Best Growth Stocks to Buy in 2024

Investing in development shares could be a profitable technique for constructing wealth over time. These shares are recognized for his or her potential to outperform the market and generate vital returns for buyers. Nonetheless, not all development shares are created equal, and it’s necessary to do your analysis earlier than making any funding choices.

In case you are contemplating investing in development shares in 2024, it’s important to establish firms with robust development potential and a stable observe file. On this article, we are going to focus on a few of the greatest development shares to purchase in 2024 and why they might be promising investments for the long run.

What Is Progress Investing?

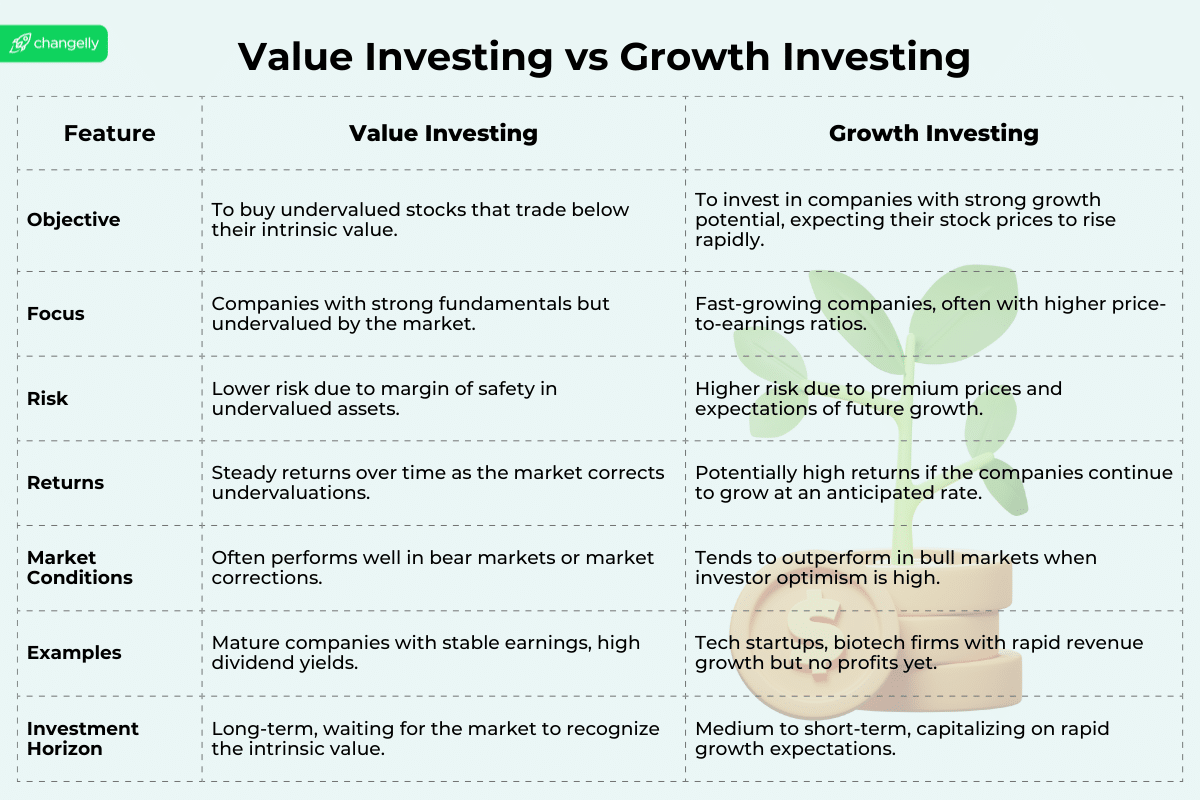

Progress investing is a technique that targets firms anticipated to develop their earnings and income at a fee above the market common, sometimes in rising sectors or industries. This strategy focuses on capital appreciation and entails deciding on firms like Meta Platforms, poised for vital future development on account of modern merchandise, applied sciences, or market positions.

Progress buyers are recognized for his or her willingness to tackle larger dangers for the prospect of outsized returns. They typically have a long-term funding horizon, as development shares might have time to develop and obtain constant earnings development. In contrast to extra secure dividend-paying shares, development shares normally reinvest their earnings again into the enterprise to gasoline additional growth and don’t pay dividends.

Throughout inventory market downturns, adept buyers would possibly outperform market indexes by selectively investing in firms that defy broader detrimental traits. Nonetheless, it’s important to notice that research point out particular person buyers typically underperform in comparison with the market indexes when choosing shares on their very own. On-line brokers can present instruments and platforms that assist buyers make extra knowledgeable choices.

What Are Progress Shares?

Progress shares are a kind of funding that represents shares in firms with the potential for vital growth and elevated profitability. These shares are characterised by their potential to ship substantial returns on funding over time.

One of many key traits of development shares is their above-average earnings development fee. These firms sometimes expertise speedy income and revenue development fueled by elements akin to technological developments, market demand, or aggressive benefits. Consequently, many buyers are lured to development shares by their potential for top returns.

Why Put money into Progress Shares?

Investing in development shares can supply a number of advantages to buyers. These shares belong to firms anticipated to expertise above-average development of their earnings and income. By investing in these shares, buyers have the chance to take part within the success of those firms and doubtlessly earn larger returns in comparison with extra secure, worth shares.

A key good thing about development shares is their potential to generate alpha. Alpha is the additional return an funding earns over a benchmark, and development shares are well-known for his or her potential to surpass market averages on account of their speedy earnings growth. By fastidiously selecting standout development shares, you’ll be able to goal to beat the final market and increase your funding outcomes.

Nonetheless, it’s necessary to stability your portfolio with each development and worth shares. Whereas development shares could be thrilling, additionally they carry larger dangers. These dangers embody excessive expectations from buyers — if an organization doesn’t dwell as much as the hype, its inventory worth might drop sharply. Furthermore, rising rates of interest can even negatively have an effect on development shares by growing their borrowing prices, which could decelerate their development.

Learn additionally: What Is Worth Investing?

Finest Progress Shares to Purchase in 2024

Learn additionally: Finest AI shares to purchase now.

Zoom Video Communications (NASDAQ:ZM)

Zoom Video Communications is a number one supplier of video conferencing and communication options. The corporate’s mission is to make video communications accessible, dependable, and straightforward to make use of for everybody. Zoom provides a variety of merchandise, together with Zoom Conferences, Zoom Telephone, and Zoom Rooms, catering to the wants of people, small companies, and enormous enterprises.

When it comes to market place, Zoom has established itself as a dominant participant within the video conferencing business. Its user-friendly interface, high-quality audio and video, and versatile pricing choices have contributed to its speedy development. The corporate’s enterprise mannequin primarily depends on subscription-based income, with prospects paying for varied plans relying on their utilization wants.

Trying forward, Zoom has a transparent development technique in place. It goals to broaden its product choices, goal new market segments, and improve its know-how to take care of its aggressive benefit. Zoom believes that the growing demand for distant communication options and the rising pattern of versatile work preparations will proceed to drive its development.

The COVID-19 pandemic has had a major influence on Zoom’s consumer base and income. The worldwide shift in direction of distant work and social distancing measures has led to a surge in demand for video conferencing options. Zoom skilled an exponential improve in its consumer base, with each particular person and company prospects relying closely on the platform to conduct conferences, courses, and social interactions remotely.

This surge in demand has resulted in a powerful income development for Zoom. Nonetheless, the corporate additionally confronted challenges in scaling its infrastructure to satisfy the sudden demand, which led to privateness and safety considerations. Nonetheless, Zoom has been proactive in addressing these points, implementing varied safety measures to boost consumer privateness and safety.

ON Semiconductor (NASDAQ:ON)

ON Semiconductor is a outstanding participant within the semiconductor business, catering to numerous purposes akin to automotive, industrial, communication, and shopper sectors. With a stable financial moat score, the corporate has established a aggressive benefit on this quickly evolving market.

ON Semiconductor’s development technique is primarily centered on two key traits: electrification and connectivity. Because the world shifts in direction of electrical autos and renewable vitality sources, the demand for energy administration options and energy-efficient semiconductors has drastically elevated. ON Semiconductor has strategically invested in analysis and growth to provide you with cutting-edge merchandise that meet these evolving wants.

One other key space of focus for ON Semiconductor is connectivity. With the speedy development of IoT (Web of Issues) and 5G know-how, the demand for connectivity options has grown exponentially. ON Semiconductor has positioned itself to capitalize on this pattern by providing a broad portfolio of wi-fi connectivity options and sensor applied sciences.

Along with its development technique, ON Semiconductor has been actively pursuing strategic acquisitions to broaden its product choices and geographic attain. These acquisitions have enabled the corporate to additional strengthen its place out there and improve its capabilities to serve a variety of consumers.

Salesforce (NYSE:CRM)

Salesforce, a worldwide chief in buyer relationship administration (CRM) know-how, has a variety of core enterprise choices. Based in 1999, the corporate is headquartered in San Francisco, California.

On the coronary heart of Salesforce’s choices is its CRM know-how, which helps companies handle their interactions with prospects all through your entire buyer lifecycle. With Salesforce CRM, companies can observe buyer contacts, handle gross sales and leads, and supply customized service and assist. The platform companies provided by Salesforce empower companies with instruments and assets to construct customized purposes and integrations, automate processes, and improve productiveness.

Along with CRM and platform companies, Salesforce additionally provides a collection of selling and commerce companies. These companies allow companies to create customized advertising and marketing campaigns, observe buyer habits and interactions, and ship focused content material and provides. The analytics options supplied by Salesforce assist companies acquire invaluable insights from their information, uncover patterns and traits, and make knowledgeable choices.

Lastly, Salesforce provides integration companies that enable companies to attach their Salesforce platform with different methods and purposes, making certain seamless information move throughout their group.

e.l.f. Magnificence (NYSE:ELF)

e.l.f. Magnificence (NYSE: ELF) is a well-liked development inventory within the cosmetics business. Recognized for its high-quality but reasonably priced merchandise, e.l.f. has gained immense recognition amongst magnificence fanatics worldwide. With its in depth vary of cosmetics, skincare, and sweetness instruments, e.l.f. has positioned itself as a key participant out there.

One of many elements driving e.l.f.’s development is its world presence. The corporate distributes its merchandise by way of varied channels, together with e-commerce, specialty retail shops, and nationwide retailers, which permits it to succeed in a large buyer base. e.l.f. operates beneath a number of model names, together with e.l.f. Cosmetics, e.l.f. Skincare, and e.l.f. Magnificence Instruments, catering to totally different magnificence wants.

Buyers are more and more drawn to development shares like e.l.f. due to their potential for vital returns. These shares are sometimes related to firms working in industries with excessive development prospects, such because the cosmetics business. As e.l.f. Magnificence continues to broaden its world presence, introduce new merchandise, and enhance its monetary efficiency, it presents an attractive funding alternative to these looking for shares with robust development potential.

Etsy (NASDAQ:ETSY)

Etsy stands out within the e-commerce area as a specialised market specializing in classic and handmade objects. It has carved a distinct segment by accommodating lovers of distinctive, craft-oriented merchandise, establishing itself because the primary vacation spot for these items.

The corporate primarily earns by way of transaction charges: sellers pay to listing every merchandise; apart from, they’re charged a fee on gross sales. This mannequin leverages the quantity of transactions to generate income. Etsy additionally enhances its earnings by way of focused promoting companies and promotional instruments that improve product visibility for sellers.

Etsy’s affect just isn’t confined to the U.S.; it boasts a sturdy worldwide presence with operations in nations like Canada, Australia, Germany, France, and the UK. This world attain helps it entry a broader buyer base and diversify its vendor neighborhood.

Etsy helps its sellers with a number of companies designed to simplify operations, together with Etsy Funds for seamless transaction processing, Etsy Adverts for promoting options, and discounted Transport Labels accessible in a number of key markets.

Past its main market, Etsy has enriched its portfolio by buying different marketplaces (e.g., Reverb for musical devices; Brazilian Elo7, specializing in handmade and customized objects; and the fashion-forward platform Depop). These acquisitions assist Etsy to broaden into new market segments and proceed its development trajectory.

PayPal Holdings (NASDAQ:PYPL)

PayPal Holdings is a number one supplier of digital fee options that’s famend for its safe and handy on-line transactions. In 2015, PayPal underwent separation from eBay. This transfer enabled the corporate to independently develop and broaden its companies to raised meet evolving buyer wants and additional improve its deal with digital funds.

One key side of PayPal’s portfolio is its possession of Xoom, a digital cash switch service that permits customers to ship funds internationally. By Xoom, PayPal has efficiently broadened its attain to incorporate cross-border transactions, catering in direction of the wants of a worldwide buyer base.

One other vital acquisition by PayPal is Venmo, a peer-to-peer cellular fee app that’s significantly widespread amongst youthful customers. Venmo permits customers to seamlessly cut up payments, pay mates, and even make purchases from choose retailers.

As of the primary quarter of 2024, PayPal boasts greater than 420 million energetic accounts worldwide. This immense consumer base is a testomony to the belief and confidence that prospects place within the firm’s safe and dependable companies. Furthermore, PayPal’s service provider community extends to over 35 million throughout the globe, enabling companies of all sizes to effortlessly settle for funds on-line, in-store, and throughout varied platforms.

With its deal with on-line transactions, possession of Xoom and Venmo, and tens of millions of energetic and service provider accounts, PayPal Holdings continues to steer the digital fee business, revolutionizing the best way we transact within the trendy age.

Alphabet (NASDAQ:GOOGL)

Alphabet, established as a holding firm in 2015 by way of a restructuring of Google, primarily earns by way of its wholly owned subsidiary, Google. This main phase brings in about 80% of Alphabet’s whole income, primarily from internet marketing companies on platforms like AdWords, AdSense, and Google Play.

Apart from promoting, Google additionally diversifies its income streams by way of the sale of {hardware} merchandise, together with Pixel smartphones, Google Residence sensible audio system, and Nest sensible residence units. These merchandise have gotten essential income parts, including selection to its earnings sources.

Alphabet’s bold moonshot tasks are housed beneath its different bets phase and managed by X Improvement LLC (previously Google X). This phase contains pioneering initiatives like Waymo’s self-driving vehicles, Challenge Wing’s internet-delivery drones, and Verily’s well being know-how efforts.

Financially, Alphabet maintains an total working margin of round 20%, though this varies throughout totally different segments. The promoting enterprise typically reveals larger margins on account of decrease direct prices in comparison with the {hardware} phase, which faces vital manufacturing and distribution bills. The opposite bets phase, nonetheless within the developmental section, sometimes information the bottom working margins on account of hefty R&D expenditures.

Qualcomm (NASDAQ:QCOM)

Qualcomm is a number one wi-fi know-how firm that focuses on growing and patenting key applied sciences within the subject. One in all its notable contributions to the business is the invention and commercialization of CDMA (Code Division A number of Entry) know-how, which has been extensively adopted in 2G, 3G, and 4G networks. CDMA permits environment friendly communication by permitting a number of customers to share the identical frequency band concurrently.

Lately, Qualcomm has shifted its focus in direction of growing applied sciences for 5G networks, the subsequent era of wi-fi connectivity. Qualcomm’s in depth portfolio of wi-fi patents positions the corporate as a key participant in driving the adoption and deployment of 5G know-how globally. These patents cowl varied elements of wi-fi communications, together with OFDMA (Orthogonal Frequency Division A number of Entry), a key know-how in 5G networks that permits larger community capability and sooner information speeds.

Moreover, Qualcomm has established itself as a number one wi-fi chip vendor, offering custom-made chips to energy smartphones, tablets, and different linked units. Its chips are recognized for his or her efficiency, energy effectivity, and integration of superior connectivity options.

In August 2021, Qualcomm introduced its acquisition of Veoneer, a number one participant in superior driver-assistance methods (ADAS) and autonomous driving know-how. This acquisition will allow Qualcomm to strengthen its place within the automotive business and broaden its product choices to assist the event of next-generation autos.

Shopify (NYSE:SHOP)

Shopify is a famend development inventory within the e-commerce business, recognized for offering subscription and service provider options. The corporate provides a variety of platforms for companies of all sizes to determine and broaden their on-line presence.

When it comes to subscription options, Shopify supplies a user-friendly and customizable platform for companies to create their on-line shops. This platform is full of varied options and themes that may be tailor-made to go well with every firm’s distinctive wants and branding. Moreover, Shopify’s subscription options embody instruments for stock administration, advertising and marketing, and analytics, permitting companies to optimize their operations and make data-driven choices.

On the service provider options facet, Shopify permits companies to simply accept on-line funds by way of a number of channels akin to bank cards, digital wallets, and even in-person transactions. This flexibility helps retailers cater to numerous buyer preferences and ensures clean transactions.

Moreover, Shopify provides a broad vary of e-commerce platforms, together with Shopify Plus for giant enterprises, Shopify Lite for smaller companies, and Shopify POS for in-person gross sales. This numerous vary of platforms accommodates companies of assorted sizes and working fashions.

Moreover, Shopify supplies varied add-on merchandise that additional improve the performance and efficiency of companies’ on-line shops. These add-ons embody Shopify Apps, which allow companies to combine third-party companies and enhance the client expertise.

Amazon.com (NASDAQ:AMZN)

Amazon.com, Inc. is a worldwide firm that operates within the retail sale of shopper merchandise, together with providing promoting and subscription companies. It has a presence each on-line and thru bodily shops worldwide. The corporate is split into three segments: North America, Worldwide, and Amazon Net Providers (AWS).

Amazon.com has established itself as a number one retailer, offering an intensive vary of shopper merchandise. It provides a big selection of selections throughout varied classes, together with electronics, clothes, books, and extra. The corporate has gained a robust foothold out there on account of its aggressive pricing, environment friendly logistics, and seamless buyer expertise.

Along with its retail operations, Amazon.com has additionally ventured into promoting. It supplies a platform for companies to succeed in a big buyer base by using varied promoting choices, together with show advertisements and sponsored merchandise. This allows manufacturers to advertise their merchandise and improve their visibility to potential prospects.

Furthermore, Amazon.com provides subscription companies that present added worth and comfort to prospects. One in all its notable subscription companies is Amazon Prime, which provides advantages akin to free transport, entry to streaming companies, and unique reductions. This has garnered a loyal buyer base and has contributed considerably to the corporate’s development.

Moreover, Amazon.com engages within the manufacturing and sale of digital units, media content material, and applications for sellers and content material creators. This contains merchandise like Kindle e-readers, Fireplace tablets, and Echo units. The corporate additionally provides companies like Kindle Direct Publishing, permitting authors and publishers to self-publish and distribute their books globally.

Easy Suggestions for Selecting Finest Progress Shares to Purchase Now

Deciding on the precise development shares entails clear, simple steps. Listed here are some simple suggestions that will help you establish potential winners:

1. Perceive Market Developments: Begin by taking a look at which industries are set to develop. Deal with areas which might be gaining from new applied sciences, modifications in shopper needs, or constructive new legal guidelines.

2. Search for Sturdy Corporations: When you’ve discovered promising sectors, decide firms that stand out in these areas. Seek for these with well-known manufacturers, distinctive merchandise, loyal prospects, or those who management a big a part of the market.

3. Examine Monetary Well being: It’s necessary to confirm how financially wholesome these firms are. Examine their previous cash information, how a lot they promote, and the way a lot revenue they make. Search for firms with good money move, low debt, and excessive returns on the cash they make investments.

4. Evaluation the Administration Crew: An organization’s success typically is dependent upon its leaders. See if the administration staff has a great historical past of creating sensible choices and rising the corporate.

5. Estimate Market Measurement: Be certain the expansion firms you’re contemplating have a large enough market to develop into. There have to be loads of potential prospects for his or her services or products.

Utilizing these simple suggestions, you could find development shares which will supply good returns over time. Simply keep in mind, choosing shares at all times comes with dangers, so it’s sensible to do your homework earlier than investing.

Disclaimer: Please be aware that the contents of this text aren’t monetary or investing recommendation. The knowledge supplied on this article is the writer’s opinion solely and shouldn’t be thought of as providing buying and selling or investing suggestions. We don’t make any warranties in regards to the completeness, reliability and accuracy of this data. The cryptocurrency market suffers from excessive volatility and occasional arbitrary actions. Any investor, dealer, or common crypto customers ought to analysis a number of viewpoints and be acquainted with all native laws earlier than committing to an funding.