Bitcoin [BTC] Futures: Key metric touches historic low as traders shift from volatility

- Bitcoin futures market experiences combined reception post-FTX crash, impacting worth volatility and utility.

- Current knowledge confirmed a decline in crypto-margined collateral, bettering spinoff collateral construction.

Ever because the dramatic FTX crash, Bitcoin [BTC] has been on a rollercoaster journey of worth volatility. This has impacted its utility within the futures market considerably. In line with the latest knowledge, Bitcoin’s reception within the futures market is a little bit of a combined bag. Additionally, it has made merchants’ interplay with it cautious.

Learn Bitcoin (BTC) Worth Prediction 2023-24

In line with latest knowledge, Bitcoin’s reception within the futures market was a little bit of a combined bag. Additionally, it has made merchants cautious.

Bitcoin Futures collateralization decline

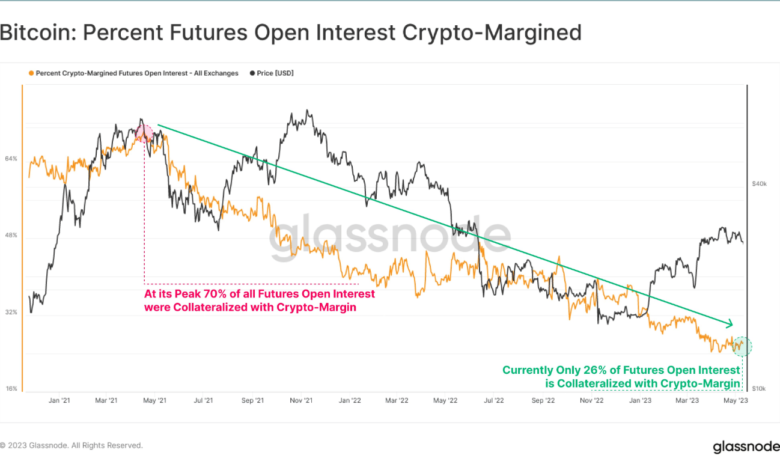

Knowledge from Glassnode indicated that there was a cautious strategy in the direction of Bitcoin (BTC) within the spinoff market. The Bitcoin % Futures Open Curiosity with Crypto-margined metric revealed a notable decline, reaching a historic low.

Analyzing the chart, it turned obvious that at its peak, roughly 70% of all Futures Open Curiosity relied on Crypto-Margin collateral. Nevertheless, in accordance with the present knowledge, this proportion dwindled to round 26%.

Supply: Glassnode

Collateral within the type of cryptocurrencies like Bitcoin or Ethereum [ETH] is inherently extra risky. Additionally, fluctuations of their underlying worth might enlarge deleveraging occasions.

The discount in Crypto-Margined collateral considerably improved the general well being of the spinoff collateral construction per Glassnode.

The % Crypto-Margined Futures Open Curiosity Metric represents the proportion of futures contracts’ open curiosity that’s backed by cryptocurrencies as a substitute of typical fiat currencies.

This metric offers insights into the proportion of merchants who select to make the most of cryptocurrencies as collateral or margin for his or her futures positions.

Present Bitcoin Futures Open Curiosity stats

Upon analyzing the Bitcoin Futures Open Curiosity chart on Glassnode, it turned obvious that it remained comparatively steady across the $10 billion mark in latest weeks.

In April, the Open Curiosity hovered round $12 billion and $11 billion however ultimately decreased to $10 billion.

As of this writing, the Futures Open Curiosity stood simply above $10 billion. Moreover, a more in-depth take a look at the present Futures Open Curiosity revealed that Binance was main the pack by way of Open Curiosity.

It had a worth that exceeded $3.8 billion. Bybit adopted carefully behind with a determine surpassing $1 billion.

How a lot are 1,10,100 BTCs value at this time

Liquidation state examined

Primarily based on knowledge from Coinglass, the 24-hour liquidation quantity for Bitcoin was at the moment reported at $32.49 million. Analyzing the distribution of liquidations, it may very well be noticed that lengthy positions and quick positions had been virtually balanced in the mean time.

The liquidation quantity for lengthy positions stood at $4.04 million, whereas for brief positions it was $5.26 million. As of this writing, BTC was buying and selling at round $26,800, exhibiting a slight achieve on the each day timeframe.

Supply: Coinglass