Bitcoin bulls force a breakout past $55k, but a drop to $53.5k seems likely

- Bitcoin reached a neighborhood excessive of $57.1k, and may lengthen increased

- The late, high-leverage bullish speculators is perhaps punished quickly.

Bitcoin [BTC] broke out previous the twelve-day vary that it had established as bullish euphoria soaked the crypto markets. Information that MicroStrategy had acquired one other 3000 BTC strengthened the bullish conviction.

Mixed with the large capital inflows into Bitcoin ETFs, the current breakout has some critical momentum behind it.

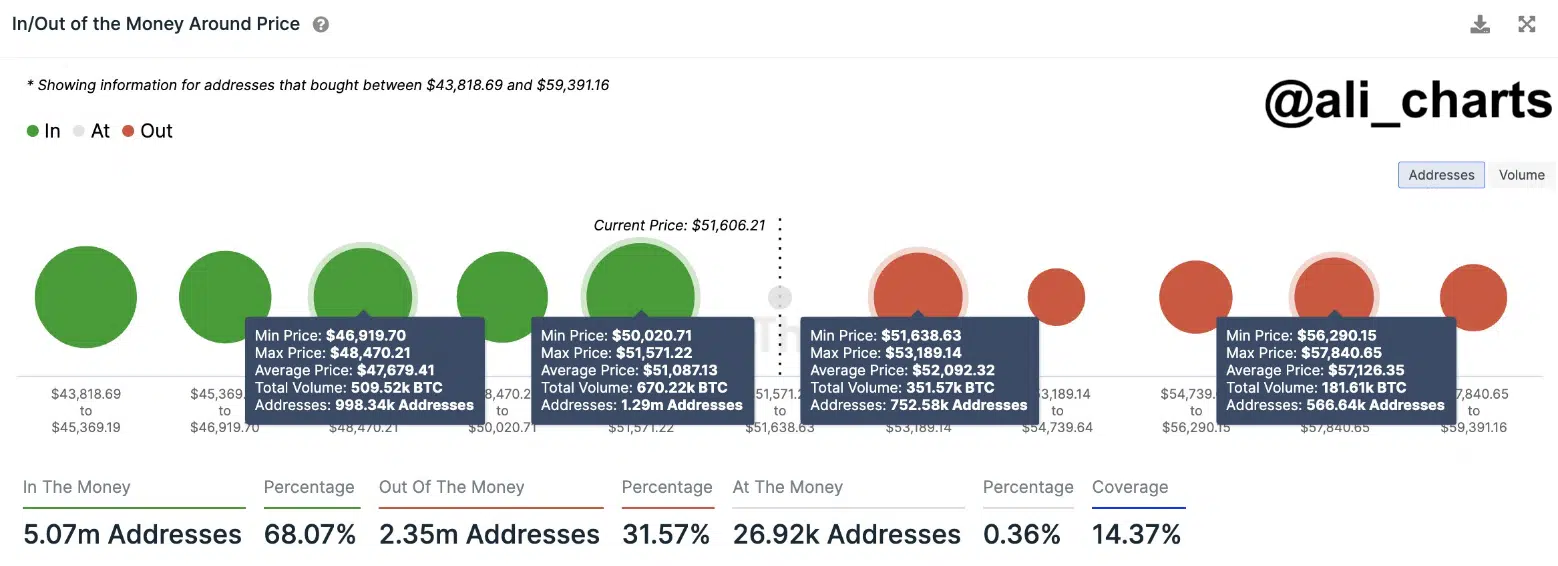

Ali Martinez, a outstanding crypto analyst, posted on X (previously Twitter) that the $57.1k is a major pocket of resistance. This has come to cross in current hours, however the energy of the transfer was a shock.

Supply: Ali on X (previously Twitter)

The vary has been blown large open

Highlighted in purple was a spread that Bitcoin has traded inside for the reason that seventeenth of February. It stretched from $50.6k to $52.5k. The current surge noticed an H4 candle shut above the vary highs and proceed to the $57.1k stage.

The RSI and the OBV noticed an enormous transfer upward. The RSI confirmed overbought circumstances and the OBV mirrored heavy shopping for quantity. The upper timeframe chart confirmed that the subsequent important resistance stage was on the $59k stage.

Was the rally pushed by the futures markets?

Supply: Coinalyze

The Open Curiosity and the spot CVD soared increased throughout the rally. Apparently, the Open Curiosity had been muted from the twenty third of February to the twenty sixth. The speculators confirmed frenzied exercise as BTC raced above the $51.8k mark.

In the meantime, the spot CVD has steadily trended increased prior to now 5 days. It accelerated throughout the breakout and has not stopped. Subsequently, it appeared that there was extra room for positive aspects.

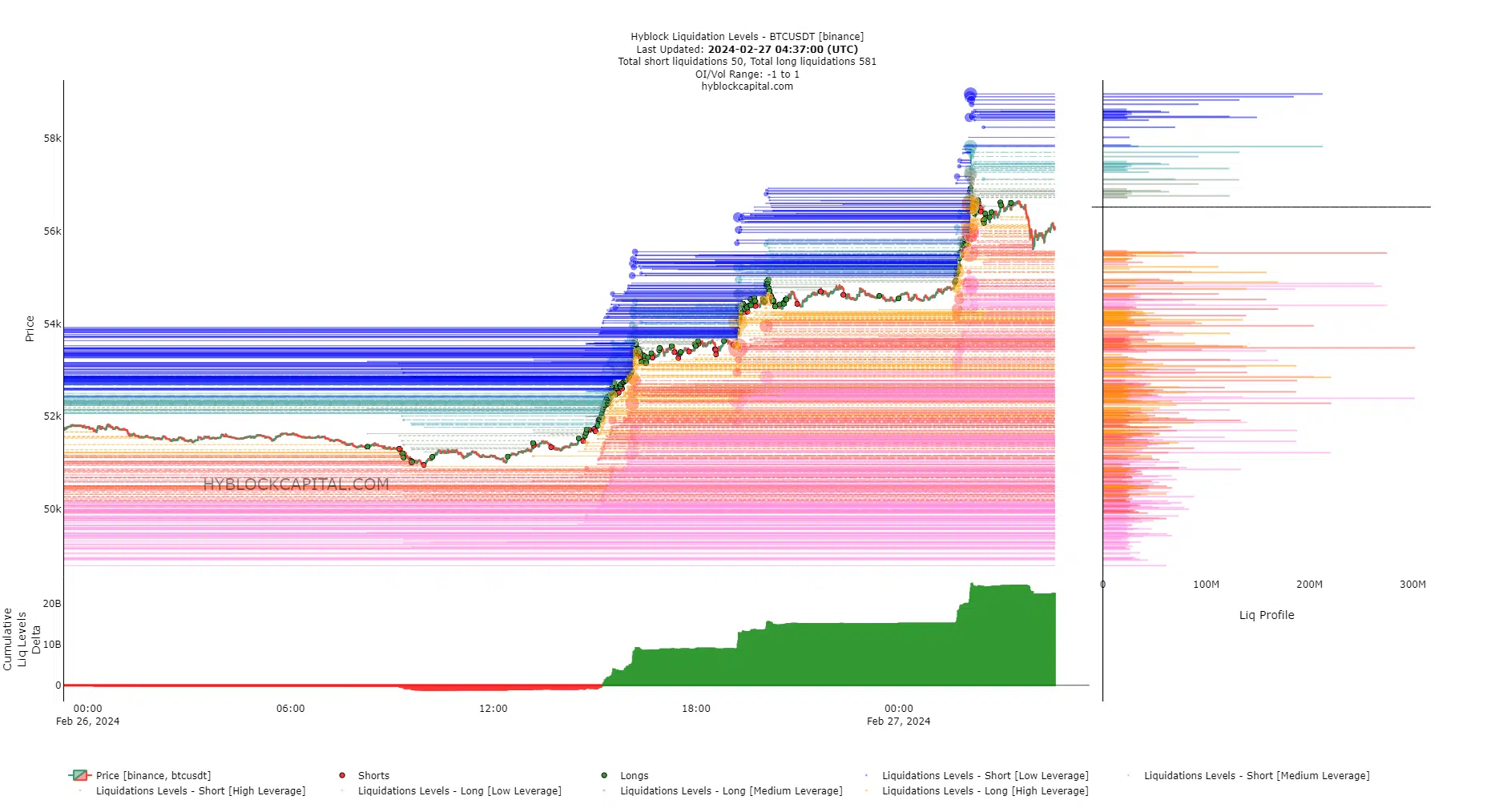

Supply: Hyblock

But, there have been authentic issues that the market is perhaps overheated on the decrease timeframes. AMBCrypto’s evaluation of the Liquidation Ranges confirmed that the Cumulative Liq Ranges Delta was massively inexperienced.

It confirmed a studying of +22.45 billion at press time, which meant the lengthy liquidations far outweighed the brief ones. In flip, this meant that Bitcoin would are inclined to retrace southward over the subsequent couple of days to pressure these positions to shut.

Is your portfolio inexperienced? Test the BTC Revenue Calculator

The $55.5k, $53.5k, and $52.4k ranges have been estimated to have round $300 million in lengthy liquidations.

The previous two have been high-leverage bulls. Therefore, a revisit of the $53.5k stage shortly appeared very seemingly. A drop to the $52.4k stage could be a retest of the previous vary highs and would provide a shopping for alternative as nicely.