Bitcoin [BTC]: Of Epoch drawbacks and surging adoption

- Bitcoin consumer adoption elevated regardless of the decline in handle progress.

- Extra BTC transactions have taken place because the final halving.

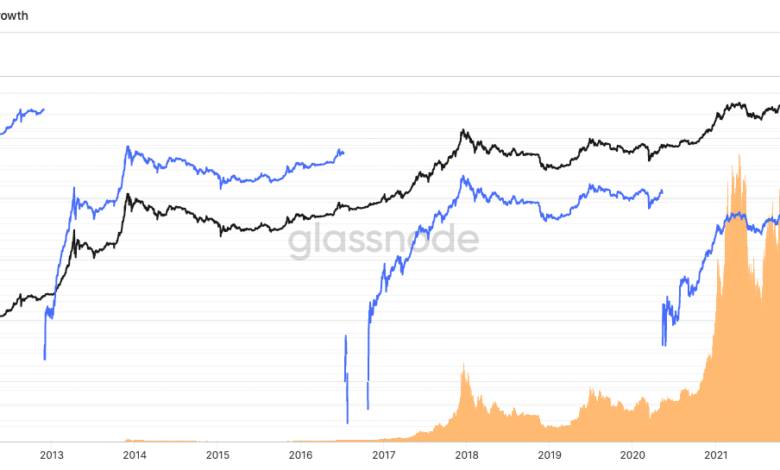

Regardless of its occasional hurdles, Bitcoin [BTC] has gained vital traction because the variety of non-zero addresses reached an All-Time Excessive (ATH). Based on Glassnode, the metric was at 46.1 million at press time.

Learn Bitcoin’s [BTC] Worth Prediction 2023-2024

This surge in adoption may very well be linked to a lot of elements corresponding to its rising recognition. And this 12 months, the cryptocurrency has proven that it may very well be a hedge towards inflation. This was after the coin’s response amid the collapse of a number of conventional monetary establishments.

New entrants have their eyes on the prize

Though this progress is likely to be thought of spectacular, there has additionally been a decline in one other facet — the Epoch. The Bitcoin Epoch retains observe of market patterns by way of handle progress between one four-year halving cycle and the next one.

Based on Glassnode, the Epoch, on the time of writing, elevated by 4.54%. Nevertheless, the variety of addresses added was 16 million, lower than the earlier cycle, which was 21 million.

#Bitcoin adoption continues to soar because the variety of Non-Zero Addresses reaches an ATH of ~46.1M.

When evaluating for progress throughout Epochs, we be aware a decline in relative progress, however a rise in absolute progress because the variety of Non-Zero Addresses continues to develop:

🔴Epoch… pic.twitter.com/iXFw52Y5eD

— glassnode (@glassnode) May 6, 2023

From Bitcoin’s genesis to the primary halving cycle, addresses elevated by a million. The second Epoch recorded 8x the primary, whereas the third cycle added one other 3x. Nevertheless, with roughly 368 days until the halving, there was nonetheless time for the fourth to comply with the identical sample.

In the meantime, there was a notable revival within the Bitcoin market valuation progress because the unlucky capitulation in 2022. For the unfamiliar, the Bitcoin demand and provide price decide the market worth.

With an listed progress of 271% because the final halving, the market valuation had elevated to $558 billion. This displays a rise within the demand for the coin and its reputation over an extended interval.

Supply: Glassnode

BTC increase the hash

Moreover the listed progress, one metric that has sustainably elevated over the past halving interval is the hashrate. The Bitcoin hashrate acts as a measure of computational energy, and is used to find out the well being, mining problem, and safety throughout the Bitcoin community.

At press time, the hashrate had grown exponentially by 184.59% because it rose to 439.23 Exahash per second (EH/s).

Supply: Glassnode

Regardless of the unlucky occasions that rocked the crypto financial system over nearly all of the quarters in 2022, the realized revenue/loss progress improved from the final halving.

Is your portfolio inexperienced? Examine the Bitcoin Revenue Calculator

Supply: Glassnode

On the time of writing, on-chain data confirmed that each realized earnings and losses had elevated by over 300%. This confirms the notion that demand had subsequently elevated, and a number of cash had been utilized in transactions through the interval.

Because the halving nears, elevated adoption may very well be bolstered, particularly as establishments have been steadily embracing Bitcoin and allocating a portion of their treasury reserves to BTC. Moreover, extra retail buyers have additionally been recognizing the potential of Bitcoin as a possible funding device.