Bitcoin bleeds as THIS group keeps buying the dip – Will the trend reverse?

- BTC’s value decline persists regardless of sturdy dip-buying curiosity from retail merchants, elevating issues about additional downsides.

- Liquidations have spiked as Bitcoin struggles to regain momentum, suggesting elevated volatility within the coming periods.

Bitcoin [BTC] has confronted a continued value decline over the previous few days, whilst retail merchants aggressively purchase the dip.

The market has exhibited a powerful contrarian conduct, with costs shifting reverse to the group’s expectations.

Traditionally, rebounds happen as soon as retail enthusiasm for dip-buying fades. Nonetheless, the present pattern means that optimism amongst retail traders stays excessive regardless of the continued drawdown.

Retail sentiment and shopping for exercise

In response to social sentiment data, mentions of ‘shopping for the dip’ have surged over the previous few days, coinciding with Bitcoin’s continued decline.

Traditionally, value bottoms are inclined to type when retail curiosity wanes, but the persistent optimism has not yielded the anticipated bounce.

Supply: Santiment

Merchants anticipating a right away reversal have as a substitute seen Bitcoin’s value fall additional, reinforcing the market’s tendency to punish overconfidence.

Bitcoin liquidations and market impression

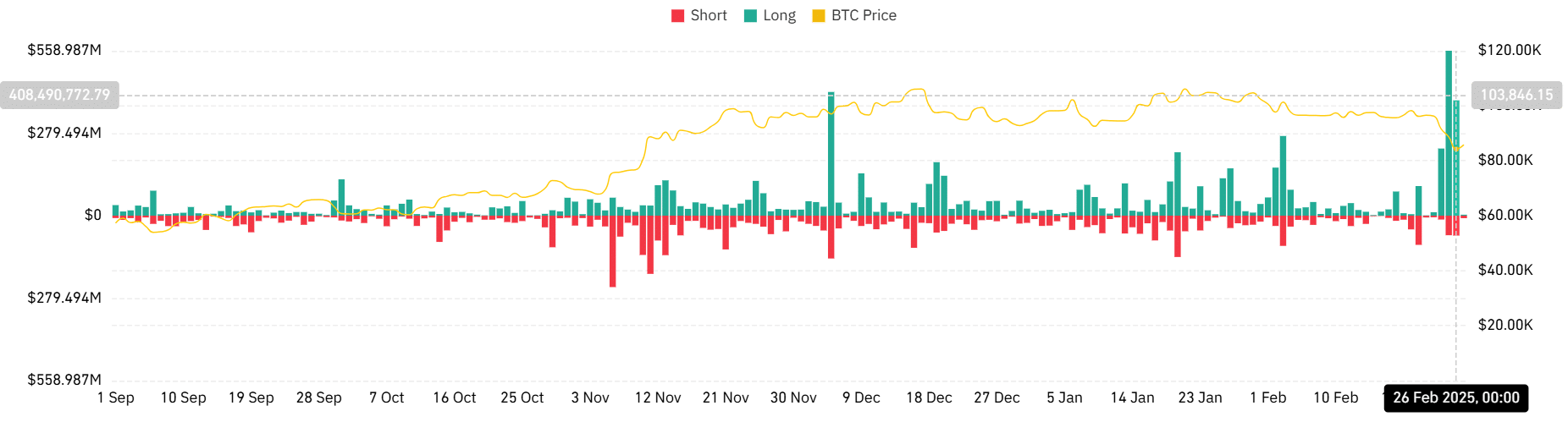

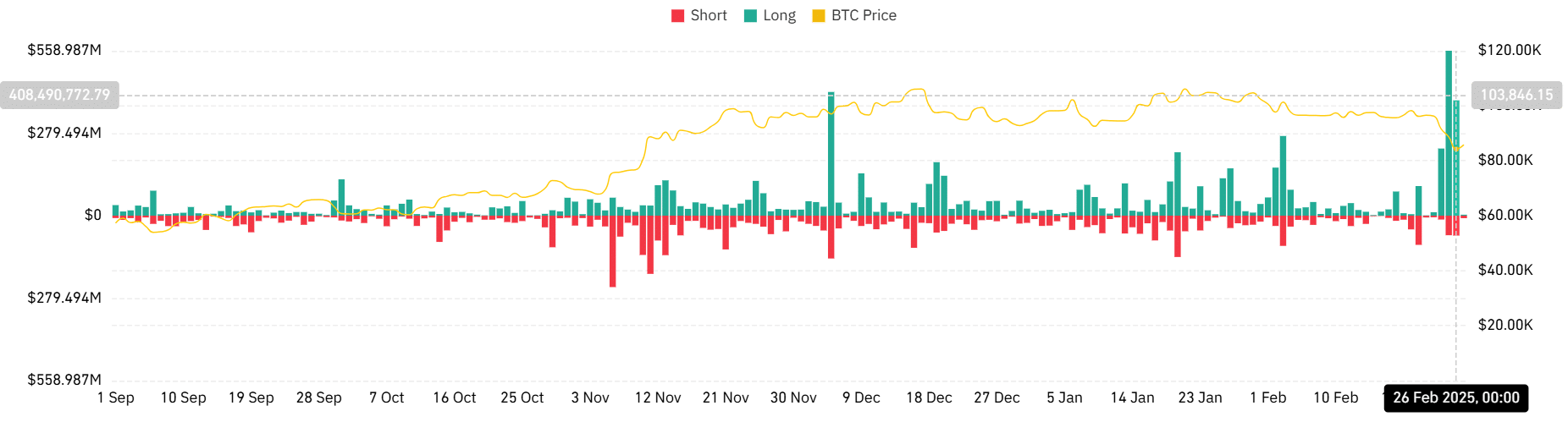

Liquidation data revealed that leveraged merchants have taken heavy losses, with vital lengthy liquidations occurring as Bitcoin did not reclaim key assist ranges.

The liquidation heatmap indicated that the most recent value drop was exacerbated by cascading liquidations, additional driving costs decrease.

The evaluation confirmed that on the twenty fifth of February, Bitcoin noticed its highest lengthy liquidation within the final 5 months. Lengthy liquidation spiked to round $559 million, with brief liquidation quantity round $66 million.

The liquidation continued on the twenty sixth of February with a $391 million lengthy liquidation, the third-highest within the final 5 months.

Supply: Coinglass

This sample has been a recurring theme, with overleveraged merchants dealing with pressured exits, compounding the bearish stress.

Bitcoin’s value pattern and key ranges

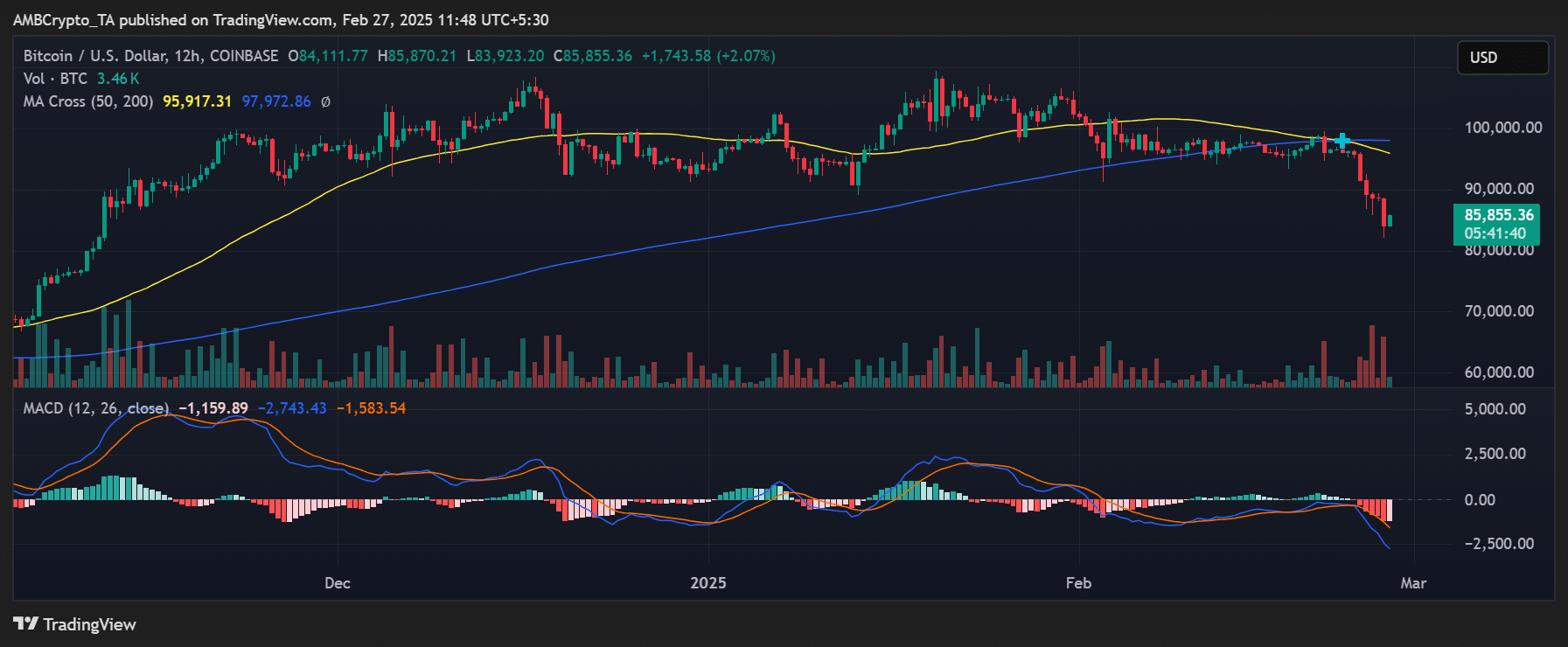

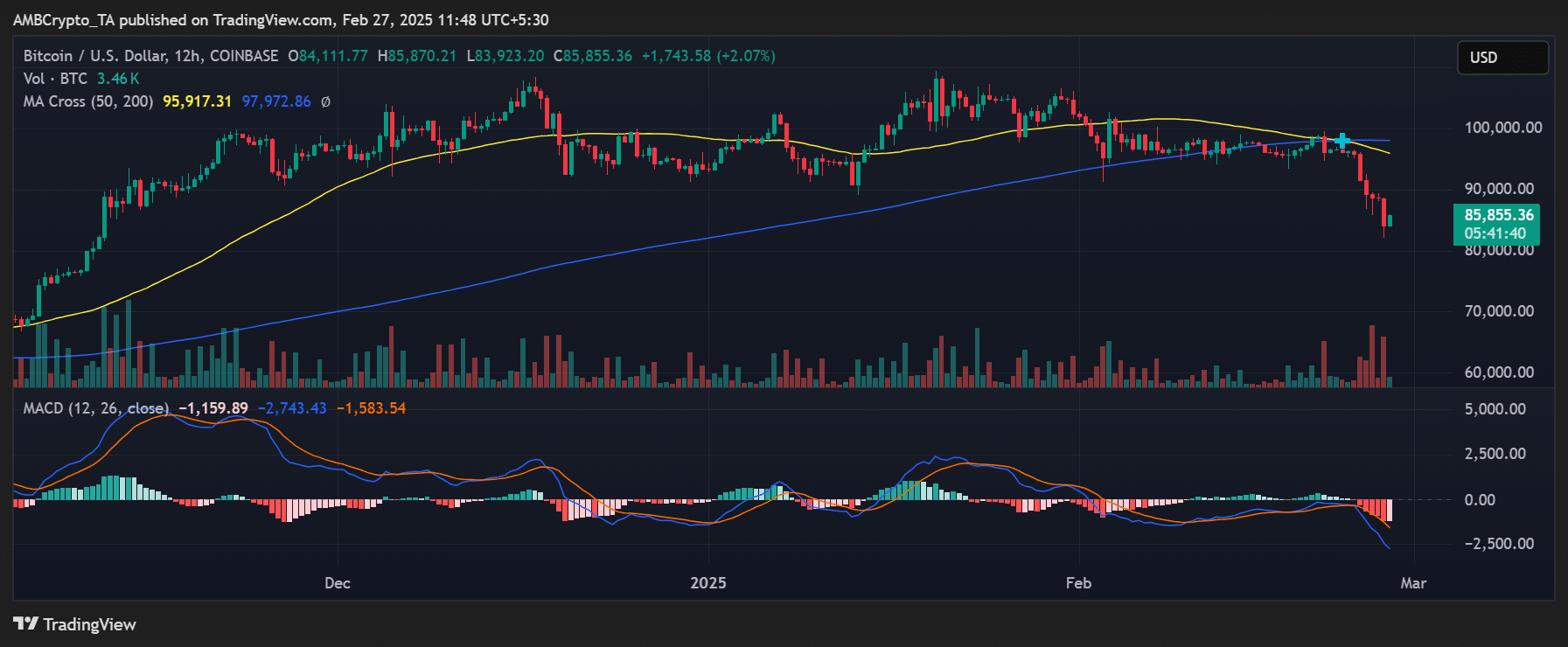

Bitcoin was buying and selling round $85,855 as of this writing, marking a steep drop from latest highs. The value has damaged under the $90,000 psychological degree, and additional draw back might see a retest of $80,000.

Supply: TradingView

Technical indicators, together with the Transferring Common Convergence Divergence [MACD], confirmed sturdy bearish momentum, whereas the 50-day and 200-day shifting averages counsel continued weak spot.

The following potential assist lies close to $83,000, a degree the place earlier demand was noticed.

What’s subsequent for BTC?

For a sustainable reversal, retail enthusiasm must subside, permitting for a real market reset. If shopping for stress from retail merchants diminishes, a short-term aid rally might emerge.

Nonetheless, given the present market construction, Bitcoin stays susceptible to additional draw back earlier than a significant restoration takes place.

Merchants ought to monitor liquidation ranges and retail sentiment traits to gauge when the market may stabilize and reverse its downward trajectory.