Bitcoin at $84K – Can BTC hold on or drop to $60K?

- Bitcoin examined a essential $84,640 stage, with potential for a brand new all-time excessive or deeper correction.

- A breakdown might result in a correction to $64,700 or $60K, but additionally precede a serious rebound.

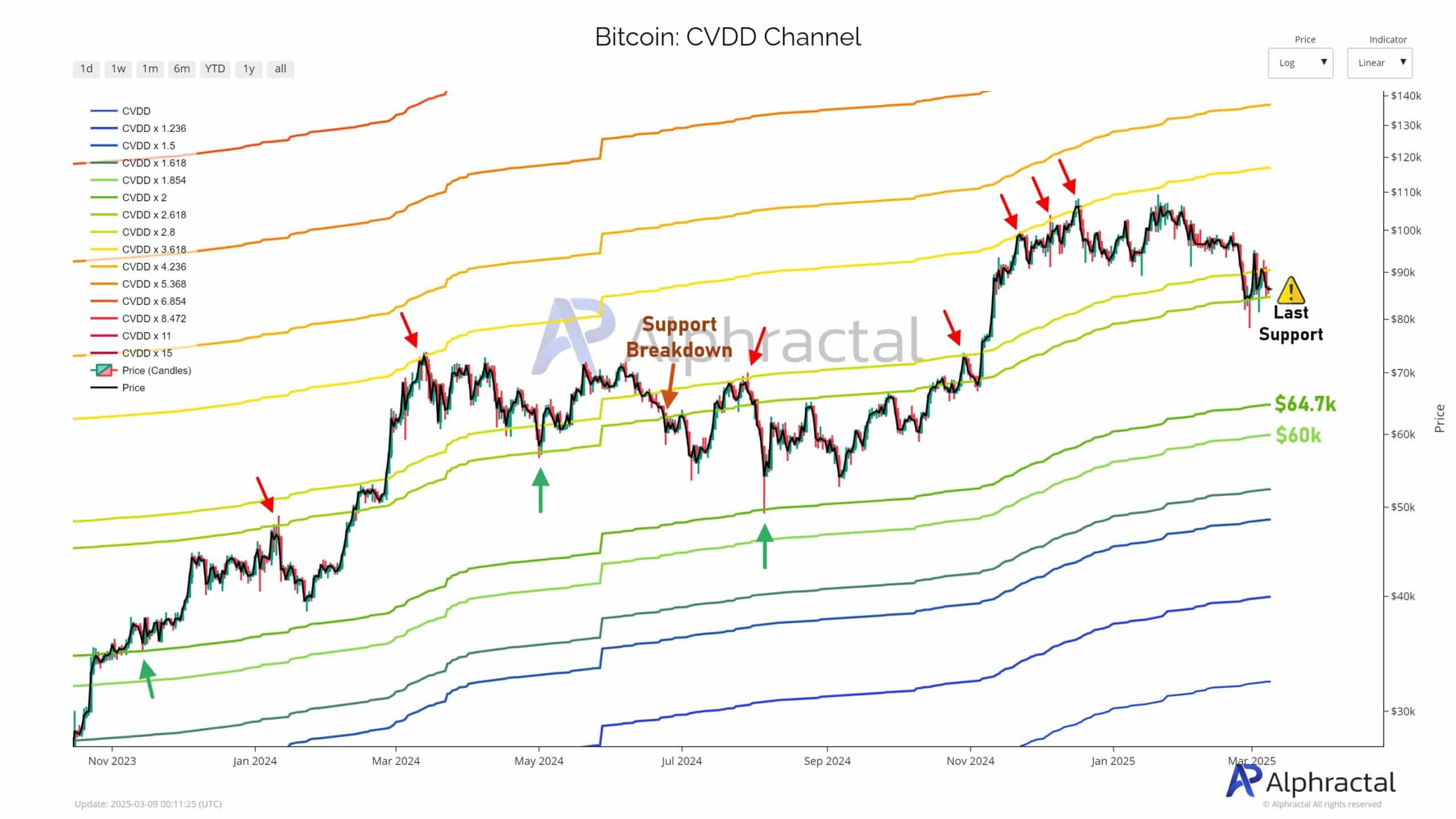

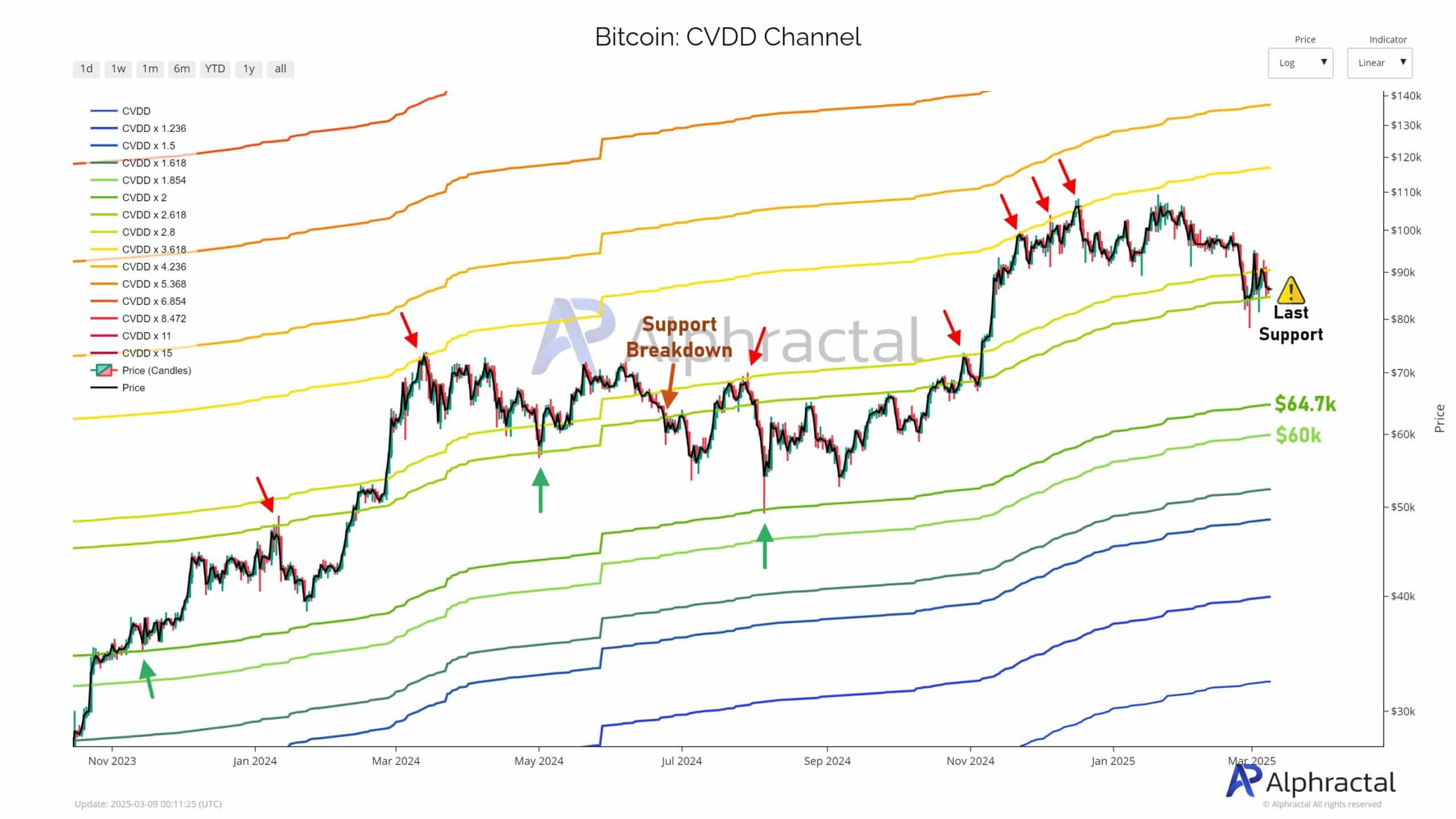

Bitcoin [BTC] is at present sitting on a razor’s edge. Based on the CVDD channel — a traditionally dependable on-chain indicator — the $84,640 stage is a make-or-break zone.

If Bitcoin consolidates above this line, a brand new all-time excessive might be in sight. But when it falters, a steeper correction towards $64,700 and even $60K could comply with.

Regardless of the looming dangers, previous breakdowns have typically led to main rallies.

The importance of the CVDD channel

The CVDD (Cumulative Worth Days Destroyed) Channel tracks long-term investor habits by measuring the worth of cash moved relative to their age. It’s some of the correct instruments for figuring out cycle bottoms.

By layering Fibonacci multiples of the CVDD, this channel creates dynamic help and resistance bands that Bitcoin has traditionally revered.

These strains provide a forward-looking framework to establish structural shifts in worth, with every breakdown or breakout typically resulting in a transfer towards the subsequent CVDD band.

In essence, it transforms on-chain investor exercise right into a predictive roadmap — one that’s now flashing a vital sign.

Bitcoin’s present situation: Historic precedent

Bitcoin was testing the CVDD × 2.618 level, which sat at $84,640 at press time. This line has acted as robust help in previous uptrends, however was now liable to breaking.

The info confirmed related breakdowns in mid-2022 and late 2024, each of which triggered sharp corrections to decrease CVDD bands.

Supply: Alphractal

Inexperienced arrows level to earlier bounces off mid-level bands, whereas crimson arrows spotlight failed helps.

The market’s present habits carefully mirrors previous phases the place worth failed to carry a stage and swiftly dropped to the subsequent.

A clear break right here might echo the 2022 plunge — but additionally arrange a rebound, as seen later that yr.

Trying ahead

If Bitcoin consolidates above the $84,640 line, it will counsel that the CVDD × 2.618 stage is appearing as a brand new base. This might point out a neighborhood backside is forming, opening the door to a brand new rally towards uncharted highs.

Related consolidations in 2021 and late 2023 preceded robust bullish runs. Sustained energy right here would reinforce bullish sentiment and validate the channel’s predictive energy.

Nevertheless, a breakdown beneath $84K could set off a deeper correction, with the subsequent help at $64,700 — aligned with the April 2021 all-time excessive.

If promoting strain persists, worth might fall as little as $60K.

Whereas bearish within the quick time period, such a transfer wouldn’t be unprecedented; Bitcoin adopted the same sample in 2021, briefly dipping earlier than launching to new highs. The important thing will likely be how lengthy it stays beneath this stage.