Bitcoin at $70K: Here’s why whales are refusing to sell so high

- Whales continued to HODL BTC and refused to promote their holdings for a revenue.

- Accumulation by retail buyers slowed down, and exercise on the BTC community remained excessive.

After reaching the $70,000 mark, the value of Bitcoin [BTC] remained stagnant. Regardless of the loads of alternatives for Bitcoin whales to take pleasure in profit-taking, most of them continued to HODL.

How are whales doing?

Information from Crypto Quant indicated that the majority whales had not caved into the temptation of promoting their holdings.

This habits can considerably influence Bitcoin’s future. Their continued confidence in Bitcoin can even increase total market sentiment, attracting new buyers and additional rising demand.

Moreover, whales holding onto their BTC can dampen worth volatility, making the market extra enticing to institutional buyers who’re cautious of enormous swings.

Supply: Crypto Quant

Anticipation of halving

Bitcoin whales could also be holding onto their BTC attributable to anticipation surrounding the upcoming halving occasion. The halving, which happens roughly each 4 years, is a programmed discount within the reward for mining new blocks on the Bitcoin blockchain.

This occasion sometimes results in a lower within the price at which new Bitcoin is created, finally lowering the accessible provide of BTC in circulation.

Traditionally, earlier halving occasions have been related to intervals of elevated shortage and upward worth stress for Bitcoin. Subsequently, whales could also be strategically holding onto their BTC in anticipation of a possible worth appreciation following the halving.

By retaining their Bitcoin holdings, whales not solely place themselves to learn from potential worth features but in addition contribute to the general discount in accessible provide, which might additional drive up costs.

Moreover, the choice to HODL throughout this era can also mirror their confidence in Bitcoin’s long-term worth proposition.

Learn Bitcoin’s [BTC] Worth Prediction 2024-25

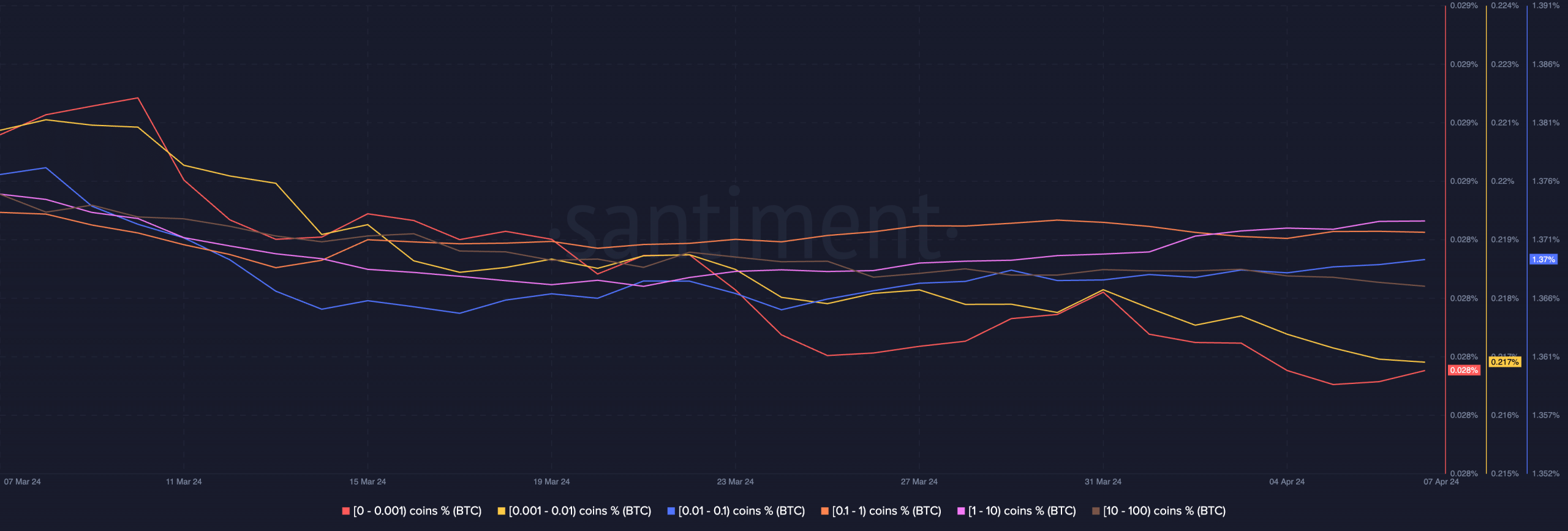

Surprisingly, retail buyers weren’t as invested in BTC. AMBCrypto’s evaluation of Santiment’s information revealed that the provision of BTC held by addresses holding 0.01 t0 1 BTC had declined considerably over the previous week.

Supply: Santiment

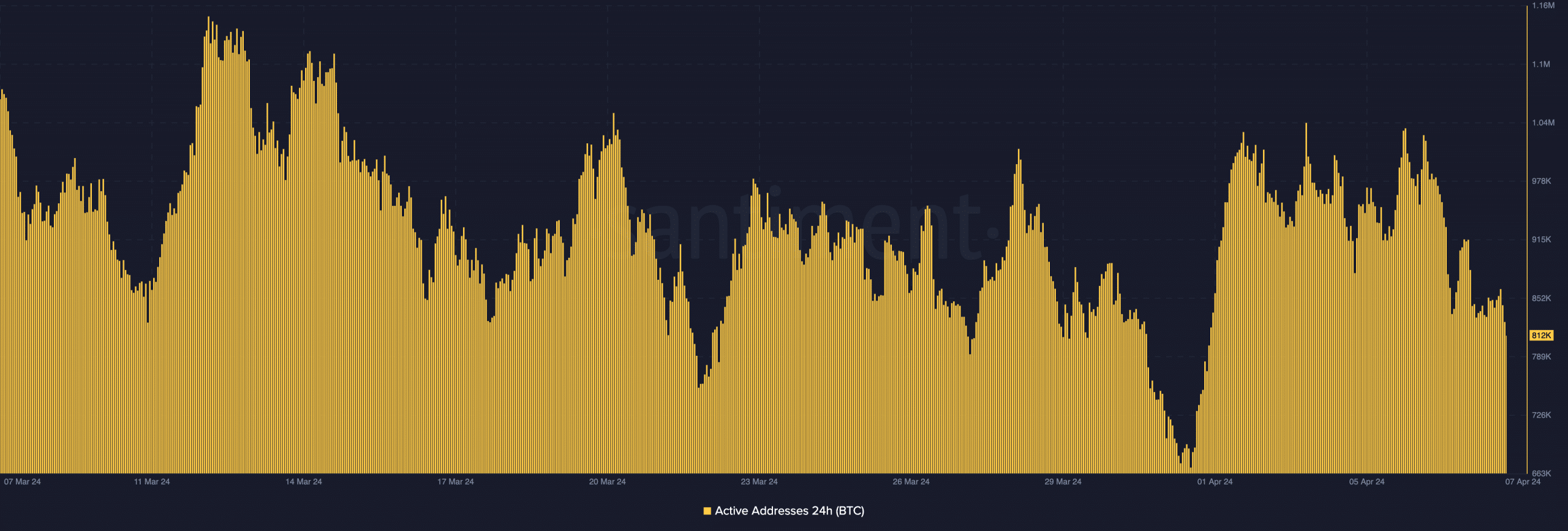

When it comes to the general well being of the community, it was seen that the variety of energetic addresses on the Bitcoin community remained constant. One of many causes for a similar could be the rising reputation of BTC NFTs.

Supply: Santiment