Minting NFTs in Minutes with Phantom Mobile

Trying to develop the accessibility of NFT creation, Phantom has lately launched its Digicam Mint characteristic. This revolutionary characteristic permits customers to create NFTs ‘on-the-go’ utilizing Solana’s blockchain.

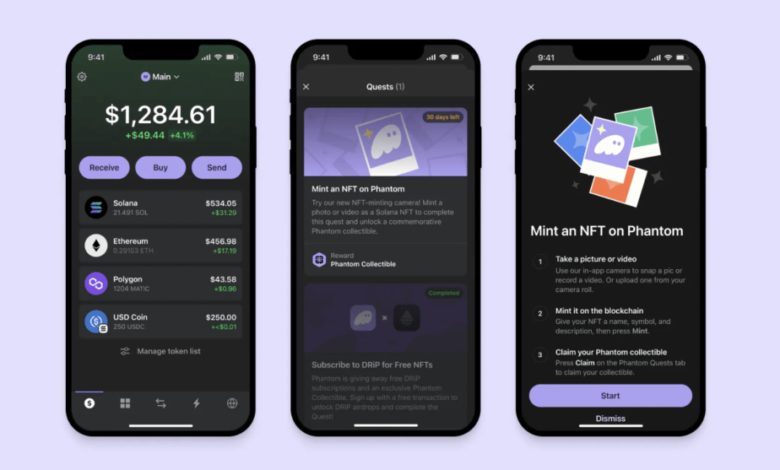

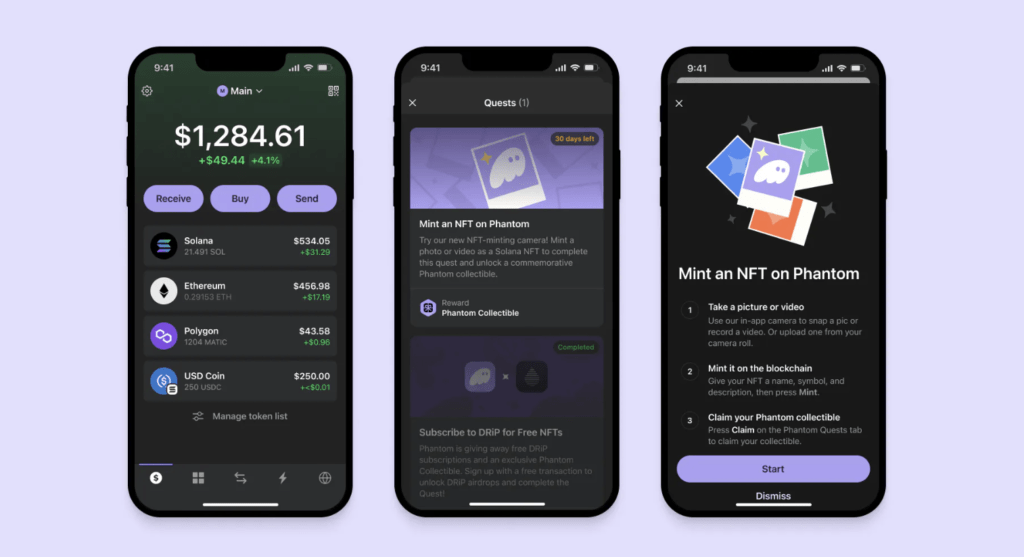

One of many major advantages of the Digicam Mint is its easy consumer interface. Customers can rapidly and simply assign names and descriptions to their images or movies, immediately minting them as NFTs from their cell gadgets. The method is reasonably priced, costing lower than a greenback for every mint, making it accessible to anybody. Moreover, the Digicam Mint allows customers to seize significant moments reminiscent of birthdays, weddings, and different life occasions and switch them into digital collectibles.

Getting Began with Phantom’s Digicam Mint

Phantom’s Digicam Mint characteristic supplies new alternatives for novice NFT creators. Fostering a deeper understanding of the complexities of NFTs, blockchain, and asset valuation reduces the dangers of the uninformed creation of NFTs.

To start out utilizing Phantom’s Digicam Mint characteristic, open the Phantom cell app and navigate to the Collectibles tab. As soon as there, click on on the “+” icon within the high proper nook and select the “Mint Collectible” possibility. You’ll then have the choice to both use the in-app digital camera to take an image or document a video—capped at 15 seconds—or add an current file out of your digital camera roll.

Phantom’s Reward System

Along with making it simple to create NFTs, the characteristic comes with a reward system. To unlock a particular commemorative Phantom collectible, go to the Discover tab, represented by a globe icon, and faucet the “Mint an NFT” quest to start out. Upon finishing your mint, faucet “Declare your reward,” and also you’ll obtain your commemorative Phantom collectible. You even have the choice to say your reward by revisiting the Discover tab and urgent “Declare.”

The Digicam Mint characteristic of Phantom is one other breakthrough in making blockchain expertise accessible to everybody, together with those that usually are not tech-savvy. This characteristic permits individuals to create NFTs with out requiring superior technical data. Phantom additionally supplies academic assets to assist customers discover ways to mint NFTs and make knowledgeable selections. This democratizes entry to blockchain expertise and empowers people and creators to take part within the NFT market.