Bitcoin at $70,000 – Should you follow these long-term holders and sell?

- Lengthy-term holders started to maneuver their BTC holdings.

- Quick sellers acquired liquidated, whereas merchants turned bullish.

Bitcoin’s [BTC] worth has been hovering on the $70,000 mark for fairly a while. Because of the stagnancy of BTC’s worth, many addresses have been considering promoting their holdings.

Lengthy-term holders make strikes

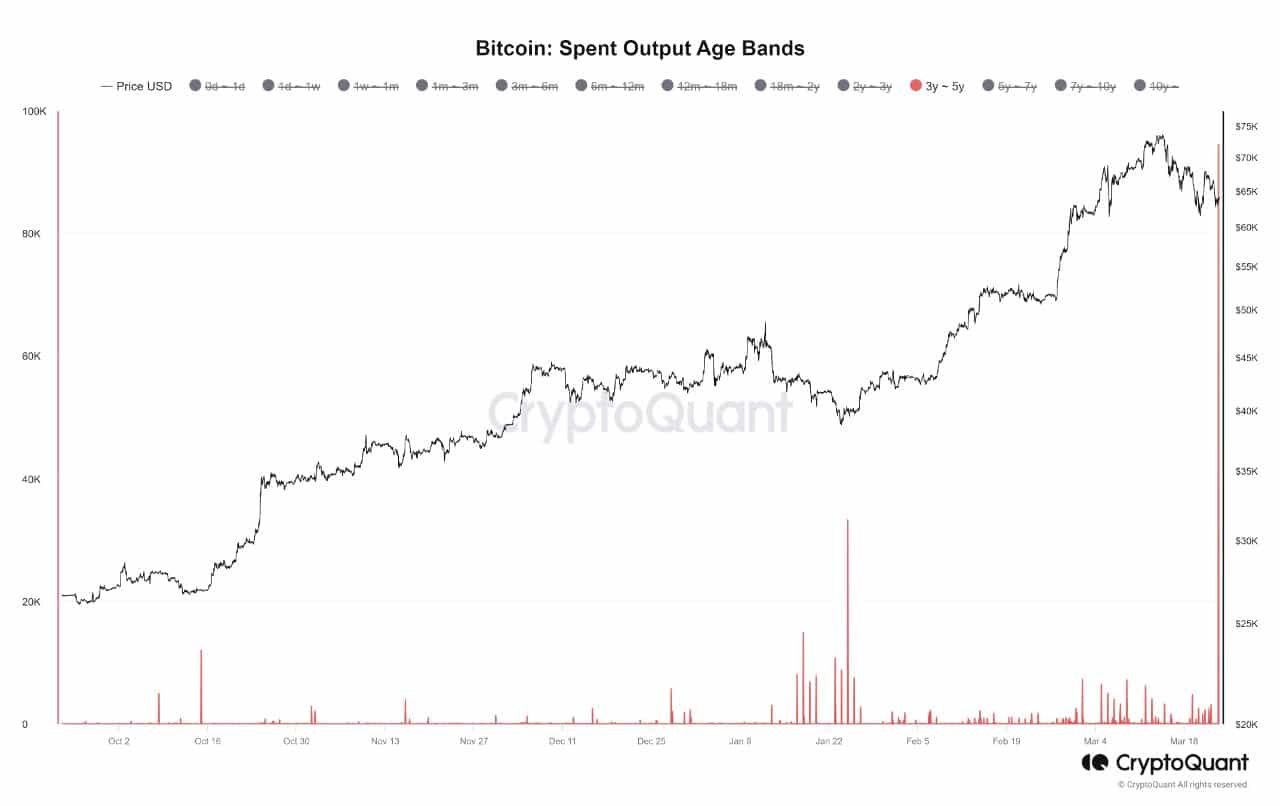

Current information indicated a large development of serious motion amongst long-term holders (3 to five years), with roughly 90,000 Bitcoin transferred over the previous few weeks. These transfers predominantly contain wallets possible owned by particular person customers, moderately than exchanges or different middleman platforms.

Lengthy-term holders are more and more liquidating their holdings, it might point out a insecurity sooner or later worth appreciation of BTC or a necessity for liquidity for different functions.

Moreover, a big inflow of BTC onto exchanges from long-term holders may exert downward strain on costs on account of elevated promoting strain.

Supply: Crypto Quant

Moreover, the Sharpe Ratio skilled a major enhance. For context, the Sharpe Ratio is a measure of risk-adjusted returns. It could actually doubtlessly influence Bitcoin negatively if it signifies an excessively excessive stage of danger relative to returns.

A rising Sharpe Ratio may counsel that the chance related to holding Bitcoin has elevated disproportionately in comparison with potential positive aspects, which may deter traders looking for a extra favorable risk-return profile.

This heightened notion of danger could result in diminished investor confidence and a subsequent lower in demand for Bitcoin, in the end placing downward strain on its worth.

Supply: CryptoQuant

Liquidations on the rise

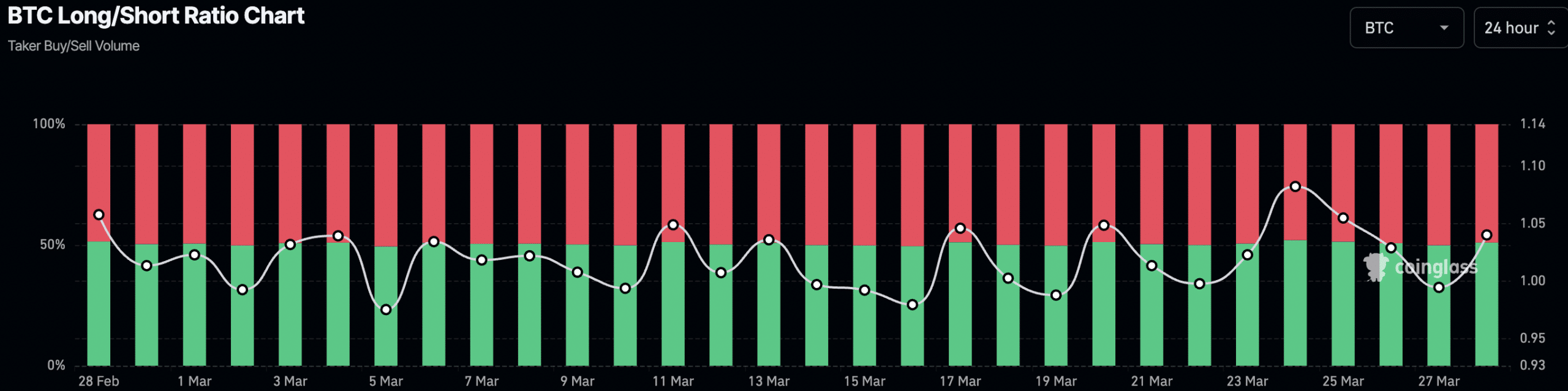

Regardless of this, merchants continued to stay bullish round BTC. This was indicated by the rising variety of lengthy positions taken by merchants.

One of many causes for the rising variety of lengthy positions may very well be because of the latest losses confronted by brief sellers. AMBCrypto’s evaluation of coinglass’ information indicated that 41.81 million brief positions had been liquidated prior to now 24 hours.

Supply: glassnode

The rising quantity of liquidations could deter brief sellers from betting towards BTC within the close to future.

Learn Bitcoin’s [BTC] Value Prediction 2024-25

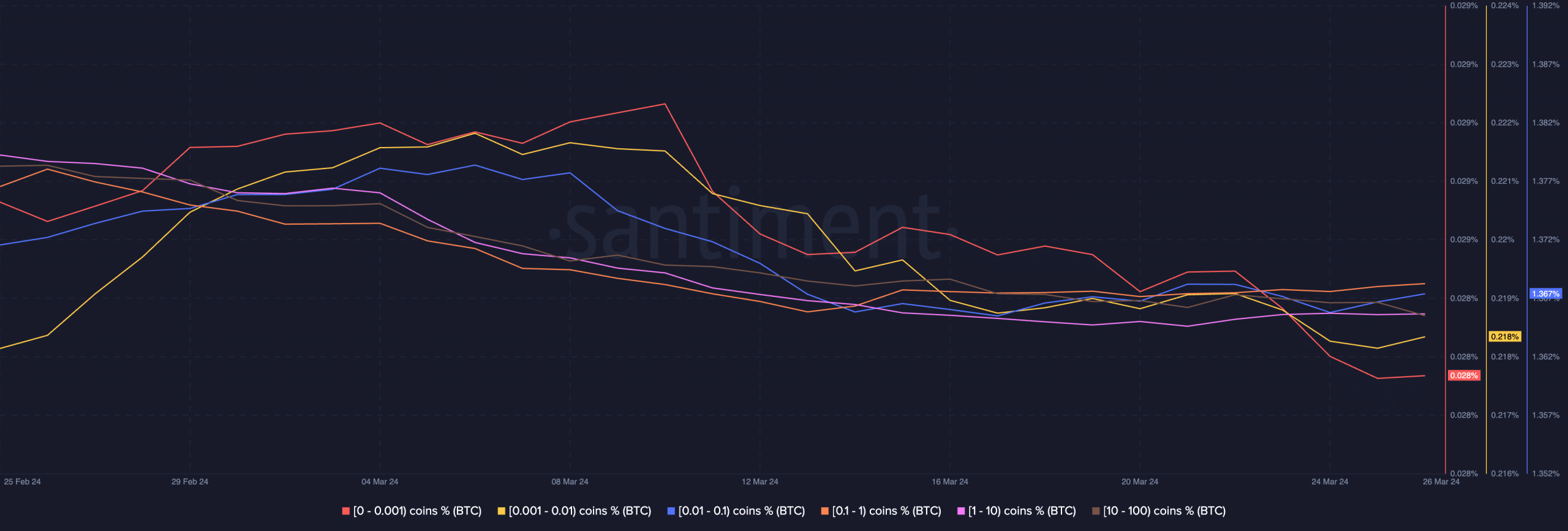

Regardless that merchants had been bullish on BTC, the general curiosity showcased by retail traders had declined. Current information showcased that the holdings of addresses that possess 0.001 to 1 BTC had fallen in the previous few days.

At press time, BTC was buying and selling at $70,732.95 and its worth had grown by 0.59% within the final 24 hours. Furthermore, the amount at which it was buying and selling at had additionally grown by 27.05% throughout the identical interval.

Supply: Santiment