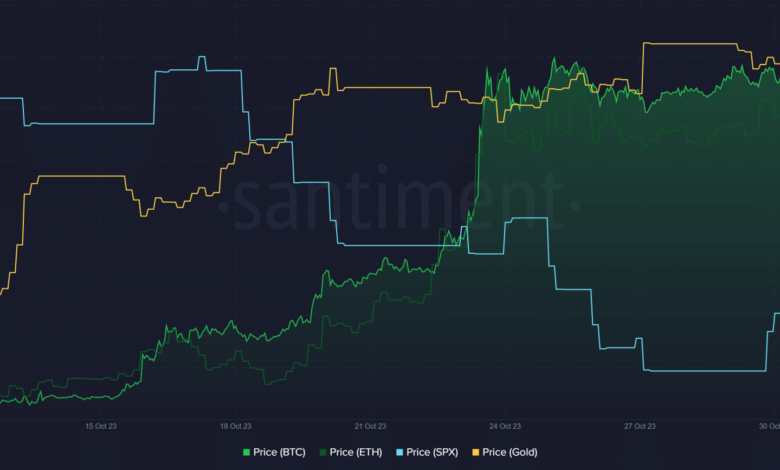

Bitcoin and Ethereum break away from S&P 500 and Gold

- S&P 500 trended above BTC and ETH briefly prior to now week.

- BTC and ETH maintained their costs above $35,000 and $1,800.

Through the previous week, cryptocurrencies equivalent to Bitcoin [BTC] and Ethereum [ETH] moved independently of the S&P 500 and Gold. Has this development endured into the brand new week, or has there been a change?

Learn Bitcoin’s [BTC] Worth Prediction 2023-24

S&P 500 developments above Bitcoin and Ethereum

Up to now week, the S&P 500 skilled a major improve, inflicting it to outperform Bitcoin and Ethereum. In accordance with Santiment’s development evaluation, the S&P 500 gained over 6% in worth inside simply 4 days.

📊 The #SP500 had a giant week after #Bitcoin & #Ethereum have cooled down. With the sectors now every having their ‘time within the solar’, this subsequent week will point out whether or not #crypto continues to be tied to #equities, or whether or not property can put together for a #bullrun. https://t.co/R9moWBoqCx pic.twitter.com/FNddr1T8PM

— Santiment (@santimentfeed) November 4, 2023

Because of this surge, inventory costs surpassed the worth of cryptocurrencies like BTC and ETH. It additionally appeared like these cryptocurrencies have been stabilizing after a interval of sturdy value development.

The current upswing within the S&P 500 could possibly be attributed to the newest Federal Open Market Committee (FOMC) report. Notably, the report introduced that the Federal Reserve would keep its present rate of interest for the second consecutive month.

This resolution has sparked hypothesis that the Fed might have accomplished its rate of interest hikes. Consequently, this led to a notable improve in inventory costs noticed through the previous week.

BTC and ETH costs meet up with inventory costs

As per a development chart analyzed by AMBCrypto, Bitcoin and Ethereum had moved forward of the S&P 500 when it comes to their value developments. Regardless of the inventory market being closed for the weekend, BTC and ETH had surpassed their earlier positions.

It remained unsure whether or not inventory costs will resume their upward trajectory when the market reopens, however cryptocurrency costs continued to rise throughout this era.

Supply: Santiment

Bitcoin and Ethereum keep uptrends

On 4 November, the day by day timeframe chart indicated that Bitcoin had closed the buying and selling session with a notable value improve of over 1%. On the time of writing, it was nonetheless buying and selling with a slight value rise, exceeding $35,000.

Regardless of occasional declines, Bitcoin managed to keep up its value inside the $35,000 vary. This was a key issue that contributed to its upward development in comparison with the S&P 500.

Supply: TradingView

How a lot are 1,10,100 ETHs value at present?

As well as, an examination of Ethereum’s day by day timeframe chart revealed an much more spectacular efficiency. As of press time, Ethereum was buying and selling with a considerable value improve of over 2%, surpassing the $1,800 mark.

The chart additionally indicated that Ethereum had been persistently on an upward development for a number of consecutive days.

Supply: TradingView