Bitcoin at a turning point: Can BTC replicate its August surge?

- BTC has crossed right into a historic “purchasing space,” indicating {that a} bounce-back is imminent.

- U.S. buyers have began buying BTC on this area, whereas spinoff merchants are promoting as a substitute.

Bitcoin [BTC] has but to completely recuperate following the market-wide sell-off.

The occasion noticed its worth drop from $90,000, which it had held because the fifteenth of November, buying and selling under it on the twenty fourth of February, placing it at a lack of 17.47% up to now month.

Per AMBCrypto’s evaluation, BTC may see a significant bounce increased as sure sentiment aligns with a bullish narrative.

Nevertheless, with the present promoting strain from the spinoff market, the rally might not materialize. Right here’s why.

U.S. buyers accumulate Bitcoin as costs hit new stage

Current evaluation from CryptoQuant exhibits that Bitcoin has entered a zone known as a historic purchasing space 1 & 2 on the chart.

To commerce on this space, Bitcoin must see a worth drop of 15 to twenty%—a decline it has lately recorded.

Supply: CryptoQuant

These ranges, as seen on the chart, are characterised as purchasing areas as a result of two main actions happen: the historic accumulation of BTC by market individuals and buyers capitalizing on the overreaction that led to a worth drop.

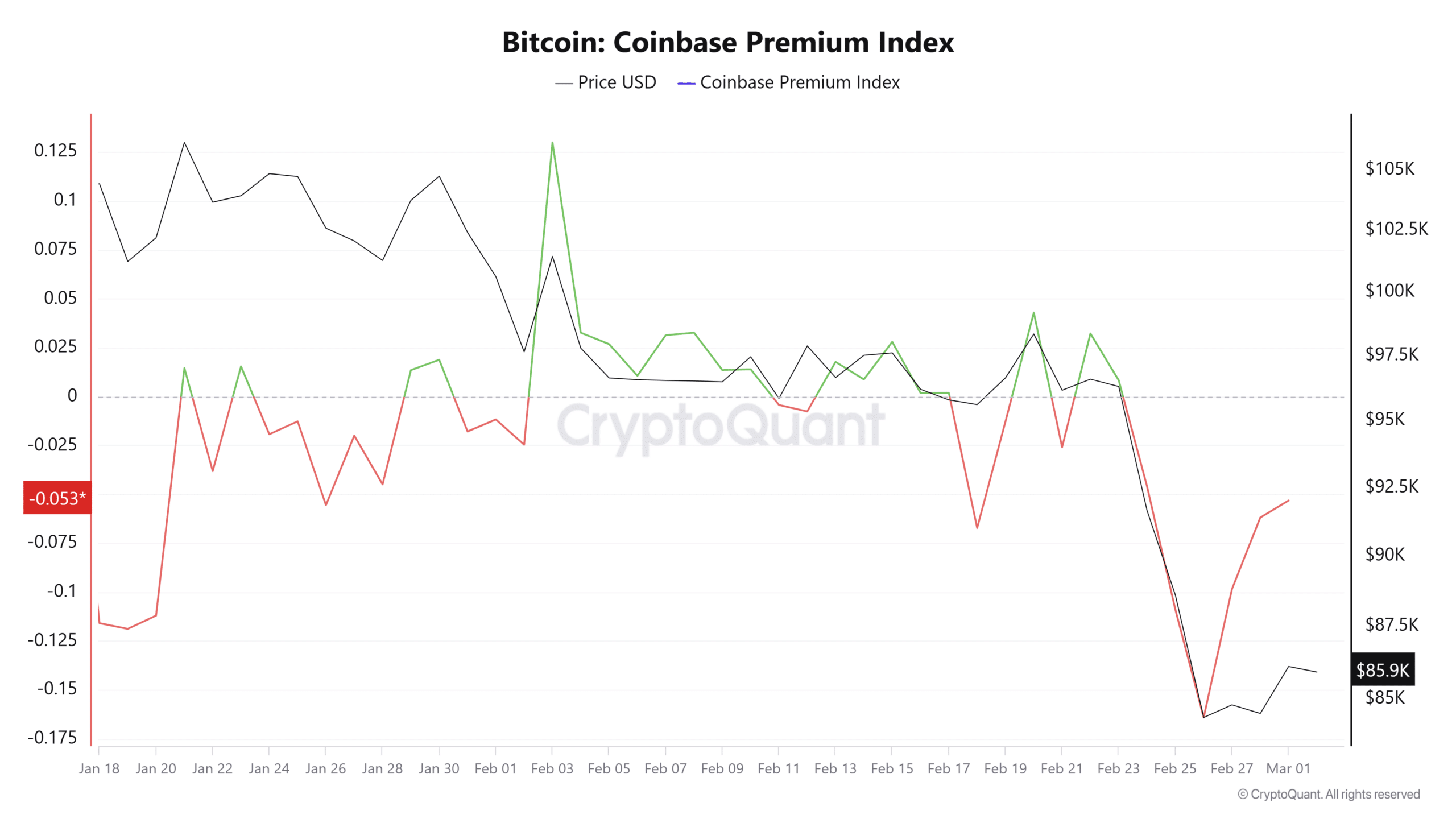

On the time of writing, U.S. buyers out there have been making the most of this drop and have begun accumulating the asset because the Coinbase Premium Index spikes to -0.053, trending up.

Sometimes, when this index is within the unfavorable area, it signifies promoting from U.S. buyers. Nevertheless, when the asset tendencies increased and heads towards crossing above 0, it indicators that purchasing sentiment is regularly increase.

Supply: CryptoQuant

If the index crosses above 0, one other wave of BTC shopping for may happen, as buyers at this stage acquire confidence that the asset is more likely to rally primarily based on its efficiency and different market sentiment.

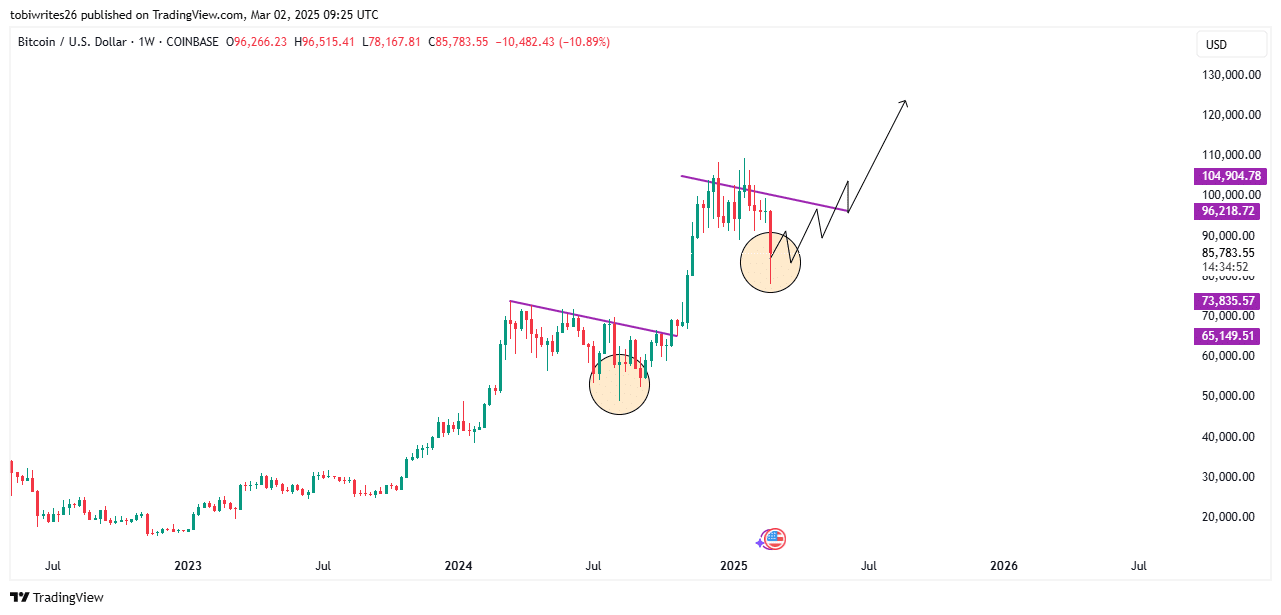

On the chart, BTC may very well be on the sting of replicating the transfer that led to its worth surge after a pointy decline in August, highlighted within the orange circle. At present, an analogous drop has occurred.

Following this sample, the bullish transfer for BTC could be confirmed as soon as the asset breaches the purple resistance line above it, doubtlessly resulting in a brand new all-time excessive.

Supply: TradingView

Whereas exercise on-chain and the chart recommend a possible rally for Bitcoin, spinoff merchants are promoting, which may hinder the anticipated upswing.

By-product merchants guess in opposition to BTC

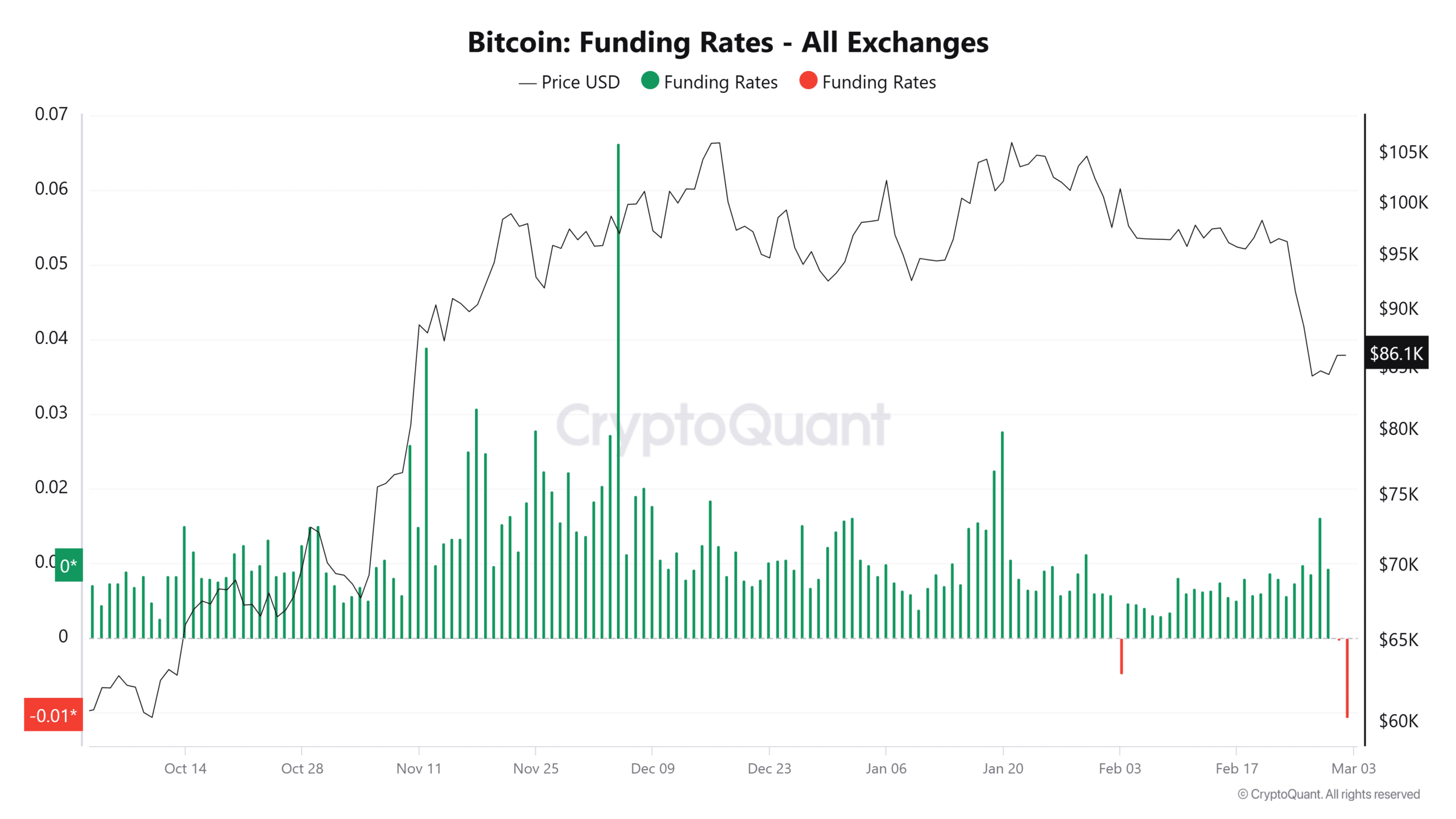

Conviction within the spinoff market is low, with funding charges dropping and promoting quantity seeing a significant hike, suggesting these merchants have impeded BTC’s main worth transfer.

The present Bitcoin Funding Price throughout cryptocurrency exchanges has seen a significant drop because the third of February decline, with a press time studying of -0.01.

A unfavorable Funding Price implies that sellers out there are paying a premium to keep up their positions in anticipation of additional worth declines.

Supply: CryptoQuant

With the Taker Purchase/Promote Ratio, used to find out whether or not shopping for or promoting quantity is dominating, evaluation exhibits that sellers out there are in management, as their promote strain outweighs purchase strain.

With key basic indicators turning bearish, BTC’s rally may face a minor setback. Nevertheless, if different key indicators flip bullish, sellers within the spinoff market may get liquidated because the asset strikes increased.