Bitcoin Bull Run In Jeopardy? Analyst Finds Market Top Signals With BTC At $40,000

Bitcoin is strolling again on a few of its features over the previous few days. The primary cryptocurrency by market cap could be on the verge of a extra vital retracement, which may push it again to the $30,000 zone.

As of this writing, Bitcoin (BTC) trades at $40,950 with a 2% loss previously 24 hours. On the weekly chart, the cryptocurrency data a 3% loss, with all tokens within the prime 10 by market recording an identical efficiency, aside from Avalanche (AVAX).

Bitcoin Hits Native Prime? Bull Run Slows Down

Over the weekend, Bitcoin was rejected from the important resistance stage at $43,500. In response to a pseudonym analyst, because the BTC value dropped to its present ranges, a big participant positioned a “substantial resistance block.”

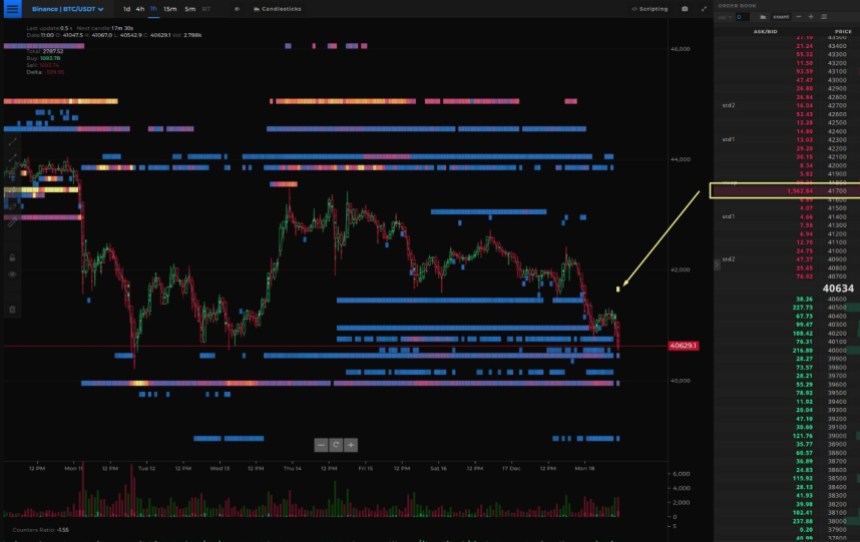

The chart under exhibits that the promoting order is 1,562 BTC, or round $7 million. It additionally exhibits thick assist for BTC because the bullish momentum fades.

In different phrases, Bitcoin may decelerate, however the space round $40,000 may present important assist for a possible bounce. The analyst acknowledged on the growing promoting orders showing on the books:

Huge resistance added on BTC Binance Spot. That is what a prime seems like. A considerable resistance block of 1562 BTC has simply arrived within the order books.

BTC Whales On The Transfer

Whereas many imagine that the market can take in the spike in promoting stress, crypto analytics agency Materials Indicators showed that Bitcoin is dropping the assist of main gamers. Over the weekend, gamers promoting orders above $1 million “dumped” their positions.

The agency has been warning merchants about this chance by arguing that the latest bullish value motion was a method to suck in liquidity from retail traders. As soon as this smaller participant jumped in, whales started to “distribute” or promote their cash into the rally.

In that sense, the agency set a possible native prime for BTC at $45,000. Keith Alan, one in every of Materials Indicators senior analysts, stated the next on the present value motion:

The excellent news is, sooner or later the market does flip to accumulation, and costs transferring decrease will get us to that time. As unhealthy because it seems for bulls proper now, I’m not anticipating a straight line down. Time to train some endurance and see how issues develop from right here.

Cowl picture from Unsplash, chart from Tradingview

Disclaimer: The article is offered for academic functions solely. It doesn’t symbolize the opinions of NewsBTC on whether or not to purchase, promote or maintain any investments and naturally investing carries dangers. You might be suggested to conduct your personal analysis earlier than making any funding selections. Use data offered on this web site solely at your personal threat.