Bitcoin above $70K again – Here’s why it happened and what could change

- Bitcoin was up by greater than 4% within the final 24 hours.

- Just a few technical indicators and metrics regarded bearish.

Bitcoin [BTC] regained its bullish momentum over the previous few hours, because the king coin’s worth surpassed the $70k mark after plummeting underneath $66k.

Within the meantime, BTC’s long-term buyers managed to take some earnings in the course of the newest value pump.

Bitcoin touches $70k

Based on CoinMarketCap, BTC was up by 3% within the final seven days. The truth is, during the last 24 hours, its worth surged by over 4%.

On the time of writing, BTC was buying and selling at $70,310.91 with a market capitalization of over $1.38 trillion.

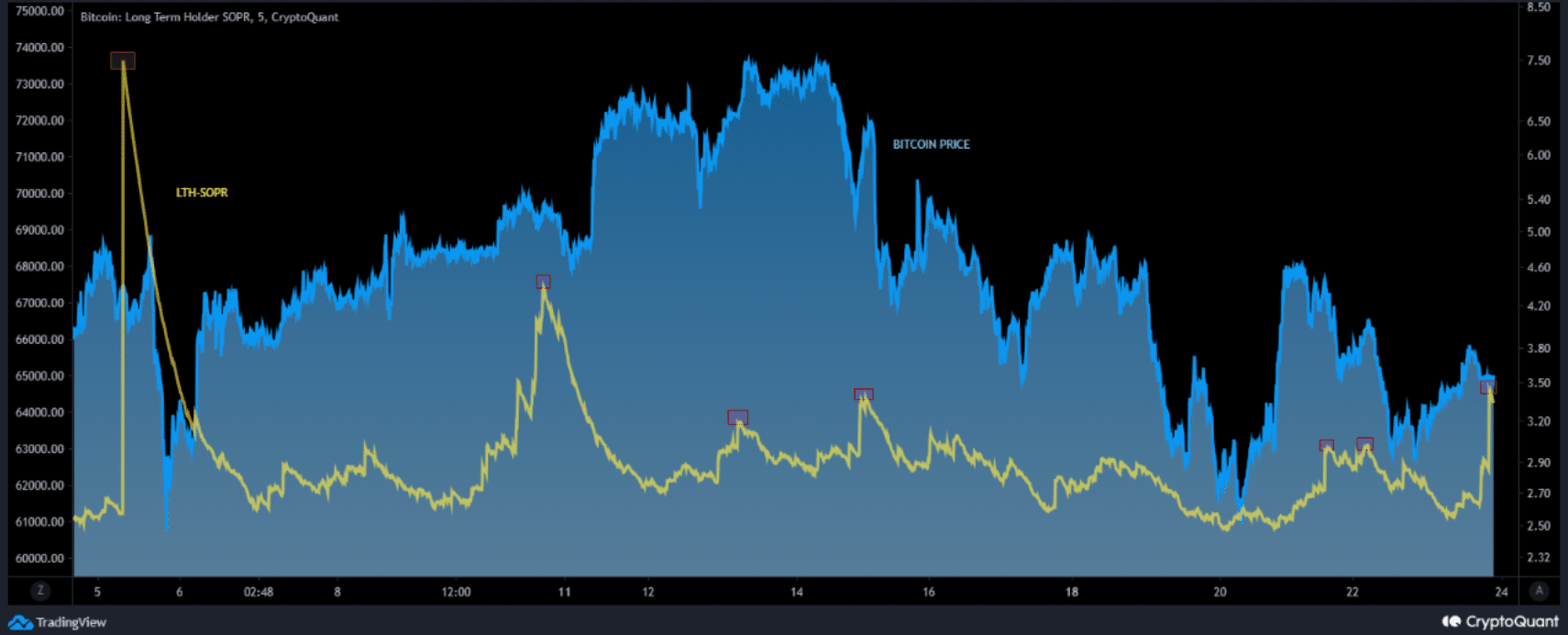

Whereas the coin’s value rose, SimonaD, an writer and analyst at CryptoQuant, posted an analysis highlighting long-term investor actions.

As per the evaluation, the Lengthy-Time period Holder Spent Output Revenue Ratio is a vital metric utilized in analyzing market traits and investor habits, notably amongst long-term buyers.

The evaluation chart confirmed that the Bitcoin long-term holder SOPR (EMA 144) had extra spikes because the starting of March.

Which means that buyers took some earnings alongside the best way as the value reached new highs.

Supply: CryptoQuat

The truth is, long-term holders continued to be extra energetic as per the most recent knowledge as nicely. AMBCrypto’s evaluation of CryptoQuant’s data revealed that BTC’s Binary CDD was pink.

This meant that long-term holders’ actions within the final seven days have been greater than common. In the event that they have been moved for the aim of promoting, it might have a unfavorable impression.

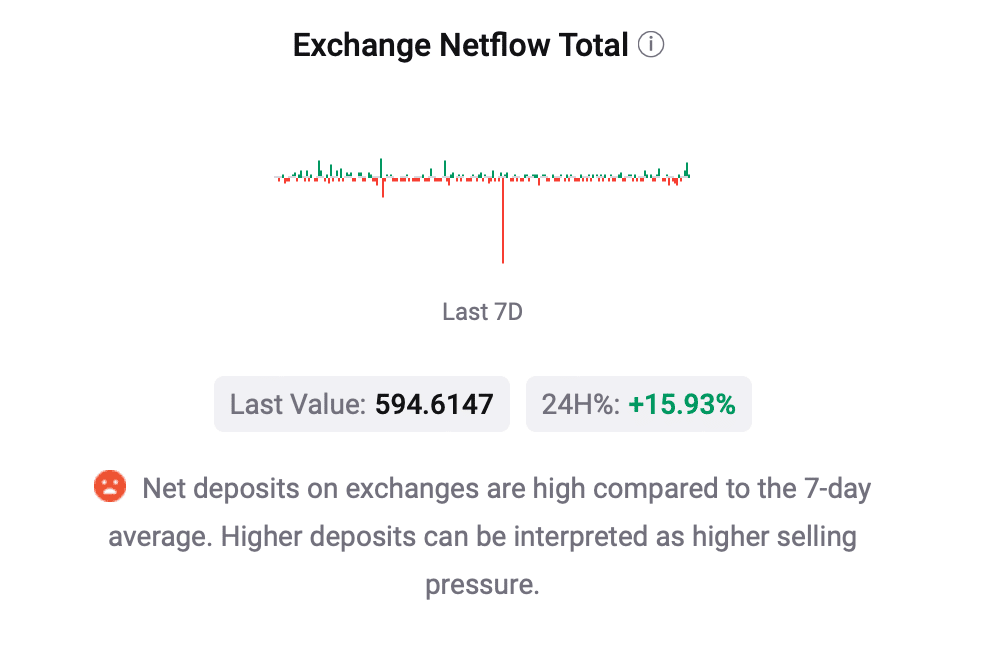

Additionally, promoting sentiment on the whole appeared to have been dominating the market as BTC’s web deposit on exchanges was excessive in comparison with the final seven-day common, which could trigger a value correction quickly.

Supply: CryptoQuant

Which method is BTC headed?

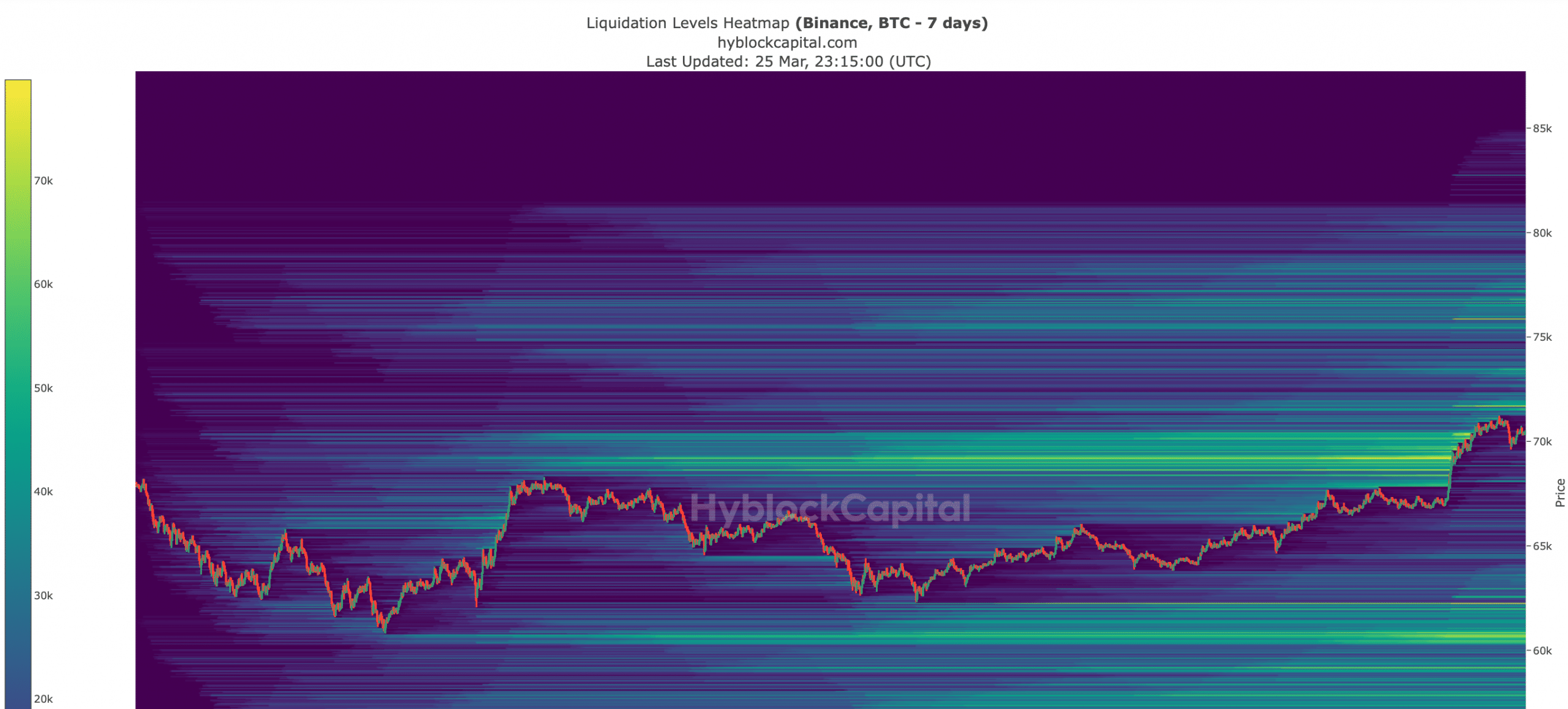

AMBCrypto’s evaluation of Hyblock Capital’s knowledge identified {that a} substantial quantity of BTC may very well be liquidated when its worth touches the $71,750 mark.

Since liquidation will rise, that stage is likely to be a resistance for BTC, which could trigger a short-term value decline.

Supply: Hyblock Capital

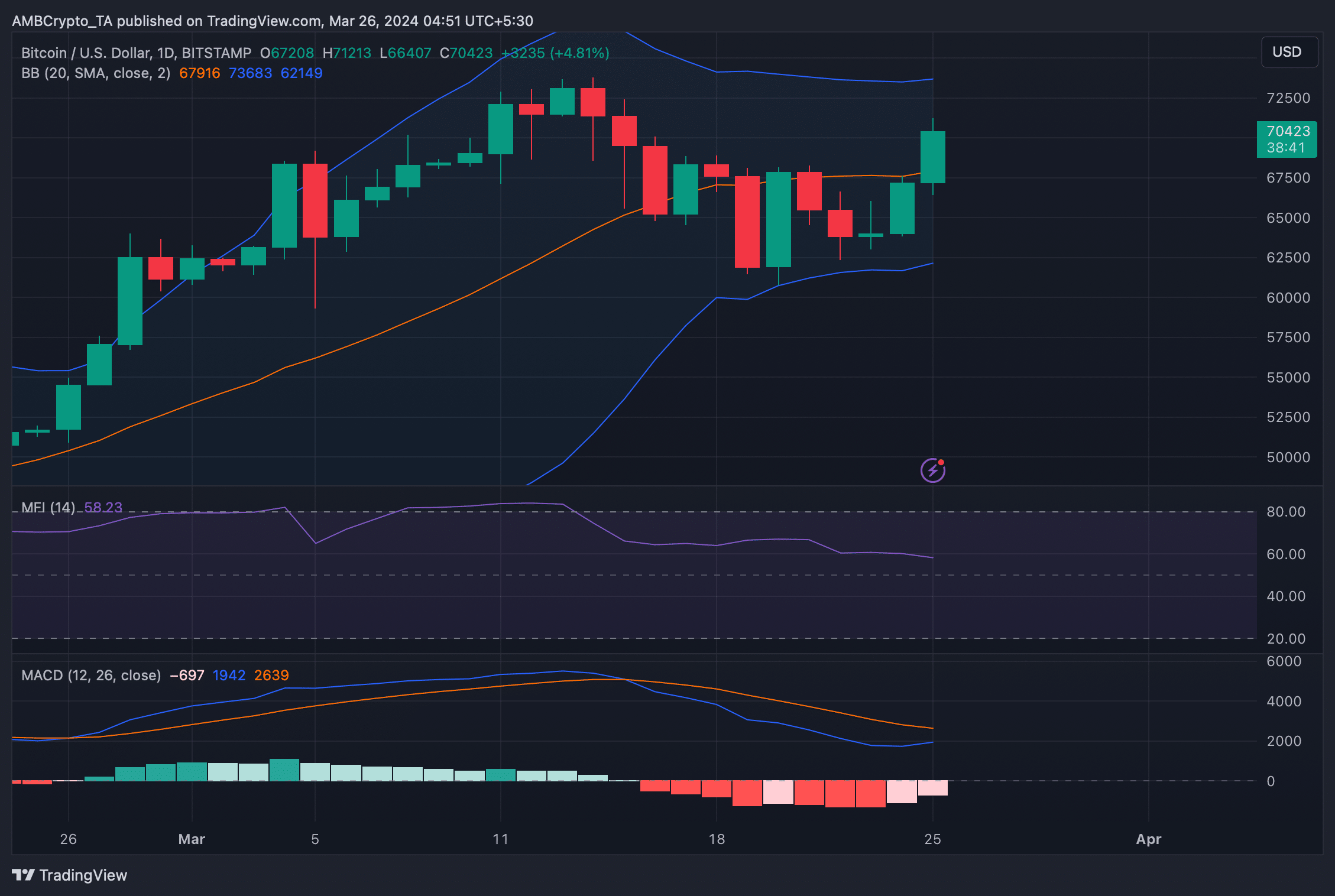

To higher perceive which method BTC was headed, AMBCrypto then checked its every day chart. As per our evaluation, BTC’s value moved above its 20-day SMA, as displayed by the Bollinger Bands.

Learn Bitcoin’s [BTC] Worth Prediction 2024-25

The technical indicator MACD additionally displayed the opportunity of a bullish crossover within the coming days.

These indicators prompt that BTC was preparing for an additional bull rally. Nonetheless, BTC’s progress momentum would possibly decline as its Cash Movement Index (MFI) moved sideways in the previous few days.

Supply: TradingView