Bitcoin at $66K: Why your BTC price predictions have been wrong lately

- BTC’s weighted sentiment has been unfavorable for the previous three weeks.

- Different on-chain indicators trace at the potential for additional value decline beneath $66,000.

As Bitcoin [BTC] extends its weekly loss by one other 4%, its weighted sentiment continues on its bearish development, in keeping with Santiment’s knowledge.

In a submit on X (previously Twitter), Santiment famous that BTC’s weighted sentiment has been unfavorable for the previous three weeks.

The start of this bearish development, which occurred on 14th March, coincided with the coin’s value falling from its $73,750 all-time excessive. Exchanging palms at $66,572 at press time, BTC’s value has since fallen by 10%.

😱 The gang’s sentiment towards #Bitcoin and #crypto markets generally has wavered ever for the reason that massive correction 3 weeks in the past. Even with the $BTC halving now simply 2 weeks away, dealer sentiment displays #FUD and #bearish expectations.

With costs bouncing again to $69K… pic.twitter.com/DYs5RYNR95

— Santiment (@santimentfeed) April 5, 2024

Utilizing historic precedents, Santiment added that BTC’s value typically “transfer (in) the wrong way of the group’s expectation.”

In periods when the market reaches euphoric highs and expects a continued rally, BTC’s value retraces. Conversely, when sentiment grows poor and the market expects additional draw back, BTC’s value has been recognized to provoke an uptrend.

This sample has performed out even in latest occasions.

Extra decline within the brief time period?

On 4th April, BTC’s value rallied above the $69,000 value degree briefly earlier than retracing to the $66,500 area. With new resistance shaped at $69,000, on-chain knowledge suggests the potential for an additional decline within the main crypto’s worth within the brief time period.

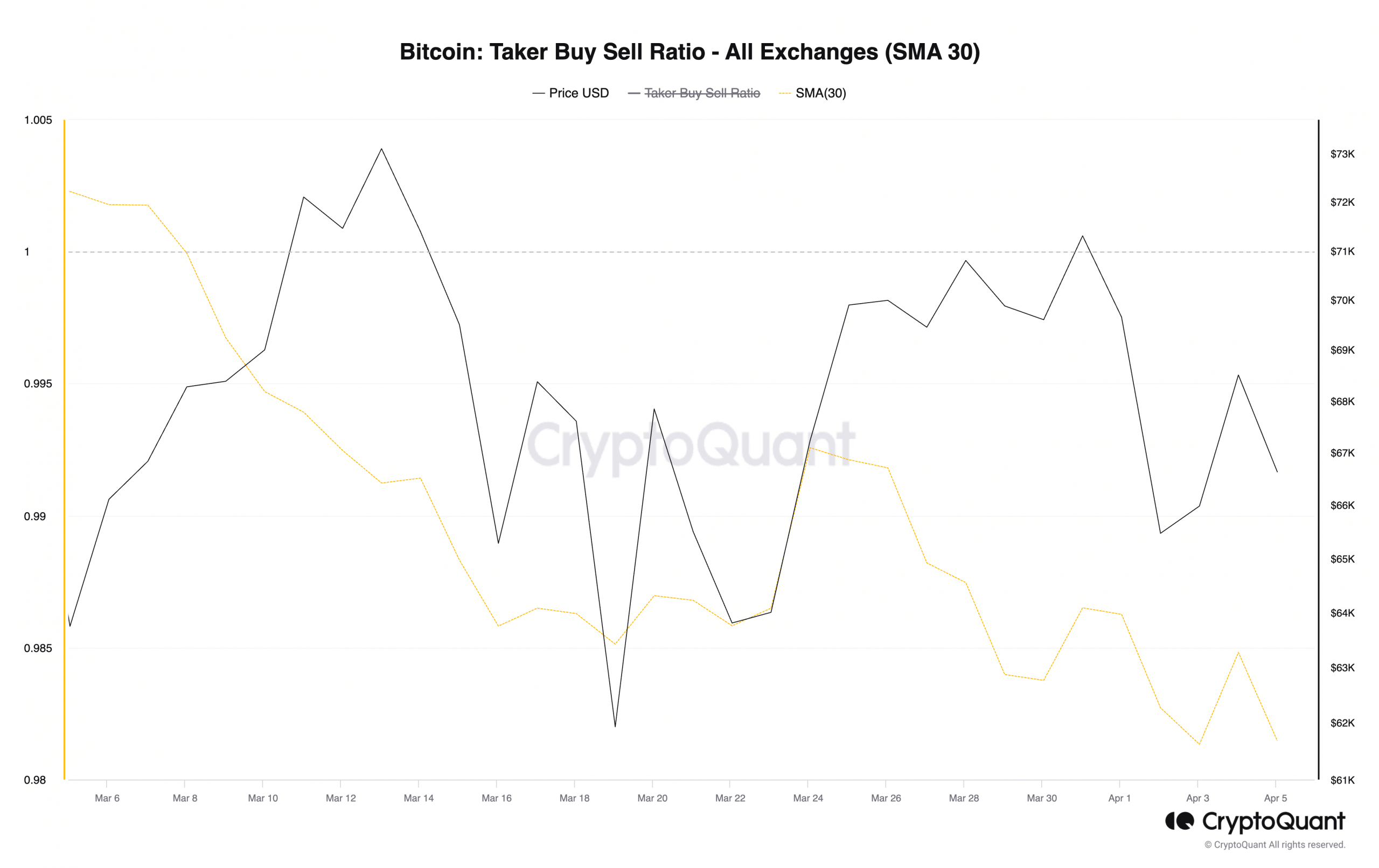

Firstly, the coin’s taker buy-sell ratio assessed on a 30-day easy transferring common (SMA) fell beneath the zero line on eighth March, foreshadowing the value decline that commenced on 14th March.

The taker buy-sell ratio is a metric that measures the ratio between the purchase quantity and promote quantity in an asset’s futures market. A worth higher than 1 signifies extra purchase quantity than promote quantity, whereas a worth lower than 1 signifies extra promote quantity than purchase quantity.

Since eighth March, the worth of BTC’s taker buy-sell ratio has been lower than 1. The regular decline on this metric signifies that there are extra sellers than consumers amongst these executing quick trades within the BTC market.

That is anticipated to proceed so long as sentiment stays bearish, placing downward stress on the coin’s value.

Supply: CryptoQuant

Additional, in a latest report, pseudonymous CryptoQuant analyst Tugbachain discovered that BTC’s NVT Golden Cross closed March flashing a promote sign.

This indicator compares the 30-day transferring common of the coin’s community worth to transactions (NVT) ratio with its 10-day transferring common.

Learn Bitcoin’s [BTC] Value Prediction 2024-25

It generates a protracted sign when it returns a worth lower than 1.6. Conversely, when the worth is above 2.2, it’s taken as a sign to enter brief positions.

In keeping with Tugbachain:

“On the finish of March, with the Bitcoin value round $71,000, the NVT worth reaching ‘3.17’ ranges served as an indicator of reaching a neighborhood peak.”