Bitcoin At $8,000? Michael Saylor Says Strategy Still Won’t Break

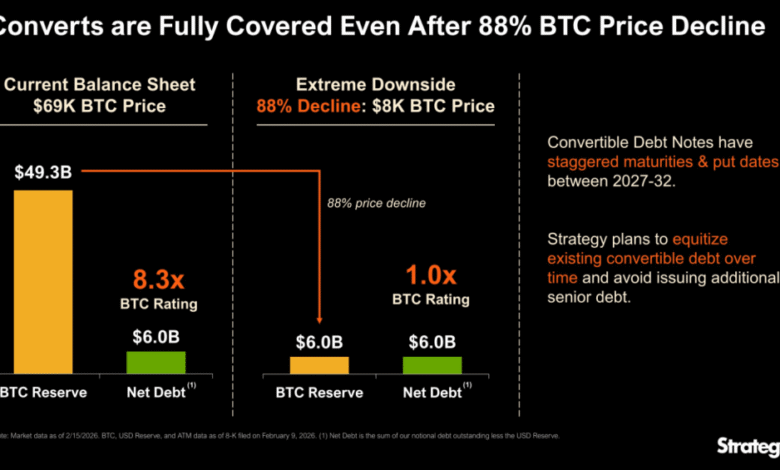

In line with Technique founder Michael Saylor, the corporate believes it might meet its obligations even when Bitcoin fell sharply, as little as $8,000. That claim is easy to state. The fact behind it’s extra complicated.

Associated Studying

Debt Cushion And What It Means

Reviews say the agency presently exhibits about $6 billion in web debt towards its crypto holdings. On paper, a steep drop in BTC’s market worth might go away reserves roughly according to that legal responsibility.

However balance-sheet math shouldn’t be the entire story. Timing issues. Liquidity home windows, market entry, and investor reactions can change the sensible choices accessible to a agency below strain. What administration calls a “cushion” may very well be skinny in a confused market.

Technique can face up to a drawdown in $BTC worth to $8K and nonetheless have enough property to completely cowl our debt. pic.twitter.com/vrw4z4Ex9q

— Technique (@Technique) February 15, 2026

Conversion Plan And Shareholder Tradeoffs

The company has a plan to equitize sure convertible notes over the subsequent three to 6 years. Meaning debt could be swapped for shares quite than rolled into new senior loans.

Reviews word this strikes some threat to shareholders by way of dilution, and it stretches out deadlines for money paydowns. Curiosity stays payable whereas the notes exist, so the agency shouldn’t be freed from near-term prices.

If markets choke up or the share worth weakens dramatically, the phrases and outcomes of conversion might change. What seems manageable now might be reshaped by turbulent markets.

Our plan is to equitize our convertible debt over the subsequent 3–6 years. https://t.co/yRsCuCRNHl

— Michael Saylor (@saylor) February 15, 2026

Shopping for Into Decline

Shopping for continued. One latest buy added 1,142 BTC at a time when unrealized losses stood within the a number of billions. That sample exhibits confidence, but it additionally will increase publicity.

Accumulation whereas holding massive paper losses amplifies the corporate’s sensitivity to Bitcoin swings. Market strikes can flip that wager into extended volatility for the inventory. Buyers who commerce the shares as a proxy for crypto threat know this all too effectively.

CEO Feedback And The Longer Run

Reviews have disclosed remarks from Phong Le suggesting that an 80% decline would take years to materially harm the working facet of the enterprise.

That timeline depends upon regular entry to credit score markets and predictable money circulation. Each might be disrupted when asset costs tumble and lenders develop cautious. The corporate’s stance assumes no sudden freeze in funding channels.

Political Pitch And Broader Appeals

Saylor has additionally urged that the US undertake a reserve posture towards Bitcoin just like how gold is handled, and he pushes for legal guidelines that may favor Bitcoin adoption. These advocacy strikes are positioned as long-term efforts to form coverage.

Associated Studying

Political winds can shift. US President Donald Trump and different leaders could have completely different priorities, and laws is a gradual course of.

Primarily based on stories, the submitting and public feedback sketch a path that may technically face up to a deep BTC hunch.

That path, nonetheless, asks shareholders to soak up volatility and potential dilution whereas hoping markets stay open lengthy sufficient to transform and alter.

Featured picture from Unsplash, chart from TradingView