Bitcoin: Assessing the ups and downs of BTC mining in Q3

- Miner charges accounted for 4.38% of the block subsidies on common in 2023.

- The hashrate dramatically climbed in September after staying muted throughout summer season.

Bitcoin [BTC] mining stays one of many fundamental foundations on which the edifice of the Bitcoin blockchain stands. Liable for bringing new cash into circulation and validating transactions on the community, the method has now advanced right into a full-fledged trade as of this writing.

Analysts and traders preserve a detailed eye on developments related to the ecosystem, to take a position on the following strikes of not simply the native Bitcoin however the broader crypto market.

Learn BTC’s Worth Prediction 2023-24

Community charges decline QoQ

Hashrate Index just lately launched its Q3 Bitcoin mining report, offering an summary of modifications that occurred within the final three months. The report additionally acknowledged a number of the key efficiency indicators.

The share of transaction charges of all block rewards in Q3 2023 was 2.7%. This represented a pointy decline from 8.17% seen within the final quarter.

Regardless of the quarter-over-quarter dip (QoQ), 2023 has been extra form to miners. To this point, miner charges accounted for 4.38% of the block subsidies on common. In distinction, the typical through the crypto winter of 2022 was under 1.64%.

Supply: Hashrate Index

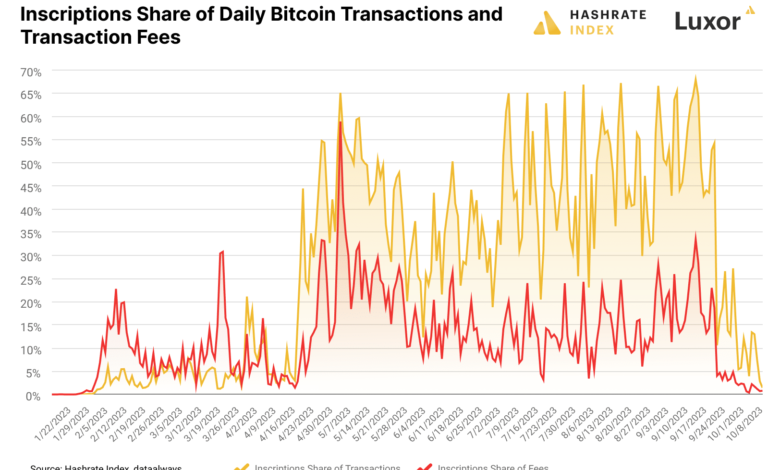

As indicated above, the drop in charges coincided with the regular drop in Ordinals-related transactions. Earnings from final quarter have been boosted by the explosive spike of such transactions in early Could. Nevertheless, there was a marked decline since then. The truth is, Ordinals’s share of charges plunged to the bottom ranges since Q1 in October.

Charges paid to miners for validating transactions stay one of many barometers of the mining sector. Miners use block rewards to offset the prices related to mining tools and electrical energy. Whereas one element of it’s mounted, massive fluctuations within the transaction payment half might adversely have an effect on miners’ economics and switch them away from the sector.

Hash Charge jumps after summer season shutdown

The hashrate is a perform of rising community visitors. A rising hashrate implies that miners need to put money into extra computational energy to validate blocks.

Reportedly, 2023 noticed a repeat of the sooner patterns seen within the hashrate trajectory. For the summer season months of June, July, and August, damaging development was noticed. Nevertheless, since September, the hashrate began to climb and maintained the uptrend until Could.

Supply: Hashrate Index

The report linked the drop in summer season months to voluntary curtailment by U.S.-based mining firms.

The nation’s Bitcoin mining hub, Texas, usually faces excessive warmth throughout these months. This ends in peak demand for electrical energy. As a part of an settlement with the state’s electrical grid operator, mining firms energy down their rigs throughout this time in order to not overstress the grid. In return, mining firms obtain vitality credit from ERCOT which may go into thousands and thousands of {dollars}.

Hash worth developments decrease

Hashprice is a well known mining metric that measures miner income on a per terahash foundation. Put merely, it gauges miners’ profitability. It’s depending on two elements — Bitcoin’s market worth and the community hash fee. Whereas it’s positively correlated to Bitcoin’s worth, it responds negatively to modifications in hash fee.

In line with the report, Bitcoin’s common worth in Q3 was $28,100 as in comparison with the 2023 common of $26,350 so far. The noticeable enhance in market worth countered the damaging impact of hashrate enhance on hashprice.

Supply: Hashrate Index

Having stated that, hashprice trended downwards from August onwards. The typical for September plunged to $61.71/PetaHashes/day, paying homage to the lows seen through the peak of the crypto winter in late 2022.

Is your portfolio inexperienced? Take a look at the Bitcoin Revenue Calculator

ASIC costs hit lows

It’s common information that specialised {hardware}, like Utility-Particular Built-in Circuits (ASICs), are used to mine Bitcoins lately. Miners put money into extra refined ASIC gadgets that suck much less vitality per TeraHash of computing energy.

Nevertheless, as a result of decline in hashprice, many mining rigs went into losses, in flip pulling the value of machines down in Q3. Costs for machines within the decrease effectivity class plunged even additional as miners rushed to money in.

Supply: Hashrate Index

On a vibrant word, Q3 witnessed the launch of the Antminer S21 by Bitcoin ASIC producer Bitmain. The brand new mannequin is the first-ever Bitcoin mining ASIC to attain an effectivity beneath 20 J/TH.