Bitcoin – Analyzing IF there’s a red flag ahead for BTC’s price

- Rising change whale ratio and hike in put choices recommended Bitcoin could face promoting stress quickly

- Bitcoin’s Choices market revealed heightened demand for draw back safety

Bitcoin [BTC] could also be heading into turbulent waters. A pointy uptick in change whale exercise and rising warning within the Choices market are flashing early warning indicators.

Because the change whale ratio climbs to its highest stage in over a 12 months and put choices outpace calls in each volumes and premium, merchants seem like bracing for potential draw back.

The shift in sentiment means that among the market’s greatest gamers is likely to be making ready to promote, elevating the potential of better volatility within the days forward.

Trade whale ratio – A sign of potential promoting stress

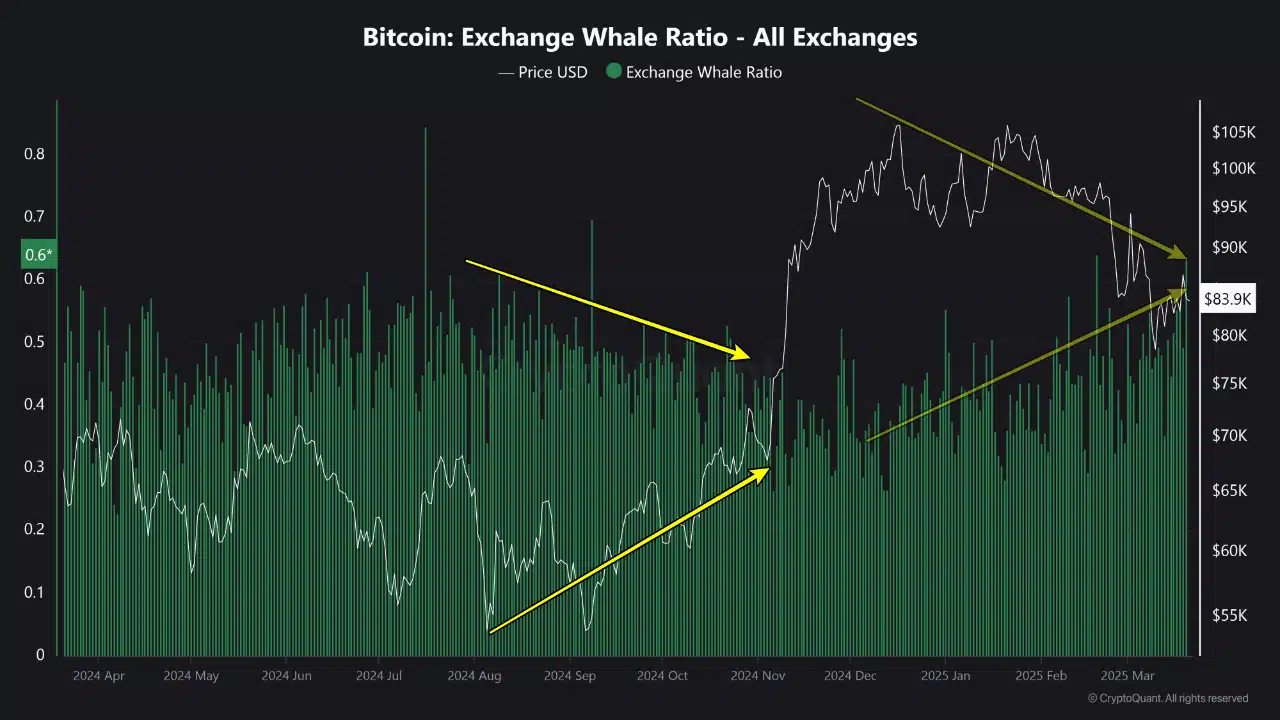

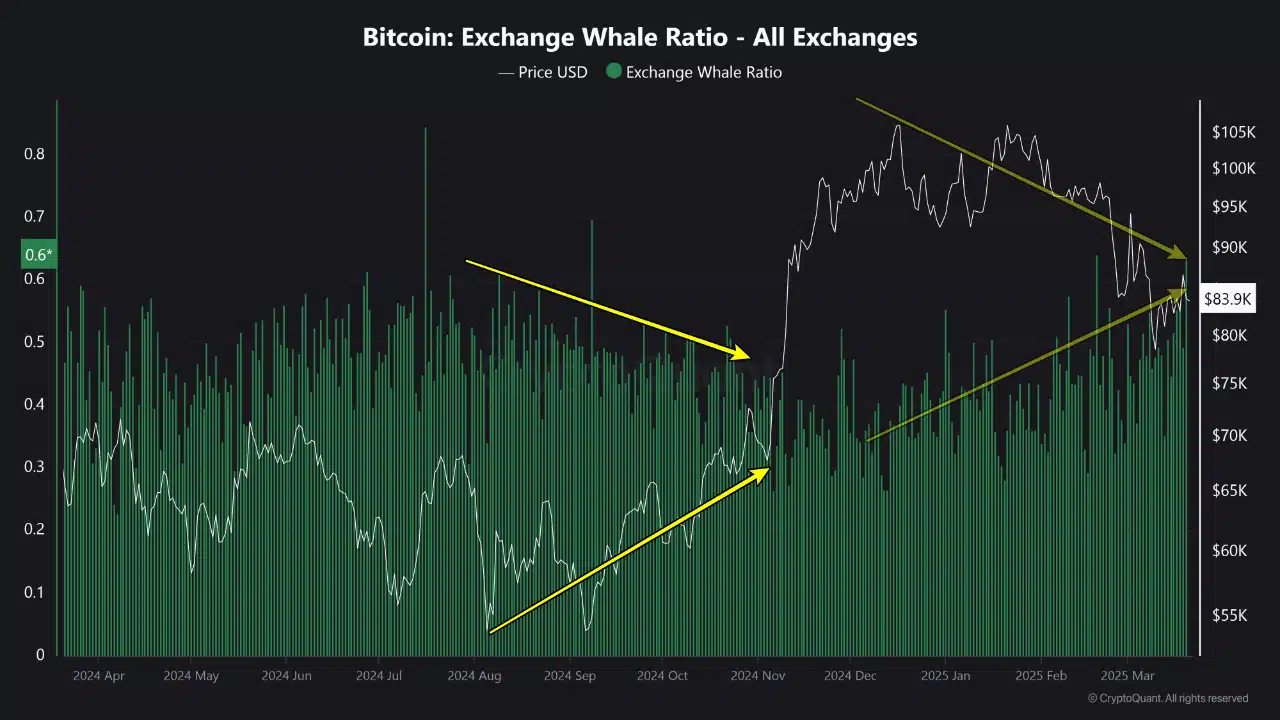

The Exchange Whale Ratio climbed to 0.6 – Its highest studying in over a 12 months.

This spike indicated that enormous holders, or whales, at the moment are chargeable for a major share of Bitcoin getting into exchanges. Traditionally, such habits tends to precede main market strikes, usually hinting at a hike in promoting exercise.

Supply: Cryptoquant

As is evidenced by the chart, related spikes in mid-2024 have been adopted by notable value declines.

The most recent hike coincided with Bitcoin’s current value retracement from its all-time excessive – An indication that whales might as soon as once more be reallocating belongings in anticipation of market weak point. If previous traits maintain, elevated whale ratio ranges might spell volatility forward.

Bitcoin Choices market – Rising demand for draw back safety

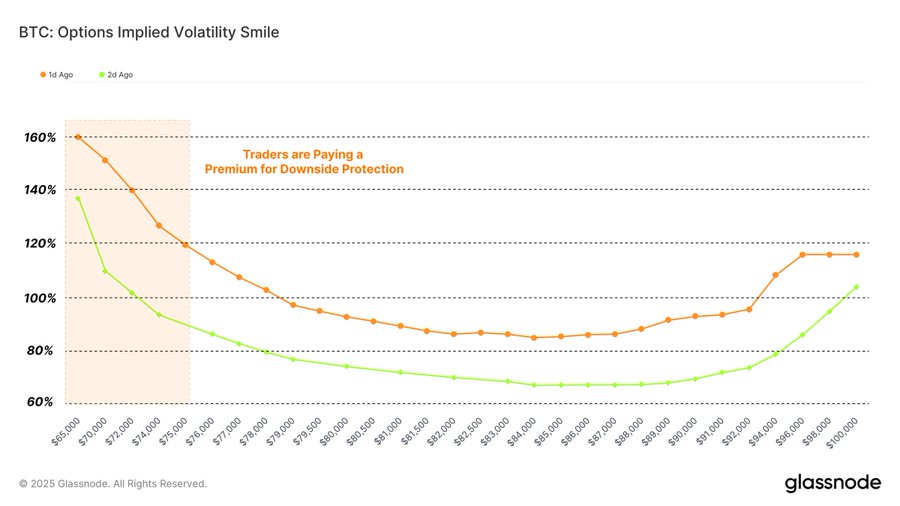

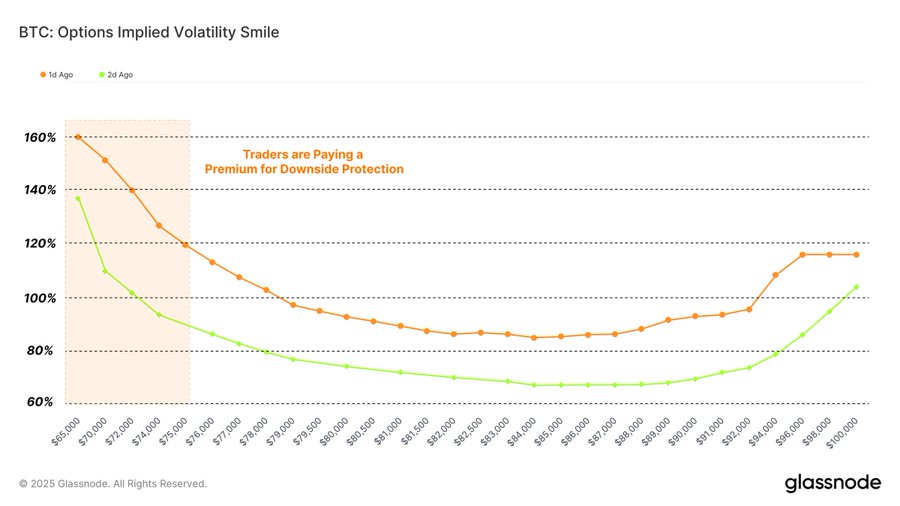

Bitcoin‘s Choices market has been flashing indicators of warning too.

Choices permit buyers to hedge towards value swings, and the press time positioning revealed a transparent tilt in direction of threat aversion. The implied volatility smile chart highlighted that merchants are paying a premium for put choices, in comparison with calls, particularly for strike costs under $80,000.

Supply: Glassnode

This pattern will be interpreted to allude to rising demand for draw back safety as buyers brace for potential declines.

The steep leftward skew on the chart hinted at heightened worry of short-term volatility and appeared to bolster the broader market’s shift towards defensive methods. This surge in put premiums can also be an indication of investor sentiment turning cautious, aligning with on-chain whale exercise whereas pointing to a extra cautious outlook for Bitcoin within the close to time period.