Bitcoin bulls aim for $72K again, but here’s why it may not be easy

- BTC was up by 2% within the final 24 hours.

- Metrics prompt that promoting sentiment was dominant available in the market.

Bitcoin’s [BTC] worth witnessed a serious correction of late as its worth touched the $67k mark. The king of cryptos, nonetheless, recovered from that plunge and managed to color its day by day chart inexperienced.

Let’s take a look at BTC’s state and the way completely different exchanges and buyers behaved throughout this whole episode.

Promoting stress on Bitcoin went up

Bitcoin’s worth took a serious blow on the fifteenth of March as its worth touched $67,200. Throughout that worth plummet, main exchanges and buyers acted curiously.

Lookonchain’s newest tweet revealed {that a} Binance deposit pockets moved 4,637 BTC, which have been price over $329 million to a Binance sizzling pockets. Coincidentally, the deposit pockets additionally moved 4,876 BTC, price $319 million, to Binance Sizzling Pockets throughout the BTC drop on the fifth of March.

AMBCrypto reported earlier how BTC’s liquidation elevated throughout the worth correction. To be exact, Bitcoin’s liquidation quantity surged to over $143.6 million on the 14th of March.

IntoTheBlock’s current tweet additionally highlighted that promoting stress on BTC was excessive. As per the tweet, over $750 million in BTC was withdrawn from exchanges, the best since Might 2023. Nearly all of these sell-offs originated from Bitfinex and Kraken.

Bitcoin’s path to restoration

Regardless of the rise in liquidation, BTC managed to considerably recuperate from the horrors as its day by day chart turned inexperienced. In response to CoinMarketCap, Bitcoin was up by greater than 2% within the final 24 hours.

On the time of writing, BTC was buying and selling at $68,996.20 with a market capitalization of over $1.36 trillion.

For the reason that king of cryptos was recovering, AMBCrypto deliberate to take a look at its metrics to see what they needed to say. An evaluation of CryptoQuant’s data revealed that BTC’s trade reserve was reducing, which means that promoting stress dropped.

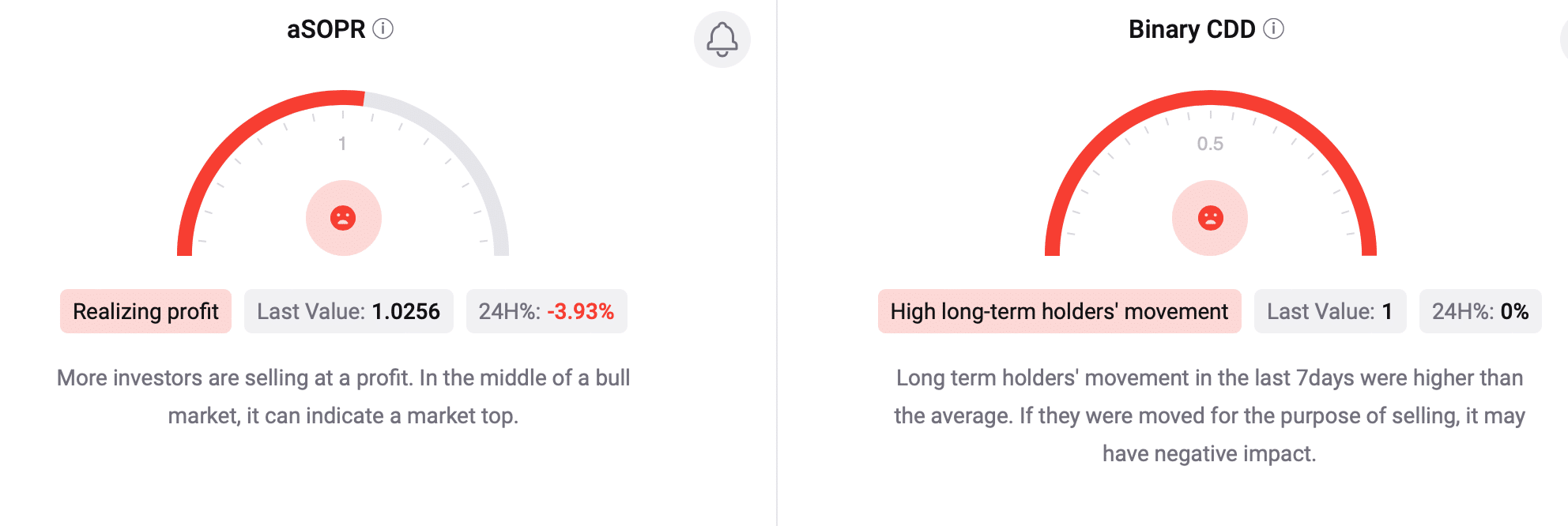

Nevertheless, the remainder of the metrics seemed bearish. For instance, its aSORP was crimson.

Supply: CryptoQuant

Which means that extra buyers are promoting at a revenue. Its binary CDD additionally remained crimson, suggesting that long-term holders’ actions within the final 7 days have been greater than common.

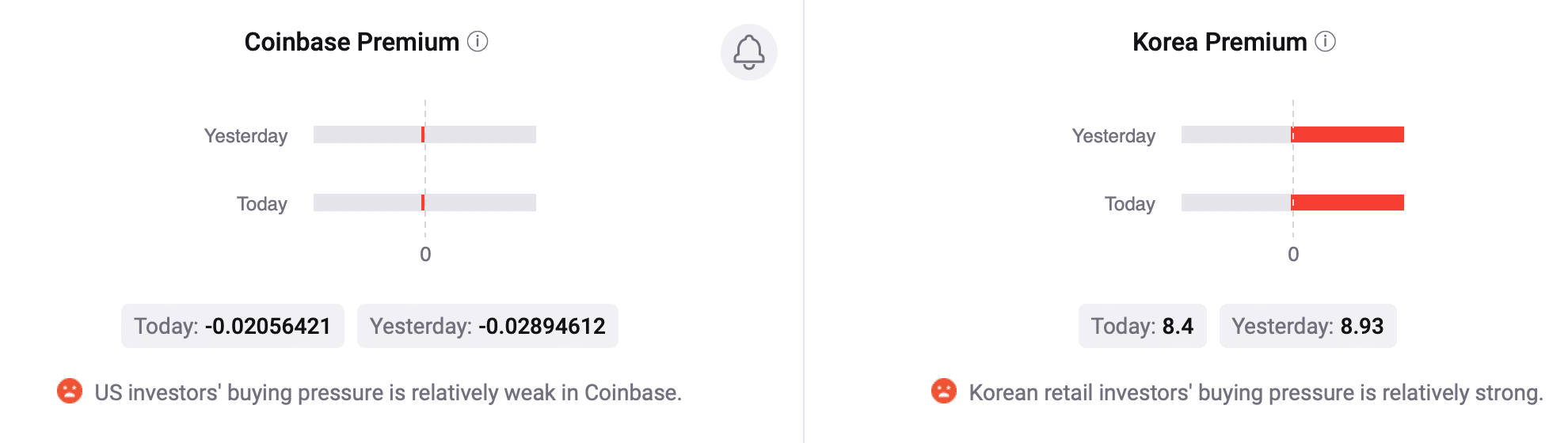

In the event that they have been moved for the aim of promoting, it might have a adverse impression. Moreover, promoting sentiment remained dominant each amongst US and Korean buyers as BTC’s Coinbase and Korea premiums have been crimson.

Supply: CryptoQant

Learn BTC’s [BTC] Worth Prediction 2024-25

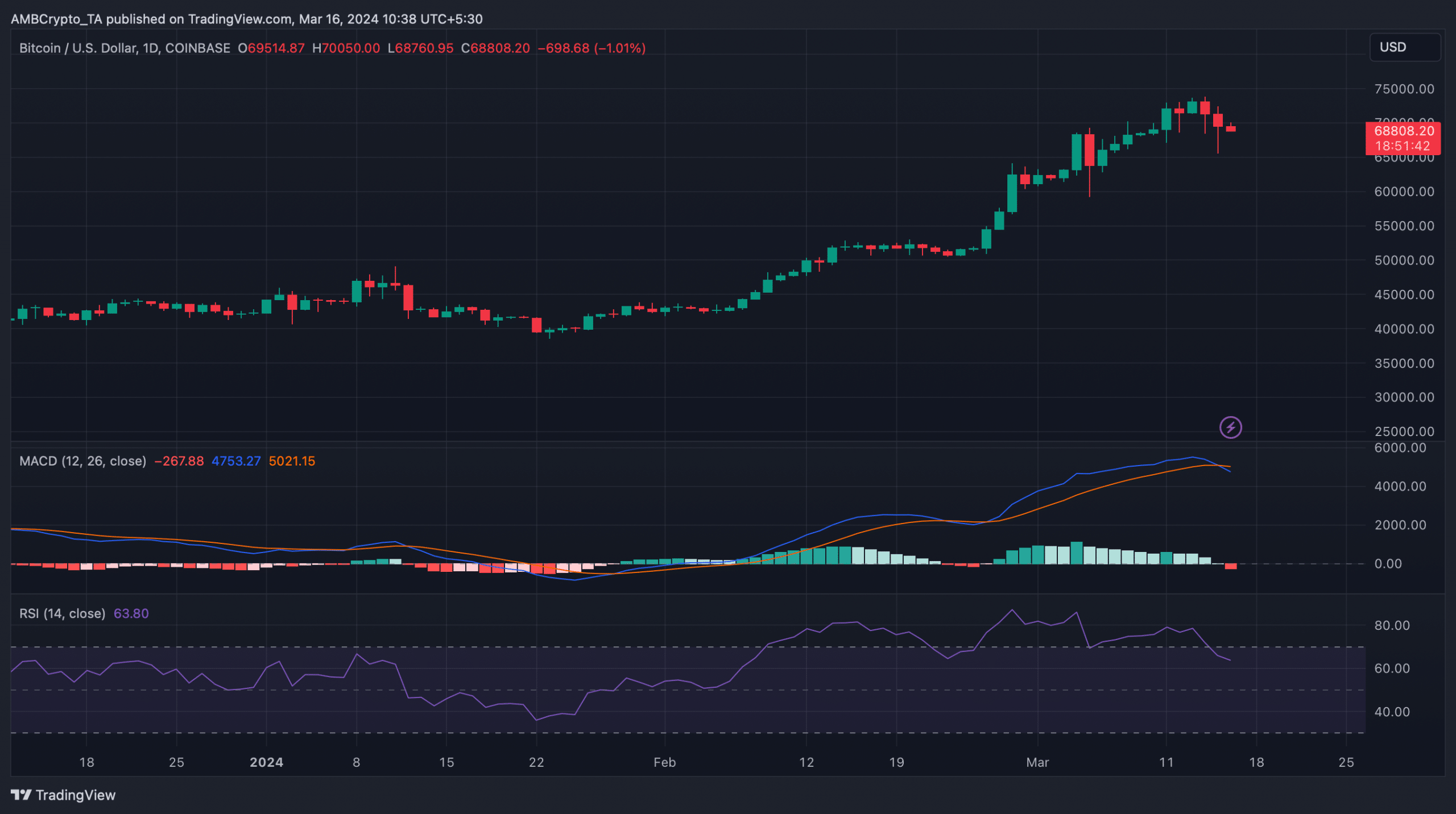

The technical indicator MACD supported the sellers because it displayed a bearish crossover. Bitcoin’s Relative Energy Index (RSI) additionally seemed fairly bearish because it went down.

These indicators recommend that the possibilities of BTC as soon as once more falling sufferer to a worth correction are excessive.

Supply: TradingView