Bitcoin: Are bears falling off the wayside?

- Brief positions fell over the previous couple of days owing to BTC’s worth surge.

- Implied Volatility grew, which might make merchants extra cautious.

As Bitcoin’s [BTC] costs surged, optimism within the cryptocurrency sector soared as effectively. Nevertheless, there was one phase that wasn’t proud of BTC’s rise – bears who had taken brief positions on the king coin.

Learn Bitcoin’s [BTC] Value Prediction 2023-2024

Bears take a again seat

In response to Datamish, Bitcoin’s brief positions on Bitfinex just lately reached their lowest ranges within the 12 months. On the identical time, hedged brief positions, which contain defending in opposition to potential losses, have surpassed unhedged brief positions.

This knowledge urged that these betting in opposition to Bitcoin’s worth have been changing into much less energetic, probably attributable to diminishing bearish sentiment out there. This shift might point out rising confidence in Bitcoin’s worth prospects amongst merchants.

Supply: Datamish

Low correlation

The rising optimistic sentiment surrounding Bitcoin may be attributed to its decreased correlation with NASDAQ, a significant inventory market index. This correlation between Bitcoin and the NASDAQ, which measures how they transfer collectively, was now at its lowest level since August 2021 at press time.

This motion meant that Bitcoin was changing into much less depending on the NASDAQ’s efficiency. Because of this, merchants could view Bitcoin as a extra unbiased and doubtlessly much less dangerous funding, contributing to optimistic sentiment.

Bitcoin’s weekly correlation to the Nasdaq is the bottom that it has been since August 2021 pic.twitter.com/MlKwwVqGMy

— Will Clemente (@WClementeIII) October 30, 2023

If Bitcoin’s worth isn’t strongly influenced by the NASDAQ, it might provide a method to steadiness out a portfolio. For instance, if shares go down, Bitcoin may not comply with the identical path, which will help scale back general threat.

Diversifying can defend in opposition to massive losses in a single a part of your portfolio. A extra various portfolio may be steadier over time.

So, if Bitcoin is much less tied to the NASDAQ, it may be a software for diversification, interesting to these in search of a mixture of belongings of their investments.

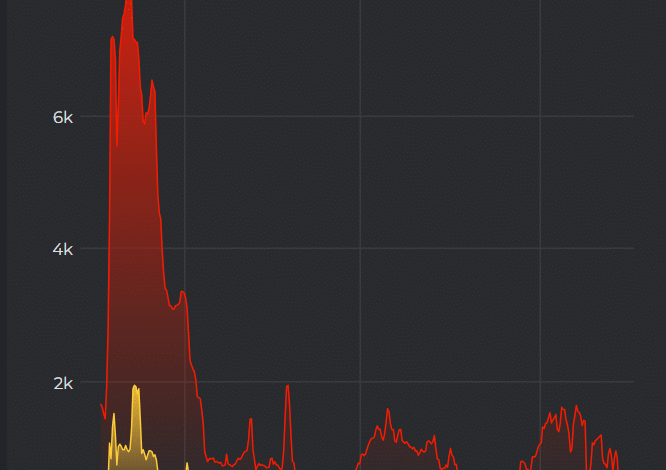

Rising Implied Volatility

Moreover, commerce may be influenced by the Implied Volatility of Bitcoin as effectively. This metric measures how a lot the market thinks Bitcoin’s worth would possibly transfer.

Is your portfolio inexperienced? Try the BTC Revenue Calculator

Just lately, this Implied Volatility for Bitcoin surged. Thus, merchants might select to be extra cautious or attempt to capitalize on the elevated worth actions. It could affect how they strategy buying and selling going ahead.

Supply: The Block

At press time, BTC was buying and selling at $34,406.07. Over the past 24 hours, the value of BTC had fallen by 0.35%

Supply: Santiment