Bitcoin: Breach of $30k barrier triggers profit-taking surge

- Revenue taking elevated to a three-week excessive as BTC crossed $30,000.

- BTC, nevertheless, witnessed a extra detrimental movement as its value elevated.

In the previous few months, the value of Bitcoin [BTC] has constantly encountered a psychological barrier on the $30,000 mark. Lately, Bitcoin surpassed this barrier, resulting in a noticeable improve in actions and curiosity.

Learn Bitcoin’s [BTC] Worth Prediction 2023-24

Bitcoin profit-taking surges

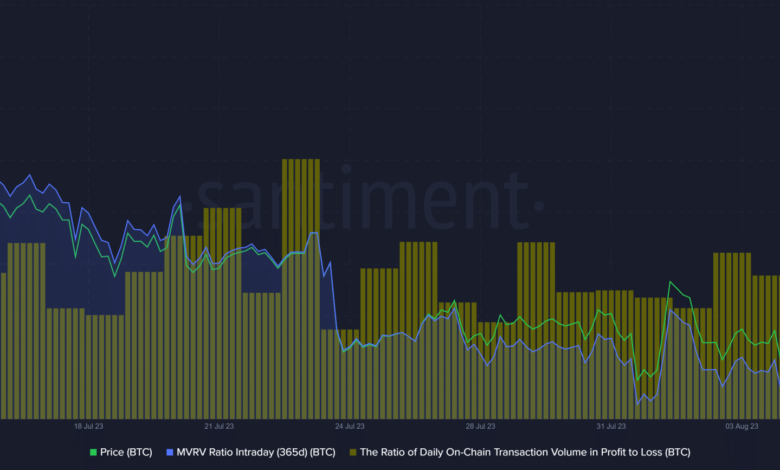

As per a Santiment chart, there was elevated profit-taking amongst sure Bitcoin holders, marking the best degree seen in practically a month. Curiously, this profit-taking exercise was primarily pushed by long-term holders.

Supply: Santiment

Analyzing the Market Worth to Realized Worth (MVRV) ratio throughout numerous durations supplied insights into the rationale behind this phenomenon. As of this writing, the depth of profit-taking has subsided, leading to a lower within the ratio of day by day on-chain transaction quantity in revenue to loss.

This ratio had declined to roughly 1.5%.

Bitcoin MVRVs present completely different revenue margins for holders

Evaluating the Bitcoin MVRV (Market Worth to Realized Worth) throughout completely different timeframes – 30, 60, 90, and 180 days – sheds mild on why long-term holders had been capable of capitalize on the rising value. Analyzing the 30-day MVRV in response to Santiment knowledge, the rise in BTC value resulted in lower than a 1% improve.

As of this writing, the 30-day MVRV was roughly 0.3%. This indicated that any gross sales by these holders would yield a mere 0.3% revenue.

A more in-depth take a look at the 60-day MVRV confirmed that holders inside this timeframe loved extra substantial earnings. As of this writing, the MVRV was round 2%. This implied a possible revenue of two% for holders that offered on this interval.

Moreover, the profitability of the 90-day MVRV has proven a rise of over 1% in comparison with the 60-day MVRV. As of this writing, the 90-day MVRV had exceeded 3.7%.

Supply: Santiment

Lastly, the 180-day MVRV underlined that long-term holders emerged because the beneficiaries of the current surge in Bitcoin’s value. Moreover, these long-term holders may have been amongst those that seized the chance to revenue when the BTC value surpassed the $30,000 mark. At the moment, the 180-day MVRV was over 6%.

Extra BTC flowing outdoors exchanges

Opposite to the profit-taking exercise within the Santiment chart, the alternate movement metric revealed a definite sample. As noticed via Glassnode’s alternate movement metric, the information for 8 August indicated a higher outflow of Bitcoin from exchanges in comparison with its influx.

This notable outflow instructed {that a} bigger quantity of Bitcoin was being withdrawn from alternate platforms.

Supply: Glassnode

How a lot are 1,10,100 BTCs price at present?

Additionally, this phenomenon indicated that, regardless of the value improve, many holders had been extra inclined to switch their Bitcoin holdings away from exchanges as an alternative of instantly promoting them.

BTC’s worth continued to hover above the $30,000 mark, albeit with a minor downward pattern changing into obvious.