Bitcoin alert: Long-term holders are shifting coins – Is a major sell-off on the horizon?

- Bitcoin’s spike in alternate CDD influx has traditionally produced non-linear outcomes.

- The important thing issue? Market sentiment and macro liquidity developments.

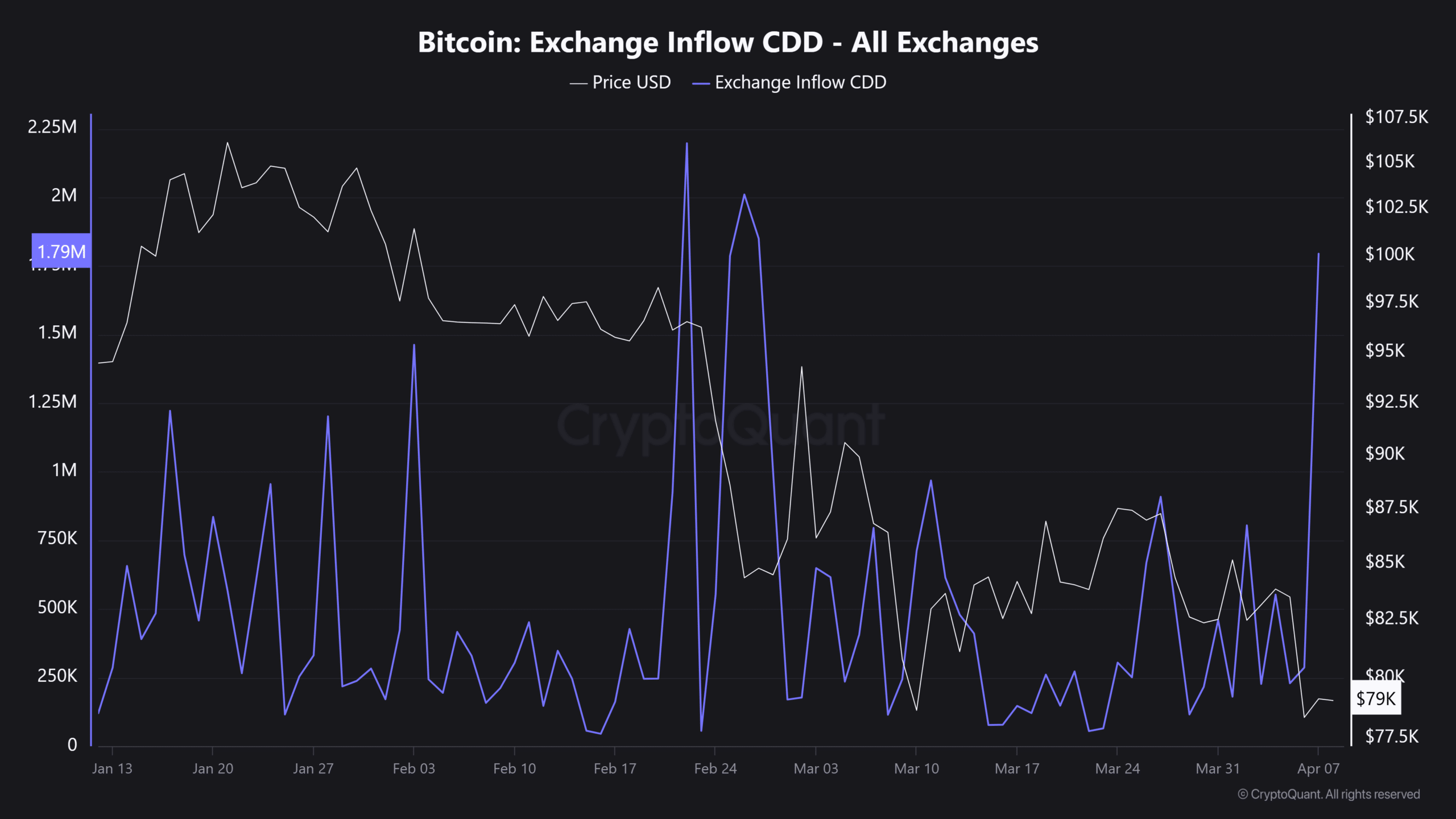

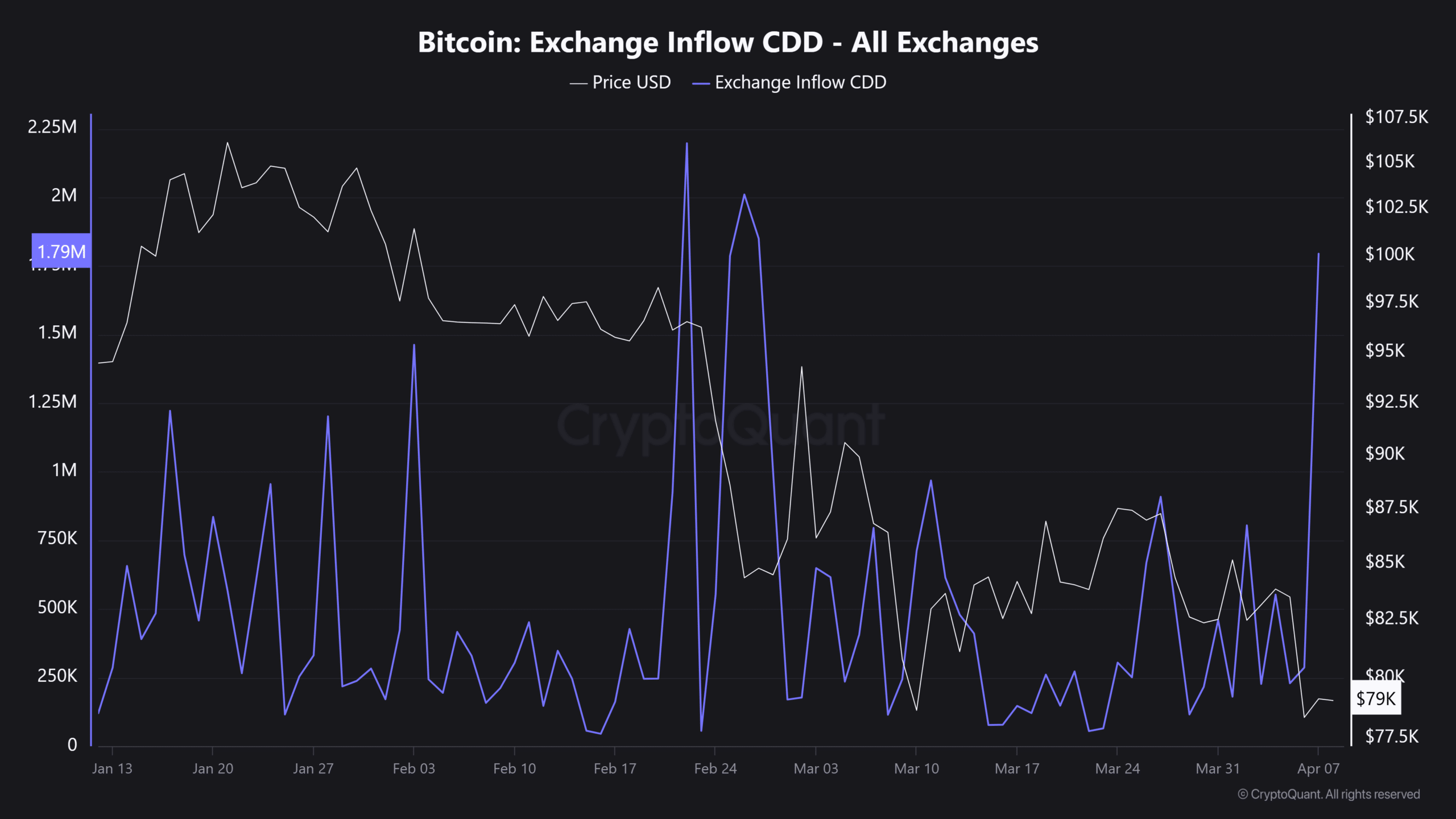

Bitcoin [BTC] simply dipped under $75k, its lowest in 5 months, proper as Alternate Influx CDD spiked. This raises a key query: Are long-term holders shedding confidence, or is that this a tactical liquidity shift?

A rising CDD usually precedes sell-offs, however it may possibly additionally point out capital rotating into derivatives for hedging or leverage.

If inflows keep elevated, promoting stress may construct. But when that is simply repositioning, Bitcoin is perhaps gearing up for its subsequent high-volatility transfer.

Historic CDD spikes and their market affect

Traditionally, CDD spikes have had blended outcomes. Whereas they often precede sharp corrections, there have additionally been circumstances the place Bitcoin rallied post-spike.

Consequently, signaling good cash repositioning somewhat than panic promoting.

On the twenty second of February, for instance: A notable CDD surge aligned with BTC’s 19% drawdown from $96,186 to $78,173 inside every week. On-chain data confirmed a 12k BTC drop in Lengthy-Time period Holder (LTH) provide, reinforcing a distribution occasion.

Supply: CryptoQuant

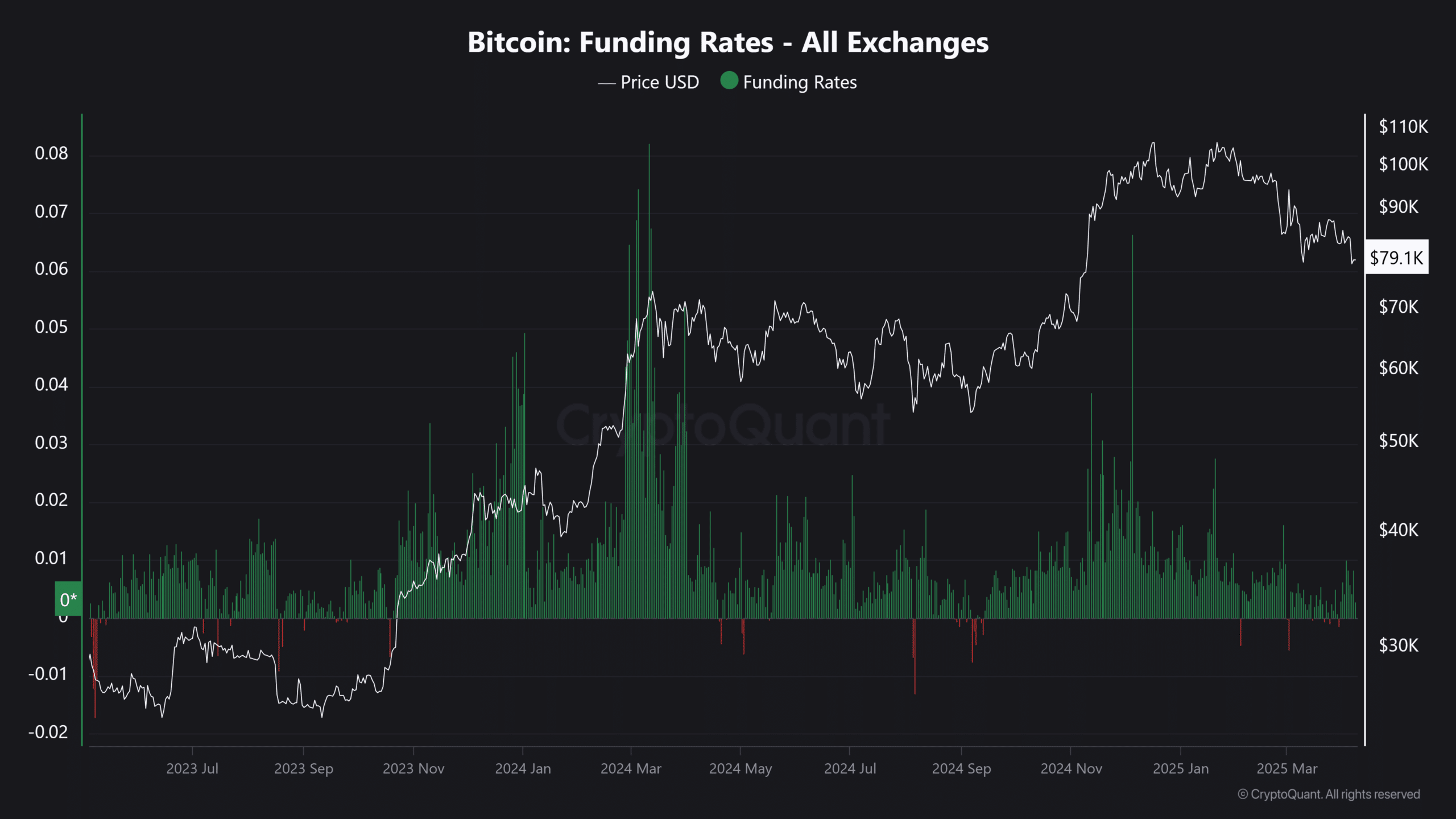

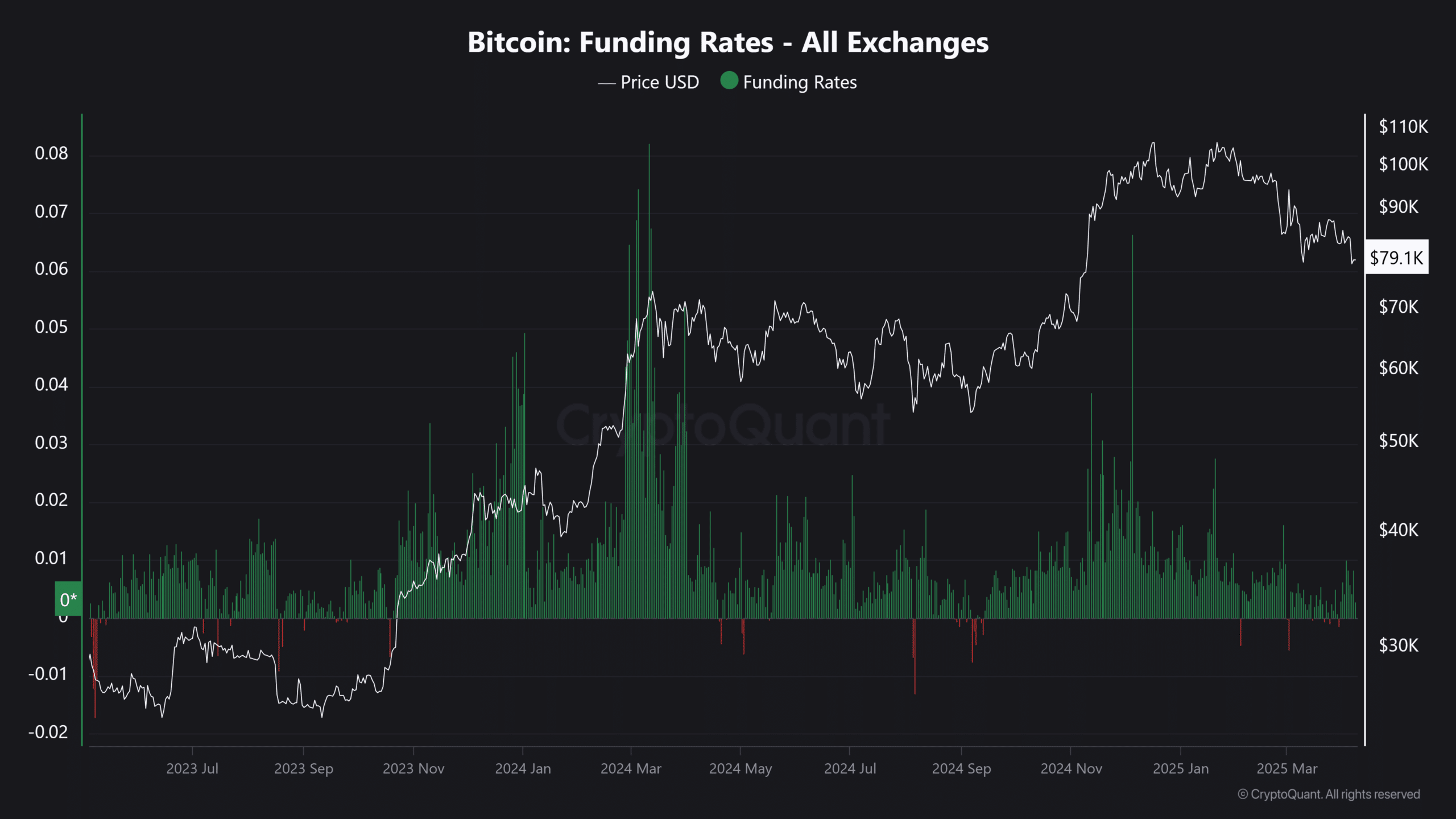

Nevertheless, on the fifth of March 2024, Bitcoin rallied to its then all-time excessive of $73k, marking a 16% surge inside every week. Notably, this rally adopted a 6.4% single-day pink candlestick.

Therefore, suggesting a possible exhaustion shakeout earlier than worth continuation. It’s a widespread market habits the place worth dips to shake out weak palms earlier than reversing larger.

Nevertheless, there’s a key improvement. Much like the February rally, LTH supply noticed a pointy decline, indicating that Bitcoin was being moved to exchanges. But, BTC’s worth appreciation defied expectations.

Upon additional investigation, a vital perception emerged. Through the March rally, Open Curiosity (OI) surged from $32.01 billion to $35.81 billion.

This confirms that Futures markets had been actively driving worth motion. In different phrases, LTH liquidity wasn’t purely spot-driven however fueled by leveraged lengthy positions.

Bitcoin at a choice level: Retest or rebound?

On the sixth of April, Bitcoin’s exchange inflow CDD stood at 286k. Only a day later, it surged to roughly 1.8 million—an enormous 529% spike. This indicated that older BTC was being moved to exchanges.

The important thing query now could be whether or not this spike will result in a February-style correction or mirror March’s resilience.

Apparently, the day after this surge, BTC rebounded 1.10% to shut at $79,164, suggesting that the market absorbed the preliminary wave of liquidity.

On-chain developments provide extra insights. Brief-Time period Holder (STH) supply has dropped to a four-month low, whereas LTH provide stays regular, indicating that long-term conviction stays intact.

In the meantime, Funding Charges (FR) are aligning with March ranges, reinforcing the concept derivatives exercise is taking part in a dominant position in worth motion.

Supply: CryptoQuant

Furthermore, Open Curiosity (OI) has reclaimed the $51 billion mark, signaling excessive liquidity flowing into leveraged trades.

Nevertheless, with Funding Charges skewed in the direction of longs, overleveraged positions may face liquidation if STHs proceed to dump.

The silver lining? Regardless of the CDD spike, no main sell-off stress has materialized—but. If Bitcoin follows its March rally construction, it may recuperate misplaced resistance ranges sooner than anticipated.