Bitcoin: After $359.7M in liquidations, BTC holds steady – How?

- BTC remained above the short-term realized value ($86.5K) regardless of a $359M lengthy squeeze.

- Value restoration instructed spot market energy, however momentum must construct for additional upside.

Bitcoin [BTC] is proving resilient regardless of a pointy liquidation occasion that worn out $359.7 million in lengthy positions.

As volatility continues to grip the market, short-term ranges are actually extra necessary than ever to gauge what lies forward for the king coin.

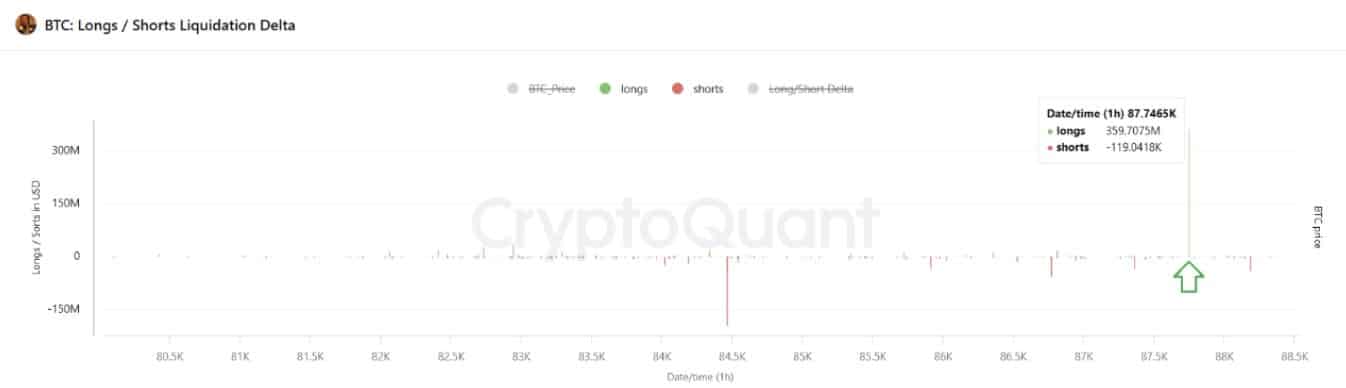

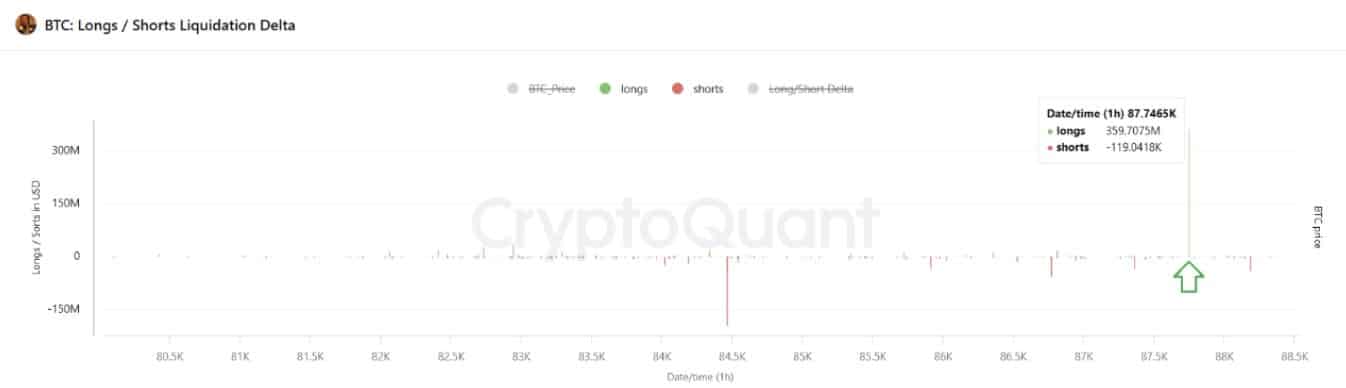

Huge lengthy liquidation however no breakdown

Based on CryptoQuant information, the market lately witnessed a large-scale lengthy squeeze, with practically $360 million in lengthy positions flushed out in a single hour.

Curiously, this was not accompanied by a pointy downward value spiral. As an alternative, BTC bounced again rapidly and traded at round $86,000, indicating robust purchaser help and a scarcity of panic promoting.

Supply: CryptoQuant

This restoration signifies that, regardless of over-leveraged merchants going through losses, spot market individuals stay steadfast.

The liquidation occasion seems to have corrected overheated derivatives positions, doubtlessly paving the way in which for extra sustainable upward actions.

Bitcoin value holds above short-term realized value

One other encouraging sign comes from the Realized Value – UTXO Age Bands chart.

On the time of writing, BTC was above the short-term realized value for the 1-day to 1-week cohort at $86,000 and the 1-week to 1-month cohort at $84,000. These ranges typically act as help zones for short-term holders.

Supply: CryptoQuant

So long as BTC maintains its place above these value bands, it implies that robust palms are stepping in, validating purchaser conviction.

Nonetheless, a breakdown under these ranges may sign a shift in sentiment and set off a wave of short-term profit-taking.

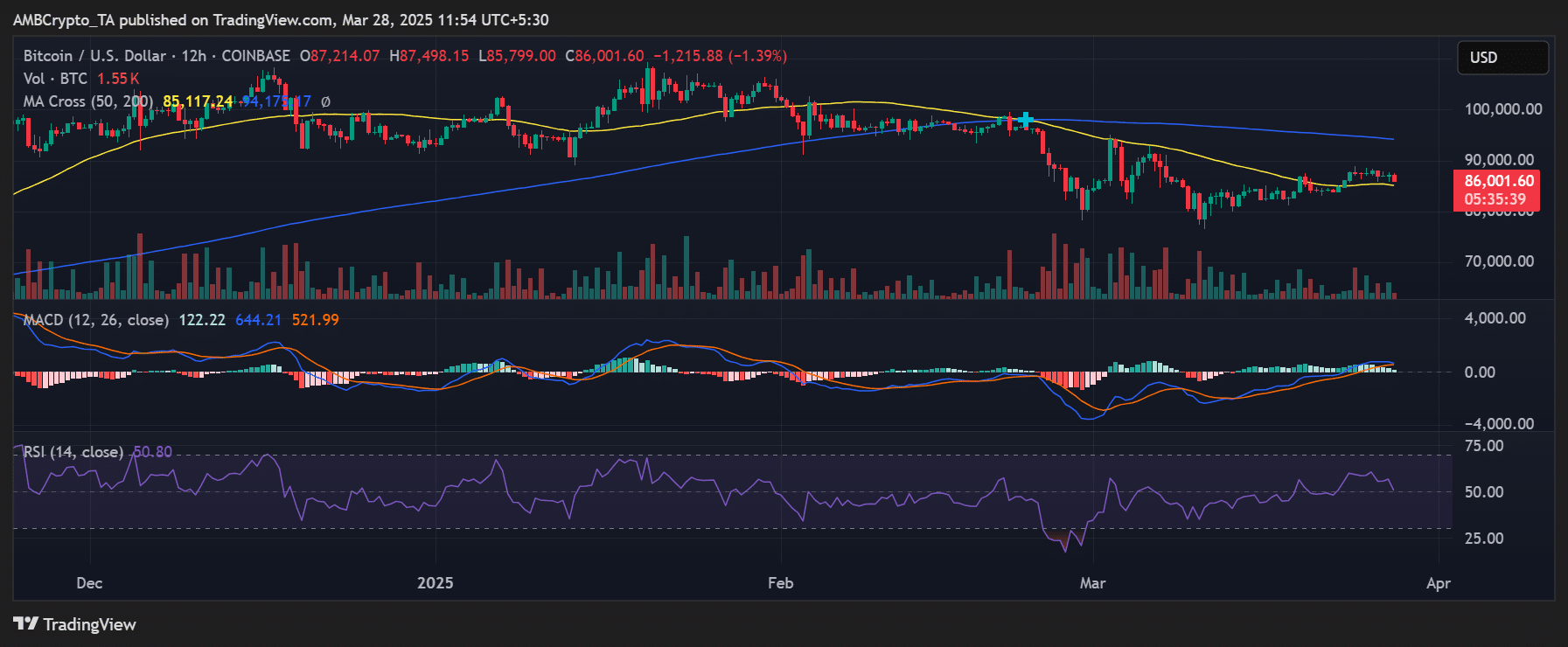

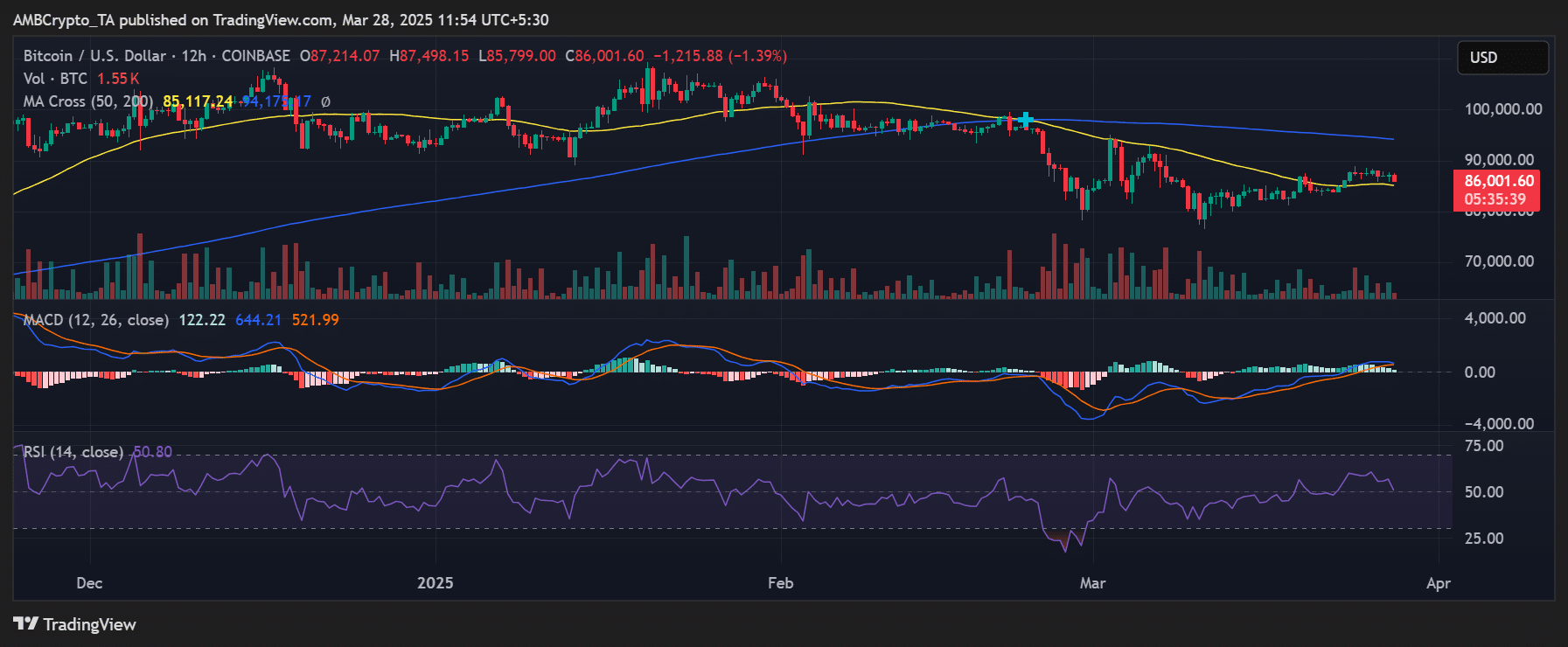

Bitcoin momentum stays intact regardless of slight cooling

From a technical evaluation perspective, Bitcoin’s 50-day Transferring Common ($85,250) stays an necessary pivot.

The worth has lately bounced off this degree and is trending above it, with the Relative Energy Index (RSI) sitting at round 50, indicating a closeness to oversold situations.

Supply: TradingView

Furthermore, the MACD line remained above the sign line, albeit with narrowing divergence, a doable signal of consolidation earlier than the subsequent leg up.

A retest of the $90,000 psychological degree seems probably if momentum picks up once more.

What subsequent?

Bitcoin’s resilience after liquidation and its means to stay above key realized value ranges spotlight robust demand.

Nonetheless, cautious optimism is important, as BTC requires sustained momentum and better quantity to interrupt out of its vary. If patrons efficiently shield short-term help zones, the subsequent bullish motion may already be unfolding.