Bitcoin: As sentiment turns neutral, investors stay their hands

- As Bitcoin’s worth remained in a decent vary, traders avoided buying and selling.

- Holders of 100 – 100,000 BTCs have largely distributed their holdings towards worth restoration.

An evaluation of Bitcoin’s [BTC] on-chain exercise signaled that the market was in a state of indecision at press time. Based mostly on the important thing on-chain metrics noticed, no main sell-off indicators existed. Nonetheless, there have been additionally no main buy-side indicators as effectively. This steered that the market would probably stay range-bound in the meanwhile.

Is your portfolio inexperienced? Take a look at the Bitcoin Revenue Calculator

Subsequent worth path stays undetermined

Pseudonymous CryptoQuant analyst Binh Dang assessed the behavioral patterns of short- and medium-term BTC holders and the alternate exercise of BTC whales and small-time traders and located that the overall market remained averse to creating any vital trades.

Dang thought of the Web Unrealized Revenue/Loss knowledge of short-term holders (STH-NUPL) and that of short-term holders (MTH-NUPL) and located each positioned at zero.

The STH-NUPL metric measures the unrealized revenue/lack of short-term holders who’ve held their BTCs for lower than 12 months. MTH-NUPL, alternatively, tracks the unrealized revenue/lack of medium-term holders which have held their cash for six months to 2 years.

Whereas these metrics are excessive and optimistic (above zero), they counsel that traders in each cohorts have been bullish and logging income. Conversely, low and unfavorable values for each metrics indicated bearish sentiment, with traders recording losses.

Remaining at zero within the press time, neither short-term nor medium-term holders have been making income. This impartial sign might imply that the market is poised for a breakout in both path.

“Largely steady with restricted will increase”

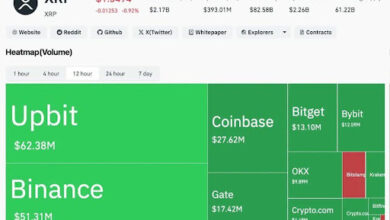

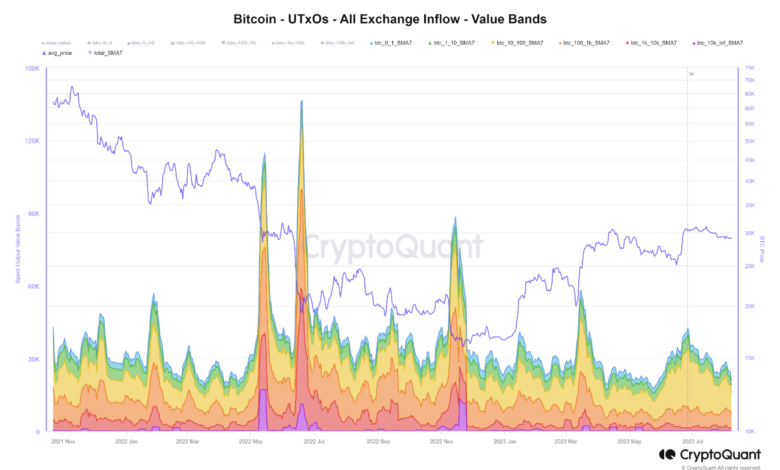

Additional, the analyst noticed BTC’s UTxOs Alternate Influx on a 7-day transferring common. This metric measures the quantity of a crypto asset that has been deposited into exchanges from unspent transaction outputs.

Based on Dang:

“Information is smoothed with a 7-day common, displaying restricted exercise from giant possession teams (100-10k) sending cash to exchanges. Essentially the most influential band since Could 25 is the 10-100 vary, which has cooled considerably. Main cohorts are largely steady, with restricted will increase.”

Supply: CryptoQuant

This reveals that there was restricted exercise from giant possession teams in sending cash to exchanges. That is additionally a impartial sign, and it means that there isn’t any main sell-off stress from these teams.

Learn Bitcoin’s [BTC] Value Prediction 2023-24

Dang took a more in-depth have a look at the dominance of this cohort of traders within the type of their UTXO proportion and famous:

“Throughout the post-ATH bear market, excessive ratios (>= 40%) of 100 – 10K – >10K possession cohorts have been linked to vital volatility, usually resulting in sharp declines.”

Nonetheless, because the 12 months started, their UTXO dominance has decreased. This means that this group of holders is holding onto their cash, and as identified by Dang, they’ve restricted “coin distribution to help the restoration development” as an alternative of reserving fast income.

Supply: CryptoQuant