Bitcoin, a better investment option than gold now? A Sharpe look says…

- Bitcoin’s Sharpe Ratio was increased than Gold’s and that of different key fairness and commodity markets

- Bitcoin’s 30-day realized volatility within the first week of April was the best since late 2022

World’s largest cryptocurrency Bitcoin [BTC] outperformed mainstream monetary devices of the market in risk-adjusted returns, all whereas sustaining its typical “high-volatility” traits.

The most effective funding possibility at present?

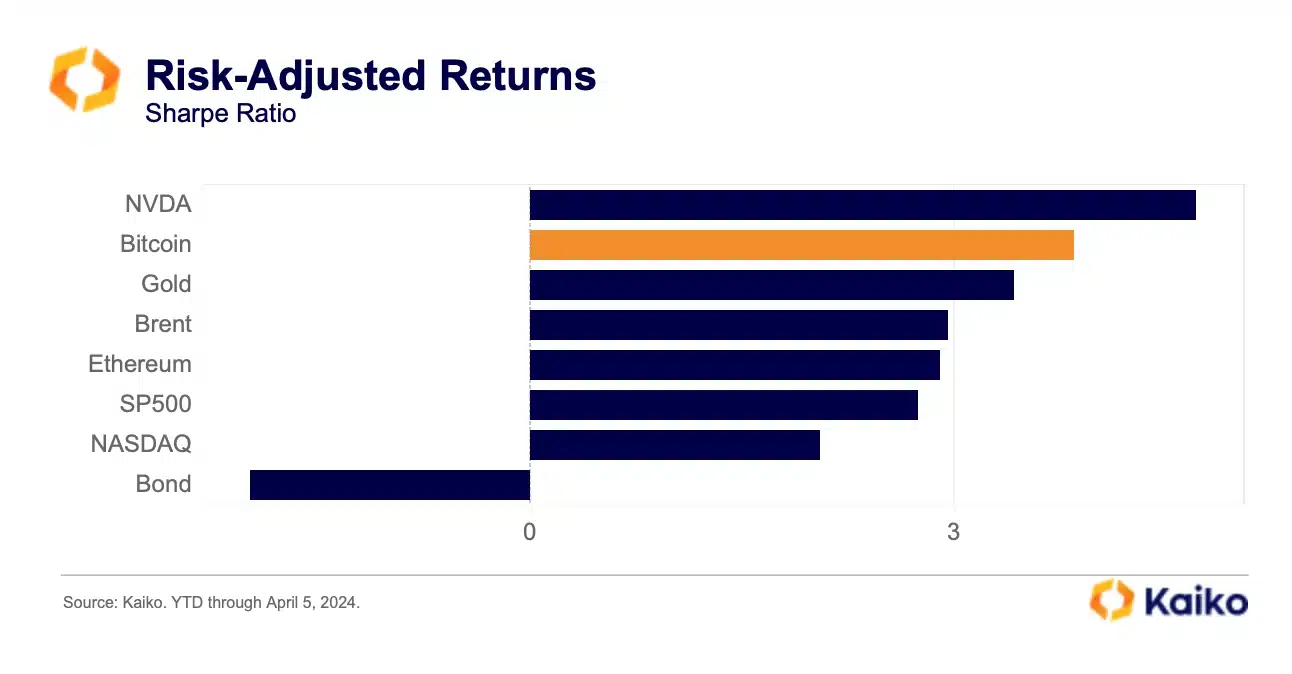

In line with crypto-market information supplier Kaiko, Bitcoin’s Sharpe Ratio was increased than Gold’s and that of different key fairness and commodity markets in early April.

Supply: Kaiko

The Sharpe ratio is a extensively used metric in finance, measuring the risk-adjusted returns on a monetary instrument. Put merely, it compares the efficiency of the asset relative to its volatility – Each draw back and upside.

Usually, a Sharpe ratio of 1 or increased is taken into account a very good risk-adjusted return charge. Within the aforementioned graph, Bitcoin’s Sharpe ratio is round 4.

Excessive volatility, however increased returns

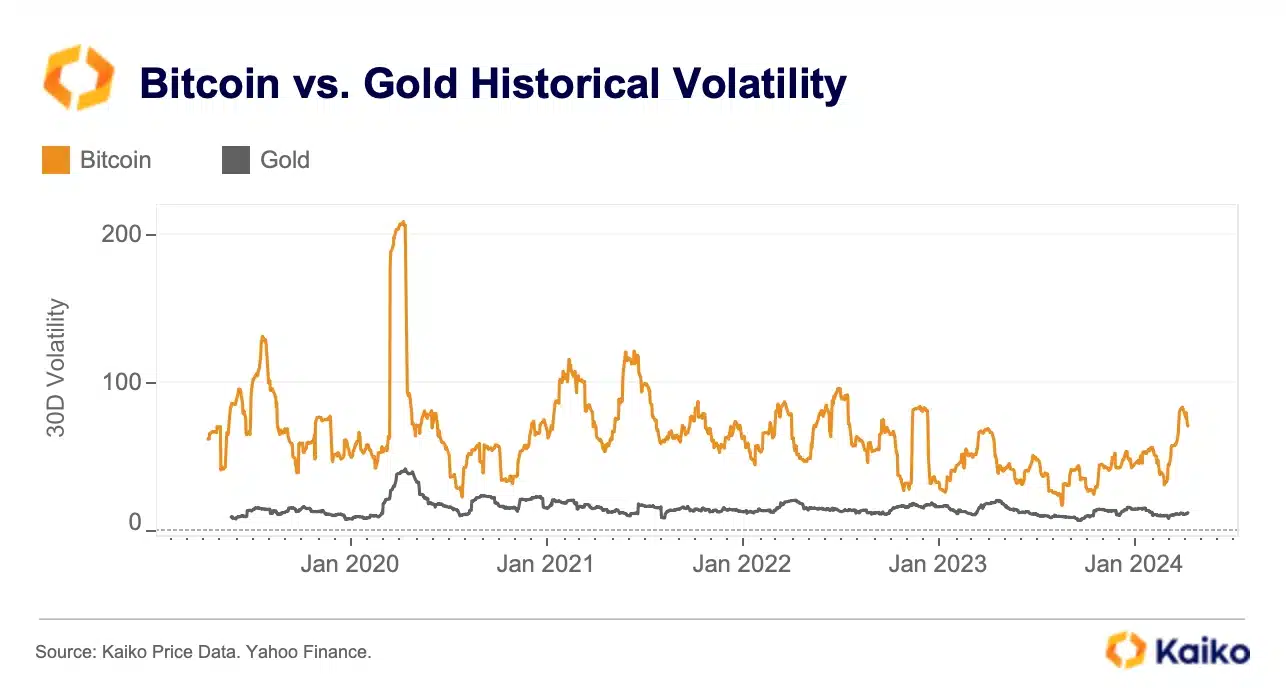

Right here, it’s price noting that Bitcoin’s 30-day realized volatility within the first week of April was its highest since late 2022. Furthermore, it exceeded volatility of belongings like Gold considerably. This urged that regardless of the wild swings in costs, Bitcoin emerged as a horny funding possibility.

Supply: Kaiko

Bitcoin has bounced 60% for the reason that starting of 2024, and greater than 4x from the lows of the 2022 bear market. On the time of writing, it was buying and selling round its high $67k levels, with a number of analyses predicting a robust bullish surge within the months to come back.

Is your portfolio inexperienced? Take a look at the BTC Revenue Calculator

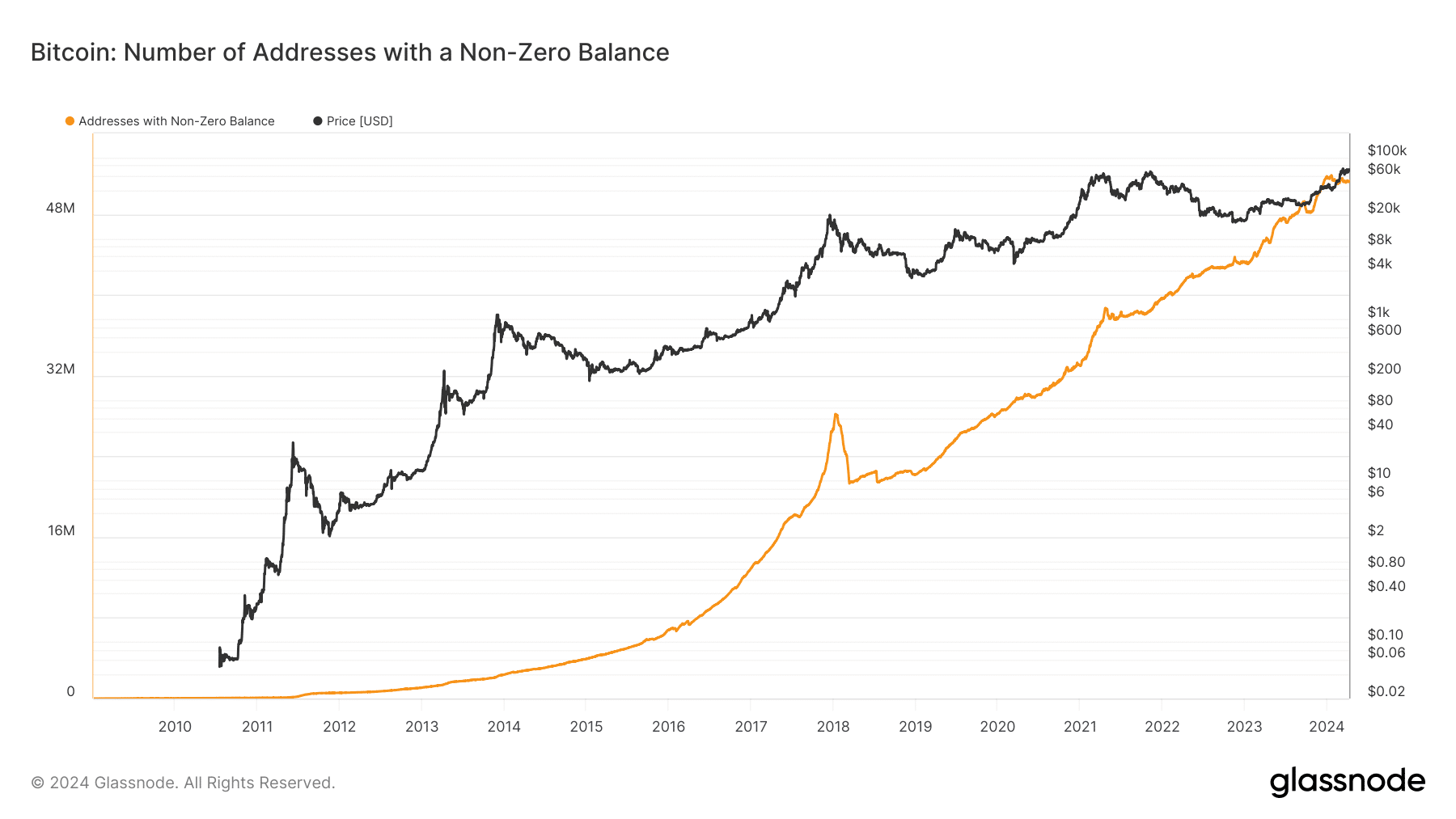

The next risk-adjusted return bodes properly for the longer term adoption of the world’s largest cryptocurrency. The truth is, the inklings of this are already noticeable too.

Lastly, in response to AMBCrypto’s evaluation of Glassnode’s information, Bitcoin wallets with non-zero balances have grown sharply in recent times, implying confidence within the asset’s long-term potential.

Supply: Glassnode