Bitcoin: Can BTC reach new ATH as crypto mirrors 2017 pattern

- Knowledge reveals that BTC “shrimps”—wallets holding over one Bitcoin—have persistently gathered the asset over time, now controlling a notable portion of its provide.

- BTC’s value trajectory additionally mirrors the 2017 rally cycle, which noticed the asset expertise important upward momentum.

Over the previous 24 hours, the market has proven indicators of restoration, with Bitcoin’s [BTC] market capitalization growing by 1.44% to $1.88 trillion, accompanied by a outstanding 144.37% surge in buying and selling quantity.

This latest motion has restricted BTC’s losses over the previous week and month to inside a 6% drawdown vary.

Historic patterns counsel that BTC stays positioned for a possible surge, as buyers proceed to steadily accumulate the asset.

BTC buyers pave the way in which for additional progress

In line with knowledge from Glassnode, after a interval of heavy distribution—marked by important BTC promoting because the asset approached its all-time excessive of $108,353—BTC “shrimps” have resumed accumulation.

On this context, “shrimps” confer with pockets addresses holding a couple of BTC.

The information reveals that this cohort has considerably elevated their holdings, accumulating a median of 17,600 BTC month-to-month. This brings their complete share to six.9% of the circulating BTC provide.

Supply: Glassnode

This accumulation pattern signifies a possible bullish outlook for the market, as buyers proceed to construct their positions regardless of latest volatility.

A better evaluation means that the latest shakeout may very well be a part of a broader setup for an impending bull run, carefully resembling the 2017 rally.

BTC mirrors 2017 rally with related market strikes

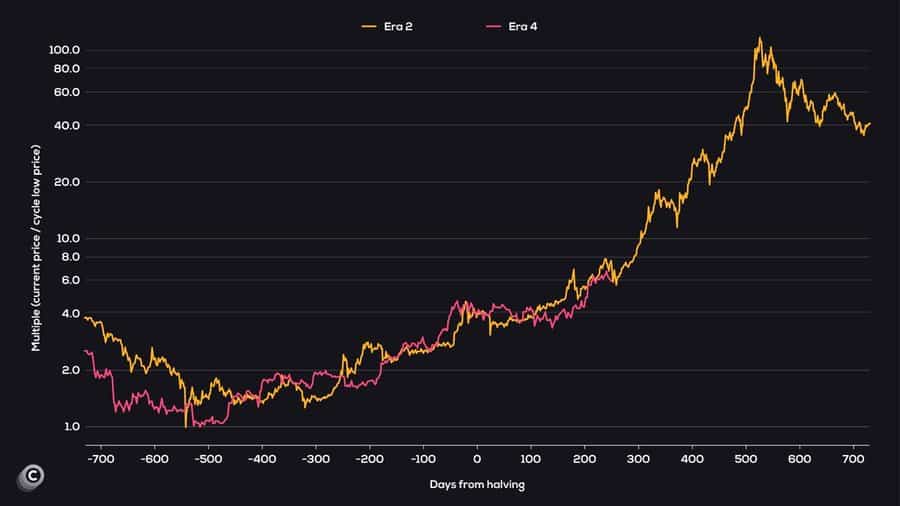

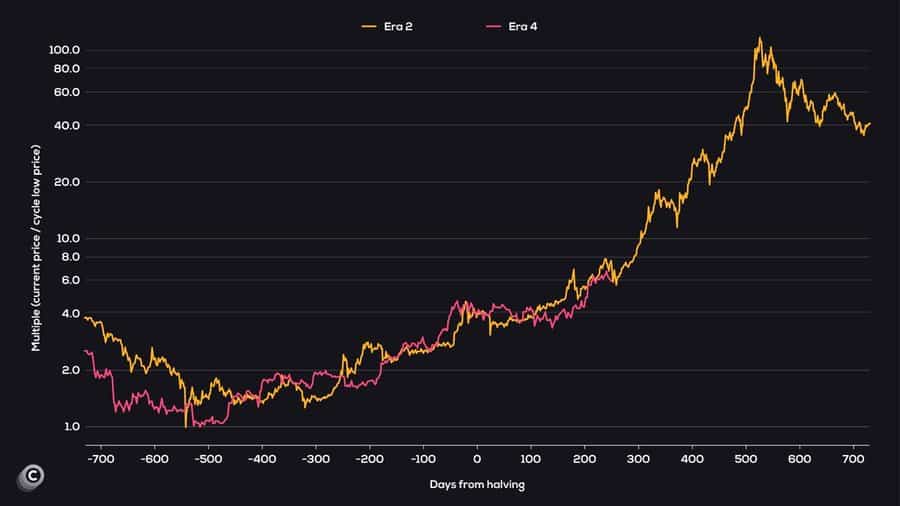

Latest knowledge means that Bitcoin’s present market cycle is carefully mirroring the trajectory of its 2017 bull run.

The evaluation tracks BTC’s value motion throughout post-halving intervals—a part when miners’ rewards are decreased.

Supply: X

This comparability reveals that BTC has persistently adopted an analogous sample. If this pattern continues, BTC may considerably surpass its present All-Time Excessive(ATH).

Nevertheless, whereas the general trajectory aligns with 2017, there have been occasional divergences within the value motion.

Ongoing shopping for exercise indicators bullish momentum for BTC

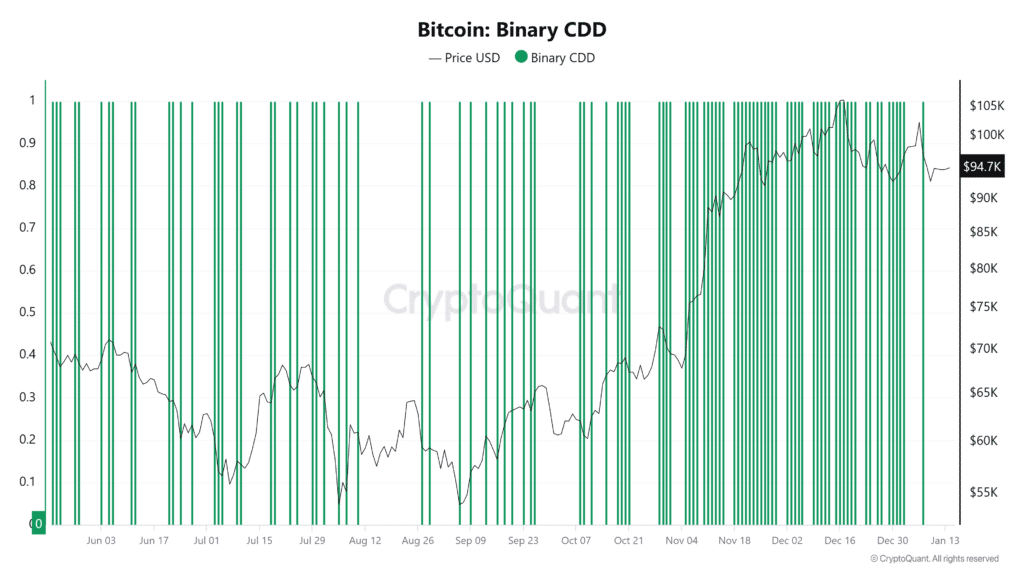

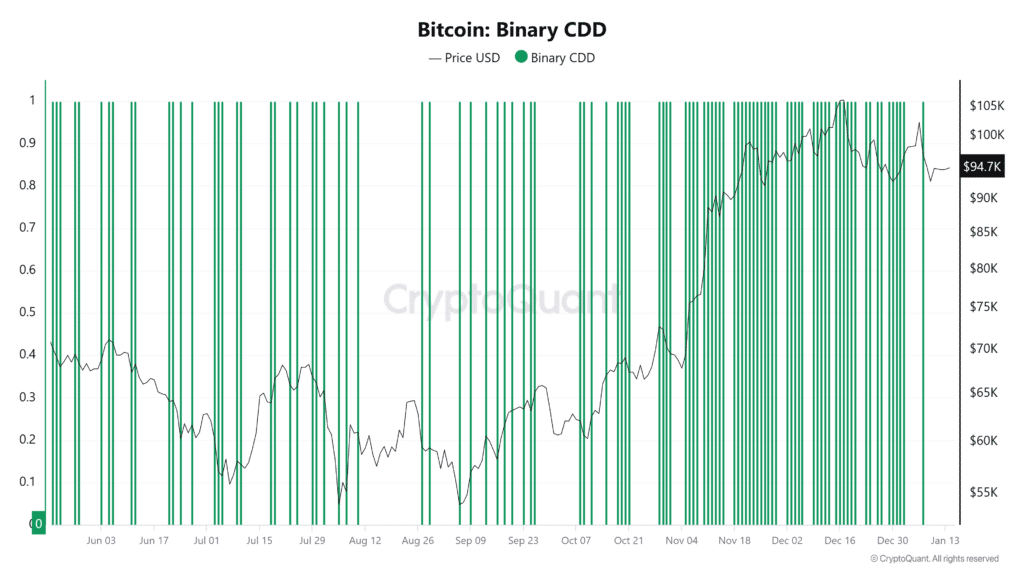

In line with CryptoQuant’s Binary Coin Days Destroyed (Binary CDD), an indicator that tracks Lengthy-Time period Holder (LTH) exercise primarily based on binary values of 1 and 0, BTC holders are displaying renewed confidence within the asset.

A studying of 1 signifies LTHs are shifting their belongings, probably for promoting, whereas 0 displays confidence, with holders opting to retain their BTC.

As of press time, BTC’s Binary CDD stood at zero, signaling that long-term holders have been accumulating reasonably than promoting.

Supply: CryptoQuant

The derivatives market can be reflecting bullish sentiment. The funding price, which turned optimistic, has climbed to its highest degree in 4 days. It rose from roughly 0.00393 on the tenth of January to 0.0124, at press time.

That is the very best price because the 2nd of January.

Learn Bitcoin (BTC) Worth Prediction 2025-26

With ongoing shopping for exercise within the perpetual market, long-term holders sustaining their positions, and gradual accumulation by buyers over latest months, BTC seems poised for a bullish rally.