Ethereum ETF update: ProShares steps up with S-1 filing as ETH slides

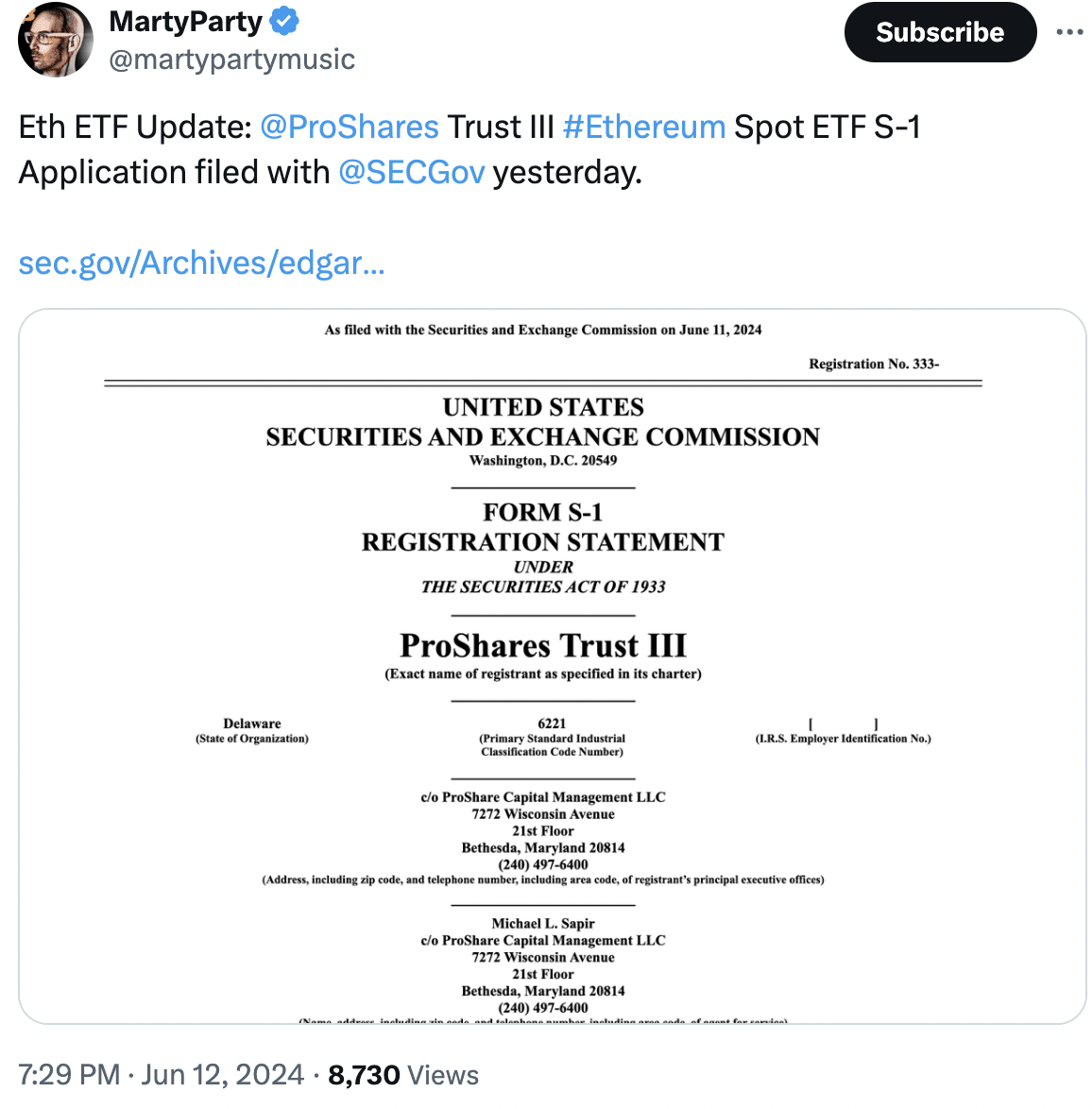

- ProShares filed an S-1 to launch an Ethereum ETF.

- ETH’s value continued to say no together with its community progress.

Over the previous few days, Ethereum [ETH] fell sufferer to the bigger bearish sentiment prevailing out there and witnessed a correction.

It’s raining ETFs

Nevertheless, monetary establishments didn’t lose any enthusiasm and ETF functions continued to be submitted to the SEC.

ETF issuer ProShares took a big step in the direction of launching its spot Ethereum ETF by submitting an S-1 registration assertion.

Based on the submitting, Coinbase Credit score will act as a essential companion by offering ProShares with a commerce credit score line.

This basically permits ProShares to borrow Ethereum and money for sure transactions that transcend their rapid buying and selling stability.

In the meantime, Financial institution of New York Mellon (BNY Mellon) will tackle the position of switch agent. This implies they’ll be accountable for processing each purchases and redemption orders for the ETF, basically retaining monitor of who owns shares inside the fund.

The submitting additionally clarified some beforehand introduced roles. As an illustration, BNY Mellon will even function administrator and money custodian, whereas Coinbase Custody will deal with the safekeeping of the Ethereum belongings.

It’s essential to notice that the submitting allowed for some flexibility in these roles.

Whereas BNY Mellon’s administrator position is initially set for a two-year time period with annual renewals, ProShares has the choice to make adjustments after that interval.

Equally, the ETF can add or take away custodians for each Ethereum and money, in addition to swap prime execution businesses at any time. Apparently, Coinbase additionally retains the proper to step down from its position as money custodian.

Supply: X

How is ETH doing?

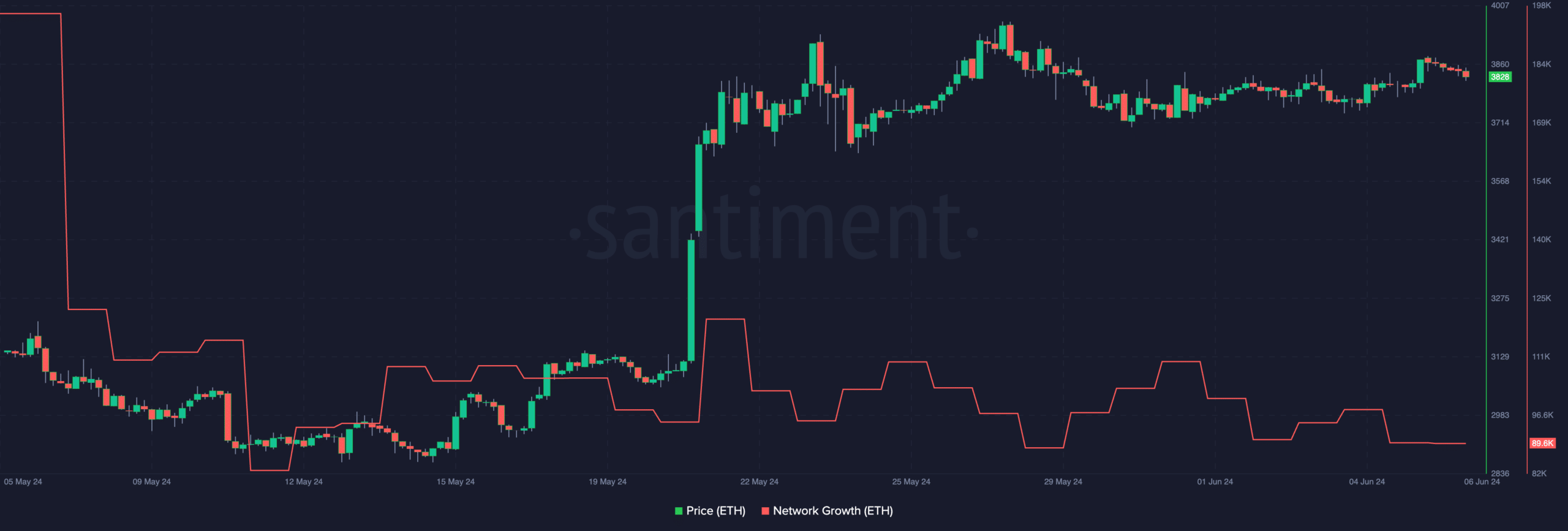

Regardless of the keenness showcased by ProShares, the worth of ETH continued to say no. At press time, ETH dipped under the $3,500 mark and was buying and selling at $3,497.81.

Despite the fact that the decline in value was vital, the general pattern for ETH seemed principally constructive.

Learn Ethereum (ETH) Worth Prediction 2024-25

Because the nineteenth of Might, the worth of ETH moved upwards whereas exhibiting greater highs and better lows, indicative of a bullish pattern.

Nevertheless, AMBCrypto’s evaluation of Santiment’s knowledge revealed that the community progress for ETH had declined together with the worth, indicating that new addresses had been shedding curiosity in ETH.

Supply: Santiment