Why Ethereum’s Rally Isn’t Overheated – And Where Demand Must Grow Next

Ethereum has pushed above the $3,350 stage, injecting recent momentum into the market after weeks of uncertainty. But regardless of this breakout, total sentiment stays clouded by concern, with many analysts nonetheless warning that the broader construction factors towards a growing bear market. Merchants now discover themselves at a pivotal juncture: is that this the start of a sustained restoration, or merely a short lived rally earlier than additional draw back?

Associated Studying

In line with a brand new CryptoQuant report, one of the crucial revealing indicators proper now could be Ethereum’s funding price conduct throughout main exchanges. In contrast to the explosive funding spikes seen through the two main rallies earlier this yr, the present transfer reveals a remarkably restrained funding atmosphere. Throughout these earlier surges, funding charges climbed aggressively into overheated territory, signaling euphoric lengthy leverage and speculative extra — circumstances that intently preceded short-term market tops.

This time, nonetheless, funding stays much more subdued. The absence of aggressive lengthy positioning means that the present rally is not being pushed by extreme leverage, which supplies the transfer a unique character in comparison with earlier spikes. Whether or not this indicators more healthy accumulation or just an absence of conviction stays the core query as Ethereum approaches the subsequent decisive part.

Muted Funding Charges Spotlight a Cautious However Probably Constructive Rally

The CryptoQuant report highlights that, in contrast to earlier explosive rallies, Ethereum’s present funding charges stay unusually low, even after its sharp restoration from the $2.8K area. This subdued funding atmosphere indicators that the derivatives market is just not but saturated with speculative lengthy positions.

Consumers are stepping in, however modest leverage drives this transfer in comparison with previous phases dominated by aggressive merchants. Consequently, spot accumulation drives the present advance greater than overheated futures exercise.

This distinction carries vital implications. With no surge in speculative demand, Ethereum could battle to ignite the type of full bullish continuation leg seen in earlier breakout cycles. Traditionally, robust uptrends have required funding charges to develop meaningfully as merchants chase value, forcing shorts to cowl and fueling upward momentum. That conduct has not but emerged within the present construction.

Nonetheless, this muted panorama is just not inherently bearish. As an alternative, it displays a recovering market, not an overextended one. This leaves Ethereum with room to climb additional — if demand strengthens. On the similar time, the shortage of leverage means the rally stays weak; robust resistance rejections may rapidly weaken momentum until recent patrons step in.

Associated Studying

Testing Key Resistance as Momentum Builds

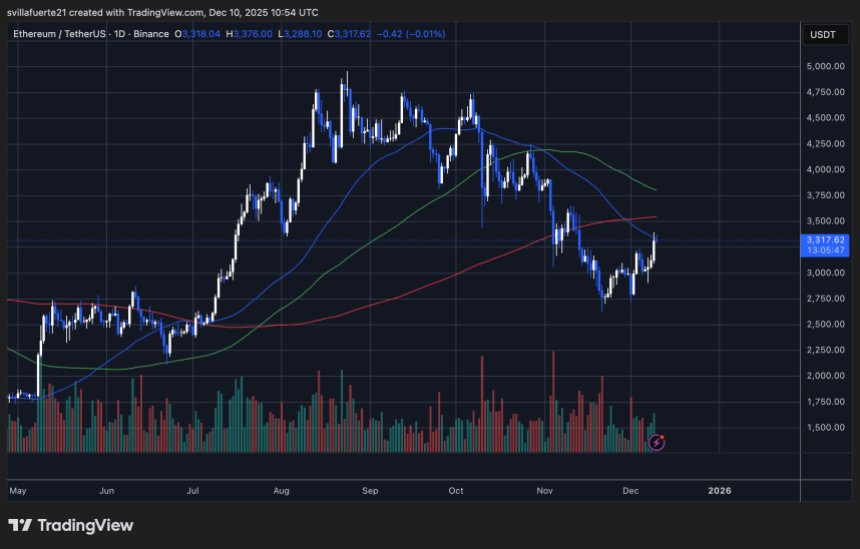

Ethereum’s day by day chart reveals a notable shift in momentum as the worth pushes towards $3,320, extending its rebound from the sub-$2,800 lows. This restoration part has been regular slightly than explosive, reflecting a market that’s stabilizing however nonetheless going through key overhead challenges.

The primary main take a look at is the 200-day transferring common (pink line), which ETH is now approaching after a number of weeks of buying and selling under it. Traditionally, reclaiming this stage has marked the transition from corrective phases into renewed bullish cycles, however a clear breakout is way from assured.

Associated Studying

The construction of the latest transfer highlights enhancing purchaser confidence: ETH has fashioned a sequence of upper lows, indicating accumulation after the capitulation-like November drop. Though patrons are lively, the comparatively subdued quantity profile suggests they lack broad-based conviction. A stronger inflow of quantity should flip the development decisively bullish.

The 50-day and 100-day transferring averages stay above the present value and are each aligned downward, reinforcing that ETH remains to be technically in a broader downtrend. For momentum to increase, Ethereum should break above the $3,350–$3,400 resistance zone, the place prior assist changed into resistance.

Featured picture from ChatGPT, chart from TradingView.com