should not monetary or investing recommendation. The data supplied on this article is the creator’s opinion solely and shouldn’t be thought of as providing buying and selling or investing suggestions. We don’t make any warranties concerning the completeness, reliability and accuracy of this info. The cryptocurrency market suffers from excessive volatility and occasional arbitrary actions. Any investor, dealer, or common crypto customers ought to analysis a number of viewpoints and be accustomed to all native rules earlier than committing to an funding.