Billionaire Chamath Palihapitiya Predicts Market Rally, Says $6,000,000,000,000 Waiting To Be Deployed

Billionaire enterprise capitalist Chamath Palihapitiya says that markets are ripe for a powerful rally as a deluge of capital seems to discover a new dwelling.

In a brand new episode of the All-In Podcast, the billionaire says that the macro image is beginning to look optimistic for america.

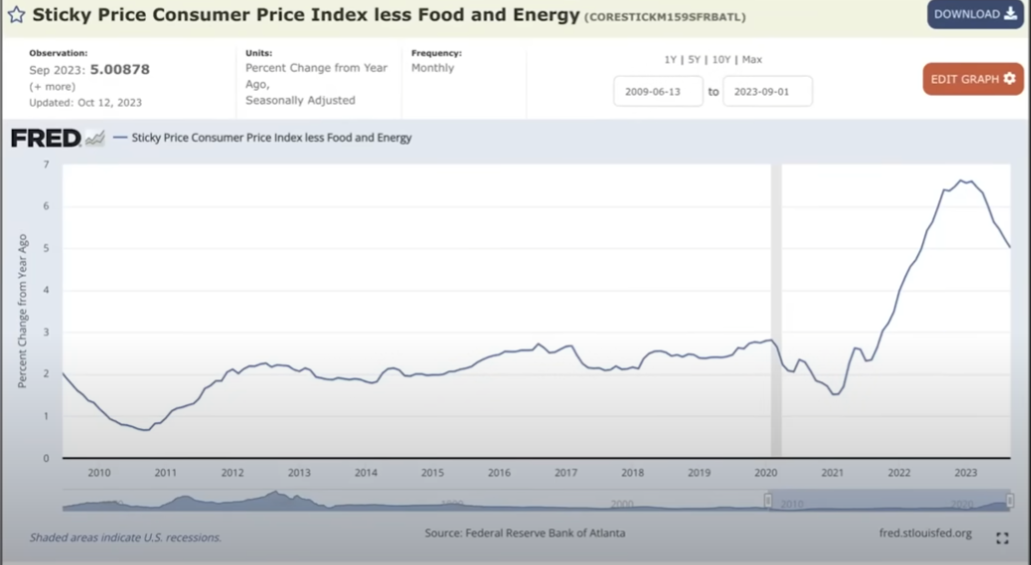

The Social Capital founder first seems on the shopper worth index (CPI), which tracks the nation’s charge of inflation over time. In response to Palihapitiya, the CPI is beginning to roll over indicating that top inflation charges are a factor of the previous.

“We’re actually in a good place with inflation. If you consider what’s going to occur within the subsequent six months, it’s principally within the bag… There’s a lag impact on a handful of [CPI] elements, particularly rents, which if you roll them into this inflation charge, you’re going to see it actually, actually flip over in a short time.

So we all know that inflation is falling. It’s going to fall much more.”

Palihapitiya then seems on the quantity of capital stockpiled in cash market funds. In response to the enterprise capitalist, trillions of {dollars} value of capital might transfer out of cash market funds and circulate into the inventory market to chase increased positive factors.

“I believe the setup is mainly the next. There’s much less cash within the system. That’s a optimistic.

There’s extra money on the sidelines… Take a look at the amount of cash in cash market funds – $6 trillion and rising, in order that’s a extremely optimistic signal which is cash might want to discover a dwelling…

In order that’s trillions of {dollars} that need to get deployed… Now you introduce charge cuts and that’s an actual accelerant. Greater than possible, I believe what meaning is that markets are set as much as do fairly effectively, fairness markets particularly.”

Palihapitiya ends his evaluation by saying that he’s optimistic concerning the prospects of the US financial system with the Federal Reserve poised to chop charges by mid-2024.

“Inflation could be very a lot within the rearview mirror. Charges are going to get reduce by the center a part of the 12 months. The financial system seems prefer it’s going to be a smooth touchdown. That’s truly very helpful for the sitting president. It’s additionally good for equities. It’s good for us… I believe we’ve had a elementary change.”

I

Do not Miss a Beat – Subscribe to get e-mail alerts delivered on to your inbox

Examine Value Motion

Comply with us on Twitter, Facebook and Telegram

Surf The Day by day Hodl Combine

Generated Picture: DALLE3