Binance backs ailing Curve Finance: All you need to know

- As a part of the strategic settlement, Curve has agreed to broaden to the BNB Chain.

- CRV whale transactions have dipped considerably for the reason that hacking occasion, indicating a potential restoration.

Investments to the tune of $5 million have been pumped into the troubled Curve Finance [CRV] token by Binance Labs, the enterprise capital arm of crypto behemoth Binance [BNB]. Head of Binance Labs Yi He mentioned,

“Given the latest occasions which have impacted the protocol, Binance Labs has supplied our full assist to Curve via our funding and strategic collaboration.”

Is your portfolio inexperienced? Take a look at the CRV Revenue Calculator

CRV acts because the utility token for widespread stablecoin buying and selling platform Curve Finance, which had property price $2.86 billion on the time of writing, per DeFiLlama.

As a part of the strategic settlement, Curve agreed to broaden to the BNB Chain. Michael Egorov, founder and CEO of Curve Finance, who has been within the eye of the storm of late, expressed hope for the collaboration and mentioned,

“BNB Chain has earned a big presence in DeFi, and is nicely positioned to deploy Curve’s present and future merchandise on its chain.”

CRV jumped 5% to $0.64 following the information of the funding on 10 August. Nonetheless, the DeFi coin shortly fell in worth, resting at $0.60 on the time of writing, knowledge from CoinMarketCap confirmed.

The harmful ‘Curve’

The decentralized alternate has hogged principally damaging headlines after malicious gamers extracted property price $73.5 million from its numerous stablepools. CRV’s worth collapsed 31% as nervous merchants began to dump their holdings.

The hack sparked off liquidation issues over CEO’s Egorov loans price greater than $100 million, all of which have been secured utilizing CRV tokens as collateral on outstanding lending protocols.

Nonetheless, the issues have been alleviated to an extent after the exploiter returned practically 73% of the funds. To get better the remaining quantity, Curve Finance supplied a bounty of $1.85 million to anybody who may reveal details about the hacker.

CRV holders shouldn’t lose hope

Whereas an eerie quantity of uncertainty gripped the Curve ecosystem, there have been early indicators that issues would possibly change for the higher.

How a lot are 1,10,100 CRVs price at present?

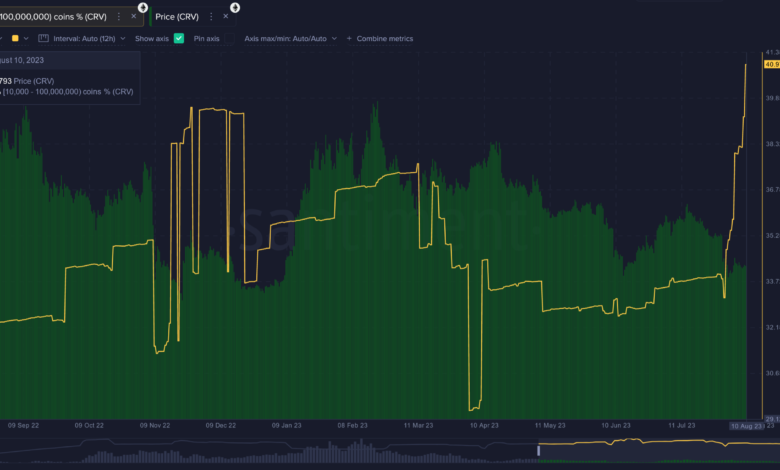

On-chain evaluation agency Santiment highlighted that addresses holding between 10K to 100 million CRV tokens have upped their accumulation sport. As of 10 August, the cohort managed 41% of the circulating provide, a big enhance in comparison with 33% across the time of the exploit.

Supply: Santiment

Moreover, the whale transaction rely cooled off significantly for the reason that intense promoting wave within the final week of July. Santiment acknowledged {that a} additional spike in transaction exercise might be an indicator of a fast restoration.

Supply: Santiment