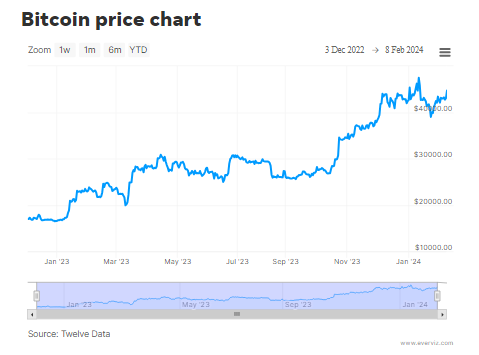

Bitcoin Breaches $46,000, Eyes $50K As Bullish Sentiment Returns

For the primary time for the reason that spot ETFs’ debut commerce on January 11, Bitcoin (BTC) has surpassed $46,000. In line with information from Coingecko, BTC had elevated 3.4% in yesterday to $46,075 on the time of publication, sustaining a 6% improve over the earlier seven days.

Bitcoin Flexes Muscular tissues, Reclaims $46K Stage

Regardless of the approval of a number of eagerly awaited exchange-traded funds that had been meant to strengthen its institutional legitimacy, Bitcoin’s 2024 has had a tough begin. Nonetheless, issues are bettering as Bitcoin is now once more buying and selling above the $46k territory.

Laurent Ksiss, a specialist in crypto Trade-Traded Merchandise (ETPs) at CEC Capital, talked about that if the present upward development continues, breaking the $45,000 mark may convey early traders within the BTC ETF near being worthwhile. He additionally prompt that this momentum would possibly result in some traders taking earnings, doubtlessly triggering a reversal and testing the $42,000 to $40,000 degree.

Laurent Ksiss, a specialist in crypto Trade-Traded Merchandise (ETPs) at CEC Capital, talked about that if the present upward development continues, breaking the $45,000 mark may convey early traders within the BTC ETF near being worthwhile. He additionally prompt that this momentum would possibly result in some traders taking earnings, doubtlessly triggering a reversal and testing the $42,000 to $40,000 degree.

After the introduction of 10 ETFs in January, the price of BTC skilled an unanticipated decline. The worth plunged after momentarily touching $49,000 when one of many funds, Grayscale, started transferring important parts of their cryptocurrency to Coinbase.

BTCUSD at present buying and selling at $46,165 on the every day chart: TradingView.com

This was attributable to the truth that, earlier than Grayscale transformed the Bitcoin Fund ETF to an open-ended fund, traders needed to maintain their shares for at least six months earlier than they might money out. Most of the traders had been desirous to money out and redeem their shares when it turned an ETF in January.

Whale Urge for food Up For BTC

Consequently, Grayscale offered huge portions of Bitcoin, which dropped in worth. It was buying and selling beneath $39,000 at one level. Nonetheless, it seems that the sell-off is ended, and Bitcoin is rising as soon as extra, partly attributable to massive holders buying the asset.

In the meantime, Markus Thielen, head of analysis at Matrixport and founding father of 10x Analysis, says that Bitcoin (BTC) is headed in direction of $48,000 within the close to future following its breakout pushed by a strong monitor document of features throughout the Chinese language New 12 months competition.

Since bitcoin usually rises by greater than 10% round Chinese language New 12 months, starting on February 10, the next few days are extraordinarily vital statistically, in line with Thielen’s analysis from Thursday.

Each time merchants acquired bitcoin three days previous to the beginning of the Chinese language New 12 months and offered it 10 days later, the worth of bitcoin has elevated throughout the earlier 9 years, in line with Thielen.

Bitcoin Seen Hitting $50K

In a associated improvement, LMAX Digital said that it anticipates bitcoin to proceed rising, possibly hitting the $50,000 mark.

In line with LMAX Digital, technically talking, bitcoin has damaged out of a variety and could also be aiming for a surge to a brand new yearly excessive via $50,000.

Utilizing Elliott Wave concept, a technical research that presupposes that costs transfer in repeating wave patterns, Thielen projected higher upside for bitcoin sooner or later.

The idea states that worth tendencies evolve in 5 phases, with waves 1, 3, and 5 serving as “impulse waves” that point out the first development. Retracements between the impulsive worth motion happen in waves two and 4.

Thielen mentioned Bitcoin has began its closing, fifth impulsive stage of its rally, aiming to achieve $52,000 by mid-March, after finishing its wave 4 retracement and correcting to $38,500.

Featured picture from Adobe Inventory, chart from TradingView

Disclaimer: The article is supplied for instructional functions solely. It doesn’t symbolize the opinions of NewsBTC on whether or not to purchase, promote or maintain any investments and naturally investing carries dangers. You might be suggested to conduct your personal analysis earlier than making any funding choices. Use data supplied on this web site solely at your personal danger.