Bitcoin braces for key US economic data: Will inflation boost prices?

Bitcoin’s worth sensitivity to financial occasions

Bitcoin traders are on edge because the market braces for 2 main financial knowledge releases this week. The CPI, a important gauge of inflation, is due tonight, the eleventh of December, whereas tomorrow’s unemployment knowledge will make clear the state of the U.S. labor market.

Traditionally, such macroeconomic occasions have influenced Bitcoin’s worth dynamics, typically by way of their affect on Federal Reserve coverage selections.

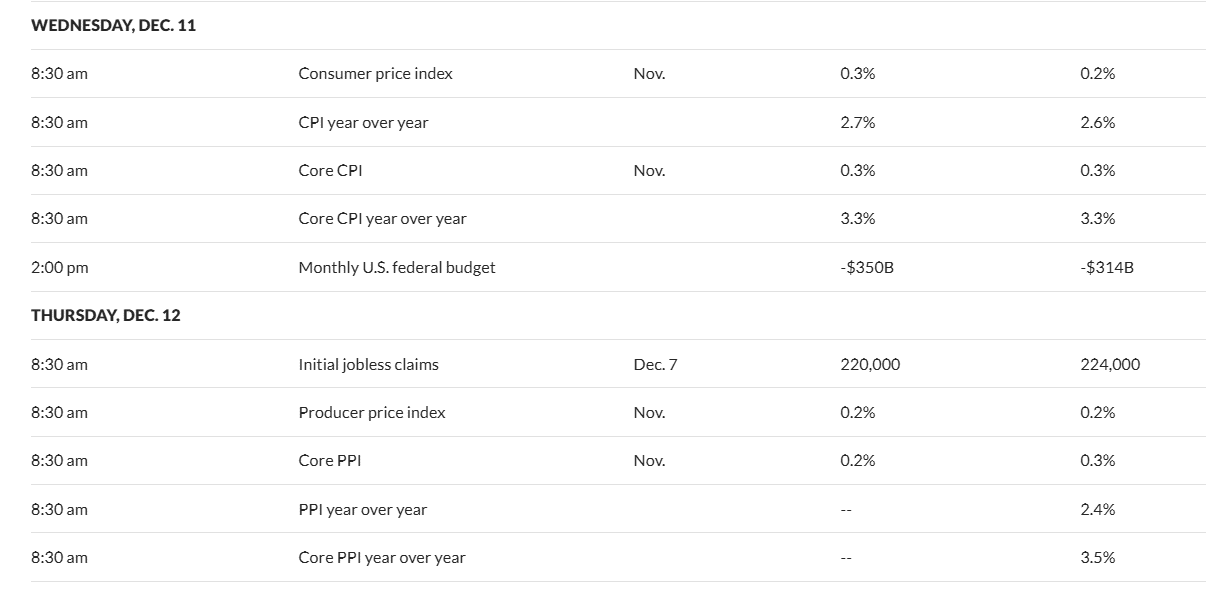

Supply: Marketwatch

Inflation knowledge, notably the core CPI, is of key curiosity because it strips out risky elements like meals and power. An increase in CPI might sign persistent inflationary pressures, doubtlessly bolstering Bitcoin’s attraction as a hedge in opposition to inflation.

Equally, unemployment knowledge can have an effect on market sentiment by offering insights into financial stability or misery, which frequently influences demand for various belongings like Bitcoin.

Unemployment knowledge: Can labor market circumstances affect threat sentiment?

Learn Bitcoin’s [BTC] Value Prediction 2024–2025

Potential eventualities

This week’s financial knowledge might form Bitcoin’s short-term worth motion. Larger CPI or weaker labor market knowledge could gasoline inflation fears, boosting Bitcoin as a hedge in opposition to foreign money devaluation.

Conversely, decrease CPI or sturdy employment figures may favor risk-on belongings like equities, lowering rapid demand for BTC. Combined outcomes might heighten market volatility as traders assess the implications for Federal Reserve coverage.

With Bitcoin close to important psychological ranges, these knowledge releases are pivotal in figuring out its course and broader market sentiment.