Bitcoin: Checking the demand for BTC as price remains stuck near $43k

- Bitcoin’s dominance grew as its market depth surged.

- Merchants continued to have a bullish outlook in direction of BTC indicated by the falling put-to-call ratio.

Bitcoin [BTC] has been transferring between the $40,000 to $43,000 vary for fairly a while, which has led to large hypothesis about the way forward for the king coin. Regardless of the unstable modifications within the worth, BTC was nonetheless in a position to assert its dominance available in the market.

Some extra depth

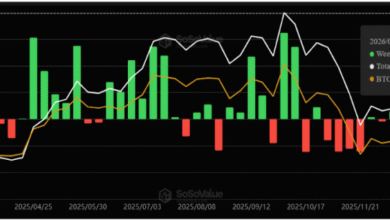

Primarily based on Kaiko’s information, there was a marginal improve in BTC’s 2% market depth because the conclusion of December.

For context, market depth refers back to the quantity of purchase and promote orders for Bitcoin inside a 2% vary of its present market worth. It gives perception into the degrees of provide and demand at totally different worth factors.

Regardless of the market depth rising, it was but to achieve its pre-FTX ranges. This instructed that regardless of the uptick, there should be some warning or hesitation amongst market members in totally participating with BTC at its earlier depth.

A surge in market depth for Bitcoin may be constructive, indicating elevated liquidity and a extra engaging setting for traders. This liquidity facilitates smoother buying and selling and attracts a broader vary of members, probably instilling confidence available in the market.

Nevertheless, if the surge is pushed by hypothesis or market manipulation, it could result in greater and sudden worth fluctuations.

👀#BTC‘s 2% market depth has seen a slight uptick because the finish of December.

📏Nevertheless, it nonetheless falls in need of its pre-FTX ranges, suggesting that market makers haven’t returned in full power. pic.twitter.com/YGBEHs5uej

— Kaiko (@KaikoData) January 30, 2024

How are merchants doing?

Merchants had been comparatively optimistic about the way forward for Bitcoin. This was indicated by the put-to-call ratio for Bitcoin which declined materially over the previous couple of weeks.

It fell from 0.52 to 0.46. One of many causes for a similar may very well be the declined Implied Volatility for Bitcoin.

A declining Implied Volatility may affect dealer conduct by signaling decreased uncertainty and danger available in the market.

Merchants might interpret decrease IV as a sign that the cryptocurrency is prone to expertise much less dramatic worth fluctuations within the close to time period.

This might affect their decision-making in direction of methods that capitalize on extra predictable market situations, resembling directional buying and selling or leveraging much less dangerous choices methods.

Supply: The Block

At press time, BTC was buying and selling at $43,361.83 and its worth had grown by 2.88% within the final 24 hours.

Supply: Santiment