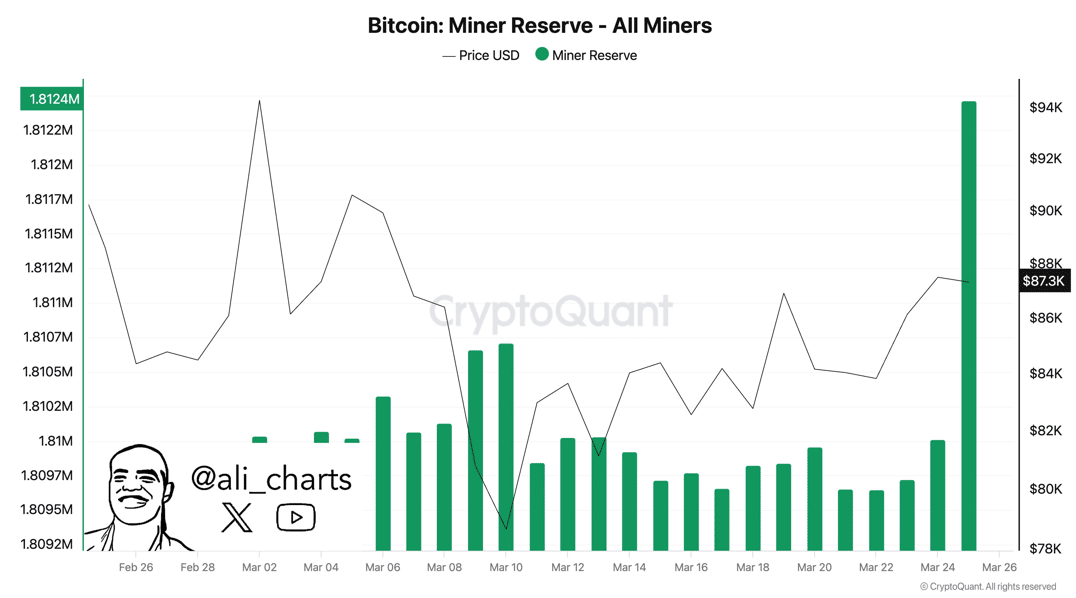

Bitcoin: Are BTC miners holding for a bigger price jump?

- Miners’ secure reserves and powerful assist advised that Bitcoin may preserve upward momentum.

- Whale and institutional accumulation, together with BlackRock, supported bullish sentiment for Bitcoin.

Bitcoin [BTC]’s Miner Reserve has remained stable, with no vital promoting exercise recorded over the previous 24 hours. This means that miners are holding onto their Bitcoin, signaling confidence in future value actions.

Supply: X

The soundness in miner habits may recommend that miners are ready for favorable market situations to promote at increased costs.

Consequently, this regular habits within the miner reserve is a key indicator to look at for potential shifts in market dynamics.

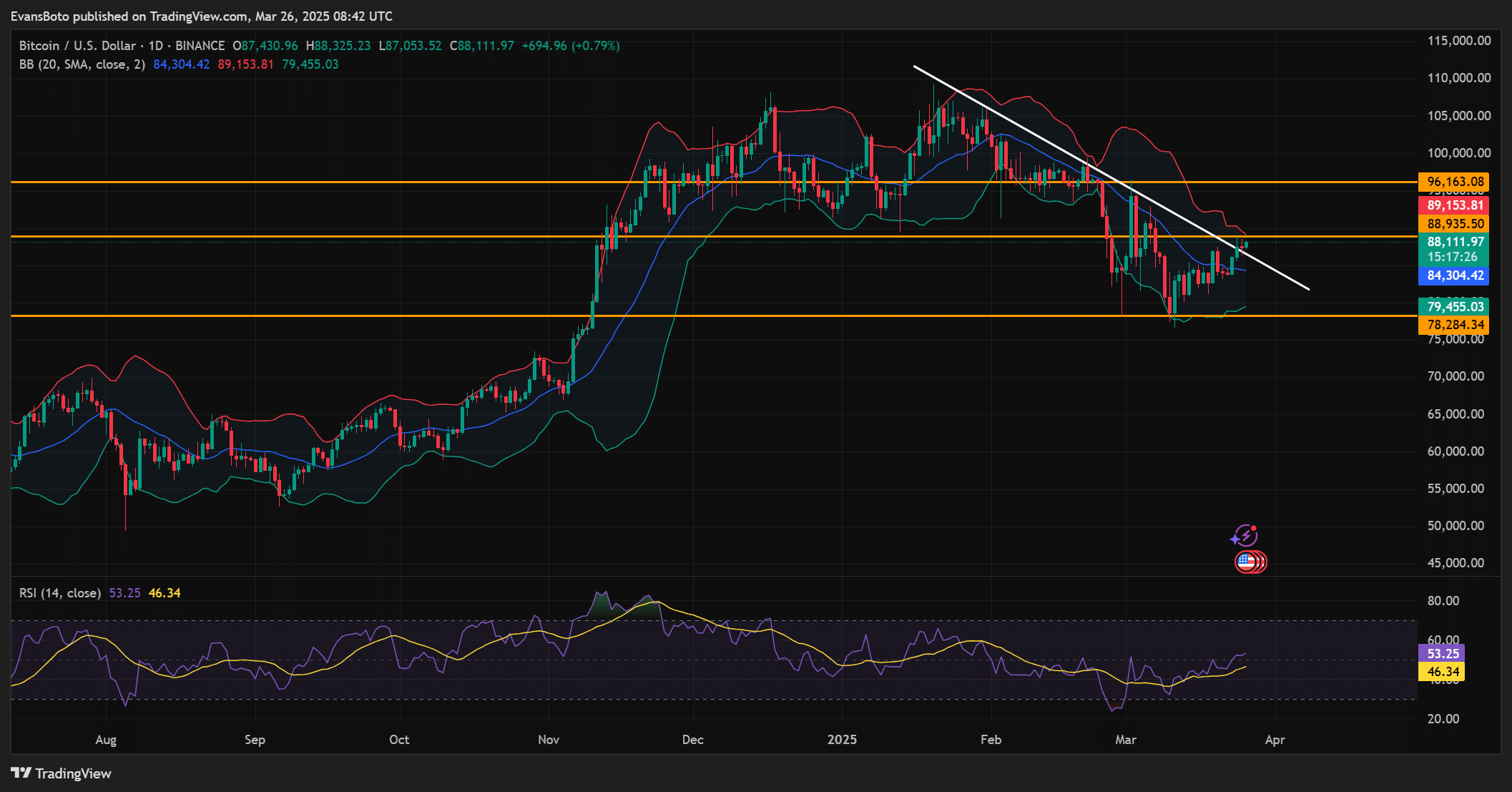

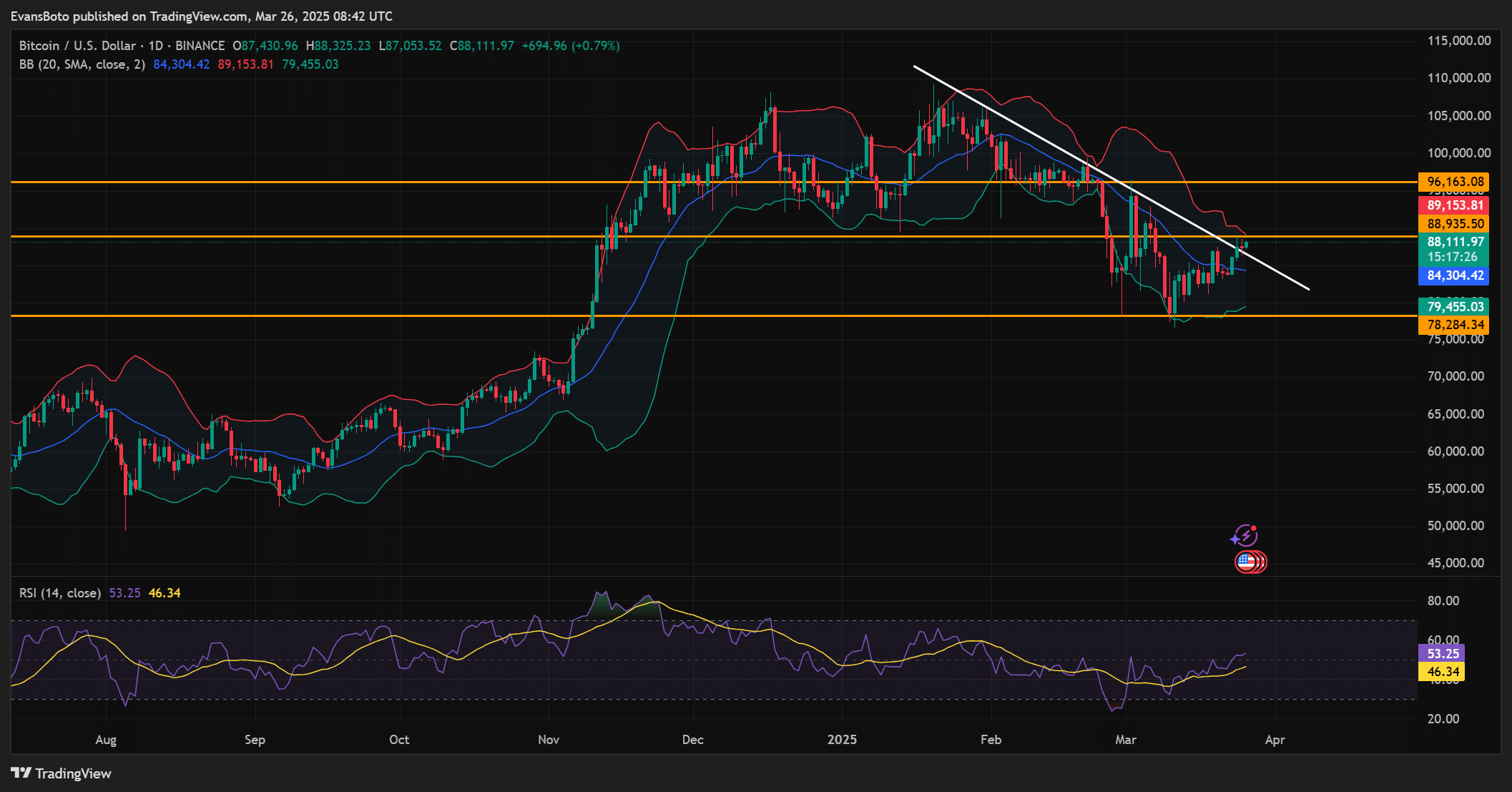

How does Bitcoin’s value motion look?

At press time, Bitcoin was buying and selling at $88,020.88, up 1.53% over the previous 24 hours.

BTC has just lately damaged out of a descending trendline and was bouncing off the demand zone. This implies robust shopping for curiosity round these value ranges, which may assist push Bitcoin increased.

The Bollinger Bands indicated that BTC was nearing the decrease vary of its bands, suggesting that consolidation is in play or a breakout is likely to be imminent.

Moreover, the RSI studying of 53.25 confirmed impartial market sentiment, signaling no overbought or oversold situations in the mean time.

Supply: TradingView

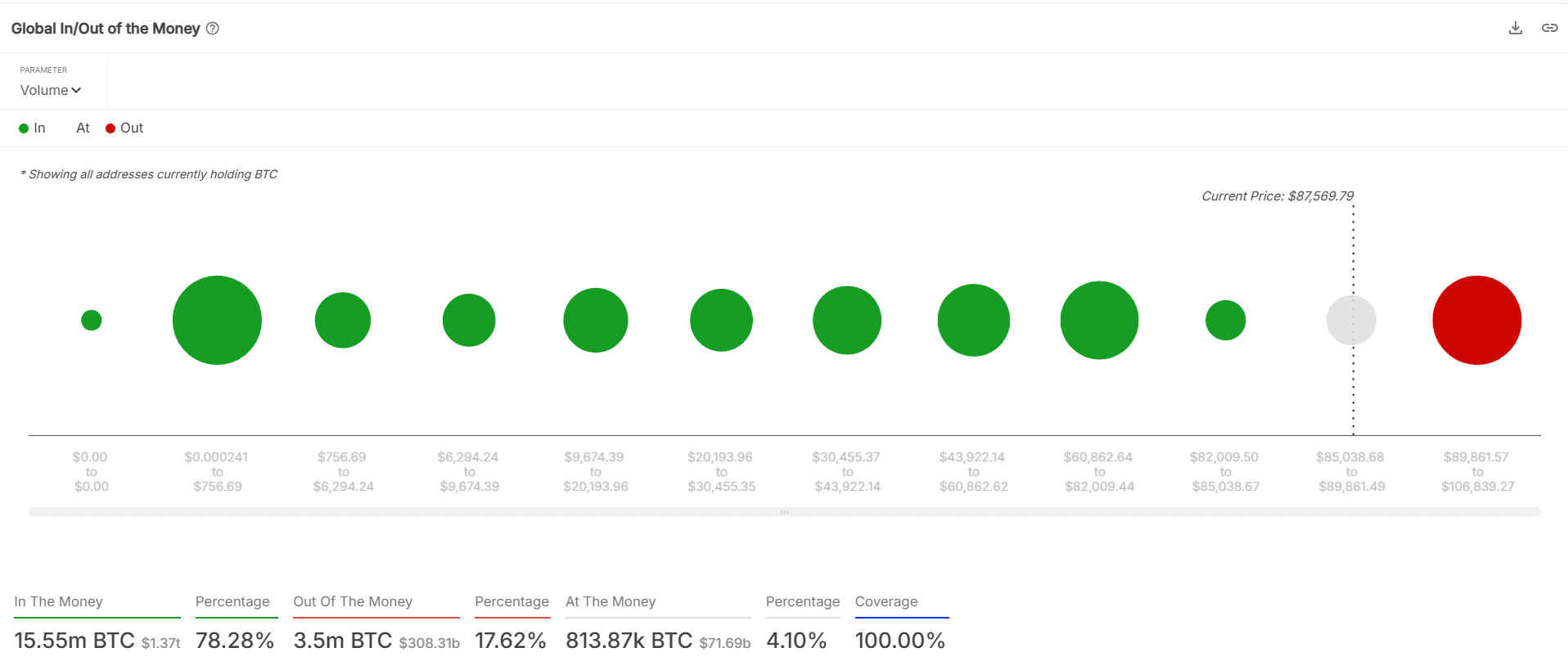

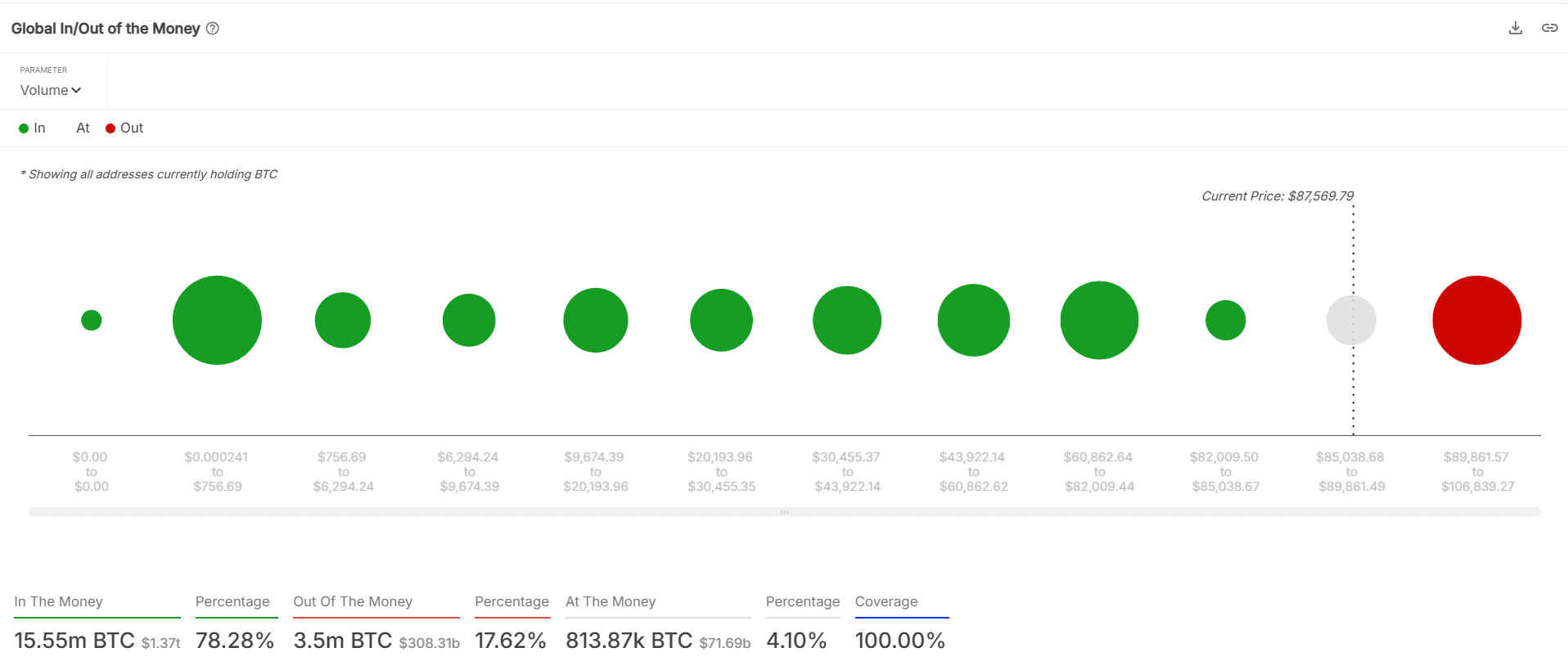

What does BTC’s In/Out of the Cash distribution inform us?

Taking a look at Bitcoin’s In/Out of the Cash chart, nearly all of addresses holding BTC are in revenue, with 78.28% of addresses “within the cash.”

This distribution is necessary as a result of it alerts robust assist ranges beneath the present value.

Moreover, it means that the market sentiment is usually bullish, as most holders are in revenue. The absence of serious losses in BTC holdings might be an indication that the value has sufficient upward momentum to keep away from a major pullback.

Supply: Coinglass

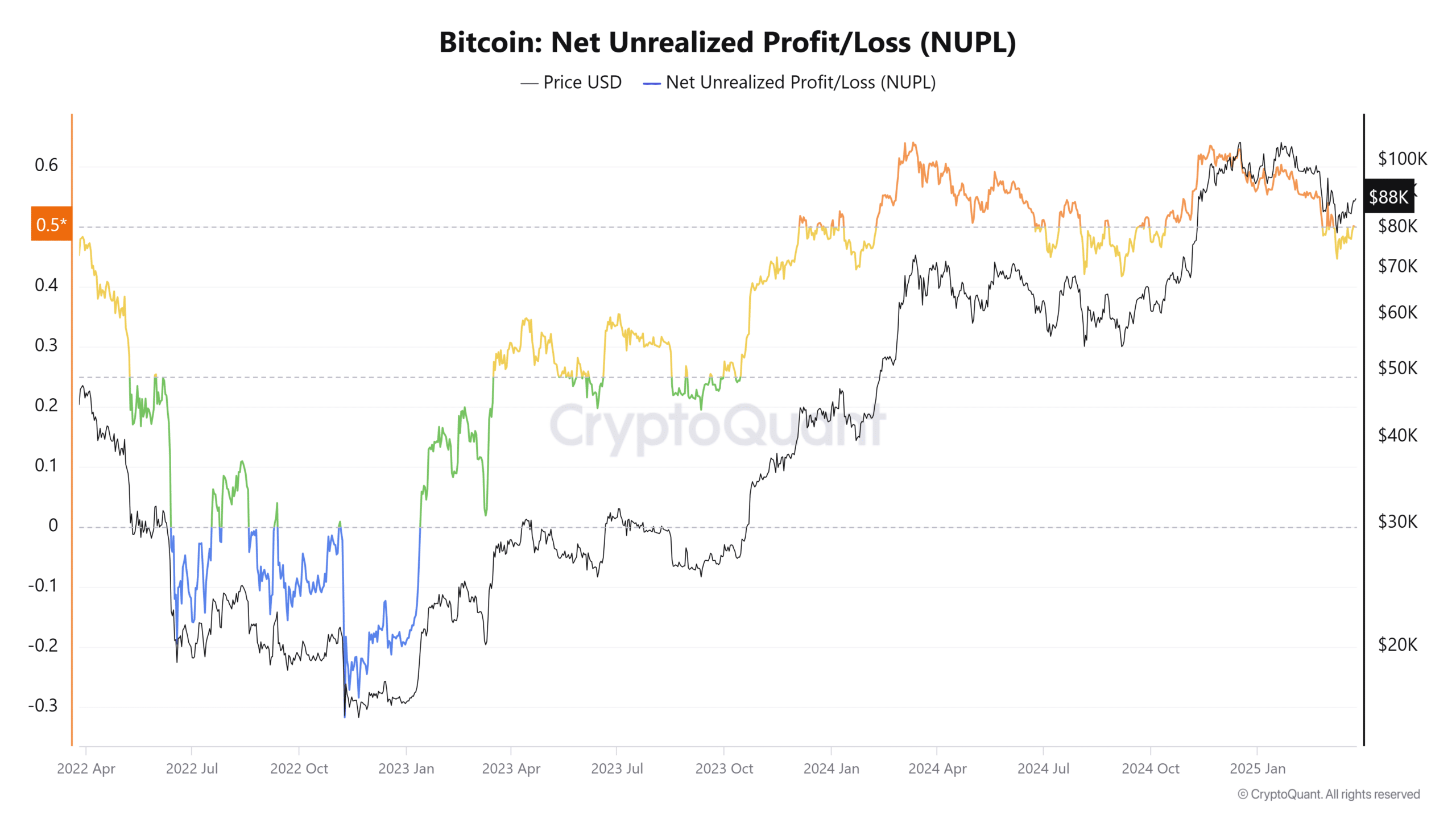

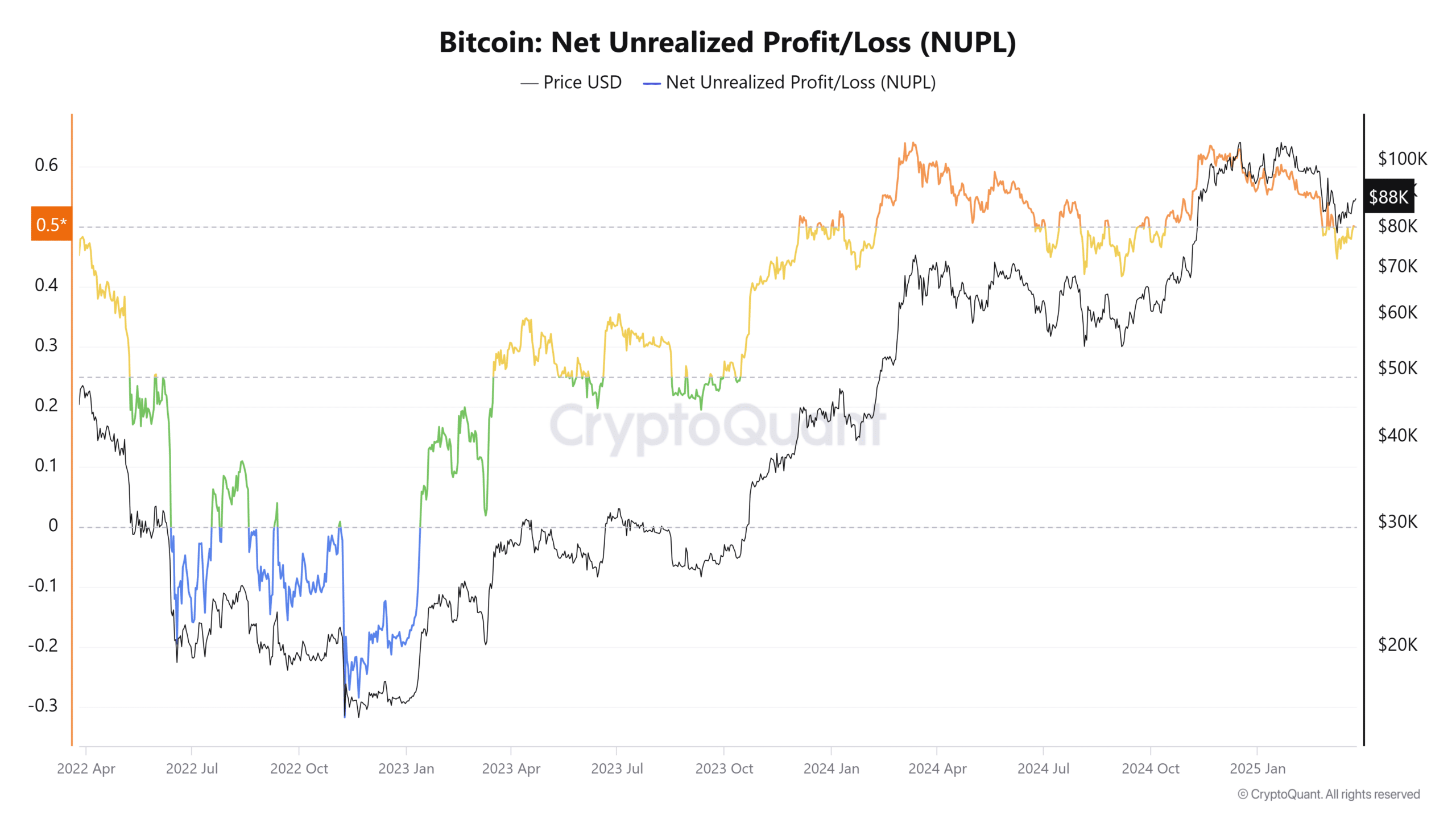

Is Bitcoin’s NUPL proposing a constructive pattern?

On the time of writing, Bitcoin’s Internet Unrealized Revenue/Loss (NUPL) stood at 0.501, displaying that the market is in a revenue zone.

A constructive NUPL displays robust market sentiment, with most Bitcoin holders having fun with unrealized features.

Supply: CryptoQuant

How are whale and institutional exercise influencing BTC’s market?

Bitcoin’s whale exercise has been noteworthy, highlighted by the latest switch of two,760 BTC. Institutional buyers, reminiscent of BlackRock, are additionally accumulating substantial quantities of Bitcoin.

Earlier this 12 months, BlackRock bought $42 million value of BTC, reinforcing the prevailing bullish sentiment. Mixed with whale actions, this institutional exercise signifies that key gamers are getting ready for potential future value surges.

What subsequent for BTC

With secure miner reserves, a constructive NUPL, and a breakout from a descending trendline, Bitcoin seems positioned for an upward transfer.

Institutional accumulation, together with BlackRock’s $42 million Bitcoin buy, alongside notable whale exercise, provides gas to this potential rally.

The approaching days might be pivotal in figuring out whether or not BTC can maintain its momentum and solidify a stronger bullish pattern.