Best Time to Buy Ethereum Could Be Soon: Last Cycle Suggests

Ethereum has been in a descending channel towards Bitcoin since August of final 12 months, that means Bitcoin has been the higher funding over this time. Nevertheless, historic tendencies present the tides may very well be altering quickly, with Ethereum probably getting ready to getting into an accumulation part.

Ethereum Worth Motion

Ethereum is buying and selling at $1600, marking a 22% lower from its worth final August. Bitcoin, then again, is 8% up over the identical interval.

This can be a widespread pattern that occurs throughout bear markets. Cash with bigger market capitalizations are typically extra resilient towards worth decreases as traders grow to be extra risk-averse and look to protect their capital. Whereas Ethereum isn’t quick at a market capitalization of $187 billion, it’s nonetheless significantly decrease than Bitcoin at $525 billion.

Throughout bull markets, cash with decrease market capitalization outperform Bitcoin once more as traders lean in direction of belongings with larger potential returns.

Ethereum Worth In contrast In opposition to Bitcoin

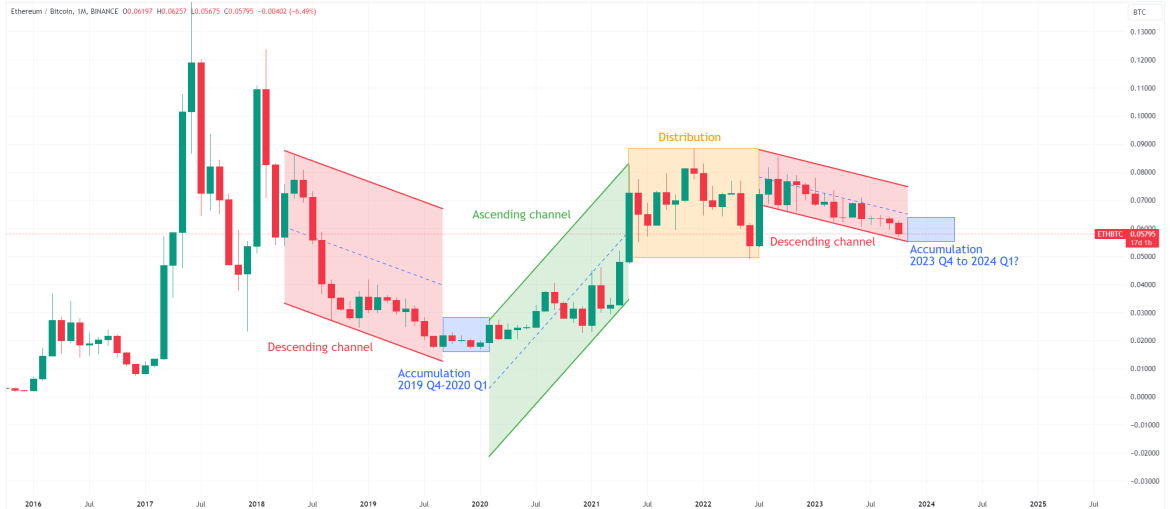

When evaluating ETH’s worth to BTC, it’s evident that Ethereum has been buying and selling inside a descending channel since final August. This sample, characterised by its decrease highs and decrease lows, usually signifies a bearish pattern out there.

ETH's valuation towards BTC over time. Supply: ETHBTC on TradingView

The chart above highlights three different distinct phases:

Accumulation part: Throughout this part, worth tends to stabilize, hinting at an upcoming change in momentum

Ascending channel: Right here, the worth experiences a major reversal, usually on a parabolic trajectory, characterised by highs and better lows.

Distribution part: Within the ultimate part, the worth ceases its upward motion. Traders sometimes use this part to capitalize on their features and liquidate their positions.

The buildup part is usually one of the best time for traders to transform their Bitcoin into Ethereum. This part is marked by worth holding on on the backside after which displaying indicators of reversal. Ethereum continues to be forming decrease lows towards Bitcoin, so it has not entered the buildup part but. Nevertheless, the final cycle exhibits that this may very well be altering quickly.

Final Cycle

Reflecting on the final cycle, Ethereum was in a descending channel towards Bitcoin for 17 months. The buildup part then occurred from September 2019 up till February 2020. Primarily based on the four-year concept, which suggests comparable phases out there happen each 4 years, this exhibits that the buildup part must also be approaching very quickly on this cycle.

But, whereas the final cycle affords precious insights, it’s necessary to notice that no two cycles are the identical. Within the present cycle, ETH’s worth motion has not seen as a lot of a drop as within the earlier cycle, which may very well be attributed to altering fundamentals and asset maturation.

Last ideas

Whereas an accumulation part for Ethereum has not been confirmed but, there stays the potential for its worth to drop even additional relative to Bitcoin. Nevertheless, if the earlier cycle is something to go by, we might enter the buildup part quickly. This part sometimes presents prime shopping for alternatives for Ethereum.

Funding Disclaimer: The content material supplied on this article is for informational and academic functions solely. It shouldn’t be thought-about funding recommendation. Please seek the advice of a monetary advisor earlier than making any funding selections. Buying and selling and investing contain substantial monetary danger. Previous efficiency isn’t indicative of future outcomes. No content material on this web site is a advice or solicitation to purchase or promote securities or cryptocurrencies.

Featured picture from ShutterStock, Charts from TradingView.com