Ethereum: 3 glaring signals for bulls inside ETH’s liquidation wall

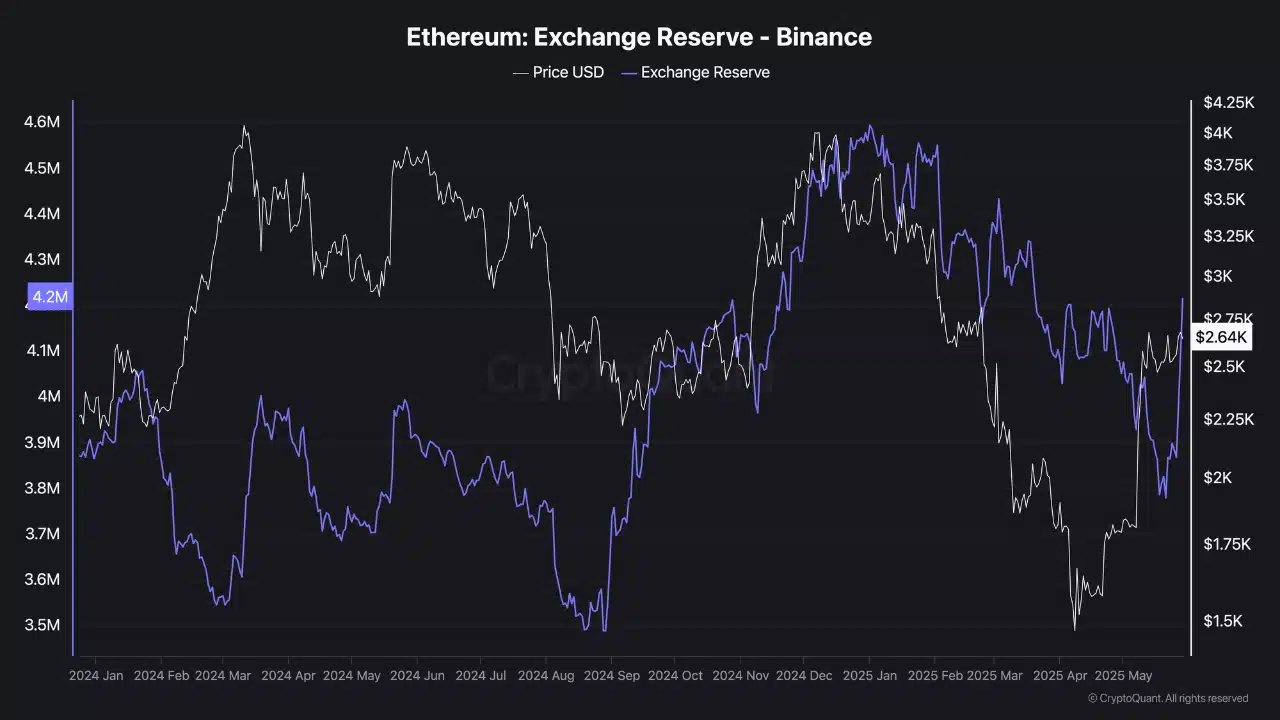

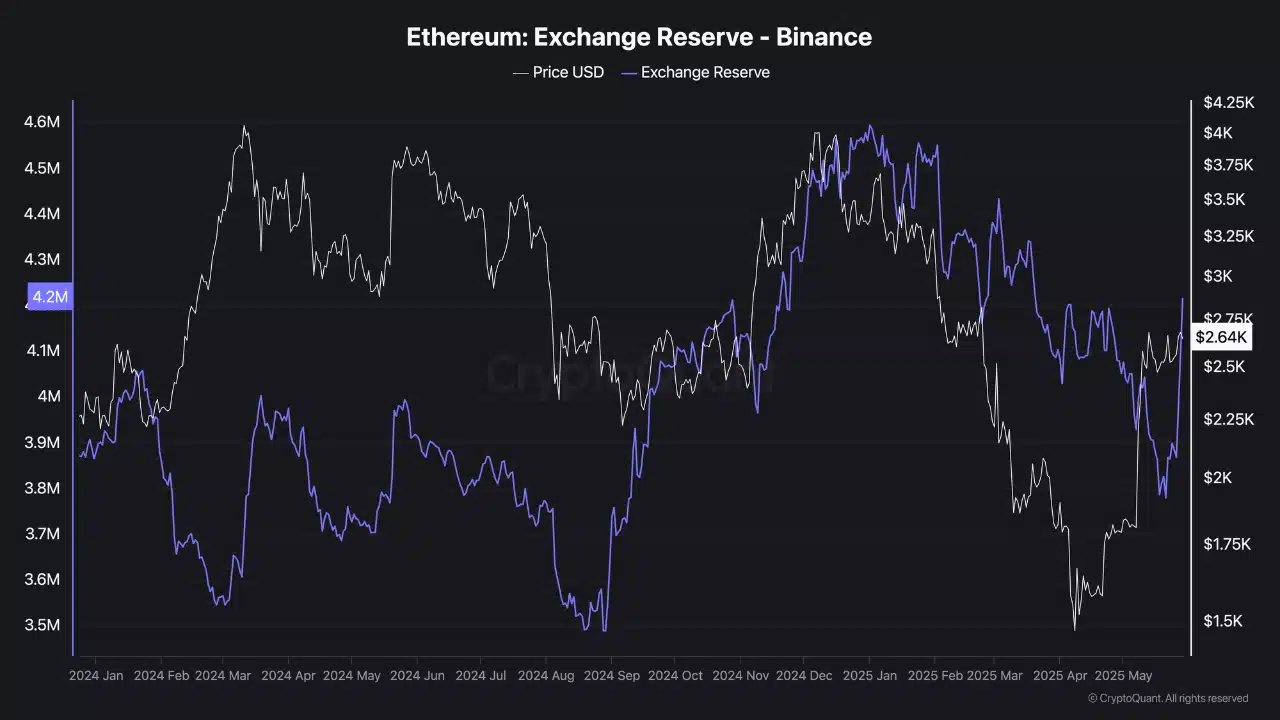

- Ethereum’s Change Reserves on Binance climbed sharply, hinting at rising sell-side strain.

- ETH faces dense liquidation resistance between $2,700 and $2,830, capping upward momentum.

Ethereum [ETH] remained locked in a slim vary between $2,400 and $2,700, however Binance on-chain knowledge revealed a mounting danger beneath the floor.

Infact, Binance Change Reserves spiked to ranges final seen earlier than earlier sell-offs, pointing to an increase in tokens being moved to exchanges—sometimes an indication of mounting promote strain.

This was compounded by regular outflows, whilst the worth briefly held above $2,600. As of writing, ETH traded at $2,623.84 after a 3.60% every day drop.

Supply: CryptoQuant

Why do damaging netflows persist regardless of sideways worth motion?

Ethereum’s Netflows remained firmly damaging, with -248.83K ETH recorded over the past seven days and -60.9K ETH over 30 days.

Whereas this sometimes suggests accumulation or investor withdrawal to chilly storage, the flat worth motion implies these withdrawals observe heavy prior promote exercise.

The 24-hour Netflow additionally confirmed a smaller decline of -4K ETH, reinforcing that capital outflows are regular, not accelerating.

Subsequently, though the worth holds above $2,600, this pattern exposes underlying hesitation. With out renewed inflows or purchaser confidence, the worth might fail to maintain present ranges.

Supply: IntoTheBlock

Dealer warning and liquidation boundaries weigh closely

Over the previous 24 hours, Open Curiosity dropped sharply by 8.99% to $18.14 billion, as merchants backed away from either side of the market.

Decrease OI sometimes alerts an absence of conviction, and with out aggressive positioning, volatility tends to compress earlier than a breakout or breakdown.

Nonetheless, what’s extra regarding is Binance’s ETH/USDT Liquidation Heatmap, which reveals dense liquidation partitions stacked between $2,700 and $2,830.

These clusters have repeatedly triggered promoting strain, creating resistance zones that take in bullish momentum. Every failed try and breach this area has led to sharp reversals, as seen on the 24-hour chart.

Supply: CoinGlass

Except ETH surges with substantial quantity to clear these boundaries, bulls might stay trapped under them. These liquidation zones act as a ceiling till market conviction shifts strongly in favor of patrons.

Ethereum’s sideways motion conceals deeper market weak spot.

Declining OI, damaging Netflows, and powerful liquidation zones recommend that promote strain is capping beneficial properties.

If bulls can’t reclaim $2,700 convincingly, the $2,480 help might come beneath strain subsequent. For now, warning stays warranted as ETH navigates a good vary with restricted momentum.