Bitcoin [BTC] raises hopes of trend reversal; is Ordinals the reason why

- BTC’s worth was hovering underneath the $28,000 mark, however issues may change quickly.

- Metrics have been bullish on BTC, however market indicators supported the bears.

Bitcoin’s [BTC] worth motion of late has not been in traders’ favor, because the chart was largely purple. The king of cryptos went beneath the $28,000 mark as soon as once more at press time, making a furor amongst traders.

Is your portfolio inexperienced? Try the Bitcoin Revenue Calculator

Is BTC establishing a pattern reversal

In accordance with CoinMarketCap, BTC’s worth registered a decline of over 2% within the final seven days, together with a dip in buying and selling quantity. On the time of writing, BTC was buying and selling at $27,706.83, with a market capitalization of over $536 billion.

😮 #Bitcoin‘s funding fee on @BitMEX is seeing its most unfavourable ratio for the reason that heavy bets towards costs in mid-March, simply earlier than costs soared. Usually, worth rise possibilities improve when the group overwhelmingly assumes costs shall be dropping. https://t.co/HbTcSouRsU pic.twitter.com/bu1dNDFTcU

— Santiment (@santimentfeed) May 10, 2023

As per Santiment’s aforementioned tweet, BTC’s BitMEX funding fee registered a large decline for the reason that heavy bets towards costs in mid-March, simply earlier than costs soared. Value rise possibilities sometimes climb when the consensus predicts that costs shall be falling.

Thus, for the reason that funding fee was low, suggesting much less demand within the futures market, the potential of BTC’s worth uptick can’t be dominated out.

Bitcoin to lastly benefit from Ordinals?

Bitcoin Ordinals have been setting new data of late whereas BTC’s worth motion suffered. Not too long ago, the variety of day by day Ordinals inscribed reached an all-time excessive, as did the Ordinals charges paid. Although BTC remained nascent in the course of the interval, Santiment’s knowledge provides hope that the king of cryptos will capitalize on Ordinals’ achievements.

That is what the metrics say

BTC gained recognition among the many whales as soon as once more, as Bitcoin addresses holding no less than 1,000 BTC have been accumulating for the final 4 days. This was excellent news, because it mirrored the whales’ belief within the coin. BTC’s trade reserve was additionally lowering, suggesting much less promoting strain.

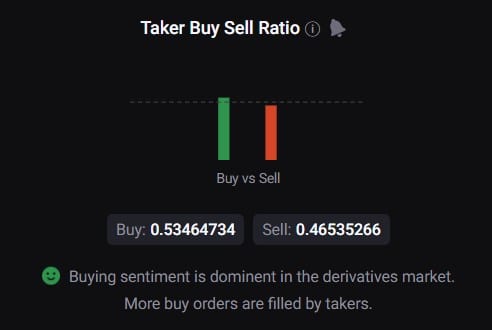

Along with that, Bitcoin’s Binary CDD was inexperienced. A inexperienced chart signifies long-term holders’ actions within the final seven days have been decrease than the typical, and have a motive to carry their property. As per CryptoQuant’s data, BTC’s taker purchase/promote ratio was additionally inexperienced, suggesting that purchasing sentiments have been dominant in a derivatives market.

Supply: CryptoQuant

Learn Bitcoin’s [BTC] Value Prediction 2023-24

The bottom actuality is likely to be completely different

Whereas the metrics have been bullish, Bitcoin’s market indicators urged in any other case. The Exponential Transferring Common (EMA) Ribbon revealed that the bears have been main the market, because the 20-day EMA was beneath the 55-day EMA.

BTC’s Chaikin Cash Circulate (CMF) additionally registered a downtick, which was a growth within the vendor’s favor. Nevertheless, the Cash Circulate Index (MFI) gave a lot wanted hope because it registered an uptick.

Supply: TradingView