Bitcoin: Analyzing how the next halving event might affect BTC

- As per stock-to-flow deflection, Bitcoin was undervalued in relation to its shortage.

- Lengthy-term holders had entry to 75% of Bitcoin’s circulating provide.

The influence of Bitcoin’s [BTC] shortage on its long-term worth has been some of the extensively mentioned and analyzed subjects inside the crypto group. Over time, consultants have developed a number of fashions that present insights into the relation between the 2 and assist traders make knowledgeable choices.

Is your portfolio inexperienced? Take a look at the BTC Revenue Calculator

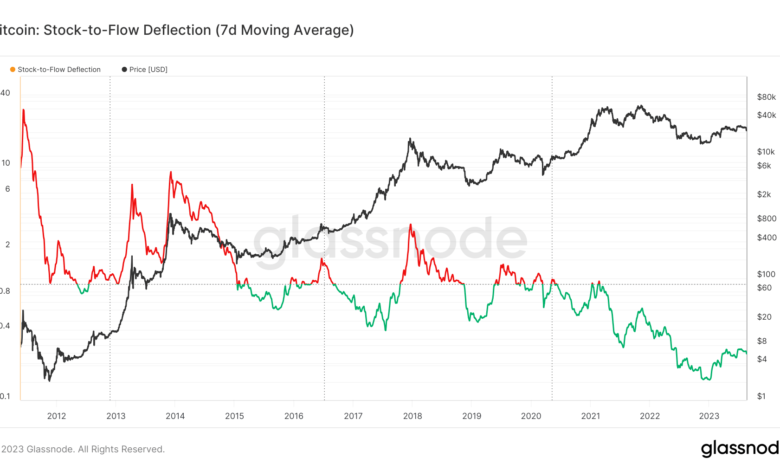

In line with a current submit by on-chain analytics agency Glassnode, BTC’s stock-to-flow (S/F) deflection dipped to a 1-month low, suggesting extra room for bull cycles within the close to future.

Supply: Glassnode

Bitcoin’s shortage to drive its worth

In layman phrases, the S/F deflection determines whether or not an asset is overvalued or undervalued in relation to its shortage. Within the present state of affairs, the deflection was lower than 1 and as indicated above, deeper within the inexperienced undervalued territory.

The S/F deflection is derived by dividing Bitcoin’s worth by considered one of its hottest fashions, the S/F ratio. Created by nameless analyst PlanB, the S/F ratio compares the present inventory of Bitcoin to the variety of new Bitcoins mined annually.

The narrative which underpins this mannequin is that the worth of an asset is instantly proportional to its shortage. The upper the ratio, the scarcer the asset turns into, and in flip drives the value.

The mannequin states that the halving occasions that happen roughly each 4 years — when the speed of latest cash mined is halved— instantly have an effect on the value of Bitcoin. Information from Glassnode additional proved this. Be aware how BTC’s worth remained subdued within the days resulting in the halving. Nevertheless, on completion, it exploded to new highs.

Supply: Glassnode

On the time of writing, BTC was price solely about 0.2 of what it ought to ideally be as per the S/F mannequin. With the subsequent halving occasion scheduled for April 2024, there was an opportunity that BTC would attain its full potential.

How a lot are 1,10,100 BTCs price immediately?

Diamond arms stocking up

The halving-induced bullish expectations spurred long-term Bitcoin holders (LTH) to refill for the massive day. On the time of writing, seasoned traders of the king coin accounted for 75% of all tokens in circulation.

Supply: Glassnode

BTC crawled again above the $26,000-mark on 19 August, because the stormy week drew to an in depth. It exchanged arms at $26,108 on the time of writing, per CoinMarketCap.